Is it true that retained earnings are net profits?

Retained earnings are truly net profits that (as the name suggests) were not distributed (divided) among the participants/shareholders of the company.

Net profit is considered to be that part of income from sales and non-sales operations that remains after paying taxes. The decision on how to distribute this income rests solely with the owners. Traditionally, the issue of retained earnings is put on the agenda of the annual meeting of the company's owners. The adopted decision is documented in minutes, which are drawn up following the results of the general meeting of participants/shareholders.

For information on how such a document is drawn up, read the article “Decision on payment of dividends to an LLC - sample and order.”

The main ways of spending retained earnings are considered to be in the following directions:

- to pay dividends to participants/shareholders;

- repayment of past losses;

- replenishment (creation) of reserve capital;

- other goals formulated by the owners.

For information about the accounting entries accompanying the accrual, payment and receipt of dividends, read the material “Accounting entries for the payment of dividends”.

Determining sources for covering losses

Liability in capital shows how the amount of losses received decreases.

Since other sections remain unchanged, the accountant has the right to post a write-off of losses using various means.

In practice, transactions for writing off losses are displayed as follows

To increase the company's profit growth, management must make effective decisions on the distribution of incoming profits, based on the analysis and prepared annual reports, or reports for the entire period of the enterprise's activities.

back to menu ↑

Equity: Retained Earnings

Is retained earnings an asset or a liability?

Retained earnings on the balance sheet are, of course, a liability. The value of this indicator indicates the company’s actual debt to its owners, since ideally this profit should be distributed among the participants and invested in the further development of the business.

In fact, the company cannot dispose of retained earnings without the owners making a decision. The loss reflected in line 1370 is also on the passive side of the balance sheet, only this is a negative value, so the number is placed in parentheses.

“How to read a balance sheet (a practical example)?” will help you better understand balance sheet analysis. .

Retained earnings must be reflected on the balance sheet. ConsultantPlus experts explained in detail how to do this correctly. To do everything right, get trial access to the system and go to the Tax Guide. It's free.

Definition

Retained earnings on the balance sheet are the portion of certain profits that remains with an organization after it has paid all taxes, salaries, dividends and other payment obligations.

To assess the company's performance, the most important indicator in the report is profit for a certain period of time.

Based on its positive or negative dynamics, one can understand how effectively the organization operated in a given period of time.

In order to increase productivity, and as a result, the growth of income received, it is necessary to correctly direct funds from retained earnings.

The allocation of these resources is influenced by the decisions of the firm's management. They will be jealous of where the retained earnings will be directed:

- employee bonuses;

- dividend payment;

- increase in the amount of authorized capital;

- increasing the reserve fund;

- distribution of funds for other purposes aimed at the development of the organization.

Important: retained earnings cannot be accumulated until the organization fulfills all monetary obligations for a certain period of time.

The concept of retained earnings closely intersects with the concept of net profit.

However, their difference is that retained earnings are primarily a performance indicator for a period of one calendar year or for the period from the start of the organization’s work to the present.

Net profit is necessary for reconciliation of indicators for the reporting period.

It should be taken into account that retained earnings in the organization are interpreted differently.

The accountant evaluates such profit as the result of the final work for the year and reflects its indicator in the 84th account.

The profit itself is distributed by the owners of the organization in the person of its owners.

They distribute it for the next year starting from March 1 and until June 30 of the current year.

The economic meaning of retained earnings will be that its indicators will be considered the next year after the date of its actual calculation and distribution by the accountant, based on the decision of the enterprise management.

back to menu ↑

Retained earnings and uncovered losses - what are they?

As mentioned above, retained earnings are the final income received by the company from its business activities, remaining after the transfer of income taxes and not yet divided (not directed to other purposes) by its owners.

Example 1

Voskhod LLC in 20XX received a profit in the amount of 800,000 rubles and paid income tax in the amount of 160,000 rubles. In line 1370 in the balance sheet liability for the year 20XX, Voskhod LLC should reflect 640,000 rubles. This is retained earnings.

The value in line 1370 of the balance sheet may be equal to that indicated in line 2400 of the financial results report if the company had no profits not distributed by the owners at the beginning of the year and no interim dividends were paid during the year.

What can retained earnings from previous years be used for? The answer to this question is in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Our article “Deciphering the lines of the balance sheet (1230, etc.)” .

As for the uncovered loss, this is the excess of the company's expenses over income at the end of the year.

Example 2

In 20XX, Parus-Trade LLC received revenue from the provision of services and other non-operating income. Their total amount was 400,000 rubles.

