Value added tax (hereinafter referred to as VAT, tax) is one of the key taxes in the tax system of the Russian Federation. Hence the increased attention of regulatory authorities to accrual, timely payment and transfer to the budget. Tax authorities online monitor mutual settlements between tax counterparties and, if there are discrepancies, send requests to taxpayers.

It is needless to note that such requests cause unwanted questions and attention from company management to the accounting service. The process of automating accounting allows you to minimize errors and reduce the labor costs of accountants in this difficult task. Next, we will provide step-by-step instructions on how to fill out a VAT return, as well as submit it correctly and in a timely manner, so that there is no need to prepare an adjustment return, using the most effective tool - the 1C: Accounting program *.

*Remember that the Basic version of the 1C:Accounting program allows you to keep records, and therefore calculate VAT, for only one organization. If you have several legal entities, you should buy the 1C: Accounting PROF program, which will allow you to calculate taxes for an unlimited number of organizations in one information base.

How to find out when the base is determined

The size of the base for compiling VAT reporting is required when shipping products, performing agreed work or providing services. The base calculation day is the date of transfer of payment for future shipments.

The rate can be 18%, 10% or zero. Taxation is carried out by persons at a zero rate if an individual entrepreneur or company sells:

- Exported products and products brought from the free customs zone.

- International transportation services.

- Works and services related to the use of pipeline transport of oil and petroleum products.

- Marine products, breeding cattle.

- Non-excise goods, the transportation of which takes place within the framework of international cooperation in the field of space exploration and use.

- Medicines that have not been registered and are necessary to help specific patients or transplantation.

- Consumables for scientific research.

Express check

In addition, it is necessary to conduct an express check of accounting, which allows you to quickly track the presence of incorrect transactions in the system that prevent the correct completion of the VAT return.

This operation is available in the menu “Reports” – “Accounting Analysis” – “Express Check”.

Fig.6 Express check

Set the period and click “Run check”.

Fig.7 Perform check

Since the program did not detect any errors, we can safely proceed to generating a declaration.

What are the penalties for late submission of documents?

If an entrepreneur or head of a company does not submit income tax reporting for more than 10 days from the expiration of the deadline (the 25th), the tax authorities have the right to suspend transactions on the organization’s accounts. Legal entities and entrepreneurs who violate the approved deadlines are subject to administrative liability.

Late reporting up to 180 days will result in a fine of 5% of the required tax amount. The sanction increases to 30% of the total tax amount and 10% for each overdue month if the overdue period exceeds 180 days. There are penalties for non-payment of taxes.

Tax return

Go to the menu “Reports” – “Regulated reports”.

Fig.8 Regulated reports

In the window that opens, click on the “Create” button and select “VAT Declaration” from the presented list of reports.

Fig.9 VAT declaration

We set the period of interest to us – the 3rd quarter of 2021, and click the “Create” button.

Fig. 10 Set the period of interest to us

A standard window of the established declaration form appears, in which we click the “Fill out” button.

Fig.11 Fill in

The declaration consists of a title page and 12 sections. Let's take a closer look at each of them.

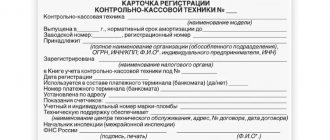

The title page is formed based on the initial data entered into the system. This is the name of the organization sending the declaration, OKVED, the reporting period and the code of the tax authority to which the declaration is submitted.

Fig.12 Title page

Section 1 of the declaration is called “The amount of tax payable to the budget (reimbursement from the budget) according to the taxpayer.”

Fig. 13 Section 1 of the declaration

OKTMO is automatically installed in the top line, as well as the current budget tax classification code. The result of our activities in the 3rd quarter of 2021 was the payment of VAT to the budget in the amount of 2,500 rubles (20,500 - 20,000.0).

Section 2 is completed by tax agents submitting a declaration for another person. Since we do not have Contracts (or Agreements with counterparties under which we act as tax agents for VAT), we do not fill out this section.

Fig.14 Section 2

Section 3 deals with taxable transactions. It reflects the tax base for the tax, as well as the amount of VAT accrued on sales payable to the budget (20,500 rubles).

Fig.15 Section 3

The lower part of this section defines the total amount payable to the budget, as well as the amount of tax presented by the taxpayer for deduction from the budget.

Fig.16 Let's pay attention to the bottom part

And also the final result of the company’s VAT activities, in our example – payment to the budget of an amount of 2,500 rubles.

