If a business operates at a loss for a long time, this creates serious problems for its owners. Working capital is being consumed, expenses have to be cut, which can cause valuable employees to quit and equipment to become unusable.

But, among other things, a negative financial result also entails tax consequences. Moreover, sometimes not only negative, but also positive for a businessman. Let's consider how unprofitable activities affect the company's tax burden.

Loss and tax accrual

For the financial result to influence taxes, their calculation must depend on the profit of the business.

This condition is met under three tax regimes.

Under the general system (OSNO), the financial result of activities is subject to income tax. If there is no profit, then there is no tax.

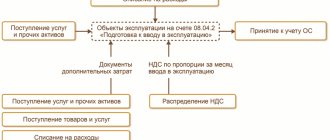

Also, a loss under OSNO also affects VAT, but not as directly as in the case of income tax. The fact is that added value consists not only of the difference between revenue and costs, but also includes all expenses not subject to VAT. First of all, these are wages and insurance premiums accrued on it. Therefore, a company operating at a loss, in most cases, still pays VAT, only to a lesser extent than when making a profit.

There are also two special tax regimes under which profits are taxed on principles similar to OSNO.

The Unified Agricultural Tax (UST) and the tax under the simplified taxation system (STS) with the object “Revenue minus expenses” are calculated based on the difference between revenue and expenses.

The differences between them are as follows:

- Under the Unified Agricultural Tax, turnover is determined “by shipment,” and under the simplified tax system, “by payment.”

- Different tax rates: under the simplified tax system it is (excluding benefits) 15%, and under the unified agricultural tax – 6%.

- The simplified tax system provides for the so-called “minimum tax”, i.e. if the financial result is unprofitable or close to zero, the businessman will have to pay 1% of the proceeds. Under the unified agricultural tax there is no such thing and an agricultural producer operating at a loss does not pay this tax at all.

Under other “special regimes,” the tax amount does not depend on profit. Under the simplified tax system “Income”, it is calculated on the basis of revenue, without taking into account costs.

As for “imputation” and the patent system, in these cases the tax is not tied to business turnover at all. The basis for these special regimes are various “physical” indicators: number of employees, retail space, number of vehicles, etc.

Those. a businessman on an imputation or a patent can work for zero, make a loss, or not conduct business at all, but he remains obligated to pay tax.

Important!

The financial result of activities affects the fiscal burden under three tax regimes: OSNO, Unified Agricultural Tax and the simplified tax system “Income minus expenses”.

Next, we will consider what threatens a businessman operating at a loss, and what benefits he can derive from this situation.

How do tax authorities treat losses?

The answer to this question is obvious - employees of the Federal Tax Service, to put it mildly, “dislike” unprofitable businessmen and suspect every such businessman of tax evasion.

Moreover, we are talking not just about the “amateur activity” of individual specialists or department heads, but about the position of the entire tax service.

The order of the Federal Tax Service of the Russian Federation dated May 30, 2007 No. MM-3-06/ [email protected] lists the criteria for selecting “candidates” for a tax audit.

Clause 11 of Part 4 of Appendix 1 to this order states that one of the criteria for inclusion in the inspection plan is a significant decrease in profitability compared to the industry average.

Those. Tax officials are not satisfied with even a drop in profits, not to mention its complete absence.

Sometimes inspectors even try to bankrupt unprofitable organizations, but in this case, judges usually do not support them.

Important!

The Supreme Court of the Russian Federation indicated that although profit is the goal of entrepreneurial activity, this does not mean that a businessman cannot work with a negative financial result (clause 13 of the resolution of the Plenum of the Armed Forces of the Russian Federation dated October 24, 2006 No. 18).

Therefore, the tax authorities are unlikely to be able to close an unprofitable company, but they are quite capable of creating a host of other problems.

This is primarily an on-site inspection. But a taxpayer working “with a minus” has the opportunity to avoid it and make his loss, so to speak, “legal” in the eyes of inspectors.

To do this, you need to prepare a reasonable explanation of the losses. We'll look at how to do this in the next section.

Losses on the simplified tax system: preparing for inspection

A loss can occur both for a new start-up and for an enterprise that has ten years of operation behind it. In the first year of activity, the lack of profit is quite justified. The company is just getting on its feet, exploring the market and building a client base. But if the negative financial result becomes systematic and continues from year to year, then the tax office may have questions for business representatives.

You may have already heard about the established practice when tax authorities conduct so-called “loss-making” commissions - they invite the owners of the enterprise to the inspectorate to explain the reasons for the loss. Such commissions, although not regulated by law, are quite legal.

