Accounting for profit generation

There are 4 types of profit in accounting:

- operating room;

- from other operations;

- clean;

- unallocated.

Operating profit is defined as the positive difference between credit and debit turnover on account 90, which at the end of the month is transferred to account 99:

Dt 90-9 Kt 99.

Profit from other operations is formed in the same order as operating profit. Only amounts for calculation are taken from account 91:

Dt 91-9 Kt 99.

Net profit is calculated on a monthly basis after closing the balance between credit and debit turnover in account 90 and account 91 and charging income tax:

Dt 68 Kt 99.

The formation of retained earnings is carried out once a year when the balance formed at the end of the year on account 99 is written off to account 84:

Dt 99 Kt 84.

You will find detailed explanations on determining the amounts of each type of profit and reflecting them in accounting in our articles:

“Calculation and formation of operating profit (formula)”;

“How to calculate net profit (calculation formula)?”;

“How to calculate accounting profit (formula)?”;

“Retained earnings in the balance sheet (nuances)”;

"Accounting and analysis of financial results."

Planning

One of the main components of the efficiency of an enterprise and obtaining high profits is financial planning, which is carried out several years in advance. The planning period can be from 3 to 5 years, if there is economic stability. In this case, first they draw up a plan for the quarter - short-term planning , then for the year - current planning . Based on these indicators, planning for the future is formed.

Note! First, a comparative analysis of profit before tax and profit from sales of products or services is carried out, and sales volume is calculated. After this, a program is developed based on previously concluded agreements. The production program serves as the basis for calculating the required amount of raw materials.

In addition, labor costs are recorded: tariff rates, payment of wages, transfer of the unified social tax.

As a result of all the calculations made, the cost of products or services , taking into account the balances of finished and unsold products in the enterprise’s warehouses.

Additional Information . The decisive point is the preparation of estimates for administrative and commercial expenses associated with maintenance and production management, promotion of goods and services to the sales market. The total amount may include intermediary payments.

Based on the above calculations, the planned profit from the sale of products or services of the enterprise is formed.

Nowadays, as the unemployment rate increases, more and more people are starting to work for themselves. Not every entrepreneur understands what accounting profit is and how to calculate it correctly. As a result, there is a risk of losing your business. To effectively develop your business, the company must have a professional accountant.

Accounting for the use of profit in an organization

The use of profit in an organization should be carried out only on the basis of the decision of its founders (participants). All transactions for spending profits recorded in accounting, but not confirmed by the specified decision, will be considered illegal, and the financial statements will be considered unreliable.

The use of profit can be represented schematically:

Let us consider in more detail the reflection in the postings of each of the areas of profit use indicated in the diagram.

Algorithm and formulas for calculating net profit

First, decide for what reporting period the calculation will be made: year, quarter or month.

A shorter period allows you to assess the current position of the enterprise and the results of its recent work; a longer reporting period allows you to consider the development trends of the company and provide the basis for planning its future activities.

Now we determine sales revenue, production costs, operating expenses and the amount of taxes and other fees. The formula for calculating net profit ultimately looks like this:

PE=V-S-OR-N

If your company receives income from investments, sales of assets and other non-production activities, income and expenses from these operations should be included in the calculation of net income.

External use of profits

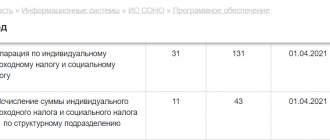

| Operation | Dt | CT |

| Profit generated at the end of the year | 99 | 84 |

| Dividends and bonuses accrued based on the results of the year | 84 | 75, 70 |

| Interim dividends, bonuses (for a quarter, half a year, 9 months). Note! This entry is not recorded in the chart of accounts, but from a logical point of view, interim dividends can only be paid out of net profit (account 99), since retained earnings (account 84) are formed only at the end of the year | 99 | 75, 70 |

| Charitable payments to citizens and organizations | 84 | 76 |

| Financial assistance to employees | 84 | 73 |

Calculation example

Let's calculate profit using the example of a conditional enterprise for 2021.

