An online cash register is a device that issues a cash receipt and transmits information about the sale to the tax office via the Internet. Since the middle of last year, most retailers have switched to such equipment. In 2021, further changes were made to the law on the use of cash register systems.

Read more: KKM in 2021: changes and latest news

Online cash registers for individual entrepreneurs on UTII: deferment until 2021 (latest news)

Postponement of online cash registers for the simplified tax system

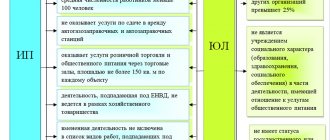

Both in each rule, and in Federal Law No. 54, there are exceptions. Some categories of entrepreneurs are subject to a deferment of the mandatory installation of cash register systems until 2021, namely:

- entrepreneurs without hired employees who sell their own goods or provide services to the public. Moreover, if at least one employment contract has been concluded, the deferment does not work. Also, it will not affect those who sell excisable goods;

- payment is made via bank transfer to the bank account of an individual or legal entity.

It is worth noting that Law No. 129 amends Federal Law-54 and completely exempts the following types of business from online use:

- the business entity is located in hard-to-reach places, these locations are determined by regional authorities (for such entities you need to use a cash register without an Internet connection and OFD);

- sells shoe covers, newspapers, theater tickets from a tray and other printed products, bottled drinks, ice cream, vegetables, sells religious goods or rents out residential premises, parking lots, etc.

The same rules apply to online cash registers for both UTII and simplified taxation system.

Is acquiring required?

By law, all commercial structures that sell goods or provide services must provide customers with the opportunity to choose a method of payment for services. This applies to all businessmen, including simplifiers. However, at a certain annual turnover, this requirement is removed. It also does not apply to individual entrepreneurs who install autonomous cash registers to operate away from communication lines.

But for businessmen it is more profitable to use acquiring services, providing clients with the opportunity to pay in cash or by card. This helps to increase customer loyalty, increase the average check, and speed up the service process.

How to choose an online cash register for individual entrepreneurs on the simplified tax system

Choosing an online cash register is a responsible step; you should approach the purchase of equipment carefully and take into account the following factors:

- specific activity - provision of services, catering or outbound trade;

- sales volumes - number of receipts per shift;

- place of sale - whether a mobile or stationary cash register is needed;

- payment method - cash and bank transfer;

- whether there are excisable goods.

When choosing an online cash register, it is important to check whether the model is in the register of approved devices, which is determined by the Federal Tax Service.

Basic requirements for an online cash register

According to the amendments to Federal Law-54 (clause 1 of article 4 and clause 1 of article 4.3), the new sample CCP must have the following properties and characteristics:

| The ability to send data to the tax service via Internet connection through the OFD. | Print receipts and send electronic versions of them to the buyer. |

| Equipped with a housing with a serial number. | Read encrypted data from OFD. |

| Have space for a fiscal drive and a built-in real-time clock. | At any time, upon request of regulatory authorities, print a document on the current status of settlements. |

| Be able to generate fiscal data. |

The user determines additional parameters for himself depending on the working conditions and type of activity.

Installing a cash register

After installing a new cash register or upgrading an old one, you need to select a FD operator and enter into a service agreement with him. A list of such companies is presented on the Federal Tax Service website. The functions of operators are to receive data about all operations performed on the cash register, their transmission, and storage. To conclude an agreement, a qualified electronic signature will be required. If necessary, it can be purchased from the same operator.

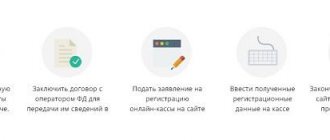

The installation proceeds as follows:

- An application for registering a cash register is generated in your personal account on the Federal Tax Service website.

- In the “My cash registers” tab, you indicate the address where the equipment will be located, the number of the device and drive, information about the FD operator, the model of the drive and the cash register itself, as well as the purpose of its use.

- The application must be signed and submitted.

- The results of the application consideration will be displayed in the corresponding section of the account.

Next, the necessary software is installed, data for fiscalization is entered: TIN, information about the OFD, the taxation system used by the individual entrepreneur, the serial number of the device and drive.

Important! If incorrect data is entered during the fiscalization process, the procedure will have to be repeated.

After completing fiscalization, you need to print the first check, which is considered a registration report. The document reflects the time and date of fiscalization, the number of the drive and the receipt.

The next stage is linking the cash register to the OFD and choosing a service tariff. This is done in your personal account on the operator’s resource. After generating the report, the information is entered into the account on the Federal Tax Service website, signed and sent. To complete the registration procedure, all that remains is to check the CCP registration card. The last step will be to verify the transfer of the check on the OFD website.

