August 28, 2015

Having considered the issue, we came to the following conclusion: Current legislation does not oblige the employer to make additional payments to employees for working on the evening shift.

Rationale for the conclusion: Article 149 of the Labor Code of the Russian Federation provides that when performing work in conditions deviating from normal (when performing work of various qualifications, combining professions (positions), overtime work, working at night, weekends and non-working holidays and when performing work in other conditions deviating from normal), the employee is made appropriate payments provided for by labor legislation and other regulatory legal acts containing labor law norms, a collective agreement, agreements, local regulations, and an employment contract. The amounts of payments established by a collective agreement, agreements, local regulations, employment contract cannot be lower than those established by labor legislation and other regulations containing labor law norms. At the same time, the Labor Code of the Russian Federation does not mention such a thing as the evening shift, and does not establish the employer’s obligation to pay at an increased rate for work on the evening shift. Previously, an additional payment for work on the evening shift in the amount of 20% was provided for in clause 9 of Resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions dated February 12, 1987 N 194 (hereinafter referred to as Resolution N 194). The procedure for her appointment was determined by the Explanation “On the procedure for applying additional payments and providing additional leave for work in the evening and night shifts, provided for by the resolution of the Central Committee of the CPSU, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions of February 12, 1987 N 194”, approved by the resolution of the State Labor Committee of the USSR and the Secretariat of the All-Union Central Council of Trade Unions dated 05/07/1987 N 294/14-38. However, the said resolution was in fact not subject to application from the date of entry into force of the Decree of the Government of the Russian Federation dated July 22, 2008 N 554, which established the minimum increase in wages for work at night (see also the ruling of the Supreme Court of the Russian Federation dated November 12, 2008 N GKPI08-2113 , letter of the Ministry of Health and Social Development of Russia and Rostrud dated October 28, 2009 N 3201-6-1), and is officially recognized as not valid on the territory of the Russian Federation by Decree of the Government of the Russian Federation dated April 28, 2011 N 332. Consequently, additional payment for work in the evening should be made only in that case , if this is provided for by a local regulatory act, collective agreement, agreement or employment contract with the employee (Articles 8 and 9 of the Labor Code of the Russian Federation). In these cases, the grounds and procedure for applying additional pay for work in the evening are determined by the provisions of these local regulations themselves (collective agreement, agreement, employment contract).

Answer prepared by: Expert of the Legal Consulting Service GARANT Chernova Anastasia

Response quality control: Reviewer of the Legal Consulting Service GARANT Victoria Komarova

August 13, 2015

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

When does the night start?

Article 96 of the Labor Code of the Russian Federation defines night time. They consider the time from 22 o'clock to 6 o'clock. The duration of work (shift) at this time is reduced by 1 hour and is not subject to work. But: if the employment contract provides for reduced working hours or night shift work, the duration of the shift is not reduced.

Therefore, the employer always tries to determine in advance the need for shift work in the employment contract. After all, if this is not stipulated, the night shift should automatically be shortened by an hour. And this leads to a loss of labor productivity and an increase in the cost of goods or services.

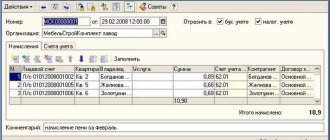

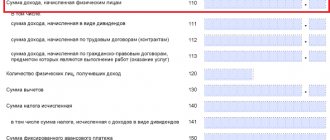

Example of compensation calculations for night work

Payment at night for certain categories of employees A special amount of payment is provided for certain categories of employees: 1. An additional 35% is paid:

- railway and metro workers;

- workers working on river ships;

- housing and communal services workers;

- trade and catering workers;

- employees of motor transport companies, in the absence of shifts;

- workers of guard, paramilitary, fire protection.

2. 50% additional payment:

- workers working at pasta factories.

3. 75% additional payment:

- yeast factory workers working in shifts or continuously;

- textile workers;

- workers in plywood factories.

Zvezda LLC provides for a 5-day work week, lasting 40 hours. The organization works in 3 shifts, lasting 8 hours:

- from 9:00 to 17:00 - first shift. Pavlov worked;

- from 17h to 01h - second shift. Sidorov worked. Night time 3 hours;

- from 01:00 to 9:00 - third shift. Komarov worked. Night time 5 hours. The tariff rate is 200 rubles per hour.

For night shifts, a 20% premium is provided to the rate per hour of work (established by the Regulations on Remuneration). The employees worked in full the monthly norms:

- in January - 128 hours;

- in February - 159 hours;

- in March - 167 hours.

