Taxes

09.02.2021

85075

Author: Igor Smirnov

Photo: pixabay.com

The standard tax deduction is the amount by which your taxable income is reduced.

Last news:

KGC has opened a criminal case against TUT.by: they suspect tax evasion on a particularly large scale

The tax office discovered underpayment of VAT for 3 years by IT companies. They face millions in payments and penalties

According to Belarusian legislation, 13% of the income received by a citizen (income tax) is withheld into the state treasury. Obviously, the higher the salary, the more tax you need to pay. However, there are benefits established by the state, the proper use of which will help “save on taxes”, since they reduce taxable earnings and, accordingly, income tax is reduced.

Standard tax deductions apply to income such as:

- Taxed at the rates of paragraph 1 of Art. 18 Taxation Law

- Received by citizens from residents of the Hi-Tech Park

- Received under an agreement from non-residents of the High Technology Park for participation in the implementation of registered projects in the field of new and high technologies

- Received individual entrepreneurs who are themselves residents of the high-tech park

In addition, this type of benefit can only apply to the income that a citizen receives from his main job. If there is none, then deductions are provided by the tax agent or tax office. If deductions are greater than income, then the tax rate is considered equal to zero, and the amount by which the deduction is greater than earnings is not carried forward to the next month.

Income tax rate

The rate is set as a percentage and is:

- 13%- on the income of individuals

- 16%-on the income of individual entrepreneurs, notaries, lawyers in the implementation of their activities

- 13%-on the income of individual entrepreneurs who are residents of the Hi-Tech Park (from 2021)

Tax payment deadline

Amounts of income tax are paid no later than the 22nd day following the reporting (tax) period

We remind you!

The tax period for income tax is a calendar year, that is, a report to the tax office must be submitted after the end of the calendar year. The reporting period is every quarter, half-year, 9 months and calendar year.

What is not subject to income tax?

are not taxed:

- benefits for state social insurance and social security pensions

- all types of compensation (exceptions: compensation for unused labor leave, compensation for wear and tear of vehicles, equipment, tools and devices belonging to the employee)

- income received from the sale of crop and (or) livestock products

- income received through the sale of beekeeping products

- income of individual entrepreneurs received from the sale of goods (works, services) in roadside service facilities for five years from the date of commencement of such activities (commissioning of such services)

- Individual entrepreneurs engaged in the sale of goods (works, services) of their own production in the territory of small, medium-sized urban settlements and rural areas (the list of such territories is specified in clause 1.1 clause 1 of Decree of the President of the Republic of Belarus No. 6 dated 05/07/2012 (as amended from 06/27/2016)

2-NDFL as it stands for

What is behind the concept of 2-NDFL and how to understand the numerous numbers and codes that it contains? Often, when citizens contact various institutions, employees solving their problem ask for a 2-NDFL certificate. The meaning of this abbreviation is not always clear. Sometimes problems arise with the preparation of such a document. Therefore, it makes sense to understand what kind of certificate this is and why it is needed. We will help you with this immediately.

What's behind the letters?

The title of the certificate consists of the initial letters of the expression “Individual Income Tax”. It reflects data on all the income that its owner has from this tax agent, and on the amount of tax paid on these proceeds.

All types of labor income and business profits are taxed by the state. That’s what they call it – income tax or personal income tax. Certificate 2-NDFL shows the economic viability of people, their solvency and ability to participate in commercial transactions.

They receive form 2-NDFL from the accounting department of their enterprise. To do this, you need to make a statement orally or in writing. According to Art. 62 of the Labor Code of the Russian Federation, it must be issued three days after submitting the application. The document contains the following information:

- name and details of the tax agent;

- employee information;

- his income subject to personal income tax, presented by month; in addition to monetary expression, types of income are distinguished by digital codes;

- benefits with their own codes;

- total income, preferential deductions, annual tax amount.

Digital income codes

Here are the main code values and breakdown of income in form 2-NDFL

| Code | Type of income |

| 2000 | Salary, incentives for standardized work |

| 2012 | Payment for next vacation |

| 2300 | Payment of maintenance during illness |

| 2010 | Income from work under non-labor contracts |

| 2530 | Wages in the form of enterprise products |

| 2400 | Income from rental of transport, pipelines, power lines, communication lines, computer networks |

| 1400 | Income from rental property, with the exception of those listed under code 2400 |

| 1540 | Share of profit from the sale of part of the business |

| 2760 | Benefits for needy employees and retiring employees |

| 2762 | Benefit for the birth and adoption of children |

| 2720 | Present |

| 2740 | Prizes for participation in advertising competitions |

| 1010 | Income from securities |

| 2510 | Payment by an enterprise for the social needs of its employee |

| 2610 | Profitable use of a loan provided by the employer |

| 2001 | Awards for governing bodies |

| 2201 | Literary, etc. royalties |

| 2202 | Royalties for the creation of artistic values |

| 4800 | Other income |

Who is the form addressed to?

