When a company offers food to customers, it should always automate its business, no matter how it operates. And we want to introduce you to the solutions that will help you do this. Let's look at what programs for public catering are relevant today, with all their main pros and cons, and figure out what kind of opportunities they provide their owners. From the review you will receive maximum useful information, on the basis of which it will not be difficult to decide and choose the software that is best suited for your purposes.

Please note that specialized software is convenient at literally all stages of service. With its help, you can simplify the reception and transmission of orders, control of food and drink consumption, the payment process, and tracking of completed operations in the database. Its implementation and proper use is the key to the absence of “human factor” errors, a step towards optimizing staff interaction, and therefore a powerful prerequisite for increasing the number of regular customers.

How to account for income in Kontur.Market

The basis of accounting is invoices: for food, drinks, consumables. Documents can be received in paper or electronic form. Contour.Market has a solution for both options.

Briefly about the differences. Data from paper invoices must be transferred to the Market yourself. And there is no need to transfer data from electronic invoices; they arrive in digitized form.

Paper invoices can be capitalized in two ways.

The first method is to create a draft invoice and manually transfer product names, quantity, purchase price and other data into it.

In a coffee shop with a modest assortment, this may take a couple of hours, in a restaurant - all four. The second method is three times faster: scan the invoice and upload the scan to the Market. The service recognizes the products in the photo and compares them with the ingredient catalog. All that remains is to check the comparison and save the document. The more often the user downloads invoices, the higher the recognition rate, because the system remembers the results and constantly learns.

Electronic waybills require a different approach. Depends on the type of product and the source of the invoice.

Invoices for alcohol are automatically received from EGAIS.

They can be accepted, rejected, or accepted with a discrepancy - this is a response to EGAIS, not posting. Balance in EGAIS and inventory accounting in the service are two different processes. Based on the EGAIS invoice, Market creates a goods invoice, which needs to be capitalized for the service to recalculate the balances. Veterinary accompanying documents (VSD) come from FSIS "Mercury". If you confirm delivery, you need to pay off the VSD. Based on it, the Market creates a bill of lading, capitalize it, and the service will update the current balances of products.

Universal transfer documents (UDD) are received from the electronic document management (EDF) operator. They can be for any goods from a supplier that is connected to EDI, for example, to Diadok. If the establishment operates in the Market with labeled goods, it will be possible to receive invoices created automatically based on the UPD. Soon such an opportunity will appear for those establishments that do not need to work with labeling.

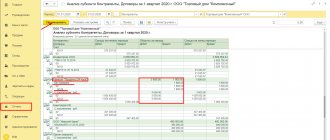

What happens as soon as you post the invoice in the Market.

- The service will recalculate the number of products and consumables taking into account the new arrival: the balances will be displayed in the list of invoices, the list of products, in the card of each ingredient and much more.

- The cost of dishes that contain ingredients from the posted invoice will be automatically recalculated.

- Reports on the movement of goods, balances and the product report will be updated.

- The Market will automatically send invoices to 1C and the Kontur.Accounting service so that your specialist can use ready-made primary documents for accounting and tax reporting.

A catering establishment will always have fresh data on balances if the accounting system correctly calculates not only income, but also expenses.

Features of accounting in public catering

According to the law, all operations occurring in the economic life of an organization must be documented in primary documents. Catering enterprises are no exception to this issue. Most forms of primary documents are unified. But if the specifics of the organization require the use of any special forms, then this is not prohibited.

A catering enterprise can develop the necessary forms and approve them in its accounting policies.

Reflection of the expenses of a catering organization in accounting accounts depends on the purpose for which it was created. If the purpose of creating an enterprise is to meet the needs of its employees, then such a cafe or canteen is a structural unit, and its expenses should be accumulated in account 29.

Ready meals brought from the supplier

The eatery sells heated pies, pizza, sandwiches and bottled drinks. All this is purchased in finished form every two days. When a sandwich is sold at the checkout, the Market receives this data and deducts 1 piece from the sandwich leftovers. The current quantity is reflected by the product card, the general list of products and the balance report.

If the sandwich has deteriorated, lost its presentation, or there is another reason not to sell it, it must be removed from the balance sheet. To do this, a write-off act is drawn up in the Market. Note that Kontur.Market also helps to write off shop food.

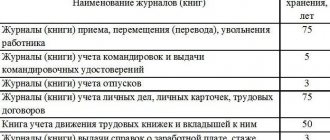

Documenting

As for the justification of the expenses incurred, the costs of equipping the premises for eating were duly documented. First of all, this rule should be enshrined in labor or collective agreements with employees. A reference should be made to the requirements of the Rules and it should be stated that the employer is obliged to create normal working conditions, as well as provide employees with a room for eating, create conditions for storing food, preparing and heating food. The same formulation can be used to account for napkins, towels, soap, etc.

Another equally important document is the manager’s order that a room for meals will be equipped, as well as the purchase of household appliances necessary for it. Of course, advance reports, invoices, receipts and other documents must be available to confirm the purchase of this property.

Dishes prepared in the establishment

The cafe sells signature cupcakes that are baked in its own kitchen. The owner keeps track of how much baked goods are sold and how much is left. This way he can order the baker a new batch of cupcakes on time.

Cafes need to take into account not only the consumption of each ingredient (more on this in the next section), but also the consumption of finished cupcakes.

