Source: Journal “Payment in state (municipal) institutions: accounting and taxation”

The question of the need to make additional payments to an employee’s salary so that the latter is not less than the minimum wage (minimum wage) arises quite often and is relevant. In the article we will remind you in which cases it is necessary to make such an additional payment and how to do it.

From 01/01/2015 the minimum wage is 5,965 rubles. per month. This is established by Federal Law No. 408-FZ of December 1, 2014 “On Amendments to Article 1 of the Federal Law “On the Minimum Wage .

The Labor Code provides for the establishment of federal and regional minimum wages ( Articles 133 and 133.1 ). How are these minimum wages different?

Federal minimum wage. According to Art. 133 of the Labor Code of the Russian Federation , it is established by federal law simultaneously throughout the entire territory of the Russian Federation and cannot be lower than the subsistence level of the working population. This minimum wage is provided by:

- organizations financed from the federal budget - at the expense of the federal budget, extra-budgetary funds, as well as funds received from entrepreneurial and other income-generating activities;

- organizations financed from the budgets of the constituent entities of the Russian Federation - at the expense of the budgets of the constituent entities of the Russian Federation, extra-budgetary funds and funds received from conducting business and other income-generating activities;

- organizations financed from local budgets - at the expense of local budgets, extra-budgetary funds, as well as funds received from entrepreneurial and other income-generating activities.

At the same time, please note that the monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage.

Regional minimum wage. By virtue of Art. 133.1 of the Labor Code of the Russian Federation , it is established by a regional agreement in a separate subject of the Russian Federation. This minimum wage can be determined for persons working in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

It is provided by:

- organizations financed from the budgets of the constituent entities of the Russian Federation - at the expense of the budgets of the constituent entities of the Russian Federation, extra-budgetary funds and funds received from entrepreneurial and other income-generating activities;

- organizations financed from local budgets - at the expense of local budgets, extra-budgetary funds, as well as funds received from business and other income-generating activities.

Please note:

The minimum wage in a constituent entity of the Russian Federation cannot be lower than the minimum wage established by federal law.

In addition, the monthly salary of an employee working in the territory of the corresponding constituent entity of the Russian Federation, in which a regional minimum wage agreement is in force, cannot be lower than the minimum wage established in this constituent entity of the Russian Federation, provided that the specified employee has fully worked the standard working hours during this period and has fulfilled labor standards (job duties).

Article 129 of the Labor Code of the Russian Federation establishes the components of wages. This:

- remuneration for labor depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed by him;

- compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal, special climatic conditions and in territories exposed to radioactive contamination, and other payments of a compensatory nature);

- incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Thus, from the provisions of Art. 129 and 133 of the Labor Code of the Russian Federation it follows that after calculating wages, which include compensation and incentive payments, it is necessary to make an additional payment up to the minimum wage if the salary turns out to be less than the minimum wage.

Arbitrators make similar conclusions. One such example is the Appeal Ruling of the Khabarovsk Regional Court dated April 26, 2013 No. 33-2252/2013 , in which the judges, citing Art. 133 and 129 of the Labor Code of the Russian Federation , noted that labor legislation allows the establishment of salaries (tariff rates) as components of workers’ wages in an amount less than the minimum wage, provided that their wages, which includes all elements, will not be less than the minimum wage established by federal law . The same conclusions are contained in the Appeal Determination of the Altai Regional Court dated May 27, 2014 No. 33-4263/14 .

Example 1.

An employee of the institution has an official salary of 4,200 rubles. per month, and incentive payments in the amount of 1,000 rubles. This employee completed his full working hours for the month. We will calculate the amount of wages that must be paid to the employee.

The monthly salary of an employee is 5,200 rubles. (4,200 + 1,000). Since he fully worked the standard working hours during this period, according to Art. 133 of the Labor Code of the Russian Federation, the employer does not have the right to pay him a monthly salary below the minimum wage. In this regard, the employer needs to make an additional payment in the amount of 765 rubles. (5,965 - 5,200).

Wages of employees of organizations located in the Far North and equivalent areas, and the minimum wage

The wages of employees of organizations located in the regions of the Far North and equivalent areas must be set at no less than the minimum wage, after which a regional coefficient and a percentage bonus for work experience in these areas and localities must be added ( Review of the RF Armed Forces from 02/26/2014 , rulings of the RF Armed Forces dated 12/21/2012 No. 72-KG12-6 , dated 07/01/2011 No. 72-B11-5 , dated 07/29/2011 No. 56-B11-10 , dated 06/24/2011 No. 3-B11-16 ).