The costs associated with conducting the main activity (transportation) are equal to 380,000 rubles. Other company expenses (not taken into account for tax purposes) amounted to another 58,000 rubles. Profit tax was assessed in the amount of RUB 4,000. Parus-Trade LLC has no reserve capital.

This means that at the end of 20XX, after the reformation of the balance sheet, an entry of 42,000 rubles will appear in line 1370 in parentheses. (400,000 – 380,000 – 4,000 – 58,000).

An uncovered loss occurs when the company receives an actual loss and there are no financing reserves. The value entered in the liability side of the balance sheet in parentheses will reduce the total for section 3 of the balance sheet.

Among the main reasons for receiving an uncovered loss are:

- obtaining an actual negative financial result from the company’s activities due to the excess of costs over income;

- changes in accounting policies that had an impact on the financial condition of the company (this is directly stated in paragraph 16 of PBU 1/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n);

- errors found in the current year, made in previous years, which affected the financial result (subclause 1, clause 9 of PBU 22/2010, approved by order of the Ministry of Finance of Russia dated June 28, 2010 No. 63n).

Read more about PBU 1/2008 in the material “ PBU 1/2008 “Accounting policies of the organization” (nuances)” .

Formation process and content

Active-passive account 90 is responsible for sales. It actually reflects all the results of the company’s direct activities, expressed in:

- production and sales of products;

- provision of services.

The debit of the account will reflect the full amount of the cost of manufactured products, the amount of calculated value added tax, as well as other expenses related to production.

The account credit will contain the full amount of proceeds from the sale of goods. The balance, as a final calculation, is transferred to account 99.

Based on these calculations, the following entry is made

The financial actions of the organization, expressed in activities that are not related to the main one, will be entered into account 91, which is responsible for other income of the company that differs from the main one.

These types of calculations will include:

- selling the company's existing assets;

- leasing of company assets;

- carrying out markdowns on assets that are outside the main circulation of funds;

- carrying out additional valuation of assets that are outside the main turnover;

- carrying out external actions with foreign currencies;

- investing funds in other organizations;

- carrying out liquidations of movable or immovable property;

- transfer of movable or immovable property as a gift;

In the above cases, actions will be recorded in the following form:

Similarly, when working with the above accounts, balances are transferred to accounts responsible for unplanned receipts of income or such unplanned receipt of losses.

An example of such income or expense could be the receipt of an insurance payment for a specific event or the loss of any asset on the balance sheet of the enterprise as a result of a natural disaster or catastrophe.

In other words, such income and expenses are not predicted and are of a spontaneous (emergency) nature.

In the same way, the balance is transferred from the account responsible for materials.

For example, it records the price of any types of property or materials received by the organization that are not required for production.

Important: retained earnings can be increased according to the indicators in the reporting, in a situation where the accountant makes a mistake, expressed in an incorrectly inflated expense indicator.

The growth of retained earnings can also be affected by payments in the form of dividends if they are not used by investors within 3 years from the date of their accrual.

In addition to financial assets expressed in one form or another, profit can also be material.

It is important to understand this when you need to conduct an economic analysis of an organization’s performance for a selected specific period of time.

At the end of the year, the accountant needs to carry out an operation in the organization’s balance sheet related to writing off the final balance from the main account to account 84.

This action is formalized as follows

After this posting is completed, account 99 from which the funds were written off must be reset, and the first entries on it will appear only at the beginning of next year.

back to menu ↑

How retained earnings from previous years are displayed

Retained earnings from previous years are accumulated in account 84. The credit balance of this account is transferred to balance sheet line 1370.

Typically, there should be no movement in the debit of the account during the year, since the distribution of profits traditionally occurs at the end of the year after the annual meeting of the company's owners. But there is also a special case when debit 84 needs to be used during the year. To make sure that you did not miss this very transaction, get free access to ConsultantPlus and go to the Typical Situation.

For information on how data on retained earnings is generated for reflection in the balance sheet (final and interim), read the article “Procedure for compiling a balance sheet (example).”

How is it calculated

Important indicators that you should know when calculating retained earnings are:

- the amount of retained earnings at the beginning of the year;

- net profit or loss for the year;

- amounts received by the owners.

According to the last point, these amounts can be in the form of dividend payments to the shareholders of the enterprise or payments of cash to the founders.

The indicators are taken from line 1370 responsible for the balance sheet and line 2400 responsible for the financial results report.

The interim payment, which is assigned during the year from the projected profit, must be reflected in the organization’s orders.

