Companies often enter into civil law agreements (CLA) with individuals: in this case, they can save a lot on costs. However, it will not be possible to completely avoid taxes and contributions in this case. Nikita Rozhentsov and Natalia Fedorova from Alliance Legal CG explained in detail what taxes need to be paid when working under GPC agreements in 2021.

Registration of relations with individuals through civil contracts is a common occurrence for many entrepreneurs. To perform one-time work or provide any service, it is not always advisable for an organization to hire an employee and bear associated expenses (personal income tax, insurance premiums), as well as provide the person with certain guarantees (annual paid leave, temporary disability benefits).

For such cases, the most optimal way out of the situation may be to conclude a service agreement or a contract with an individual. But for managers, the question of the fiscal burden immediately arises: how, how much and in what order to pay taxes and insurance premiums.

Features of calculating insurance premiums regarding the status of the insured person

The objects of taxation with insurance premiums are specified in Article 420 of the Tax Code of the Russian Federation.

COMPANY ACCOUNTING

We systematize in the table the features of taxation of insurance premiums depending on the subject of the GPC agreement:

| Subject of the GPC agreement | Procedure for levying insurance premiums (pension and health insurance) | Rule of Law |

| performance of work, provision of services by individual entrepreneurs engaged in private practice by lawyers (notaries) | not taxed | Subclause 1 Clause 1 Article 420 of the Tax Code of the Russian Federation |

| performance of work, provision of services (except for individual entrepreneurs, lawyers (notaries) engaged in private practice) | are taxed in general | |

| author's order in favor of the authors of the works | are taxed taking into account the following features: the base for calculating insurance premiums is reduced by the amount of expenses actually incurred and documented. If expenses are not documented, they are accepted for deduction within the standard | paragraph 2, paragraph 1, article 420 of the Tax Code of the Russian Federation, paragraph 8 of article 421 of the Tax Code of the Russian Federation |

| alienation of the exclusive right to works of science, literature, art, granting the right to use works of science, literature, art (including remunerations accrued by organizations for managing rights on a collective basis in favor of the authors of works under agreements concluded with users) | paragraph 3, paragraph 1, article 420 of the Tax Code of the Russian Federation, paragraph 8 of article 421 of the Tax Code of the Russian Federation | |

| The standard (calculated as a percentage of accrued remuneration), within which documentary evidence is not required, is (clause 9 of Article 421 of the Tax Code of the Russian Federation): - for the creation and execution of literary works, scientific developments and works - 20%; - for the creation of musical works not related to the theatrical sphere or audio design for video films - 25%; - for the creation of artistic, architectural, audiovisual works, photographs - 30%; - for inventions, discoveries and creation of industrial designs - 30% of the amount of income of an individual received during the first 2 years of using the results of work; - for the creation of sculptures, decorative and design graphics, as well as musical works intended for theater or films - 40%. | ||

| transfer of ownership or other proprietary rights to property (property rights), and contracts related to the transfer of property (property rights) for use, with the exception of copyright contracts, contracts on the alienation of the exclusive right to works of science, literature, art, publishing license agreements , licensing agreements granting the right to use works of science, literature, art | not taxed | Clause 4 of Article 420 of the Tax Code of the Russian Federation |

| payments and other remuneration calculated in favor of individuals who are foreign citizens or stateless persons in connection with their activities outside the territory of the Russian Federation within the framework of concluded civil contracts, the subject of which is the performance of work, the provision of services | not taxed | Clause 5 of Article 420 of the Tax Code of the Russian Federation |

| payments to volunteers as part of the execution of civil contracts concluded in accordance with Article 7.1 of the Federal Law of August 11, 1995 No. 135-FZ “On Charitable Activities and Charitable Organizations” for reimbursement of volunteers’ expenses | are not taxed, with the exception of food expenses in an amount exceeding the daily allowance provided for in paragraph 3 of Article 217 of the Tax Code of the Russian Federation (more than 700 rubles for each day of a business trip in the Russian Federation) | Clause 6 of Article 420 of the Tax Code of the Russian Federation |

| payments to foreign citizens and stateless persons under agreements with FIFA (Federation Internationale de Football Association), FIFA subsidiaries, the Russia-2018 Organizing Committee, subsidiaries of the Russia-2018 Organizing Committee | not taxed | Clause 7 of Article 420 of the Tax Code of the Russian Federation |

