What to write to the tax authorities if they demand an explanation of the loss

Tax officials send demands to explain why the company is at a loss. And accountants share wording and lists of what to write so that they fall behind.

They ask at the “Red Corner of an Accountant”.

“Colleagues, who else was sent a request to provide an explanation of the amount of loss? And what to do with it?

PS So, did I understand correctly, I’m sending this by email and that’s it?

- explanations confirming the reasons for the loss based on the results of financial and economic activities for 6 months of 2020.

- Tax accounting registers, with an explanation of the following lines 2_010 “Income from sales”; 2_ 020 “Non-operating income”; 2_030 “Expenses that reduce the amount of income from sales”; 2_040 “Non-operating expenses”, including 2_2_201 “expenses in the form of interest on debt obligations of any type, including interest accrued on securities and other obligations issued (issued) by the taxpayer” income tax return for period 6 months 2021

- analytical note from the chief accountant on the legality of including expenses incurred in reducing the tax base for income tax;

- information about the presence (absence) of the organization’s business plan for exiting the unprofitable state; if there is a business plan, indicate the main directions and date of exit from the unprofitable state.”

In the comments, someone shared their details:

They also write that it is not necessary to provide business plans:

“You don’t have to provide any business plans or registers.”

And at the same time, this is how tax officials are advised to respond:

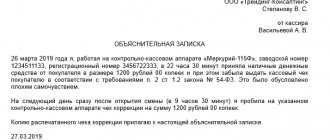

“In response to your request for clarification, I inform you of the following:

- Tax registers for the above period have been rechecked.

- No omissions or errors were found in determining income.

- Expenses in tax accounting correspond to income. No errors or excessive expenses were found.

- The loss resulted from a drop in revenue with a simultaneous increase in expenses amid the coronavirus pandemic.”

But to the question of normative justification for what they can demand and what they cannot:

"P. 7 tbsp. 88, the tax office has the right to request explanations only for errors and inconsistencies, and does not have the right to request additional documents if this is not provided for in this article. Regarding losses specifically: clause 3 of Art. 88 may require explanations justifying the amount of loss, but not documents or information about business plans.”

They also shared what they write to tax authorities:

“I write explanations and breakdowns of expenses. No registers. Then the tax authorities ask me to remove the losses so that it would be nice for them, but I refuse. This concludes the dialogue."

GLX Consult

You cannot do without mistakes in practice. It is worth noting that the freight forwarder is the link between the client and service providers, which means he has to defend the rights of both. One of the ways to avoid costs is to insure the activities of the forwarder. Plan to open a forwarding company taking into account the time of year. In the fall, there is a rush of work, and if you do not prepare in advance, at best this will threaten lost profits, at worst - a bad reputation due to supply disruptions. On the other hand, there is no point in starting work in the spring. The summer period is always the quietest. The flow of orders is seasonal - the volume of work, according to experts, increases sharply before the May and New Year holidays, and the peak load occurs in the fall. Experts also note an increase in the number of orders at the end of each month. Experts recommend expanding the list of services as the company develops - large clients are increasingly demanding from the forwarder a comprehensive solution to their transport problems: not only moving cargo from point A to point B, but also organizing insurance, armed security, warehousing, for which they are willing to pay. Experts recommend hiring experienced specialists because, in addition to practical skills, they have established connections with contractors and client bases. Unfortunately, the demand for experienced employees significantly exceeds the supply. The second way is to teach capable beginners. You can raise a specialist in a year. The company starts to break even if the total cost of services provided is 1.5-2 million rubles. per month. This volume of orders is provided by one or two regular customers three months after the start of work. It will take at least six months to form a client base that generates a stable income, market players estimate. The costs of creating a company pay off on average within a year and a half after the start of activity, experts say. After two years of operation, the enterprise, which has four specialists on staff, is capable of transporting about 100 thousand tons of cargo per year. The structure of the volume of commercial cargo transportation in Russia is dominated by the share of road and rail transport (58.3% and 36.5%, respectively). At the same time, the trend towards an increase in the share of road transport and a reduction in the share of rail transport continues (in 2007, the share of road transport was 56.3% and railway transport - 38.5%). Of all types of cargo transportation (railway, road, air, river and sea transport, multimodal), experts call the road transportation segment the most promising. There are several reasons. As the main one, Sergei Akimov notes the state monopoly on rail and air transportation: On the railroad, the rules are dictated by the state, in the aviation industry, in fact, too. Transport and logistics market players in these areas do not have the opportunity to reduce their costs or increase volumes. The quality level and price are strictly fixed there. In addition, road transportation is more convenient for the client, says YURIY KALINOVSKY, deputy head of the branch of the Association of International Road Carriers (AsMAP) in the Urals Federal District: Only a car can deliver cargo from door to door.