All data is shown in the table below, they can also be found. Table 1. Calculation of accounting profit

| Quarter | Gross income, t.r. | Cost of production, t.r. | Accounting profit, etc. |

| I quarter 2017 | 76 135 000 | 49 287 790 | 26 847 210 |

| II quarter 2017 | 78 823 000 | 47 267 650 | 31 555 350 |

| III quarter 2017 | 79 006 000 | 46 876 000 | 32 130 000 |

| IV quarter 2017 | 81 276 000 | 45 309 000 | 35 967 000 |

| Year | 315 240 000 | 188 740 440 | 126 499 560 |

| Average per quarter | 78 810 000 | 47 185 110 | 31 624 890 |

Accounting profit for the year amounted to 126,499,560 thousand rubles, which corresponds to 31,624,890 per quarter. It increased throughout the year and in the fourth quarter amounted to RUB 35,967,000. Positive dynamics indicate a favorable situation in the company.

Rice. 1. Dynamics of BP growth

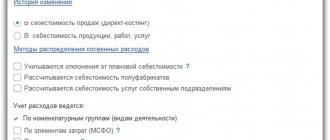

Internal active use of profits

When using profits for the development of the organization and covering losses for previous years, its movement is taken into account only in analytical accounts. This movement is not reflected in any way in synthetic accounting. This fact is due to the fact that the profit received is not withdrawn from current turnover, but continues to work.

The purchase of fixed assets, intangible assets and other costs for optimizing the organization’s activities, made at the expense of profits, are accounted for in the usual manner without using account 84.

And in order to understand how much of the profit received is aimed at optimizing activities, and what remains unclaimed, it is recommended to open at least the following sub-accounts for account 84 “Retained earnings”:

- subaccount 1 “Profit received”;

- subaccount 2 “Profit in circulation”;

- subaccount 3 “Loss of previous years”.

And when the organization’s participants make a decision on the use of profits, record them with internal postings to account 84:

- Dt 84-1 Kt 84-2 - the profit received is used to purchase new equipment.

- Dt 84-1 Kt 84-3 - the profit received is used to cover the losses of previous years.

What affects profit

There are many ways to increase a company's profits. Various factors influence the flow of money into an organization:

- internal (related to the volume of products produced);

- external (do not depend on the internal processes and operation of the enterprise, but indirectly affect profit).

Table 2. Internal and external factors

| Domestic | External |

| Equipment performance. | Competitors and economic situation. |

| Number of staff. | Supplier prices for raw materials and equipment. |

| Management decisions. | Depreciation deductions. |

| Modernization of processes and equipment. | Adopted laws. |

| Distribution of financial resources. | Use of natural resources. |

| Features of work processes. | Payments to the budget. |

| Quality of products and services. | Cost of energy resources. |

All these factors directly or indirectly affect profit margins. It is extremely difficult to deal with external factors, but it is possible to reduce their negative impact. For example, if the prices of the main supplier increase, try to find a cheaper replacement for its raw materials.

Internal factors are closely related to the amount of income received. For any enterprise, it is extremely important to work in detail with each of them, try to increase output and reduce costs.

Traditional options for increasing business profitability:

- expansion of the range of goods produced and sold;

- entering new markets;

- modernization of equipment, optimization of work processes;

- reduction in raw material costs;

- increasing production volumes;

- improving product quality;

- reduction of various costs (raw materials, energy resources, wages and rent, etc.).

Important! The easiest way to increase income is to raise prices. But it could lead to a drop in demand. Therefore, all effective ways to increase profits can be reduced to two options: reducing the cost per unit of production and increasing revenue due to increased sales volumes.

Results

When profits are paid to the founders, employees of the organization or third-party citizens and organizations, it is written off to the accounts of settlements with recipients of funds.

When the profit is attributed to the increase in the reserve and authorized funds of the organization, it is written off to the capital accounts. And when profit remains in the organization’s turnover, its movement is recorded only in analytical accounting. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Types of profit: economic and accounting profit

Profit is the most important qualitative indicator of the efficiency of an organization (enterprise), which characterizes the rational use of means of production and labor, material, and financial resources.

There is a certain difference between the accounting and economic approaches to production costs, which leads to different concepts of profit.