"INSURANCE" DISPUTES. REVIEW OF JUDICIAL ACTS OF THE RF Armed Forces ON THE ISSUES OF PAYMENT OF INSURANCE PREMIUMS TO NON-BUDGETARY FUNDS

Important!

Remunerations under GPC agreements are not subject to contributions for insurance against temporary disability or in connection with maternity (clause 2, clause 3, Article 422 of the Tax Code of the Russian Federation). “Unfortunate” contributions are charged if such conditions are contained in the GPC agreement (Clause 1, Article 20.1 of the Law of July 24, 1998 No. 125-FZ).

When concluding GPC agreements by a company, the documents necessary to make payments under the agreement must be requested from an individual:

- passport details;

- certificate of registration with the tax office (with information about the TIN);

- copies of bank documents with details for transferring payments;

- certificate of compulsory pension insurance (green plastic card with insurance number).

Income tax

Expenses incurred for the payment of remuneration under civil contracts must be recognized as of the date of signing the act of provision of services. These expenses are taken into account in labor costs (if the contractor is not an individual entrepreneur/self-employed) or in other expenses (when the contractor is an individual entrepreneur or self-employed).

Note: the entrepreneur is required to confirm the expenses incurred with documents (agreement, acts of completion of work/provision of services, in some cases - reports on the work done, and so on). Failure to fulfill this obligation, as well as failure to confirm the actual completion of these works/provision of services, may serve as the basis for claims from the tax authorities and lead to additional assessment of income tax, as well as penalties and fines.

At what rates are insurance premiums calculated under GPC agreements?

The rate of insurance premiums for calculation from the amounts of remuneration under GPC agreements is established by Article 426 of the Tax Code of the Russian Federation (for 2021 - 2019):

- for compulsory pension insurance - 22%, taking into account the maximum base for calculation and 10% from income exceeding it (the maximum base for calculating insurance contributions for pension insurance was established by Decree of the Government of the Russian Federation of November 29, 2016 No. 1255 for 2021 - 876 thousand. rubles);

- for compulsory health insurance - 5.1%.

The concept of a civil law agreement (GPC)

Labor relations with employees employed on the basis of an employment contract are regulated by the Labor Code, and relations under a GPC agreement are regulated by the Civil Code. In the matter of paying insurance premiums under a GPC agreement, it is important that when signing such a contract, any hints of its similarity with a standard employment contract are excluded , since in judicial practice there have been cases when a GPC agreement was recognized as an employment contract, and subsequently the company was forced to pay additional insurance premiums and pay penalty for late payment.

To avoid any difficulties, the terms of the agreement must include the following points:

- The subject of the contract must include work, services or the transfer of rights to property, but not the performance of official functions. The expected result of the work should be a completed project, equipment in a state of high-quality assembly, rental of premises, etc. As the basis for payment, indicate an order, act, statement (not a time sheet).

- An employee cannot be required to follow the company’s labor discipline, internal regulations, or subordination, which are accepted for full-time employees. The same calculation standards that apply to employees cannot be applied to wage conditions.

- How and in what amount an employee’s work will be paid under a civil process agreement is not regulated by Labor legislation, but is approved by agreement of the parties. Money is paid upon completion of the work, unless the agreement requires an advance payment.

- The GPC agreement is one-time in nature and limited in time, so write down how long the work must be completed.

- Make sure in advance that the GPC agreement does not imply the regular provision of services to the organization for the same fee, otherwise regulatory authorities may recognize the agreement as a disguised employment contract.

