In the Russian Federation, every year before April 15, legal entities need to confirm their main type of activity. A simple procedure must be performed in order for the Social Insurance Fund (SIF) to set the correct percentage of the contribution “for injuries”. About the process of determining and confirming the main type of activity, about the accompanying documents required by the FSS, as well as about who does not have to annually record the type of activity and what the consequences of delay in submitting data are in more detail in the article below.

The concept of the main activity

According to the ninth paragraph of the Rules for classifying types of economic activities as professional risk, approved by Government Decree No. 713 dated 01.12.05 (hereinafter referred to as the Rules ), the main type of economic activity (OVED) includes the activities of a commercial organization for which a large amount of revenue was received for the past reporting period. year.

This criterion is the main one when installing ATS, despite the fact that:

- The state register of a legal entity indicates another main activity.

- The state register does not indicate at all the type of activity that has become the main one in terms of income.

The rules help the Social Insurance Fund select and fix the rate for the company’s “injury” contribution.

Note! The rules for selecting and installing ATS for non-profit organizations differ significantly from the Rules for commercial ones.

Who is recommended to confirm ATS?

The eleventh paragraph of the Rules states that all legal entities confirm the ATS once a year. An exception to the rules are newly founded companies - during the first year of economic activity they are exempt from the obligation to confirm the type of activity. More details are specified in paragraph 6 of the Procedure for confirming the main type of economic activity of the insurer for compulsory social insurance against accidents at work and occupational diseases - a legal entity, as well as the types of economic activities of the insurer's divisions, which are independent classification units, approved by order of the Ministry of Health and Social Development of the Russian Federation dated January 31, 2006 No. 55 (hereinafter referred to as the Procedure ).

Also, the eleventh paragraph of the Rules states that for branches of companies it is additionally necessary to confirm the VD if they have separate current accounts at their disposal and they independently make payments and benefits to employees. As for divisions without existing bank accounts, but which are involved in separate internal affairs, different from the main organization, and are established as separate units of economic activity on the basis of clause 7 of the Rules and clause 7 of the Procedure, then additional documents must also be submitted for them to the Social Insurance Fund.

Note! Individual entrepreneurs do not confirm the Department of Internal Affairs to set the “injury rate” for the wages of hired personnel. The main type of commercial activity of the individual entrepreneur is unchanged and is indicated in the Unified State Register of Entrepreneurs in the line “Type of information” as “Main”. The entrepreneur does not pay this fee for himself.

In the Unified State Register of Legal Entities, according to Part 3 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation, the current main foreign economic activity must be displayed, otherwise the manager faces a fine of 5,000 rubles.

The principle of calculating the contribution percentage for private entrepreneurs differs from legal entities. The tariff is calculated based on the type of activity that is established as the main one in the state register, and not on the income received for the previous reporting year. Data on ATS are taken at the beginning of 2021 and recorded for 365 days, even if the ATS has changed.

Where can I find a sample of filling out the OKVED confirmation certificate?

The algorithm for confirming the main VD is regulated by Order of the Ministry of Health and Social Development dated January 31, 2006 No. 55, and the certificate form is enshrined in Appendix 2 to this regulatory legal act.

The certificate in question contains information:

- about the policyholder (name, INN and Unified State Register of Legal Entities codes, address, names of the manager and chief accountant, as well as the number of employees);

- distribution of income across the company’s main internal activities;

NOTE! From 01/01/2017, the document must display new OKVED2 codes approved by the order of Rosstandart “On the adoption and implementation of the All-Russian Classifier of Types of Economic Activities (OKVED2)” dated 01/31/2014 No. 14-st.

- selected VD.

Form and sample of filling out the OKVED confirmation certificate.

OKVED confirmation form

Sample of filling out the certificate

Principle of determining ATS

The calculation of the OVED of commercial organizations occurs using reporting data for the previous year.

In order to calculate the share of revenue for each type of activity, the following indicators are taken from the balance sheet without VAT:

- Total sales revenue for the entire organization.

- Revenue separately for each company's income statement.

Activities with a larger share of revenue will be OVED. If the shares are equal, then the main one is the one with the larger profrisk class, as specified in paragraph 14 of the Rules.

Nonprofit organizations determine their ATO based on the number of personnel they employ. Thus, paragraph 9 of the Rules states that the type of activity will be the main one in which more workers were involved in the previous reporting year. Unfortunately, the Rules and Procedures do not indicate on what principle the internal affairs department is to be determined in the case of an equal number of employees involved in different internal affairs departments. In the event of such situations, accounting employees determine according to the example with commercial activities, which means they determine according to the highest class of professional risk.

Example of defining the main type of work

The main type of entrepreneurial activity is determined by the legal entity independently. It depends on the VD with the highest share for commercial entities or on the VD with the maximum number of employees for non-profit structures. If a company maintains several VCs, and the specific weight as a result of the calculation is the same, then the highest class of profrisk is selected. Let's look at the algorithm for choosing the main OKVED using an example.

Example:

Assorti LLC carries out the following internal activities:

| Type of work | OKVED code | Sales volume for 2021 (RUB) | Income level (%) | Profrisk class |

| Production of alcoholic beverages | 11.01.1 | 7 550 000 | 40 | II |

| Wholesale trade of alcohol | 46.34.2 | 7 550 000 | 40 | I |

| Retail sale of alcohol in specialized stores | 47.25.1 | 3 740 000 | 20 | I |

| Total | 18 840 000 | 100 |

To determine the rate of “unfortunate” contributions, we select the indicator with the highest share of income. In the example conditions, this is the wholesale trade of alcohol and its production. Since the indicators are equal, we choose a higher occupational risk class, which includes the production of alcoholic beverages, that is, II. The rate of “unfortunate” contributions corresponding to risk class II is 0.3%.