Accounting profit is the firm's total income minus accounting (that is, explicit) costs;

Economic profit is the firm's total income minus economic (that is, explicit plus implicit) costs, or if they are mathematically equated. then Economic profit = Accounting profit - Implicit costs.

Normal profit A component of economic costs is always “normal profit” - this is the income from the use of entrepreneurial talent. Normal profit occurs only when the firm's total revenue equals its total economic cost. Under these conditions, the firm's economic profit is zero. Naturally, normal profit is necessary in order to keep an entrepreneur in this field of activity.

Net economic profit If a firm uses its available resources in the most efficient way and total revenue exceeds total economic cost, then positive economic profit arises. Depending on the market structure and the relationship between the elements of monopoly and competition in a particular market, economic profit can be maintained for a more or less long period.

The presence of positive or negative economic profits in an industry stimulates the influx of new enterprises into the industry or the corresponding outflow of firms to other areas of activity.

Accounting profit - formula

If we consider the data from the point of view of drawing up a balance sheet (Form-1), then the formula for determining profit has the following form:

Profit according to accounting = Revenue (line 2110) – Cost (line 2120) – Commercial expenses (line 2210) – Management expenses (line 2220) + Income received from participation in enterprises (line 2310) + Amount % to receipt (line 2320) – Amount % payable (line 2330) + Other income (line 2340) – Other expenses (line 2350)

Important! When results are received, negative values in reporting are reflected not with a minus sign, but in parentheses.

Classification of costs.

First of all, external and internal costs are distinguished. External - the company pays for workers, fuel, components, i.e. everything that she does not produce herself to create this product. Internal - the owner of this company receives the so-called normal profit. Otherwise, he will not deal with this matter. The profit he receives (normal) constitutes an element of costs. It is customary to distinguish net (economic) profit, which is equal to total revenue minus external and internal costs, including normal profit. Accounting profit equals total revenue minus external costs. [p.254] What are the differences between the concepts of economic profit and accounting profit [p.422]

Thus, the final financial result of the activities of a commercial organization of any organizational and legal form of business is expressed by the so-called accounting profit (loss), identified for the reporting period on the basis of accounting of all its business transactions and assessment of balance sheet items according to the rules adopted in accordance with the Regulations on maintaining accounting records and financial statements, approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34 no. According to this Regulation, the final financial result of the reporting period is now reflected in the balance sheet as retained earnings (uncovered loss), i.e. the final financial result identified for the reporting period, minus taxes and other similar mandatory payments due from profits established in accordance with the legislation of the Russian Federation, including sanctions for non-compliance with tax rules. [p.285]

Next, you should pay attention to the fact that f. No. 2 The profit and loss statement allows you to reveal the influence of factors not only on sales profit and the margin of financial strength, but also on other types of profit shown in f. No. 2, and primarily on such as profit before tax (economic profit) and net profit or retained earnings (accounting profit). Thus, economic profit is influenced by all factors generating profit from sales, as well as changes compared to the previous year in interest receivable (+) interest payable (-) income from participation in other organizations (+) other operating income (+) non-operating income expenses (—). According to the data in Table. 9.1 we will compose an intermediate table. 9.11, which reveals the factors of formation of profit before tax (economic profit). [p.306]

When calculating all these indicators, some important circumstances should be taken into account. Firstly, the choice of the components of the numerator and denominator of the coefficients depends on the purpose and objectives of the analysis. For example, what profit should be taken from f. No. 2 to assess the profitability of various aspects of the enterprise’s activities: profit from sales of goods, products (works, services) gross profit profit before tax (economic profit) profit from ordinary activities, i.e. after tax, net (redistributed) profit or, as it is also called, accounting profit. [p.362]

Define the following key concepts: income, expenses, profit, deposit, advance, pledge, management and financial accounting, recognition of income (expense), economic and accounting profit, marginal profit, net profit, retained earnings, cost, costing, economic element of costs , costing item, cost standards, profitability. [p.201]

The tax orientation of accounting is the maintenance of accounting records and the calculation of financial results based on the principle of dominance of the requirements of the tax authorities (as a result, the reported accounting profit and taxable profit coincide). [p.305]