For example

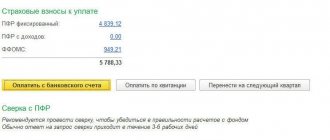

A company using the simplified tax system pays insurance premiums at reduced rates, since its income does not exceed 79 million rubles and the revenue from one of the preferential types of activities is more than 70% of the total income (clause 3, clause 2, article 427 of the Tax Code of the Russian Federation, Letter Ministry of Labor of the Russian Federation dated September 29, 2015 No. 17-4/10/OOG-1357).

And therefore, in relation to an individual contractor, the company also has the right to apply reduced tariffs, i.e. during 2021 - 2018, insurance premium rates for compulsory pension insurance will be 20.0%, for compulsory health insurance - 0%.

MAINTENANCE OF PERSONNEL RECORDS

Now let’s consider the question of when it is necessary to charge additional contributions to the compulsory pension insurance. Let us recall that the list of professions subject to additional contributions to pension insurance is contained in Article 30 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ.

According to paragraph 1, paragraph “a”, paragraph 1 of Resolution No. 537, when early assignment of an old-age pension to workers engaged in underground work, work with hazardous working conditions and in hot shops, List No. 1 of production, work, professions is applied, positions and indicators in underground work, in work with particularly harmful and especially difficult working conditions, employment in which gives the right to an old-age pension on preferential terms, approved by Resolution of the Cabinet of Ministers of the USSR dated January 26, 1991 No. 10 (hereinafter referred to as text - List No. 1).

Nuances of calculating and paying insurance premiums

A significant advantage of a GPC agreement is the ability to legally reduce the amount of insurance payments, and sometimes not pay them at all. But in order not to break the law, you need to understand what is the subject of the contract and what category it can be classified into.

| Subject of contract | The need to pay insurance premiums |

| Contract or service agreement | Available, in full |

| Royalty | Yes, but you can deduct costs that can be documented |

| Waiver of rights to a work of art, scientific or literary | Yes, but you can deduct costs that are documented |

| Transfer of property for temporary use or ownership (including donation, lease) | Not available |

| Reimbursement for volunteers in charities | Does not have (except for food costs that turned out to be above daily norms) |

| Participation in FIFA 2021 | Not available |

| Reimbursement of costs for personnel training (professional), including apprenticeship contracts | Not available |

As it became known, it is possible to reduce the base for taxation of insurance premiums by deducting costs. There are rules regarding the amount of the deduction - there is a limit to the accrued amount of remuneration, and if the expenses are within its boundaries, they are not required to be confirmed with documents:

- for writing music for theater and films, creating design and decorative graphics, as well as sculptures - 40%;

- for the creation of industrial designs, inventions - 30% of the contractor’s revenue for the first two years of using the results of his work;

- for the creation of photographs, artistic, audiovisual, architectural works - 25%;

- for scientific developments, writing literary works - 20%.

Table of differences

The Supreme Court of the Russian Federation came to the conclusion that in a number of cases, GPAs concluded with individual entrepreneurs, which provide for monthly remuneration, compliance with labor regulations, etc., should be reclassified as employment contracts, since they are illegal and infringe on the rights of employees (definition Sun dated 02.27.17 No. 302-KG17-382). This means that companies take a big risk when they enter into GPAs, which are very similar to employment contracts.

For clarity, the main distinguishing features of these agreements are shown in the table:

| Signs | GPC agreement | Employment contract |

| Parties to the agreement | Customer and performer | Employer and employee |

| Subject of the agreement | Specific task | According to job description |

| Payment under the contract | Reward | Salary |

| Execution of the contract | Personally or with the involvement of third parties | Personally |

| Deadline | Defined, which ends upon completion of the contract | Indefinite. Urgent only in special cases |

| Time and end of the working day | Not regulated | Internal labor regulations |

| Working conditions | The contractor independently equips his workplace | The employer is obliged to equip the workplace, provide tools and, if necessary, provide special clothing and footwear. |

| Documenting | GPC agreement | Reception order. An entry in the work book, if the employee has not previously written a refusal to submit a paper work record. Transfer of information to the Pension Fund of the Russian Federation using the SZV-TD form. Employment contract |

| Business trip | The performer's trip is not considered a business trip and is paid for by the performer himself. The customer cannot send on a business trip | When sent on a business trip, the employer pays daily allowance, travel and accommodation expenses |

When can you conclude a GPC agreement with an individual, read our article.