Example 2.

The employee works in an institution located in an area where the regional coefficient of 1.3 applies. In addition, he is entitled to a percentage bonus for length of service of 10%. The employee's official salary is 4,100 rubles. We will calculate the amount of additional payment that must be paid to him.

The salary of this employee will be 5,740 rubles. (RUB 4,100 + RUB 4,100 x 30% + RUB 4,100 x 10%). He fully worked out the standard working time for this period, in connection with this, in accordance with Art. 133 of the Labor Code of the Russian Federation, the employer does not have the right to pay him a monthly salary below the minimum wage. We will calculate wages based on the federal minimum wage. Regional coefficient – 1,789.50 rubles. (RUB 5,965 x 30%), percentage increase – RUB 596.50. (RUB 5,965 x 10%). Thus, the employee’s salary will be 8,351 rubles. (5,965 + 1,789.50 + 596.50). So, the additional payment to this employee will be equal to 2,611 rubles. (8,351 - 5,740).

Example 3.

Let’s use the conditions of example 2. Let’s add that the institution is located in a constituent entity of the Russian Federation, where a regional agreement stipulates that an employee’s salary for a fully worked month should not be less than 6,800 rubles. taking into account all compensation payments and additional payments. We will calculate the amount of the surcharge in this case.

Before calculating the surcharge, we draw your attention to the conclusions of the RF Armed Forces, made by it in the Review of 02.26.2014 : the regional coefficient and percentage bonus are not calculated on the minimum wage established in the constituent entity of the Russian Federation (RMW), if the wages of employees of organizations located in the regions of the Far North and equivalent areas, determined by calculating the regional coefficient and a percentage increase on the size of the federal minimum wage, exceeds the RMW in the constituent entity of the Russian Federation.

The salary of this employee will be 5,740 rubles. (RUB 4,100 + RUB 4,100 x 30% + RUB 4,100 x 10%). First, we will calculate the amount of additional payment for the regional coefficient, taking into account the federal minimum wage. It will be equal to 1,789.50 rubles. (RUB 5,965 x 30%). Percentage increase – 596.50 rubles. (RUB 5,965 x 10%). Thus, the salary will be 8,351 rubles. (5,965 + 1,789.50 + 596.50). As a result, wages calculated using the federal minimum wage turned out to be higher than those established by the regional agreement, which means that the minimum wage does not apply in this case. Accordingly, the additional payment to this employee will be equal to 2,611 rubles. (8,351 - 5,740).

Example 4.

Let’s use the conditions of example 2. Let’s add that the regional agreement stipulates that an employee’s salary for a fully worked month should not be less than 9,800 rubles. taking into account all compensation payments and additional payments. We will calculate the amount of the surcharge in this case.

From the calculations made in example 3, it is clear that wages using the federal minimum wage are equal to 8,351 rubles, which is less than the minimum wage established by the regional agreement. This means that in this case the employee needs to make an additional payment in the amount of 4,060 rubles. (9,800 - 5,740).

If the institution is financed from the federal budget, no additional payment to the regional minimum wage is accrued, since according to Art. 133.1 of the Labor Code of the Russian Federation, the regional minimum wage does not apply to him.

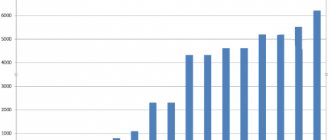

Additional payment to the minimum wage in 2021

This information is current as of 2021.

On 01/01/2021, the minimum wage (hereinafter referred to as the minimum wage) changed once again, reaching the level of 12,792 rubles. (Law “On Amendments...” dated December 29, 2020 No. 473-FZ). Previously, its size was 12,130 rubles.

Important! The Labor Code of the Russian Federation guarantees citizens wages in an amount not less than the minimum wage (paragraph 7 of Article 133 of the Labor Code of the Russian Federation). At the same time, the regional minimum wage cannot be lower than the federal one.

We draw attention to the following points:

- In addition to the minimum wage determined at the federal level, some constituent entities of the Russian Federation set their own minimum wage in accordance with the rules of Art. 133.1 Labor Code of the Russian Federation.

