Home / Articles / Accounting in certain areas of activity /

Accounting - from 5,000 RUR per month Consultation - free

PRICE LIST

Organization of accounting at manufacturing enterprises ( accounting in production

) mainly depends on the technology and organization of production, the nature of the products, management structure and other factors that predetermine the processes of documenting business transactions, their systematization, generalization and reflection.

Production in the economic sense is the process of creating various products, i.e. any process aimed at satisfying our needs. Production can be simple, requiring no equipment, or it can be complex, that is, using the necessary equipment (tools) and very complex - using large and varied equipment, raw materials, materials, etc.

Production typically consists of:

- technology—method of production;

- resources - structures, equipment, auxiliary materials and energy;

- the object(s) of processing is the material(s) from which the product will be produced;

- performers of the production process - all employees, departments, directly or indirectly, participating in the process;

- result (results) - finished products.

As we see, in order to start producing something, at a minimum you need technology and a performer, and for more complex and material productions you also need something with which and from what the product will be produced. Regardless of how simple or complex the production at your enterprise is, it is necessary to maintain accounting and management records at the production enterprise

.

Enterprise managers involved in production activities need to have an operational, reliable information system in order to make informed management decisions.

In the process of economic activity of an enterprise, a significant amount of operational information arises. Operational accounting is carried out at the places where work is carried out, various economic functions are performed (department, warehouse), and therefore its information is limited within the enterprise.

Our team will help you manage operational planning, control and accounting issues within your production enterprise, helping to optimize costs and financial results. With modern communications of the 21st century, transmitting information via email is a matter of one minute.

Competent accounting of product production provides the necessary mechanism for effective management of financial and labor resources.

Primary documents, accounting registers, and financial statements are subject to mandatory storage in accordance with the established procedures and deadlines, and it is necessary to bear responsibility for ensuring their safety during the period of working with them and their timely transfer to the archive.

Accounting in production

(accounting for enterprises with production processes) includes:

- organization and maintenance of accounting at production enterprises;

- preparation of financial statements;

- studying the peculiarities of taxation of manufacturing enterprises;

- analysis of financial statements and accounting organization

Each accomplished fact, documented in a document, is called a business transaction in production in accounting.

The financial statements of an organization are the final stage of the accounting process. It reflects, on an accrual basis, the property and financial position of the organization, the results of economic activities for the reporting period (month, quarter, year).

The regulation of accounting at manufacturing enterprises in Russia is based on the legislative framework, as well as from the working documentation that forms the accounting policy of the enterprise:

- Tax Code of the Russian Federation (part two) dated 08/05/2000 N 117-FZ (as amended on 07/19/2011) (as amended and supplemented from 08/01/2011);

- Letters of the Ministry of Finance of Russia dated June 1, 2007 N 03-07-08/136, dated April 20, 2007 N 03-07-08/88;

- Decree of the Government of the Russian Federation of July 28, 2006 N 468 (as amended on February 7, 2011) “On approval of lists of goods (work, services), the duration of the production cycle of production (execution, provision) of which is over 6 months”;

- Federal Law of November 21, 1996 N 129-FZ (as amended on September 28, 2010) “On Accounting” (as amended and supplemented, from January 1, 2011);

- Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 N 43n (as amended on November 8, 2010) “On approval of the Accounting Regulations “Accounting Statements of an Organization” (PBU 4/99)”;

- Order of the Ministry of Finance of the Russian Federation dated June 9, 2001 N 44n (as amended on October 25, 2010) “On approval of the accounting regulations “Accounting for inventories” PBU 5/01” (registered with the Ministry of Justice of the Russian Federation on July 19, 2001 N 2806 );

- Order of the Ministry of Finance of the Russian Federation dated March 30, 2001 N 26n (as amended on December 24, 2010) “On approval of the accounting regulations “Accounting for fixed assets” PBU 6/01” (registered with the Ministry of Justice of the Russian Federation on April 28, 2001 N 2689);

- Order of the Ministry of Finance of the Russian Federation dated 06.05.1999 N 32n (as amended on 08.11.2010) “On approval of the Accounting Regulations “Organizational Income” PBU 9/99” (Registered with the Ministry of Justice of the Russian Federation on 05.31.1999 N 1791) (with changes and additions, from 01/01/2011);

- Order of the Ministry of Finance of the Russian Federation dated May 6, 1999 N 33n (as amended on November 8, 2010) “On approval of the Accounting Regulations “Organization Expenses” PBU 10/99” (registered with the Ministry of Justice of the Russian Federation on May 31, 1999 N 1790) (with changes and additions, from 01/01/2011);

- "OK 005-93. All-Russian Product Classifier" (approved by Decree of the State Standard of the Russian Federation dated December 30, 1993 N 301) (date of introduction July 1, 1994) (codes 01 0000 - 51 7800) (as amended on December 23, 2010)

Accounting in production: where to start

In order to better understand the goals and objectives of accounting in production, let's imagine a certain hypothetical production that produces a PRODUCT. Our PRODUCT production process has several stages:

- Preliminary processing.