List of documents for submission to the FSS

List of documents to confirm OVED for a legal entity:

- Policyholder's application.

- Confirmation certificate using the template.

- A copy of the explanatory note to the organization’s balance sheet for the past reporting period (according to the third paragraph of the Procedure - for everyone except small businesses).

A package of documents is submitted to the local authority of the Social Insurance Fund. Branches of organizations with their own bank accounts that make payments to hired personnel generate the same set of documents for submission to the Fund at their location (clause 8 of the Procedure).

In appendices No. 1 and No. 2 of order No. 55 of the Ministry of Health and Social Development of the Russian Federation you can find examples of applications and certificates.

ATS confirmation process

Clause 3 of the Procedure allows you to submit a set of documents to government authorities at the place of registration of the legal entity and the location of the branch, both in paper and electronic form.

Methods for submitting documents online:

- In the organization’s personal account on the Social Insurance Fund website.

- Through specialized telecom operators.

- In your personal account of the Unified Portal of State Services.

Electronic document flow is carried out only after signing with an enhanced electronic signature.

Note! The electronic document management service “Kontur.Extern” generates and sends documents to the Foundation online. For easier use, the system has collected the above-mentioned documents into one form.

Deadlines for submitting documents

In 2021, the date for submitting the package of documents has not changed - until April 15 of the current year inclusive .

The company receives a message from the state fund about setting the basic rate of contributions “for injuries” within two weeks from the date of receipt of the package. Clause 4 of the Procedure states that the tariff is determined based on the professional risk class of the main type of activity.

Note: Thirty-two standard rates remain unchanged for the current 2021 year. The interest rate in the range of 0.2-8.5 is calculated on the amount of payments and remunerations paid in favor of individuals working under employment contracts of the Labor Code of the Russian Federation and civil contracts.

Application of insurance rate

Before the date of receipt of the notification, all transfers to the Social Insurance Fund must be calculated at the old rate that was in effect last year. And only after the company receives an official letter, insurance payments can be calculated according to the new insurance rate.

If payments need to be made according to the new tariff, the subject must:

- Recalculate all payments that were transferred to the Fund from the beginning of 2021 until the receipt of the notification. If the new tariff has increased, the penalty is not removed, since information about it was received only now, and the company could not know about the new rate;

- Send updated calculations for the new tariff in accordance with Form 4-FSS for the period from January 1, 2021 until the receipt of notification.

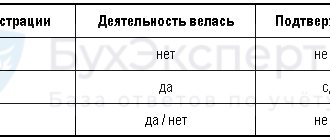

What are the consequences of not confirming ATS?

In case of failure to submit documents on time, the regulatory authority independently sets a tariff based on information from the Unified State Register of Legal Entities. The principle of choosing a tariff rate is fixed in paragraph thirteen of the Rules: the percentage of the rate is taken from the register of the foreign trade activity that has a higher class of professional risk. To make such a choice, the FSS does not need evidence of the reality of this type of activity, as established by the Supreme Court of the Russian Federation dated November 2, 2018 No. 308-KG18-17110.

The resolution of the Arbitration Court of the Volga-Vyatka District dated 02/04/19 No. F01-6889/2018 provides an exception. The FSS can approve the percentage of contribution according to the Unified State Register of Legal Entities only when it does not have data on the organization’s internal affairs bodies. If the Fund received such information in other reporting documents, then fixing the rate in the Unified State Register of Legal Entities is prohibited.

To top it all off, if a legal entity submitted documents late, the budget organization is obliged to change the tariff rate previously established in the Unified State Register of Legal Entities - to fix a percentage that coincides with the percentage of the current OVED. These conditions were determined by the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated September 11, 2018 No. 309-KG18-7926 and dated November 12, 2018 No. 304-KG18-9969.

If you send confirmation earlier than the notification from the Social Insurance Fund arrives, overpayments can be avoided

Due to untimely confirmation of the main type of activity, the FSS assessed additional insurance premiums, penalties, and also issued a fine to the company.

The employer appealed the additional charges in court. In his justification, he explained that although he was overdue for submitting documents confirming the type of main activity, he managed to send information before receiving notification of the assigned tariff from the fund.

The courts of three instances (Resolution of the Arbitration Court of the Moscow District dated October 28, 2019 No. F05-17412/2019) sided with the applicant and declared that in this case the definition of the type of activity according to the highest class of profrisk was incorrect.

The judges indicated that when submitting documents confirming the main type of business, before actually determining the size of the insurance tariff, the FSS must take these documents into account in order to select a rate.

Otherwise, the principle of differentiation of insurance rates depending on the class of insurance coverage will be violated.

Let's sum it up

It will not be difficult for an accounting employee to prepare documents to confirm the ATS. A simple calculation of the share of sales proceeds is carried out according to a generally available rule and will not take much time. Therefore, the main goal remains to submit the correct package of documents to the Social Insurance Funds on time in 2021, so that the legal entity avoids an increase in the interest rate “for injuries” and payment for it.

Download the confirmation certificate. certificates