If a profit is made for the current year, then it will be calculated using the following formula

If there is only a loss for the current year, then the calculation formula will be slightly modified

The first value can also be negative if losses in the current year exceed the calculated amount of profit at the beginning of the year.

If this happens, then such an indicator will be designated as an uncovered loss.

The calculation formula can also be supplemented and modified depending on what form of ownership and type of activity the organization has.

back to menu ↑

Retained earnings of the reporting year

The credit balance at the end of the year according to accounting account 99 is net profit. But in addition to the financial result, this account also reflects some other indicators. You can learn which ones and how not to make mistakes when making transactions from the Typical Situation from K+, having received trial access to the system.

When reforming the balance sheet, it is written off to accounting account 84 (Dt 99 Kt 84) and constitutes retained earnings at the end of the reporting year.

Read about the reformation procedure in the material “How and when to reform the balance sheet?”.

In order to separate the indicators of retained earnings of the current (reporting) year from last year’s, some accountants allocate separate lines 1372 and 1372 in the balance sheet, which respectively reflect the retained earnings of the reporting period and previous years.

The use of retained earnings is the prerogative of the company's owners. And highlighting this financial indicator for different years in the balance sheet is primarily convenient for them. But it is worth keeping in mind that the retained earnings of the past year cannot be fully distributed without taking into account the company’s previous operating results.

IMPORTANT! It must not be allowed that the value of the company’s net assets, after transferring retained earnings of the reporting year for the payment of dividends, becomes less than the size of the company’s authorized capital even if there is a reserve fund. The caution applies to cases where uncovered losses were recorded in previous years. The decision to cover last year's losses from retained earnings of the reporting year is made exclusively by the owners of the company.

But retained earnings for previous years can be distributed by the participants/shareholders of the company not only at the end of the year, but at any time. The main thing is to hold a thematic meeting of all company owners and approve the appropriate decision.

Does an LLC have the right to make incentive payments to employees from retained earnings and how to formalize this, and are they taken into account when calculating the average salary? The answer to this question was prepared by labor inspector in the Nizhny Novgorod region V.I. Neklyudov. Get free trial access to the ConsultantPlus system and get acquainted with the official’s point of view.

Reflection in reports

This profit must be reflected in the company's capital or in its reserves.

When preparing annual reports, the total amount of profit will be reflected excluding pre-made deductions.

This means that the following were subtracted:

- loss for the previous year;

- payment on dividends;

- transfers of funds from reserve funds;

- and other items of expenses of the enterprise.

All numerical indicators for the above points may be modified until the management of the organization finally approves them.

back to menu ↑

Previous year report

There are 2 ways to calculate profit:

- accumulation calculation;

- calculation by year.

In the first option, dividing profits into previous years and the reporting year with the further opening of a separate sub-account, which will relate to account 84, is not required.

Profit is recorded on an accrual basis from the moment the enterprise starts operating.

In the event that losses occur with this form of calculation, they will overlap with the profits that were received in previous years.

This type of calculation is only effective for small organizations.

The main difference between the calculation by year is the presence of a separate sub-account for keeping records of the amounts of profit received for different periods of time.

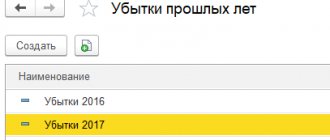

Subaccount options may vary. For example, such accounts might look like this:

In 2 situations presented in the example, the amounts that were received in previous years will be included in the calculations at the end of the year.

In order to obtain detailed information, you need to take the following types of indicators:

- explanatory notes that can go along with the balance sheet of the enterprise;

- accounting entry for account 84;

- reports for previous years.

Attention: if errors are discovered when calculating profits or losses for the previous year, information about them will be included in the financial results for the current year.

back to menu ↑

Report for the current year

If you need to display the profit for the current year in the company’s accounting department, you can open additional accounts for account 84.

An example might look like this:

If a positive result is obtained in the current year, based on the example, the posting will look like this:

Dt 84.1 Kt 84.2

If the posting is applied to an 84.3 account, then this will mean that the profit will be used for various funds.

In any of the accounting options, the closing entry at the end of the reporting year will be noted in the general ledger.

This posting will be an operation to write off funds from account 99 to account 84.

From the amount used, income taxes must already be deducted, as well as interim payment of dividends and other forms of payments.

Therefore, the following type of wiring is done

back to menu ↑

Retained earnings: calculation formula

According to general accounting data, retained earnings are a company's net profit after taxes that can be distributed to the company's owners.