- Actually production.

- Final processing.

That is, in our production cycle there are at least three sections. At each site, the PRODUCT goes through its own technological cycle.

The production process in general can be represented as a diagram:

As we see in the diagram, raw materials enter production. In our case, raw materials go through three (in practice there may be more or less) stages of processing, and the output is a finished product.

In this regard, the accounting department of a manufacturing enterprise faces several important tasks:

- Determine the procedure for acceptance and accounting of raw materials.

- Establish the procedure and rules for accounting for materials at each stage of production, determine the frequency and form of material reports, take the form of primary documents on the basis of which material resources are released to the workshops and transferred from one technological site to another.

See how the warehouse accounting card and the materials warehouse accounting book are maintained and what transactions reflect the movement of materials in accounting.

Important! From 01/01/2021, materials accounting is carried out in accordance with the new FSBU 5/2019 “Inventories”, PBU 5/01 has become invalid. The Guide from ConsultantPlus will help you adapt to the new accounting rules. If you do not already have access to this legal system, trial access is available for free.

- Determine the nature of remuneration for production workers.

- Establish procedures and rules for accounting for finished products.

- Find out which structures of the enterprise are involved in the production process (departments of the chief mechanic, chief technologist, laboratory, quality control department, other support services - repairmen, equipment cleaning and adjustment, industrial premises cleaners, transporters). For each support service, it is necessary to determine a list of material costs and equipment used, the nature of remuneration, and introduce a procedure for accounting for material and technical resources.

There are many tasks - therefore, in the process of setting up production accounting, an accountant must be well versed in all the intricacies of the production process. And you need to start introducing accounting by studying the technology and features of those products that are obtained at each stage of production. At the same time, the main task of accounting at the production site is to accurately determine the actual costs per unit of production.

Receipt of materials

In our step-by-step example, we will produce a product in 1C 8.3 - a chair.

Before we produce anything, we need to purchase materials (boards, nails and varnish). In 1C: Accounting, this operation is reflected in the document “Receipts (acts, invoices)”. The type of operation in this case will be “Goods (invoice)”. Materials arrive on the tenth count.

We will not fill out this document in detail. If you have any difficulties, we recommend reading Goods Receipt in 1C 8.3 or watching the video:

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

What is included in production costs

Production costs may include:

- material costs for main production: raw materials, components, semi-finished products purchased externally;

- energy costs for production: electricity, fuels and lubricants, thermal energy, etc.;

- human labor costs expressed in wages of main workers and workers in auxiliary production;

- costs of compulsory social insurance;

- depreciation of equipment used in the production process;

- labor costs of management personnel involved in production;

- cost of materials for auxiliary workshops;

- depreciation of equipment in auxiliary workshops.

Costs are grouped by elements in accordance with the requirements of clause 8 of PBU 10/99.

Find out more about reflecting main production in the balance sheet from our article.

At the same time, the costs of maintaining the main and auxiliary production facilities are of a general production nature. Such costs must be accumulated on the 25th account and attributed to cost using one of the methods for distributing indirect costs. The method is chosen by the enterprise based on economic feasibility and in accordance with industry instructions on the formation of product costs (for industry enterprises).

Thus, cost accounting is carried out by elements and items. Material accounting can be carried out in the context of workshops (sites), financially responsible persons, by types of finished products, varieties, etc.

More information about the classification of production costs can be found in the publication “Production cost accounting system and their classification.”

Read about the new rules for accounting for work in progress, which is included in inventories from 01/01/2021 (according to FSBU 5/2019 “Inventories”) in the Ready-made solution from ConsultantPlus. Trial access is available for free.

Determination of the actual cost of manufactured products

At the end of the reporting period, the actual cost of production is determined.

After the actual cost is formed, an adjustment is determined.

An adjustment is a deviation of actual agricultural production from the planned one.

The adjustment is written off in two ways:

- Red reversal - if the actual cost is lower than planned.

120 centners of grain sold; the actual cost of grain is 300 rubles; planned cost – 320 rubles. Adjustment 300-320=20 rub.