How do “unprofitable” commissions work?

Inspectors are interested in companies that:

— have been operating at a loss for two or more years;

— sharply increased their expenses and at the end of the year received a loss large enough to attract the attention of the inspector.

Having received the company's annual reports, which reflect the loss, the inspector may ask for clarification in this regard. In other words, make sure that you do not hide income from taxation, and all expenses are economically justified, documented and aimed at making a profit.

The inspector has the right to send a notice to summon the taxpayer to find out the reasons for the loss received from the director. Often, some inspectors send a letter asking you to justify the loss in an official form and provide primary documents to confirm expenses. Since 2014, the tax office has every right to demand such written explanations. Let us recall that previously a written justification for a loss had a legal basis only when errors were discovered in the declaration. Since the new year, the provision of the “anti-money laundering” law No. 134-FZ has come into force, which has expanded the powers of tax authorities. According to the law, inspectors can not only summon inspectors to explain the causes of losses, but also send demands to provide official explanations within 5 days.

We are preparing an explanatory note

Even if you are at risk of being blacklisted or you have already received an invitation to the tax office, you should not worry. Activities without profit are not a violation of the law and there are no sanctions for this. But a loss-making commission can serve as the first call that they want to include you in the list of scheduled on-site inspections. Competent explanations of the reasons for the loss will help you avoid claims from tax authorities. Please pay special attention to the preparation of documents.

First, check the legality of writing off all expenses and the availability of supporting documents. Remember that in the simplified tax system expenses are taken into account according to special rules. Only those expenses listed in Article 346.16 of the Tax Code of the Russian Federation are subject to write-off.

Tax authorities have access to information on bank accounts, so they can compare account turnover and income that you declare. Questions may arise, for example, in agency transactions, when your income is only agency fees, and the amount of cash received will be larger. Make sure that all documents related to intermediary transactions are completed properly.

Analyze the reason for the loss-making activity and prepare a formal letter with objective arguments to explain the loss. Often, a loss on the simplified tax system occurs due to large expenses, for example, when a company decides to purchase premises for a new office or expand production and purchase expensive equipment. In the simplified tax system, such expenses are written off within one calendar year. Attach all supporting documents for the purchase of property, documents for state registration of rights, if required, commissioning certificates, etc.

Be sure to back up your position with a plan of action you are going to take to get the company out of its current state of affairs.

How to justify losses to tax authorities

If an organization has submitted a “negative” declaration, or even several in a row, this does not mean that inspectors will immediately appear at the doorstep of the office.

Most likely, the tax authorities will first request written explanations or call the head of the commission.

And the further situation largely depends on how weighty the businessman’s arguments are.

You should not “unsubscribe” with general phrases about the economic crisis, falling demand, etc. The explanation must be extremely specific and characterize the situation at this particular enterprise.

The causes of losses include, for example, the following:

- Recent start of activity.

- Launch of new production.

- Significant increase in supplier prices.

- Termination of contracts with large counterparties.

- Force majeure (accident, fire, etc.)

All specified reasons must be documented. For example, if we are talking about relationships with counterparties, then you need to attach copies of contracts, letters and price lists; in emergency situations, acts of government bodies, etc. will be confirmed.

If a businessman managed to justify his losses, then he can use them in the future for tax optimization. We will show you how to do this in the next section.

How to carry forward losses to the future

All tax regimes “tied” to financial results provide for the transfer of losses to the future, but each of them has its own characteristics.

In case of OSNO, losses are transferred in accordance with Art. 283 Tax Code of the Russian Federation.

There are a number of restrictions:

- Only losses received after 01/01/2007 can be used to reduce the current tax (Clause 16, Article 13 of Law No. 401-FZ of November 30, 2016).

- Until 2021 inclusive, transferred losses can reduce the tax base by no more than 50% (clause 2.1 of Article 283 of the Tax Code of the Russian Federation).

- You cannot carry forward losses on preferential activities to which a zero income tax rate applies.

- Also, some “specific” types of losses, for example, from the sale of securities, are not subject to transfer.

If losses have “accumulated” over several years, then they should be written off in chronological order.

Businessmen are required to store all primary documents confirming losses until they are completely written off (clause 4 of Article 283 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of the Russian Federation dated May 25, 2012 No. 03-03-06/1/278).

The transfer of losses under the simplified tax system (clause 7 of article 346.18 of the Tax Code of the Russian Federation) and unified agricultural tax (clause 5 of article 346.6 of the Tax Code of the Russian Federation) is carried out generally according to the same principles as under OSNO, but taking into account the following features:

- The period during which losses can be used for tax optimization is no more than 10 years.