Types of online cash registers, taking into account the specifics of individual entrepreneurs’ activities

There are four main types of online cash registers for the simplified tax system:

| fiscal registrar - requires connection to a computer, interacts with EGAIS, prints checks at high speed. Easily customizable and covers an unlimited base of products. The disadvantage is stationary use and dependence on associated equipment. Models are distinguished by receipt width, printing method and component life. In the budget segment, we can note Atol 1F with a minimum set of functions that is suitable for small businesses. A representative of multifunctional powerful equipment is Viki Print 80 Plus with an auto-cutter and high printing speed; Go to the model catalog |

| Autonomous cash register — a push-button cash register with a small display for displaying information. Models of this format are equipped with a printer for printing receipts. The product base is limited. The use of such a cash register is possible in micro and small businesses; Go to the model catalog |

| Smart terminal - the most common type of technology, as it has small dimensions, a simple interface and settings. There are mobile and stationary devices of varying hardware capacity. Portable devices at an affordable price include the MTS 5 model; Go to the model catalog |

| POS system — performs all the necessary functions and represents a single interconnected system of equipment. The kit usually includes a computer or terminal with a fiscal recorder, keyboard, buyer display, etc. Go to the model catalog |

The cost of a cash register depends on many parameters, including manufacturer, functionality, appearance and additional options.

How much does it cost to service it?

The cost of the contract with the OFD is 3,000 rubles per year. Another 5-7 thousand rubles. you will have to pay for the drive itself (the price depends on the validity period). Registration with the tax office is free, but an electronic signature is required to complete the procedure online. Its registration will cost 1000 rubles per year.

In addition, you need to pay for Internet connection (12-25,000 rubles per year). Total annual maintenance of cash register equipment costs 21-36,000 rubles.

Important! An annual contract with a central service center costs 6-25,000 rubles.

Most entrepreneurs on the simplified tax system are required to use an online cash register, that is, install new devices or upgrade old ones. Individual entrepreneurs can provide services without a cash register 2021 only for several types of activities and only in the absence of employees. CCPs generate receipts for transactions performed, transmit the OFD information and then to the tax authorities. Receipts can be printed or sent to customers electronically. To install a cash register, you need to select a suitable model, enter into an agreement with the FD operator and go through the registration procedure with the tax office. There is no deduction for the purchase of a device under this special regime.

What else is worth paying attention to

When purchasing an online cash register for the simplified tax system, be it an individual entrepreneur or an LLC, there are many nuances. In particular, it is worth paying attention to a number of factors:

- size of the receipt tape - the wider the tape, the greater the number of characters that will fit on it; such receipts may contain the company logo, information about ongoing promotions and discounts, coupons;

- maintaining a product database - simplifies doing business, allows you to obtain data on balances, display sales statistics, etc.;

- the presence of a personal account - expands the possibilities of personalization and allows you to conveniently set up the cash register, as well as enter information and adjustments;

- screen type and size - there are touchscreen and push-button devices, color and monochrome, it all depends on the personal preferences of the owner;

- interaction with external equipment - the more different devices you can connect to the cash register, the more efficient the outlet will operate;

- Autonomous power supply is a convenient method of accepting payments. A mobile online cash register for services using the simplified tax system is the right solution for field activities and payment directly at the place of work;

- Dimensions and weight - contribute to the organization of a compact cashier's workplace, an especially important parameter in limited space.

All of the above deadlines, types of cash desks and their additional capabilities must be taken into account in accordance with the specific type of activity. However, it is worth remembering that an individual entrepreneur using the simplified tax system without an online cash register may be subject to penalties if he does not acquire all the necessary equipment on time and does not register with the relevant authorities.

Is there a tax deduction on purchase?

Entrepreneurs are entitled to a tax deduction for purchasing an online cash register. Its amount is 18,000 rubles. You can apply for compensation for:

- purchase of a fiscal drive;

- purchase of cash register software;

- provision of services for setting up equipment and putting it into operation;

- modernization of the old cash register.

Receipt of payments is available via cash registers included in the register and registered with the Federal Tax Service in a certain period.

However, deductions are not provided for entrepreneurs on the simplified tax system. An exception is the case of combining this special regime with PSN or UTII. It will be possible to offset expenses only for equipment that is used for imputation or patent.

Rent online cash desks on favorable terms

Favorable conditions for renting and servicing cash registers under 54 Federal Laws.

Replacement of equipment in case of breakdown. Technical support. MORE ABOUT THE OFFER

What is usually included in the kit:

- The online cash register itself

- Registering it with the tax office

- Connection to OFD

- Fiscal registrar

- Technical support and service

- Replacement if broken

- Automatic update of the cash register program, etc.

Need help choosing an online cash register?

Don’t waste time, we will provide a free consultation and select a suitable online cash register for the simplified tax system.

Terms of use

Settlements with the population or organizations are carried out by the client transferring cash to the cashier or providing a bank card to write off the required amount. Using online cash registers has some features:

- A buyer who wishes to receive a check in electronic format must inform the seller about this before generating a fiscal document.

- The cashier enters information about the operation being performed into the cash register and generates a paper receipt.

- Purchase data is transferred to FN.

- The drive encrypts information for sending OFD.

- The operator receives the information, sends confirmation to the cash register equipment and once a day transfers the received information to the tax office.

A check with fiscalization has legal force. If the seller is legally obligated to return the money, but refuses to do so, the buyer has the right to appeal to the courts.