Letter justifying losses for the tax office or bank

This article will discuss in detail how to write explanations to the tax office regarding losses. A sample will be given at the end of the article. How to behave? and it’s no secret that not a single chief accountant wants his company to be included in the list of “lucky ones” for conducting on-site events to audit financial and economic activities by tax authorities.

In short, there is already a fairly well-known law 115-FZ “On combating the legalization (laundering) of proceeds from crime and the financing of terrorism.”

This is necessary so that the bank has a real understanding of the company’s business activities and its operations. And on this basis, he could subsequently correctly identify the operations that she carries out on the account as a client.

C) The mere fact of receiving a request is already evidence that your transactions in the bank have been recognized as suspicious and, accordingly, this already means that since you were working before the request, you cannot continue to work, otherwise the request may come again even if the bank does not do it for the first time the claim will be withdrawn (even if all transactions are formally legal).

Explanation to the tax office regarding losses. sample and form 2021

I have no thoughts other than: “since we are an operating LLC, we need an accountant, a programmer, to transport our goods and a cabinet to store them.” (((The prices may seem too high to them, but the income allows. Do we need to make excerpts from the contracts? Did they pay the physicists? Are the amounts large?

These include:

- level of well-being of the population;

- entry of a new competitor into the market with a similar product;

- the price level prevailing in the market for one or another type of product;

- solvency of buyers;

- inflation, etc.

A colleague from plushki.su published an interesting article about explanatory notes to the bank regarding “plush” transactions.

You may also like…

Here, to be honest, I really went too far, and I screwed up the selects to hell, and through debiting it was processed very decently, and mostly without keeping track and withdrawing cash.

Justify the loss by saying that the enterprise is new and needs to take certain measures for development. As a rule, this reason is a compelling justification for the excess of expenses over income. Be sure to clarify that the company’s activities comply with the established business plan; indicate the reporting period in which profit is expected.

Therefore, they ask almost every client for information and documents confirming where the company gets so much “cash” from. In order not to have to explain yourself about each operation, you can inform the bank in advance that constants are natural for the company.

Report that the company has decided to develop new production or reconstruct fixed assets. As a result, sales volumes temporarily decreased and costs increased. If the company was previously listed by the tax office as stably operating, then such an explanation will be accepted with understanding.

Therefore, they ask almost every client for information and documents confirming where the company gets so much “cash” from. In order not to have to explain yourself about each operation, you can inform the bank in advance that constants are natural for the company.

Among other things, it would not be superfluous to indicate the reason why different information was indicated in the original declaration. This may be an error in calculation due to misunderstanding of legislation or program failure and other similar factors.

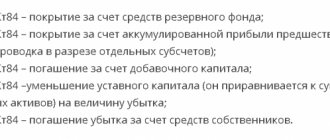

Typically, there are three types of losses:

- a fairly large loss;

- the loss is repeated over two tax periods;

- the loss was shown last year and in the interim quarters of the current year.

However, if you show a loss for more than one year, the inspectorate will require you to explain the reasons for this situation, since it may consider that you are deliberately reducing profits. Therefore, we recommend that if you have a loss, submit a balance sheet and profit and loss statement with an explanatory note, this will allow you to avoid unnecessary questions.

The legal address is real, but now another organization is located there. Activities (services) were carried out only in the 2nd quarter of 2015.

It is not recommended to ignore such a “sign of attention”. This article will discuss in detail how to write explanations to the tax office regarding losses. A sample will be given at the end of the article.

The company has a business plan for long-term development, according to which it expects to make a profit from the second half of 2015.