- There are no restrictions on the percentage of reduction of the tax base and types of activities.

It should also be borne in mind that when the tax regime changes, accumulated losses are “cancelled”, i.e. cannot be used in the future to reduce the tax base.

Of course, this provision applies only to tax accounting. In accounting, the financial results of a company’s activities accumulate throughout its “life”, regardless of changes in the form of taxation

USN. Losses at the end of the year

We work on the simplified tax system (income - expenses). We made a loss in 2012, we will pay 1% of income. Please tell us, using a hypothetical example, how this loss will be transferred to future expenses. What accounting entries need to be made?

According to paragraph 7 of Art. 346.18 Tax Code of the Russian Federation

a taxpayer who uses income reduced by the amount of expenses as an object of taxation

has the right to reduce the tax base calculated at the end of the tax period by the amount of loss

received based on the results of previous tax periods in which the taxpayer applied the simplified tax system and used income reduced by the amount as an object of taxation expenses.

Under loss

means the excess of expenses determined in accordance with

Art.

346.16 of the Tax Code of the Russian Federation , over income determined in accordance with

Art.

346.15 Tax Code of the Russian Federation .

The taxpayer has the right to transfer to the current tax period

the amount of loss received in the previous tax period.

A loss not carried forward to the next year may be carried forward in whole or in part to any year out of the next nine years.

.

Reduce the tax base based on the results of the current tax period (2013)

it is possible

for the entire amount

of the loss received at the end of 2012. No limits.

If you have had losses before, then such losses are carried forward to future tax periods in the order in which they were received

.

You are required to keep documents

, confirming the volume of the loss incurred and the amount by which the tax base was reduced for each tax period,

during the entire period of exercising the right to reduce the tax base by the amount of the loss

.

In accordance with paragraph 1 of Art.

346.19 of the Tax Code of the Russian Federation, the tax period

for taxpayers using the simplified tax system is

a calendar year

.

Considering that advance payments are calculated based on the results of the reporting period, and the tax base

a taxpayer applying the simplified tax system

has the right to reduce only based on the results of the tax period (calendar year); when calculating advance payments

, the taxpayer

does not have the right to take into account the amount of losses

received in previous tax periods.

This position was stated by the Federal Tax Service of the Russian Federation in a letter dated July 14, 2010 No. ШС-37-3/ [email protected]

That is, during 2013 you cannot reduce the tax base by the amount of loss based on the results of the reporting periods

(first quarter, half year, 9 months).

During 2013, you must make advance tax payments in the manner prescribed by clause 4 of Art. 346.21 Tax Code of the Russian Federation

.

Previously calculated amounts of advance payments for tax paid in connection with the application of the simplified tax system are counted when calculating the amounts of advance payments for tax for the reporting period and the amount of tax for the tax period (clause 5 of Article 346.21 of the Tax Code of the Russian Federation

).

As the Ministry of Finance of the Russian Federation explained in letter No. 03-11-06/2/42 dated April 1, 2011, the above procedure for paying taxes and advance payments

tax

is mandatory

for all taxpayers who have switched to the use of the simplified tax system,

including taxpayers who suffered losses based on the results of previous tax periods

.

Amount of loss

received in the previous tax period(s),

reducing

the tax base for the tax period (calendar year),

is indicated by line code 230 of Section 2

“Calculation of the tax paid in connection with the application of the simplified taxation system and the minimum tax »

tax return

for tax paid in connection with the application of the simplified tax system, approved by order of the Ministry of Finance of the Russian Federation dated June 22, 2009 No. 58n.

To calculate the amount of loss

that reduces the tax base for the tax paid in connection with the application of the simplified tax system for the tax period,

you must fill out Section III

“Calculation of the amount of loss that reduces the tax base for the tax paid in connection with the application of the simplified taxation system for the tax period” (

line codes 010-250

)

Books of accounting of income and expenses

of organizations and individual entrepreneurs using the simplified taxation system, which was approved by order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n.

Early 2013

in section III

, line code 010

indicates the amount of losses received at the end of 2012, which were not carried forward to the beginning of the expired tax period.

Line code 020

indicates the amount of loss for 2012.

The amount of loss for 2012 should be reflected using line code 150

Section III of the Accounting Book for 2012.

The value of this line is carried over

in section III of the Book of Income and Expenses for 2013 (for 2013) and is indicated

by line code 010

.

In the Accounting Book for 2012 in the Help to Section I by line code 041

you need to indicate the amount of loss received for the tax period (2012) (line code 020 + line code 030 – line code 010).