The information contained in this document is required by the tax authorities. Decoding 2-NDFL allows you to get a general picture of each employee’s income, determine what benefits he is entitled to, and how much tax he must pay. Each enterprise fills out this form for its employees and individual entrepreneurs for its employees.

In addition, a 2-NDFL certificate is needed when resolving issues such as:

- obtaining bank permission for a loan;

- provision of tax benefits for the period of study, treatment, when purchasing land and other real estate;

- registration for part-time work;

- determining the amount of vacation pay and sick leave payments;

- acquiring a foreign visa;

- buying a home with a mortgage.

Every enterprise is required to prepare 2-NDFL forms: they provide the necessary information for generating income tax. Based on clause 2 of Art. 230 of the Tax Code of the Russian Federation, all employers are required to provide information to the Federal Tax Service on the amount of personal income tax for the past year by the end of the first quarter of the coming year. Failure to comply with this requirement in a timely manner will result in a tax penalty: a fine of 200 rubles for each overdue document.

Another type of organization that requires information in Form 2-NDFL is banks that issue large loans for the purchase of housing, cars, and other real estate. When issuing them, the bank must be confident in the client’s ability to repay the loan amount and interest on it.

State structures implementing social policy need a certificate of income to establish benefits for especially needy persons whose income does not allow them to solve pressing life problems.

In what cases is it necessary

Any citizen will definitely need this document when solving the following problems:

- admission to a new job (the certificate must already be in hand upon dismissal from the previous job);

- registration of benefits for study, treatment, improvement of housing situation;

- calculation of pension benefits;

- adoption or guardianship;

- labor litigation;

- determining the amount of alimony, etc.

Particular attention should be paid to the pension registration situation. During his life, a person can work in different cities and at many enterprises. It is difficult to collect the required personal income tax certificates in a short time. Therefore, you need to take care of this in advance.

Procedure for obtaining a certificate

The rules for document preparation are fixed in Chapter. 23 of the Tax Code of the Russian Federation and Art. 62 Labor Code of the Russian Federation. The first step is to fill out an application. If, after three days after this, the employee does not receive the required paper, he can file a complaint with authorities such as the labor inspectorate, the court or the prosecutor. Failure to issue a certificate is considered a serious violation.

Most often, enterprises issue Form 2-NDFL to people leaving their jobs.

In difficult situations with obtaining this document, you can contact the tax office directly and the electronic resources of the Federal Tax Service.

The most important

- If a person cannot find the organization where he previously worked, he should contact the tax office at his place of residence and leave a statement there.

- If the company (IP) no longer exists, a certificate is obtained on the tax service website through your personal account.

- When an enterprise is liquidated, data about it in the Federal Tax Service registers may be completely absent. Then, when applying for a new job, a statement is written stating that it was impossible to obtain Form 2-NDFL due to the absence of the previous employer. Then the accounting department submits a request to the Pension Fund and the Tax Service to confirm the necessary data.

How to write a statement

At those enterprises that have their own forms for filling out documents, a written request is made in accordance with the established form. Where there are no such rules, a free form is used. However, the following points must be mentioned in all cases:

- information about the person submitting the application;

- passport data;

- location;

- phone number;

- indication of the period for which data is needed in the certificate;

- number of copies;

- signature, date.

Sample application

It is important that the application reflects the necessary information: the period during which the applicant’s income and tax must be reflected, the number of copies, his address and telephone number for contact.

How to check the correctness of registration

After receiving the required paper, you must read it carefully to avoid further misunderstandings. It is no longer possible to correct anything in the finished document, so you will have to draw it up again, wasting a lot of time.

The ability to decipher a 2-NDFL certificate will help you notice an error in time and quickly correct it.

In practice, you can encounter the following shortcomings.

- The signature certifying the document is incorrectly executed. A personal income tax certificate is a tax document, not an accounting document. Therefore, it is not necessary for it to be signed by the head of the enterprise. For this purpose, an accounting employee is usually appointed by special order. His signature must be deciphered (surname, initials, position), and the details of the document giving him the right to sign must be entered. In addition, it cannot be covered with a seal (if the company/individual entrepreneur uses it in their work).