Fig. 17 Final total for VAT

Sections 5-6 are filled in when reflecting tax benefits (see the article “Confirmation of the 0% VAT rate when exporting to 1C 8.3”).

Section 7 is filled out if there are transactions provided for in Article 149 of the Tax Code of the Russian Federation (Part Two) and contains information on goods (work, services) that are not taxed.

Sections 8 and 9 reflect information from the purchase and sales ledger, respectively.

Fig.18 Sections 8

Fig.19 Sections 9

Sections 10 and 11 reflect information on invoices issued and received as part of the implementation of commission agreements and agency agreements in the interests of another person.

Section 12 is completed in the cases provided for in paragraph 5 of Article 173 of the Tax Code of the Russian Federation (Part Two).

After visual inspection of the document, it is necessary to check the control ratios of the document, which is done automatically by clicking the “Check” – “Check control ratios” button.

Fig.20 Check control ratios

The program found no errors.

However, with a large number of operations, errors are inevitable, so it is necessary to remember the basic control relationships when generating declarations. Thus, lines 040 and 050 of Section 1 must correspond to lines 200 and 210 of Section 3, respectively. In turn, Section 3 is formed from the book of purchases and sales (sections 8 and 9 of the declaration).

Next, you need to upload the declaration. To do this, click the “Upload” button.

Fig.21 Next you need to upload the declaration

The program will generate a file, which is subsequently loaded into the electronic reporting program and sent to the regulatory authority.

The declaration can also be sent from 1C using the “Send” button.

Fig.22 Send

To do this, the 1C-Reporting program must be connected to your system. Contact our 1C subscriber service to find out about the tariffs for this service.

Important! After submitting the declaration, tax authorities, if questions arise regarding it, have the right to request appropriate explanations to the declaration, which, from the beginning of 2021, the taxpayer provides only in electronic form.

Filing VAT reports using “Taxpayer”

The “Taxpayer PRO” program was created to generate and promptly send declarations for verification to the Federal Tax Service.

Accountants who use this software note the following advantages:

Book of purchases and sales

Before generating a VAT return, we need to make sure that our transactions are reflected in the Purchase Book and Sales Book. Both of these documents are located in the “Reports” – “VAT” section.

Fig. 3 Reflection of transactions in books

Having set the period to the 3rd quarter of 2021, click the “Generate” button.

Fig.4 Generate

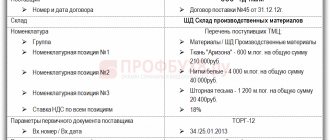

The purchase book reflects the transaction for the purchase of goods, VAT is reflected in the amount of 20 thousand rubles.

We create a Sales Book in the same way.

Fig.5 Sales book

VAT on sales in the amount of 20,500 rubles is also reflected in the sales book.

Reporting from 1C

The general list of regulated reports is called up from the “Reports” section, subsection “Regulated reports” (Fig. 1).

Fig.1

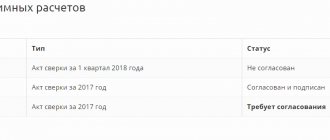

This option is convenient because it contains all the regulated reports generated by the user at once (Fig. 2), including various options. In addition, various services are connected here for sending, monitoring and reconciliation with tax authorities.

Fig.2

The second, no less convenient option for generating a VAT return is to use the VAT accounting assistant (Fig. 3).

Fig.3

The assistant panel sequentially lists all the actions that must be performed before generating a declaration (Fig. 4), and also indicates their status. The operation that needs to be performed at the current moment is marked with an arrow.

In our example, this is the item “Transition to separate VAT accounting.” Bright font indicates operations that do not require correction; pale font indicates possible errors. The declaration itself is shown in the last paragraph.

Fig.4

All forms of regulated reports are stored in the 1C database in a special directory - “Regulated Reports” (Fig. 5). This is where the latest printed versions will be recorded after installing the new release.

From this dashboard you can get detailed information about each report, including legislative changes. You can get to this window from the general list of directories (the “All functions” button). You can create a declaration by clicking the “New” button by highlighting the desired line with the cursor.

Fig.5

If the reference book “Regulated Reports” contains current printed forms of reports, then the reports themselves with data are stored in the document of the same name (Fig. 6). You can get to the document from the general list of documents by clicking the “All functions” button. From this panel you can open a declaration without a start form. Here you can see the unloading log.

Fig.6