To do this, in the “Branded Cupcake” technological map, enable the “Keep a record of the leftovers of the finished dish” setting.

Now the Market will write off ingredients based on the preparation of the dish, and not its sale. The fact of preparation is documented in the Production Certificate. Here's what it will look like for the cupcake:

When the cupcake is sold at the checkout, the Market will write off the finished “Signature Cupcake” dish from the leftovers. The ingredients will not be written off when selling, because the service has already deducted them when you completed the Production Act.

A cafe can enable leftover tracking only for those dishes that require it. In the general list of dishes, such dishes will be indicated with remainder and without extra charge. For other dishes, a markup is displayed, the remainder is not indicated.

Why is the cost and markup not indicated when accounting for leftover dishes is included?

The same dish is prepared at different times from ingredients with different purchase prices, so the cost changes all the time, and therefore the markup. If you need to monitor the profitability of such dishes, use the sales and profit report for the period.

Benefits of programs for catering establishments

When used correctly they:

- simplify staff interaction;

- help track employee activities online;

- allow you to automate data transfer to Mercury and EGAIS;

- prevent “human factor” errors;

- make it possible to attract and retain target audience by improving the loyalty policy.

Each of them generally coordinates the team and optimizes the conduct of business. Moreover, its implementation benefits not only the manager, but also his subordinates, because the same waiters or cooks improve the quality of service, and therefore their professional level.

Ingredients for your own dishes or cocktails

The restaurant indicates the calorie content, protein, fat and carbohydrate content (KBZHU) in the menu. Guests are offered about 30 dishes: pizza, salads, shish kebab, side dishes... There are ingredients that go into several dishes at once, they need to be ordered from the supplier more often and in larger quantities. And there are wasabi and other low-cost products that a restaurant orders once a month or less.

In addition to accounting for ready-made dishes (more on this in the previous section), the restaurant needs to take into account the consumption of each ingredient.

What affects the data on ingredient balances in the Market:

- directly - using products for cooking,

- indirectly - losses during frying, boiling and other methods of processing products.

Use of products for cooking. The service calculates this data based on the technological map and sales data from the cash register.

In the technical sheet, it is enough to indicate the quantity of ingredients, and the service will automatically calculate the cost. If processing methods are selected for ingredients, the service will calculate gross or net weight (depending on what was previously specified). How to indicate processing methods in a technical map.

The technical map also indicates the output weight of the whole dish, the cost and retail price, which is calculated based on the markup you specified.

When the dish is sold at the checkout, the Market will automatically write off each ingredient from the balances and make all changes to the reports: on balances, on sales for the day, on profits and others.

Loss of food during cooking and indication of KBJU. This data is stored in the service in the form of a virtual directory. Compare the ingredients with this reference book so that the technical map reflects the nutritional value of the dish and losses due to the chosen processing method. Find out details.

This is what the tab with processing options looks like in the technical map. Choose the one you need, and the service will show how much weight the dish will add or lose.

This is what the tab with KBZHU looks like in the technical map. Nutritional information is indicated for each product and for the dish as a whole. This information does not have to be calculated on a calculator to indicate on price tags or in the menu.

Information about the KBZHU is needed to comply with the law.

The establishment is obliged to inform guests about the nutritional value of dishes, including calorie content, protein, fat and carbohydrate content (Resolution of the Government of the Russian Federation No. 1515 of September 21, 2020).

Cafe expenses

Accounting in a cafe involves calculating the retail cost of dishes, in other words, calculation. First, you need to create technological maps for each item on your cafe’s menu. These are catering documents containing information about the recipe, cooking technology, processing losses and calorie content. You can use ready-made collections of technological maps. Using them, the accountant-calculator calculates the cost of production. The selling price of the dish will be equal to the cost multiplied by the markup.

When a cafe purchases products from suppliers, they first go to the warehouse, and not directly under the chef’s knife. Therefore, accounting in a cafe should include inventory accounting. Unlike a trading or manufacturing enterprise, everything here is much more complicated. Firstly, due to the frequent movement of raw materials. Secondly, there is a constant need to conduct inventories and identify surpluses and shortages. Thirdly, it is necessary to write off a lot of perishable products. Which entails a huge amount of paperwork. In addition, the warehouse itself must comply with SANPIN standards. In many ways, cafe accounting is consistent with materials accounting in other industries.

A separate story is cash transactions. Accounting in a cafe involves maintaining a cash register in accordance with legal norms, and, of course, where can we get away from online cash registers? The limit on the cash balance at the end of the working day must be determined, a cash book, and cashier-operator journals must be drawn up. The use of cash registers in cafes is mandatory. The only thing worth paying close attention to in this matter is the Robocheki service, this is practically the only, but at the same time very, very important opportunity to save on online cash registers, you don’t need to invest in Robocheki, you have zero investment rubles, and you don’t rent an online cash register as offered by banks (for exorbitant money...). Your costs are turnover commission. No more no less. There is turnover - there is a commission, no turnover - a pandemic, coronavirus, season, relocation, it doesn’t matter - no commission! To write this article, we checked one life hack to see how we could still save money. It turned out that Robocheki and Robokassa itself (yes, yes, it was this aggregator that created such a powerful service) use a promotional code. We took the promo code PVK01 and received a reduced commission of up to 2.7% for several months. At good speeds, this gave no less good savings (in thousands of rubles), use