- The seal itself is not in its place: in the lower left corner.

- The date of the document is inaccurate. Its correct form is DD. MM. YYYY.

- The amount of tax stated in the certificate is indicated without kopecks: rounded up or down to the nearest ruble. But the remaining amounts are still indicated to the nearest kopeck.

- The certificate may reflect an incomplete or incorrect representation of a person's income.

An error in the last paragraph leads to punishment of the official in the form of a fine from 300 to 500 rubles.

With the help of special computer programs, filling out the certificate occurs automatically and, as a rule, is not a labor-intensive process.

If you find an error, please select a piece of text and press Ctrl+Enter.

Tax deductions in 2021

First, let’s define what it is and what types of deductions there are.

Tax deduction is the amount by which the amount of income tax is reduced, provided that the person has the right to this deduction in accordance with the law.

Types of tax deductions:

- Standard

- Professional

- Social

- Property

And now more about each of them

Standard

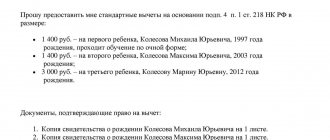

This deduction can be used by payers who do not have their main place of work during the reporting (tax) period. It is necessary to submit the necessary documents confirming the right to a standard deduction to the tax authority when filing a return for the first reporting period.

Applies to: Payers (individual entrepreneurs, lawyers, notaries) whose income subject to taxation, reduced by the amount of professional deductions, does not exceed 1,687 rubles in a calendar quarter. The amount of the deduction is 93 rubles per month for each child and (or) dependent under the age of 18 years - 27 rubles, as well as for paying parents who have 2 or more children or disabled children under the age of 18 years, then the amount of the deduction is 52 rubles Disabled groups I and II, as well as for other persons entitled to preferential taxation in accordance with the Law of the Republic of Belarus dated April 17, 1992 No. 1594-XII “On Veterans” - 131 rubles

Learn more about standard deductions

Professional

The right to apply a deduction if, in carrying out their activities, these persons incurred expenses directly related to the implementation of their activities. For example, hotel accommodation, travel to the client. To apply, you need primary accounting documents confirming your expenses, included in the list of documents established by the Council of Ministers, containing the necessary details. Primary documents must contain:

- name of the document and date of its preparation

- name of the organization, surname and initials of the individual entrepreneur

- the reason for this operation and the valuation in monetary terms

- signatures, initials and surnames of officials who are responsible for the transaction

It's easier for notaries and lawyers. Documents confirming expenses are any documents that confirm the specified expenses (invoice for renting a residential premises, etc.)

Important!

Instead of a professional deduction, these payers have the right to apply a deduction in the amount of 10% of the total amount of taxable expenses

Social

Applicable by payers who do not have a main place of work during the reporting (tax) period. To verify deductions, you must have proof of eligibility that is submitted with your tax return. Deductions: Upon receipt of the first higher, first secondary specialized and first vocational education - in the amount of the amount paid for your training, as well as if this training was provided by a payer who is in a close relationship with the students, and both parents have the right to apply the deduction , regardless of who paid for the training. If the payer paid insurance organizations of the Republic of Belarus in the form of contributions under voluntary life insurance contracts and additional pensions, in the amount of no more than 2874 rubles. In this case, it is necessary that the term of such an insurance contract be at least 3 years.

On a note!

In the event that social deductions have not been used in full, part of the unused amount is transferred to subsequent tax periods.

Property

The same applies to payers who do not have their main place of work during the reporting (tax) period. Cases of application (Clause 1 of Article 166 of the Tax Code): Expenses related to the construction of housing made by the payer and members of his family (even those who are not married at the time of the expenses, but recognized in court as members of his family) who are registered those in need of improved housing conditions, as well as costs associated with the purchase of housing bonds (purchase of a one-room residential building or apartment).

Required documents:

- A certificate indicating that the payer and his family members are registered as in need of improved housing conditions

- During the construction of apartments, an extract from the decision of the general meeting on the inclusion of the payer or a member of his family in the housing construction cooperative

- In case of purchasing an apartment, copies of documents confirming registration of ownership rights

- When you are reconstructing an apartment or a single-apartment residential building - copies of construction contracts, etc. (Clause 2 of Article 166 of the Tax Code)

Similarly with the previous deduction - if the tax deduction was not applied, then it is transferred to the next period.

Deductions for pension payments and savings insurance contracts

A deduction for pension payments is provided in the amount of 1 minimum wage for each month for payments from pension savings of taxpayers formed through:

- Mandatory pension contributions;

- Voluntary pension contributions;

- Mandatory professional pension contributions.