- It is the employee’s salary that must reach the established level of the federal minimum wage or the regional minimum wage - taking into account all its components: salary, allowances. For example, according to the accepted remuneration system in an organization, an employee is paid a bonus for traveling work. In this case, it is necessary to compare the amount of the salary and this bonus with the minimum wage (Article 129 of the Labor Code of the Russian Federation, Letter of the Ministry of Labor dated 09/04/2018 N 14-1 / OOG-7353).

- When comparing salaries with the minimum wage, additional payments for part-time work, overtime work, additional payments for working at night, on holidays and weekends (Resolution of the Constitutional Court of the Russian Federation of April 11, 2019 No. 17-P), financial aid, bonuses for holidays are not taken into account.

- The salary level of employees of organizations located in the regions of the Far North and in areas with a similar status, without taking into account the regional coefficient and bonuses for length of service, should not be lower than the minimum wage (see Section 1 of the Review of Practice, approved by the Presidium of the RF Armed Forces on February 26, 2014) .

In connection with the changed minimum wage, you will be interested in reading the new review by ConsultantPlus “Minimum wage in 2021: what payments need to be revised.” If you do not yet have access to the ConsultantPlus system, you can sign up for a free trial access for 2 days.

Salary based on minimum wage

If an employee works full time and fulfills the monthly work quota, his monthly salary cannot be lower than the minimum wage (Article 133 of the Labor Code of the Russian Federation).

The region in which the company operates can set its own minimum. Then the salary must be compared with it. But provided that the regional minimum wage is not lower than the federal one.

To find out exactly what payments are included in the minimum wage in your region, you need to read the relevant agreement. You can find this document:

- on the website of the regional government or on the websites of associations of trade unions and employers;

- in the official printed publication of the constituent entity of the Russian Federation.

A new way to calculate the minimum wage

Starting from 2021, the rules for calculating the minimum wage and subsistence level in Russia are changing (Law No. 473-FZ dated December 29, 2020 “On amendments to certain legislative acts of the Russian Federation”).

The size of the minimum wage will now be determined based on the median wage for the previous year, and not on the subsistence level (consumption basket).

Median wage is the average earnings of workers, relative to which half of Russians have higher wages, and the other half have lower wages.

Note! The median salary should not be confused with the arithmetic mean. The median salary is usually lower than the arithmetic mean. This is primarily due to the uneven distribution of wages across regions and sectors of the economy, as well as the large gap between high and low wages in the country as a whole.

The median salary is calculated by the Federal State Statistics Service (Rosstat) taking into account the collected information, based on the methodology developed by this body. According to Rosstat, in 2021 the median salary was 34,335 rubles.

From 2021, it is proposed to set the ratio of the minimum wage to the median salary at 42%. Further, this ratio will be reviewed at least once every 5 years.

In addition, the minimum wage will be calculated immediately for the year, in contrast to the previous procedure, when it was calculated for each quarter.

Important! The minimum wage established for the current year should not be less than:

- the cost of living of the working population as a whole in the Russian Federation for a given year;

- The minimum wage established in the previous year.

The procedure for establishing the minimum wage in the regions of the Russian Federation

The minimum wage differs in different regions of the Russian Federation and is determined depending on socio-economic conditions.

Risks! If a regional minimum wage is established in a constituent entity of the Russian Federation, it does not apply to employees of organizations receiving funding from the federal budget.

The regional minimum wage is established by a tripartite commission by concluding a regional agreement, which will be officially published along with an invitation to employers of the subject to join it.

Note! The employer is considered to have automatically acceded to the agreement if it does not send a reasoned refusal to the authorized body within 30 calendar days.

The table below shows the constituent entities of the Russian Federation in which the minimum wage differs from the federal one:

| The subject of the Russian Federation | Minimum wage, rub. | Base | |

| Republic of Tatarstan (Tatarstan) | for state and municipal institutions of the Republic - in the amount of the minimum wage | 12 792 | Agreement on the minimum wage in the Republic of Tatarstan for 2021 dated December 30, 2020 No. 313 |

| for employees of organizations in the non-budgetary sector of the economy | 15 400 | ||

| Altai region | for public sector workers, agricultural workers, workers participating in public works or temporarily employed under agreements between employers and employment services, as well as for employees from among citizens with disabilities employed under agreements on the creation or allocation of jobs for the employment of disabled people in account of the established quota in public organizations of disabled people - in the amount of the minimum wage | 12 792 | Regional agreement on the amount of the minimum wage in the Altai Territory for 2021 - 2021 dated December 17, 2018, Additional agreement to the regional agreement on the amount of the minimum wage in the Altai Territory for 2021 - 2021 dated December 17, 2018 (concluded on December 20, 2019) |