Based on global financial practice, retained earnings (hereinafter referred to as RR) are calculated using the following formula:

NPk = NPn + PE – Div,

Where:

NPk - NP at the end of the reporting year;

NPn - NP at the beginning of the reporting period;

PE - net profit remaining after accrual of income tax;

Div - dividends paid in the reporting year based on the NP of previous years.

If you do not have the NP value, then to calculate the NP you can use the following scheme:

- first calculate profit before tax (to determine it, calculate operating profit, which is defined as the difference between operating income and operating expenses);

- then subtract depreciation and interest costs from operating profit;

- Subtract tax from the resulting profit value.

To find out whether it is possible to see the amount of operating profit in the accounting statements, read the article “Which line is operating profit reflected in the balance sheet?”

Indicator for investors

Retained earnings are a very convenient indicator for investors of the success of an enterprise. There may be several options, and from each a certain conclusion is drawn. Here are some examples:

- A situation when a company accumulates retained earnings without launching development projects. If the business is stable and does not require further progress, this is a good option that allows you to receive dividends.

- If modernization or further advancement in the market is needed, such conservatism can lead to stagnation and then a drop in income.

***

Retained earnings in the balance sheet are determined according to an established formula and show how much business owners can distribute in different directions. In addition, this indicator gives investors an idea of the company's success.

Similar articles

- The ratio of penalties and losses

- How to calculate income tax: example

- How to calculate income tax on an accrual basis?

- What is book profit?

- How to show a loss on the balance sheet

Indicators for investors

When analyzing the financial condition of a company, investors pay attention to the use of retained earnings. If NP accumulates and is not put into circulation, this state of affairs should seem to suit investors, since they can count on significant dividends.

However, without investment in its activities, the company stops growing, and its income not only does not increase, but may also decrease (due to a drop in competitiveness, high wear and tear of equipment, and for other reasons related to the lack of investment). So a company that accumulates profits but does not invest in its activities cannot be attractive.

At the same time, a company that does not make a profit and does not pay dividends cannot interest investors at all.

The ideal option for investors is a company that invests the funds remaining after paying dividends in its development. Although the owners may decide not to pay dividends and direct the entire volume of NP into circulation.

Where to send consumables

According to the decision of the organization's management, the entire amount of retained earnings is directed to the sources chosen by it.

Attention: the accountant does not have the right to independently make decisions on the distribution of profits. The basis for starting the relevant postings will be the act issued by the management of the organization.

Unlike other income accounts, management can dispose of retained earnings quite freely.

However, such an order should not go beyond the scope of the organization’s charter, as well as current legislation.

An example of typical postings could be the following:

Management cannot make decisions on the distribution of profits if one of them has debts on investments in the authorized capital.

The same rule will apply in situations where:

- the size of the organization's net asset is lower than the size of the authorized capital;

- the size of the organization's net asset is lower than the size or reserve fund;

- in cases where the organization is in bankruptcy proceedings.

With such restrictions, it is prohibited to pay amounts intended for dividends from the company's shares.

Legal entities of the LLC form have the right not to create reserve funds.

This rule is applicable for joint stock companies, where the size of the fund must be at least 5% of the amount of the authorized capital.

An LLC can create various funds, the purpose of which will be to distribute profits.

To reflect the actions taken on them, it is enough to open additional accounts for the main ones, from which this profit will be distributed.

Joint-stock companies, on the basis of current legislation, can create a fund for the corporatization of employees.

The entire amount from it will be used only for the purchase of securities from their owners. JSC employees also have the right to buy back parts of free shares.

If retained earnings are directed to the development of the organization, then such an action is called self-financing.

A feature of this type of distribution will be considered a fact that is associated with changes in the balance.

Thus, when purchasing additional equipment necessary to modernize production, there will be no decrease in the liability balance sheet.

In this case, the asset will move in the direction of decrease. Such transactions will not affect the company’s capital in any way.

The accountant must display all funds spent on the balance sheet for additional accounts related to account 84.

At the moment when the accumulated income is spent, that is, the balances of account 84 go into debit, it will be noted that further transfer of funds to improve production will be carried out using funds in the organization’s circulation.

back to menu ↑

Results

There is a separate line in the balance sheet to reflect retained earnings (profit remaining after the amount of income tax or net profit has been withdrawn from it). The figure entered into it corresponds to the amount of the entire net profit accumulated over the years of the company’s activity. During the reporting year, the value of retained earnings in accounting relating to this year can be seen in a separate accounting account. Dividends are paid out of net profit.

Sources: Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.