For payments to individual residents of the Republic of Kazakhstan who have reached retirement age and left for permanent residence outside the Republic of Kazakhstan, a deduction is provided in the amount of 12 minimum wages.

Deductions under accumulative insurance contracts are provided in the amount of 1 minimum wage for each month of accrual of income for which the insurance payment is made.

Healthy

- When partially withdrawing pension savings in 2021, when calculating personal income tax, is a person entitled to receive a tax deduction in the amount of 1 minimum wage?

How to calculate your income tax?

The tax is calculated by you yourself, and no one will calculate it for you. To calculate the tax, you need to reduce the amount of all your income (both in cash and in kind) by the amount of tax deductions (if any) and multiply by the tax rate.

Tax deductions are :

- income exempt from income tax

- professional deductions

- standard deductions

- social deductions

- property deductions

That is, income tax = Amount of income - tax deductions deductions (professional + standard + social + property) * tax rate

OPV deduction

The deduction is provided in the amount established by the legislation of the Republic of Kazakhstan.

To provide a deduction for OPV, supporting documents are not required, and an application from the person is also not required.

Useful for OPV deduction

- Is it possible to use the OPV deduction in several organizations when calculating personal income tax?

On the issue of reporting and deadlines for its submission

In 2015, personal income tax is calculated and withheld when income is calculated, i.e., having calculated the salary, the accountant transfers the tax amount to the budget no later than the day the salary is issued. From 2021, it will be possible to transfer personal income tax the next day after the payment of salaries. At the end of the year, a certificate of form No. 2-NDFL is prepared for each employee of the company. Entrepreneurs report on income tax by annually submitting a declaration of Form 3-NDFL. This information is submitted to the Federal Tax Service once a year before April 1 of the year following the reporting year. Starting from 2021, it is planned to introduce a quarterly reporting system for the calculation and payment of income tax.

Failure to pay, late payment of tax or late reporting will, of course, result in penalties. A bill is under development that proposes impressive measures: the fine for failure to submit or late submission of tax calculations will be 5,000 rubles. for each month from the date established by law for submitting the report. It is possible to block all company accounts. Paying only part of the tax will entail a fine of 20% of the unpaid amount, and for a repeated similar violation the fine will be 40%.

moneymakerfactory.ru

How to make an accounting entry?

The accrual and withholding of personal income tax must be documented in accounting entries. For example, it might look like this:

Debit 70 Credit 68 - Personal income tax subaccount - tax is withheld from the employee’s earnings.

Debit 76 Credit 68 - Personal income tax subaccount - tax is withheld from the amount of the contract.

In general, in accounting there are no difficulties with processing transactions for personal income tax. Difficulties usually arise with the return of income taxes from salaries. If you still have unclear questions about how to calculate income tax on wages in 2021, you can ask them in the comments to this publication. Our consultants will try to help everyone who applies.

my-biz.ru

Distribution of withheld funds according to NFDL

In accordance with Article 13 of the Tax Code of the Russian Federation, personal income tax is a federal tax. The funds received from its retention go to local and regional budgets. The Budget Code states that personal income tax is credited to the budgets:

- subjects of the Russian Federation - 70%;

- settlements - 10%;

- municipal districts - 20%.

Note that a participant in a transaction who does not receive the desired result within a certain time frame has the right to demand a penalty.

Salary income tax in 2021 is calculated using the following algorithm:

1. Salaries are fully calculated, taking into account all additional payments and coefficients (for the reporting period). 2. It is determined whether all types of accrued income are taxed. 3. The status of the taxpayer is determined for calculating personal income tax. 4. The taxpayer’s right to a tax deduction is determined. 5. From the total amount of accrued income, the amount that is not subject to taxation and the amount of tax deduction (if any) should be subtracted. 6. Calculate personal income tax from the amount of income received.

Let us remind you that for a tax resident of the Russian Federation the tax amount will be 13%, for non-residents - 30%.

The employer withholds income tax from wages on the day of actual payment of wages and transfers them to the budget no later than the day following the day of actual payment.

How to fill out 6 personal income taxes if the tax is transferred before the salary is issued?

In this case, entries are used to establish the relationship between the deduction and the expected salary. Declaration 6 of personal income tax indicates the amount that is specified in the employment agreement without the expected bonuses. In practice, the following method is used: if deductions were made earlier, then its amount, which must be stated in the 6 personal income tax declaration, is established by multiplying by 13%. This can be calculated in any version of 1C. But it is advisable to make contributions after the salary is issued. This is the most convenient method used in most organizations.