| for employees of the non-budgetary sector of the economy (without taking into account the regional coefficient) | 13 000 | ||

| Bryansk region | for public sector organizations | 12 850 | Regional agreement on the minimum wage in the Bryansk region for 2021 dated December 5, 2018 |

| for non-budgetary organizations | 13 200 | ||

| Volgograd region | in the amount of minimum wage: 1) for state and municipal institutions, non-profit organizations; 2) organizations created by public associations of disabled people; 3) workers carrying out labor activities in public and temporary jobs (including internships), organized by the employer for temporary employment of workers as part of the implementation of programs of additional measures to reduce tension in the labor market of the region and promote employment of the population | 12 792 | Regional agreement on the minimum wage in the Volgograd region dated June 26, 2019 No. RS-71/19 |

| for the extra-budgetary sphere - in the amount of 1.3 times the subsistence minimum of the working population of the region | |||

| for employers classified by type of economic activity as agriculture - in the amount of at least 1.3 times the subsistence minimum for the working population based on the results of the calendar year | |||

| Kaliningrad region | 14 000 | Regional agreement on the minimum wage in the Kaliningrad region dated May 18, 2018 | |

| Kemerovo region | for commercial organizations (except for organizations operating in the field of regulated pricing) and individual entrepreneurs - not less than 1.5 times the subsistence level of the working population of the region | 17 110 | Kuzbass regional agreement for 2021 - 2021 from 01/25/2016 |

| Leningrad region | from January 1, 2021 - 12,800, from April 1, 2021 - 13,000, from September 1, 2021 - 13,315, from December 1, 2021 - 14,250 | Regional agreement on the minimum wage in the Leningrad region for 2021 dated December 24, 2020 No. 6/C-20 | |

| Lipetsk region | for public sector employees - in the amount of the minimum wage | 12 792 | Regional agreement on the minimum wage in the Lipetsk region for 2021 - 2021 dated December 27, 2017 No. 46 (as amended on February 26, 2020) |

| for employees of non-budgetary organizations - not less than 1.2 times the subsistence level of the working-age population for the fourth quarter of the previous year, but not less than the minimum wage (12,792) | |||

| Moscow region | 15 000 | Agreement on the minimum wage in the Moscow region dated October 31, 2019 No. 243 | |

| Omsk region | for employees of organizations and individual entrepreneurs carrying out as the main type of economic activity “agriculture, forestry, hunting, fishing and fish farming”, non-profit organizations, organizations financed from the regional and local budgets of the region, as well as workers participating in public works organized in accordance with paragraph. 8 pp. 8 clause 1 art. 7.1-1 of the Law of the Russian Federation “On Employment of the Population in the Russian Federation” (without taking into account the regional coefficient established for the region) | 12 792 | Regional agreement on the minimum wage in the Omsk region dated December 23, 2020 N 70-RS |

| for employees of other employers (without taking into account the regional coefficient established for the region) | 13 377 | ||

| Pskov region | in the amount of minimum wage: 1) for employees of state institutions of the region and state unitary enterprises; 2) employees of municipal institutions and municipal unitary enterprises of municipalities of the region; 3) employees working in the region in socially oriented non-profit organizations; 4) employees working in the region in consumer cooperation organizations; 5) employees working in the region for small businesses | 12 792 | Regional agreement on the minimum wage in the Pskov region for 2021 dated December 30, 2020 No. MV-385 |

| for employees working in the region for other employers: | |||

| for employees belonging to the main personnel | the cost of living of the working-age population in the region for the second quarter of the previous year | ||

| for employees classified as support personnel - in the amount of the minimum wage | 12 792 | ||

| Rostov region | at enterprises and non-budgetary organizations - not lower than 1.2 | 5 350,4 | Rostov regional tripartite (regional) for 2021 - 2022 dated November 21, 2019 No. 13 |

| for public sector employees | 12 792 | ||

| Tula region | for employees of state and municipal institutions of the region | 12 792 | Regional agreement on the minimum wage in the Tula region dated December 21, 2020 |

| for non-budgetary workers | 14 200 | ||

| Ulyanovsk region | for employees of organizations established by the region or municipalities of the region, as well as for employees of small businesses - in the amount of the minimum wage | 12 792 | Regional agreement on the minimum wage in the Ulyanovsk region dated December 11, 2020 No. 107-DP |

| for employees of extra-budgetary spheres and medium-sized businesses | 14 800 | ||

| Moscow | in the amount of the subsistence minimum of the city’s working population | 20 589 | |

| Saint Petersburg | 19 000 | Regional agreement on the minimum wage in St. Petersburg for 2021 dated December 27, 2019 | |