In modern accounting theory, primarily in English-speaking countries, a distinction is made between tax and economic concepts of profit. In this regard, there are two possible options for calculating profit: the first is that accounting profit is equal to taxable profit; in the second, their amounts do not match. In the first case, the gaze of users of accounting information is directed to the past, in the second - to the future. The latter takes into account the fact that financial reporting data influences the company's stock price. Therefore, the profit shown in the balance sheet and income statement should not be identical to the profit on which taxes are paid. [p.48]

Profit (loss) of the organization. Accounting profit (loss) is the final financial result (profit or loss) identified for a certain period on the basis of accounting of all business transactions of the organization and assessment of balance sheet items according to the rules adopted in accordance with the Regulations on accounting and financial reporting in the Russian Federation Federation. [p.45]

Before the entry into force of Chapter 25 Income Tax of Organizations of the Tax Code of the Russian Federation, the tax base for the tax was determined according to accounting data. Reported (accounting) profit (credit balance of the Profit and Loss account) was adjusted by drawing up a Certificate of Determination Procedure [p.175]

Based on common sense, the company had neither profit nor loss in the reporting year, since there were no transactions; the same result occurs if we use the second definition of profit. However, in accordance with the definition of profit through the change in equity, the company still has a profit of $10,000. So, economic profit is equal to $10,000, and accounting profit is zero. [p.365]

Accounting profit represents total income minus explicit costs. At the same time, explicit costs are understood as the actual expenditure of resources on the production of a certain amount of products at the prices of their purchase. [p.82]

Net profit is formed in accordance with PBU 4/99 in the income statement (Fig. 3.1), and in its content corresponds to retained earnings. From Fig. 3.1 it is clear that in the new profit and loss statement, firstly, accounting profit is not indicated; if necessary, it can be defined as the amount of profit (loss) before tax and extraordinary income, reduced by extraordinary expenses, and secondly, new concepts of profit before tax and profit from ordinary activities. [p.83]

So, as we see, there is not and cannot be a single understanding of profit, because it depends on the goals set by the interested party. Such a person, first of all, must decide what to include in the asset and how accounting profit is calculated (static or dynamic interpretation is accepted). [p.444]

Accounting profit (loss) represents the final financial result (profit or loss) identified for the reporting period on the basis of accounting of all business transactions of the organization and evaluation of balance sheet items according to the rules adopted in accordance with these Regulations. [p.364]

We'll cover bias in accounting earnings and profitability measures in Chapter 12 after we apply the concept of present value to determine true economic profit measures. For now, we just want to remind you that accounting profits are a slippery animal. [p.63]

This criterion has several serious shortcomings. The first is that because it reflects only the average return per investment's book value, it does not take into account the fact that immediate receipts are worth more than distant ones. If the payback rule does not take into account cash flows that are more distant in time, then the profitability rule, based on the book value of assets, gives too much importance to them. In Table 5 we can compare two projects, B and C, which are characterized by the same book value of investments, average accounting profit and average accounting profitability as project A. However, the net present value of Project A is higher than that of Projects B and C, since Project A has a larger share of its cash flows in the early years. [p.81]

Also note that the average return per investment book value is based on accounting profit, not the cash flows generated by the project. Cash flows and accounting profits are often very different. For example, accountants classify some areas of cash outflows as capital expenditures and others as operating expenses. Of course, operational dis- [p.81]

A firm using average earnings per book value must select a criterion to evaluate the project. This decision is also arbitrary. Sometimes a firm uses current accounting profit as a criterion. In such cases, companies with high rates of profitability of their existing business sometimes refuse good projects, and companies with low rates of profitability agree to bad ones. [p.82]

The first and most important considerations are that the net present value rule relies on cash flows. The concept of cash flow is very simple: cash flow is simply the difference between the dollars received and the dollars paid. However, many people confuse cash flow with accounting profit. [p.102]

Accountants start with the concepts of “dollars in” and “dollars out,” but they adjust these data in two basic ways to arrive at accounting profits. First, they strive to show profits when they are earned, not when the company and customer pay their bills. Second, they divide cash outflows into two groups: operating expenses and capital expenses. When calculating profits, they deduct operating expenses but do not deduct capital expenses. Instead, they “depreciate” capital expenditures over a number of years and subtract depreciation charges from profits annually. As a result of such procedures, some cash flows are included in earnings and others are excluded from it, and earnings are reduced by the amount of depreciation charges, which are not cash flows at all. [p.102]