Typical errors in calculations

Mistake #1. The GPC agreement was concluded with an individual entrepreneur. The employer paid insurance premiums.

In the case of a GPC agreement concluded with an individual entrepreneur, insurance charges do not occur due to the fact that entrepreneurs have the obligation to make mandatory insurance payments independently (“for themselves”).

Mistake #2. Insurance premiums were accrued for a GPC agreement concluded with a foreign citizen working remotely from the territory of his country.

When a GPC agreement is concluded with foreigners who are outside the borders of Russia during the fulfillment of obligations under the agreement, their remuneration is not considered subject to insurance premiums.

Features of the document

The features of a civil contract are revealed when compared with an employment contract.

Article 67 of the Labor Code of the Russian Federation. Employment contract form

Article 57 of the Labor Code of the Russian Federation. Contents of the employment contract

Key differences are identified in the following positions:

- the contractor undertakes to implement the customer’s assignment, the content of which is known before the conclusion of the agreement;

- the principle of equality between the contractor and the customer is observed;

- the parties to the contract independently establish the procedure for implementing the acquired obligations, performing all inherent actions at their own expense;

- the contractor and the customer have the opportunity to involve third parties in the implementation of acquired responsibilities;

- participants in the agreement do not receive a salary, but a monetary reward, which is paid in accordance with the conditions specified in the text of the document;

- if any of the parties to the transaction caused losses, then he bears personal responsibility for them and is obliged to compensate them in full at his own expense;

- if the contract is drawn up to perform specific work or provide certain services, then it ends either at the end of the term or before the desired result occurs.

Additionally, it is worth noting that if an individual takes part in a transaction, then all the guarantees that are provided for by the Labor Code of the Russian Federation for employees working under an employment contract apply to him.

Answers to common questions

Question No. 1. What to do with insurance premiums if there is a mixed subject of the contract? For example, under the agreement it is intended to sell real estate and provide services related to the transfer of property.

It will be necessary to draw a line between the amount of an individual’s income that relates to the taxable part and the non-taxable part. Insurance payments are made in relation only to that part for which insurance deductions are provided.

Question No. 2. Is it necessary to pay insurance premiums under a GPC agreement if the employee is a citizen of another country?

If a foreigner has the status of a temporary resident in Russia, there is no need to make insurance payments.

Statutory agreements

The civil law nature of the contract makes it possible to obtain certain benefits for both the contractor and the customer. However, both of them must understand that it will not be possible to completely free themselves from contributions and taxes - a reduction in the amount paid is possible only if there are legal grounds for this.

The relations themselves are regulated primarily by the Civil Code of the Russian Federation. Certain points regarding deductions are prescribed in the Tax Code of the Russian Federation.

The parties to the transaction must take into account that if these provisions are not observed, they will be subject to liability and subsequent punishment, the negative effect of which may cover all the positive aspects of the agreement.

Allotted time frame

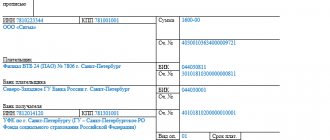

In order to prevent the occurrence of penalties from government agencies, the payer is obliged to strictly follow the established deadlines for transferring insurance contributions to the budget.

Deductions from a civil law agreement are made in the same periods as in the case of full-time employees of the organization. In other words, the parties to the transaction are obliged, no later than the 15th day of the month followed by the month of payment, to send contributions to the appropriate funds.

For example, if a person purchased a cash reward in June, then the payment deadline is the entire time period until July 15. Important: if the last payment date falls on a weekend or holiday, it is transferred to the next working day.