Minimum wage for workers with children in St. Petersburg from May 1, 2021

If an employee is paid a salary in the amount of the minimum wage, he receives less. This is due to the fact that personal income tax is withheld from accrued wages. Employees with children are entitled to a standard tax deduction. Therefore, their personal income tax is withheld in a smaller amount than that of childless workers.

For example, if an employee has no children and the salary is minimal, he will be paid 9,712 rubles from the company’s cash desk. (11,163 – 1163*13%). And if the employee has one minor child, he will receive 9894 rubles. (11163 – [11163-1400]*13%).

Service for calculating minimum payments to employees with children

In different cases, employees receive different standard deductions for children. Our service takes into account various features and shows what minimum amount an employee with children will receive:

In the city of St. Petersburg, a regional agreement sets the minimum wage at 17,000 rubles. Consequently, the minimum take-home amounts will differ from the national ones.

Example

If an employee does not have children, then his minimum take-home salary is 14,790 rubles. (17000 – 17000*13%).

If an employee receives a tax deduction for one child, the minimum take-home salary for him will be: 14,972 rubles. (17000–[17000–1400]*13%).

For comparison, we have compiled a table that shows how the minimum income in St. Petersburg differs for childless employees and employees with one, two or three children:

| Minimum income in St. Petersburg from May 1, 2021 | |||

| For a childless worker | For an employee with one child | For an employee with two children | For an employee with three children |

| RUB 14,790 | RUB 14,972 | RUB 15,154 | RUB 15,544 |

Additional payment up to the minimum wage for an incomplete month worked

Important! The salary may be lower than the minimum wage if:

- a part-time/part-time work week is established for an employee (you can learn more about the various modes of organizing working time in our article “Working time under the Labor Code - types and features”);

- the employee works part-time.

In these cases, since the employee is underemployed, the remuneration he receives at the end of the month may be lower than the established minimum wage. In this case, the minimum amount to be paid is calculated in the appropriate proportion of the minimum wage.

Example: A teacher works at 0.25 salary. The minimum wage from 01/01/2021 is 12,792 rubles. This means that this teacher cannot receive less than 3,198 rubles from 01/01/2021. (i.e. 12,792 × 0.25).

Risks! If the employees’ salary is below the minimum wage, the employer may be held administratively liable on the basis of Part 6-7 of Art. 5.27 of the Code of the Russian Federation on Administrative Offences.

How to correctly pay extra up to the minimum wage in various situations is described in the ready-made solution ConsultantPlus “How to calculate and process an additional payment to your salary up to the minimum wage.” If you do not yet have access to the ConsultantPlus system, you can sign up for a free trial access for 2 days.

Salary below the minimum wage: responsibility

An employer does not have the right to pay full-time employees a salary below the minimum wage. For ignoring this rule, the labor inspectorate may punish the employer under paragraph 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. Fine for the manager - from 10,000 to 20,000 rubles; for organization - from 30,000 to 50,000 rubles.

For a repeated violation, the manager will pay from 20,000 to 30,000 rubles or will be disqualified for a period of one to three years. And the company itself will be fined in the amount of 50,000 to 100,000 rubles.

Order for additional payment up to the minimum wage (sample)

There is no unified/standard form of order for additional payment to an employee whose salary does not reach the minimum wage level.

We recommend! The said administrative document can be drawn up in free form, taking into account the established document flow features of the organization and the requirements of local documentation.

At the same time, the issuance of an order to increase the salary must be preceded by the following personnel procedures:

- Conclusion of an additional agreement to the employment contract. In this document, it is necessary to agree on a new salary amount with the employee, since the amount of remuneration for labor is an important condition of the employment contract (Article 72 of the Labor Code of the Russian Federation).

- Making changes to the staffing table (if necessary) or issuing a new staffing table with current data.