When we work with accounting earnings, we subtract $15 million of depreciation each year. to recoup the initial investment. If Clunker sells 60,000 cars a year, the revenue will be sufficient to both cover operating costs and offset the $150 million in initial expenses. However, this amount is not enough to offset the opportunity costs of investing this $150 million. If we assume that $150 million. can be invested in some other project and bring 10%, then the annual cost of investments will be equal not to 15 million dollars, but to 24.4 million dollars. [p.241]

Managers of enterprises and branches care about their own future. Sometimes their interests are at odds with the interests of shareholders, and this can result in investment decisions that do not maximize shareholder wealth. For example, managers of a new plant naturally want to demonstrate good results right away in order to move up the corporate hierarchy. They may be able to offer projects with a quick payback, even if they sacrifice net present value to do so. And if their performance is judged by accounting profits, then they will be attracted to projects with good accounting results. [p.286]

Accounting profit - cash flow - - depreciation according to accounting data = fBV - BV,,). [p.292]

Accounting profit of stores [p.295]

Note. Accounting profit = cash flow + change in book value for the year. Accounting ROI in a sustainable environment. [p.295]

The desire to have good accounting earnings results comes from senior management. Managers have good reasons to show good short-term profits. The bonuses they receive probably depend on this. The market tracks current net earnings per share (in part because it has no visibility into management's five-year plans). Is it surprising that senior management does not always prefer projects with high net present values, but which will reduce earnings per share next year?

Although accounting profits and capital employed (the basic quantities used in the calculations of RO E and RT) are easy to derive from accounting records, their application poses some difficulties. [p.731]

Note that the long-standing dispute about whose priorities - the state or the owners - should be taken into account in the accounting system first of all and/or be in a certain harmony, is precisely expressed in the construction of either tax-oriented accounting or non-tax-oriented accounting . Tax orientation of accounting means keeping records and calculating the financial result based on the principle of dominance of the requirements of the tax authorities (as a result, the reported accounting profit and taxable profit coincide). Non-tax orientation involves maintaining accounting records and calculating the financial result based on the principle of dominance of the requirements of accounting legislation (as a result, the reported accounting profit and taxable profit do not coincide; the latter is obtained by adjusting the former based on the requirements of tax legislation). [p.372]

Researchers were also interested in the influence of political costs (politi al osts) on the choice of accounting policy. Political costs arise from the fact that firms are more likely to come to the attention of politicians than to be represented by them. Large firms attract more attention from the media, politicians and the public at large than small firms, especially if the former's profits appear high. They become likely targets for costly regulation. This may result in increased taxes and compliance costs. According to the concept of selfish behavior, large firms have incentives to use accounting practices that reduce accounting profits. [p.127]

Determining profit is an integral part of the accounting process. Accounting profit is often used as the basis for calculating income tax, as an indicator of the company's economic performance, as a criterion for determining dividend payments, as a determining factor in setting the level of wages and remuneration of the administration, etc. The concept of profit is widely used in economics. This is quite natural, since the subject of economics and accounting is the same. As Whittington writes [p.309]

Please understand the gross profit here and further in Chapter. 4 is used in the sense given to it by the current law on income tax, and corresponds to the concept of accounting profit established in paragraph 79 of the Regulations on accounting and financial reporting in the Russian Federation. [p.109]

Projected accounting profit and return on investment for the proposed store in Nodhead. Accounting return on investment is lower than the economic rate of return in the first 2 years and higher in subsequent years. [p.293]

The regional manager is puzzled by the conflicting signals. On the one hand, he was asked to find and propose a good investment project. Good from a discounted cash flow perspective. On the other hand, he was also required to increase accounting profits. But these two goals conflict with each other because accounting profits do not provide an indication of actual profits. The more pressingly a regional manager is pressed for quick accounting returns, the greater his desire to forego good investments or to choose short-term projects over long-term projects, even if the latter have high net present values. [p.294]