Quite often, tax specialists have various questions based on the results of reports submitted by a tax agent. In such situations, inspectors send a letter to the organization asking for clarification.

If you don't want to attract attention to yourself, follow a few rules:

- If possible, let the money sit in your accounts for two or three days;

- try to keep the money “ overnight” in banks , and not in electronic wallets or in your pockets;

- if possible , it is better to send money by interbank transfer or money transfer than to withdraw cash and deposit it in another bank;

- if you want to increase the volume of transactions, do not spend everything on one account, it is better to take another card, attract “relatives”;

- make “honest” purchases in stores using the cards that are most valuable to you, thereby diluting “dubious” transactions;

- alternate the ways of depositing and withdrawing funds if there are several possible options, even if some of them are less convenient or more expensive.

What does this look like in practice - the Central Bank has developed criteria for identifying suspicious transactions, banks, based on these criteria, have developed their own automated systems that automatically track all transactions according to specified criteria, and if the system recognizes your transactions for a certain period as suspicious - you a request comes in under 115-FZ.

D) A specific bank employee reviews the documents and ultimately makes a decision on your situation (accordingly, at this stage there is already a certain dependence on a specific bank employee) and either removes all claims and all restrictions on the card, or leaves the blocking in force and, as a rule, this In this case, you are asked to write a statement about closing the card “at your own request.”

Enterprises that, based on the results of the reporting period, showed a loss in their tax return, are required to write an explanation justifying the unprofitability of their financial and economic activities. Otherwise, the tax office may decide to conduct an on-site audit or (as a last resort) liquidate the company.

The accountant always opens the envelope from the tax office with a sinking heart: “Well, thank God, it’s not an on-site audit!” However, if a company reports losses over several tax periods, the letter may well foreshadow such an audit. Tax authorities usually require justification for “unprofitable” reporting. In such a situation, it is not enough to simply prepare a duty “unsubscribe”.

In this review, we consider where it is better to refinance your loan; It is worth noting that this opportunity only exists if the client has a positive credit history and has not made any delays. That is, you should submit an application for such a program as soon as you realize that you will not be able to make the next payment.

Civil law is based on the fact that entrepreneurial activity is aimed at systematically generating profit (Clause 1, Article 2 of the Civil Code of the Russian Federation). But this principle still cannot be considered universal for Russian reality. He “works” in big business for foreign companies whose shares are traded on the stock market.

Letter about the reasons for the decrease in revenue to the bank

On the growth rate of accounts receivable and accounts payable. These indicators should be almost the same.

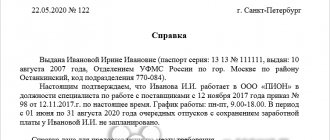

What should an explanatory note about losses look like? How to write an explanation to the tax office? There is no standard form as such; explanations are written in free form on the official letterhead of the enterprise and signed by the manager.

Letter of request We bring to your attention a general template of such a document for download: Like any other document, this letter must contain an introductory part, namely: If the letter contains several requests at once, then they must be indicated in separate paragraphs or paragraphs.

If you have at your disposal all the properly completed documentation that can confirm the validity of the expenses incurred, then there is no need to artificially adjust the reporting, i.e., there is no need to remove the company’s losses, since they will be lost to you forever. In such a situation, it would be more appropriate if you prepare an explanation for the losses to the tax office.

Well, if the collateral is not very good, then offer him your collateral. The two partners agreed. Then one of them didn’t like the contract.

Explanation of the decrease in revenue for the bank

In accordance with the law, their main task is to stimulate organizations to independently understand the causes of losses and prevent their further occurrence.

For cash deposit transactions, the main supporting document in accordance with the Regulations of the Central Bank of the Russian Federation dated April 24, 2008 No. 318-P is a cash receipt order of the approved form. For transactions using bank cards, the main document confirming the transaction, in accordance with the Regulations of the Central Bank of the Russian Federation dated December 24, 2004

The main type of business activity of the Limited Liability Company "Company" from the moment of its creation to the present day is associated with the retail trade of food products, including drinks, and tobacco products in specialized stores (OKVED code 52.2).

I never found the request in the mail; apparently it ended up in spam or didn’t arrive. Couldn't you have called? To date, there has been no response to the letter and apparently there will not be any.