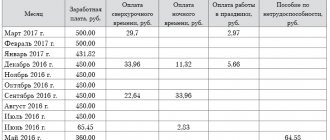

When employees are given a salary (for example, 20 thousand rubles), the calculation will look like this: Pavlov’s salary for January, February and March was 20,000 rubles each; Sidorov's salary was:

- for January: 20,000 rubles 20,000 rubles / 128 hours * 48 hours * 20% = 21,500 rubles;

- for February: 20,000 rubles 20,000 rubles / 159 hours * 60 hours * 20% = 21,509 rubles;

- for March: 20,000 rubles 20,000 rubles / 167 hours * 63 hours * 20% = 21,508 rubles.

Similarly, Komarov’s salary will be:

- for January: 22,500 rubles;

- for February: 22515 rubles;

- for March: 22514 rubles.

There are 2 options possible:

- At increased piece rates for the quantity of product manufactured at night, when the production of a certain type of finished product takes no more than an hour,

- According to the formula: (Product production per month * Price per unit) / Number of hours worked (total) * Number of night hours * Additional payment for night time - in the case when the product manufacturing process takes more than a day.

Zvezda LLC has a piece-rate wage system - 90 rubles per unit of goods. Night time is paid at a rate of 20% of the established rate. 3 units are produced in 1 hour. goods. Within a month, Pukhov produced 350 units. goods per day shift and 20 units. per night.

Payroll: 350 units. * 90 rubles/unit. 20 units * 90 rubles/unit. × 20% = 31,860 rubles. In the case where the production process is long: the piece rate is 5,000 rubles per unit of finished product.

At the same time, 10 units were produced per month. goods. Amount of time worked: in total for a month - 130 hours, incl. night shift – 15 hours. For manufactured goods, Pukhov will receive: 10 units. * 5000 rubles = 50000 rubles.

Additional fee for night work: 10 units. × 5000 rubles / 130 hours × 15 hours × 20% = 1154 rubles. Accrued wages: 50,000 rubles 1,154 rubles = 51,154 rubles.

Human physiology requires rest at night and wakefulness during the day, so those who work at night have a doubly difficult workload to bear. Especially for such employees, the Labor Code establishes norms regulating their right to receive a salary with an allowance. Content

- 1 What is night work and how is it paid?

- 2 Payment at night for certain categories of workers

- 3 Some points related to payment for night work

- 4 Example of compensation calculations for night work

What is night work and how is it paid? According to Art.

96 TK, night time is considered to be from 22.00 to 6.00 am. Work during this period is recognized as night work. The employment contract specifies working hours; the employee signing the contract additionally signs his consent to work at night.

Terms of payment for evening and night work hours

Therefore, when setting an hourly tariff rate, it can be calculated taking into account the surcharge for night work. At the same time, this option of establishing an hourly tariff rate is not very convenient, especially if the employee is hired to work not only at night.

In addition, in the event of an inspection by the labor inspectorate, each time you will have to confirm the fact of increased payment for work at night by calculation. Therefore, it is more convenient to set a separate tariff rate and a separate surcharge for night work.

In practice, there are cases when the employer includes additional payment for night work in the monthly bonus. The consequences of such actions are such that the inclusion of an additional payment for night time in the monthly premium will lead to a distortion of the meaning of Part.

We invite you to read: Top best business ideas for women

1 tbsp.

- in February - 159 hours;

- in March - 167 hours.

Thus, Pavlov's salary:

- for January: 200 rubles/hour * 128 hours = 25,600 rubles;

- for February: 200 rubles/hour * 159 hours = 31,800 rubles;

- for March: 200 rubles/hour * 167 hours = 33,400 rubles.

Payment for work in the evening and night time Sidorov:

- for January (night 48 hours): 200 rubles/hour * 128h 200 rubles/hour * 48h × 20% = 27520 rubles;

- for February (night 60 hours): 200 rubles/hour *159 hours 200 rubles/hour * 60 hours * 20% = 34,200 rubles;

- for March (night 63 hours): 200 rubles/hour * 167h 200 rubles/hour * 63h × 20% = 35920 rubles.

A similar calculation of Komarov’s salary:

- for January (night 80 hours) = 28,800 rubles;

- for February (night 100 hours) = 35,800 rubles;

- for March (night 105 hours) = 37,600 rubles.

When employees have a fixed salary (for example, 20 thousand)