In general, the contents of an order for additional payment to the minimum wage should include the following information:

- name of the document and its details;

- grounds for additional payment - discrepancy between the salary level and the established minimum wage, including a reference to the relevant regulatory legal act at the federal or regional level regulating the current minimum wage amount;

- information about the employee in respect of whom this order is issued: last name, first name, patronymic, position, name of the structural unit in which he is employed;

- amount of surcharge;

- date of payment;

- indication of persons responsible for executing the order;

- signature of the employer’s authorized person with a transcript;

- signatures with a transcript of the persons responsible for executing the order, and the inscription “I have read the order”, the date of familiarization.

A sample of the mentioned document can be found at the link below: Order for additional payment up to the minimum wage - sample.

How can an employer organize additional payment?

In order to fulfill the requirements of Art. 133 of the Labor Code of the Russian Federation, each employer must organize:

- conducting a monthly comparison of the accrued salary of each employee with the current minimum wage;

- calculation of additional payment up to the minimum wage (if the salary turned out to be lower);

- payment of the calculated amount of additional payment to employees.

To achieve this goal, the employer has several ways:

- monthly, based on accounting calculations, issue an order for additional payment up to the minimum wage, indicating specific employees and the amount of additional payment due to them;

- issue a one-time order (order) providing for mandatory monthly procedures for payroll payers: comparing the accrued salary with the minimum wage and determining the amount of additional payment;

- include a section on additional payment up to the minimum wage in an internal local act (in a collective agreement, regulations on wages, etc.)

If you have access to ConsultantPlus, check whether you have correctly calculated and completed the additional payment to the minimum wage. If you don't have access, get a free trial of online legal access.

We will tell you further how to issue an order for additional payment up to the minimum wage.

Calculation of the amount of additional payment up to the minimum wage

As examples, let's look at the most common situations, let's take the minimum wage, effective from 01/01/2021:

- The employee works full time, there are no regional coefficients or bonuses, the salary is 5,000 rubles, the monthly bonus is 2,000 rubles, a budgetary organization. So, the employee receives 7,000 rubles in hand, which is 5,792 rubles. less than the established minimum wage. Accordingly, he needs to pay an additional 5,792 rubles.

- The employee works for a Moscow company that is a party to the regional agreement on the minimum wage in Moscow. Salary – 15,000 rubles, monthly bonus – 2,000 rubles. Since at the moment the regional minimum wage in Moscow is 20,589 rubles. (see “Moscow tripartite agreement for 2021 - 2021 between the Moscow Government, Moscow trade union associations and Moscow employers’ associations”), then the employee must pay an additional 3,589 rubles.

- The employee works in an area equated to the regions of the Far North. Salary - 5,000 rubles, regional coefficient - 1.2, bonus for length of service - 10%, no regional minimum wage. As we wrote above, for this category of workers, the salary part of the salary is brought up to the minimum wage level, without taking into account the coefficient and bonus for length of service. In this case, since there are no other additional payments, we evaluate only the salary. Accordingly, the employee must pay an additional RUB 7,792. And then the coefficient and bonus will be calculated on the salary amount increased to the minimum wage - 12,792 rubles.

Note! The regional coefficient and percentage increase in wages depend on the place where the employee actually works, and not on the location of the employer (see letter of Rostrud dated January 15, 2016 No. ТЗ/23333-6-1).

***

So, to an employee whose salary does not reach the established minimum wage level (federal or, in certain cases, regional), the employer is obliged to pay an additional amount so that the salary, taking it into account, is not lower than the minimum wage.

If an employee works part-time or has a part-time job, then his salary may be lower than the minimum wage, but its minimum threshold is determined as part of the minimum wage, proportional to the time worked. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to issue an order to establish an additional payment

Let's look at an example that explains how to issue an order for an additional payment up to the minimum wage and how to pay the additional amount correctly.

Kvanta LLC has 5 employees. Everyone works under employment contracts on a full-time basis. Employment contracts with managers establish a fixed salary and define the condition for receiving monthly bonuses: their percentage depends on the number of new contracts concluded with potential buyers during the month.

When calculating salaries, the company draws up a calculation table. Below is a table for January 2021:

In order not to waste extra time on additional calculations and their execution, the chief accountant put the necessary data and formulas into an Excel table and enters monthly only the bonus amounts (the variable part of the salary). To compare the accrued salary with the minimum wage and calculate the additional payment, a separate column 6 is provided. It shows that two employees need to be paid additionally (R.G. Perov and A.N. Surin). The calculation takes into account the current minimum wage in January 2021, equal to 12,792 rubles.

A sample order for additional payment up to the minimum wage can be downloaded here.