D90 K20 – (20*120) = 2400 rub.

A red reversal means a negative number and is subtracted when counting revolutions.

- Additional entry - if the actual cost is higher than the planned one.

120c grain sold. actual cost is 300 rubles, planned cost is 270 rubles. Adjustment 300-270 = 30 rub.

D90 K20 = (30*120) = 3600 rub.

The adjustment is written off at the place where the product is consumed:

- The adjustment for sold products was written off - D90 K20

- The adjustment for products left in the warehouse was written off - D 43 K 20

Accounting for the production process: basic postings

Let's look at what transactions are used in production accounting. The process of accumulating production costs takes place through the debit of account 20 in correspondence with the credit of accounts 10, 02, 05, 70, 69, 23, 25, as well as other accounts from which production costs are written off (Chart of accounts approved by order of the Ministry of Finance of the Russian Federation dated 31.10.2000 No. 94n).

You can familiarize yourself in detail with the postings for account 20 in this article.

The 20th account accumulates information about direct costs. Indirect costs are formed on accounts 25 and 26. Then these costs are distributed per unit of finished product:

- in proportion to the basic indicator approved at the enterprise (production cost, workers' wages, volume of products produced);

- by accounting for costs by type of product.

The cost of the finished product is written off to the financial result by posting Dt 90 Kt 40 (43).

IMPORTANT! It is also possible to write off general business expenses from account 26 to the debit of account 90, and the posting looks like this: Dt 90 Kt 26. The chosen method of writing off this type of expense must be fixed in the accounting policy.

Typical wiring

| Operation | Debit | Credit |

| Raw materials were transferred to the OP, the write-off of raw materials to the OP is reflected | 20 | 10 "Inventories" |

| Salaries accrued to the staff of the OP | 20 | 70 “Payroll calculations” |

| Insurance contributions have been accrued to the payroll fund of the OP personnel | 20 | 69 “Calculations for social insurance and social security” |

| Expenses of auxiliary stages are written off to the OP | 20 | 23 “Auxiliary production” |

| General business and general production costs are written off to the OP account | 20 | 25 "OPR" 26 "ОХР" |

| Losses from manufacturing defects are written off to the OP account | 20 | 28 “Marriage in the OP” |

Differences in accounting and taxation in production

There are many differences between tax and accounting in production. In this regard, permanent and temporary differences arise, requiring more detailed consideration, which cannot be carried out within the framework of a short article. Fortunately, this issue was considered in great detail by ConsultantPlus experts in a Ready Solution. Get free trial access to the system, go to the material and learn everything about the application of PBU 18/02, the procedure for working with which there were significant changes in 2021.

Specification

Next, we definitely need to add our future finished product to the “Nomenclature” directory.

Next, it is necessary to enter into the program the specification of the chair we produce. It reflects the materials required for production and their quantities. A kind of ingredients of our finished product.

You can go to the specifications of an item from its card in the directory (submenu “More”).

From the list form, you can create a new specification and specify an existing one as the main one.

Let's create a new specification and fill out its tabular part.

By default, the first specification created will automatically be set as the main one for this product. In our case, the production of one chair requires 1 board, 100 grams of nails and 800 milliliters of varnish.

Finished products

Finished products (account 43) - a type of inventory that was obtained as a result of production activities. In accounting, such inventories are reflected at actual cost, which is the sum of all costs incurred by the enterprise in the process of their production.

In more detail - postings for finished products, sales of finished products.

Expenses of service industries

Expenses of service industries and farms (account 29) are not related to the main production (housing and communal services, preschool institutions, healthcare institutions, culture, catering, sanatoriums, rest homes, etc.), however, they are designed to solve social issues and are necessary to maintain and, if necessary, , restoring the ability to work of employees.

Provided raw materials

Operations with customer-supplied raw materials (tolling) represent the transfer of raw materials by the supplier for processing, processing and production of finished products based on them at the production facilities of the enterprise with the subsequent transfer to the owner of the raw materials of the finished products produced from them in full or in part according to the contract.

During the entire period of its presence at the enterprise, customer-supplied raw materials are accounted for in off-balance sheet account 003, since they do not become the property of the enterprise. Finished products produced from customer-supplied raw materials are reflected in off-balance sheet account 002.

For more details, see the article about customer-supplied raw materials.

Waste

Waste – materials, substances or items generated as a result of production activities that are not suitable for further use or external sale and require processing or disposal. Reflected on account 10.