In section III by line code 140

the amount of loss for the expired tax period is indicated (corresponds to the value of the indicator according to line code 041 of the reference part of Section I of the Book of Income and Expenses).

At the end of 2013

in section III

, line code 120

indicates

the tax base

for the expired tax period (2013), which can be reduced by losses in 2012 (code line 040 of the reference part of section I of the Book of Income and Expenses).

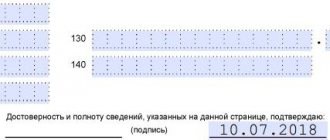

By line code 130

indicates

the amount of losses

by which you actually reduced the tax base for 2013 (within the amount of losses indicated on page 010).

If the amount of loss for 2012 turns out to be greater than the tax base for 2013, then you have the right to transfer the remaining amount of the loss to future tax periods.

This amount is reflected in line 150.

For example

, tax base for 2013 – 500,000 rubles. The amount of loss at the end of 2012 is 550,000 rubles.

Line 150 indicates the amount of 50,000 rubles

.

Indicator value by line code 150

in this case, it is transferred to section III of the Book of Income and Expenses for the next tax period (for example, 2014) and is indicated

by line code 010

.

The taxpayer has an obligation to pay a minimum tax

if at the end of the tax period the taxpayer received a loss and the amount of tax calculated in the general manner is zero.

As the Ministry of Finance of the Russian Federation explained in letter No. 03-11-11/157 dated June 20, 2011, the taxpayer has the right in the following tax periods to include the amount of the difference between the amount of the minimum tax paid and the amount of tax calculated in the general manner

, expenses when calculating the tax base,

including increasing the amount of losses by the amount of the minimum tax paid

, which can be carried forward to the future, in accordance with the provisions of

clause 7 of Art.

346.18 Tax Code of the Russian Federation .

Therefore, you have the right to include the amount of minimum tax paid for 2012 in expenses in 2013 or increase the amount of losses by this amount

.

In accordance with the Instructions for using the Chart of Accounts...

in accounting

at the end of the reporting year, when preparing annual financial statements,

account 99 “Profits and losses” is closed

.

The amount of net loss for the reporting year is written off

the final turnover of December

to the debit of account 84

“Retained earnings (uncovered loss)”

in correspondence with account 99 “Profits and losses”

.

PBU 18/02 “Accounting for income tax calculations”

, approved by Order of the Ministry of Finance of the Russian Federation dated November 19, 2002 No. 114n, established the rules for the formation in accounting and the procedure for disclosing in the financial statements information on income tax calculations

for organizations recognized in accordance with the legislation of the Russian Federation as income tax payers

.

In this regard, permanent and temporary differences are determined by income and expenses recognized when calculating income tax.

Therefore, organizations that apply the simplified tax system do not form a deferred tax asset, deferred tax liabilities, or permanent tax liabilities (assets).

.

Order of the Federal Tax Service of the Russian Federation dated October 14, 2008 No. MM-3-2/ [email protected] approved publicly available criteria for self-assessment of risks for taxpayers, used by tax authorities in the process of selecting objects for on-site tax audits

.

One of the criteria is the reflection in accounting or tax reporting of losses over several tax periods.

That is, the implementation by the organization

financial and economic activity

with a loss for 2 or more calendar years

practically

guarantees the inclusion of the company in the plan for conducting an on-site inspection

.

Conclusion

The resulting losses not only worsen the financial position of the organization, but can also lead to problems with the tax authorities.

Inspectors suspect any unprofitable company of using illegal tax evasion schemes.

To avoid an on-site inspection, a businessman should prepare reasoned explanations and convince officials that the losses were caused by objective reasons.

If the taxpayer’s arguments were sufficiently weighty, then in the future the “confirmed” loss can be used to reduce the tax base.

Who is at risk of “unprofitable commission”

The inspectors are interested in the following companies:

- conducting unprofitable activities for two or more years;

- sharply increased their expenses and received a fairly large loss at the end of the year.

After receiving the company's annual reports that reflect the loss, the inspector may ask for clarification. His task is to find out the reasons for the resulting loss and make sure that the company does not hide income from taxation, all its expenses are economically justified, documented and aimed at making a profit.

The inspector has the right to call the taxpayer to a commission. Often, inspectors send a letter asking you to justify the loss in an official form and provide primary documents to confirm expenses.

According to current legislation, the tax office has the right to demand written explanations only if errors are identified in the taxpayer’s declaration. But already in 2014, the provision of the “anti-money laundering” law No. 134-FZ comes into force, according to which inspectors will not only be able to summon inspectors to explain the causes of losses, but also demand to provide written explanations within five days.