More details - waste postings

Cost accounting

Product cost is the sum of all enterprise costs for the production of one unit of product. In addition, the cost of semi-finished products of the main production, products of auxiliary, service, ancillary and by-products, as well as the entire volume of commercial products of the enterprise can be calculated.

The process of calculating the cost per unit of production is called costing. Account 20 is used to determine production costs.

Short video on the topic:

Additional features

Flexibility and customizability

The configuration can be adapted to any accounting features at a particular enterprise.

This means the ability to enter your own accounting mechanisms into the configuration and configure the reflection of any specific business transactions in accounting. It is also possible to create the necessary additional analytical reports for the needs of the enterprise. Data exchange

For a more complete and detailed salary calculation, it is possible to exchange data with the 1C:Enterprise 7.7 “Salary + Personnel” configuration.

This allows you to obtain from the configuration in which full payroll is calculated the necessary information for calculating the cost of production. Internet support

The Internet support mechanism for users allows you to quickly receive exchange rates and a classifier of Russian banks. With it, you can send a question to the consultation line or your opinion about using the program. ITS disk subscribers can receive configuration updates and new reporting forms.

Purchase and posting of materials in 1C

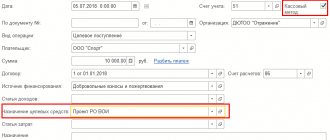

To start accounting for production in 1C, you will need to determine cost estimates. The purchasing department concludes contracts for the purchase of materials for production. In 1C you can register all concluded contracts, enter data on invoices and invoices linked to specific contracts with suppliers. This is done in the “Purchases” section, where you select the “Invoices received” or “Invoice from supplier” tab.

After the invoice is paid, in 1C the materials are accepted into the warehouse and do not require re-entering the data with the list of purchased materials into the system. Account 10 “Materials” is automatically posted as a debit from account 60 “Suppliers and contractors” of the loan.

Application configuration features

- Work in progress is assessed at the cost of costs, taking into account the share of indirect costs, and remains entirely with the enterprise

- Sales of finished products are carried out from the finished products warehouse

- Accounting for the cost of products (works, services) and work in progress balances is carried out in the context of types of products (works, services), divisions, orders for production (with custom accounting), items and types of costs

- Records for one organization are kept in one information base, records for several organizations can be kept in different information bases

Receipt of goods and input of product specifications

As they say, the theater begins with a hanger, and the production process, whatever one may say, begins with the well-known document “Receipts of goods and services.” We will only receive the materials.

I think there is no need to describe the preparation of the admission document; this has already been written in a separate article. Let me just say that the materials come on the 10th count.

We will produce the LED lamp “SIUS-3000-CXA”. Let’s create a new nomenclature unit with the same name in the 1C “Nomenclature” directory.

Now we need to indicate what our lamp will be made from, or rather, create a product specification (we also talked about specifications in the article Components of items in 1C). Expand the “Production” section in the product card and create a new specification:

We have decided what our lamp consists of; the necessary components have been registered and are in the warehouse. You can start the production process in 1C 8.3. Let's take a brief look at how this happens and what documents we will have to create.

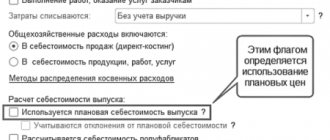

To write off materials for your own production in the 1C program, two documents are usually used:

- The invoice requirement is used to reflect general business and production costs. In this case, expenses are allocated to products using the regulatory procedure “Calculation of cost” at “Closing the month”.

- The production report for a shift allows you to distribute direct costs (materials and services) to specific items of finished products, which are recorded on the “Materials” and “Services” tabs.

Under no circumstances should you complete two of these documents at once.

Creating a product range in 1C

In order to begin accounting for production, it is necessary to determine the range of products produced. To perform these actions in the 1C system, you will need to go to the “Directories” menu, then to the “Goods and Services” section, where you need to click on the “Nomenclature” indicator. Clicking the "Create" button will bring up a pop-up window that says "Nomenclature (creation)." Here you fill out the fields in which you enter data about the name of the product (short and full name), units of measurement and article number. In further calculations, these records will significantly simplify the product accounting procedure. In the example used, the product will be a bag made of black genuine leather.

After the nomenclatures are entered into the system for at least a single type of materials used, the system automatically includes the “Specification” tab.

A specification in the generally accepted sense is a document according to which production requirements are established. The specification of a manufactured product is a technology-approved list of materials and accessories required for sewing a unit of product. For this example with a bag, the specification includes the following materials:

- 40 cm genuine black leather;

- 20 m of black thread;

- 1 PC. 30 cm zipper;

- 1 PC. 15 cm zipper.