“Form 23-FSS RF” is a special unified standard document that is filled out in cases where an enterprise or organization wants to return overpaid funds to extra-budgetary funds (Pension Fund, Social Insurance Fund, etc.). Such situations are not uncommon; as a rule, this occurs as a result of the “human factor”: accounting errors, incorrect calculations, or simply inattention, as well as failures in accounting programs.

FILES

General rules

The key responsibility of all policyholders is the timely accrual and payment of insurance coverage in favor of working citizens. VNiM contributions generate funds from the Social Insurance Fund, which pays for sick leave, maternity leave and other categories of social benefits.

The first three days of sick leave are paid by the employer, the rest is paid by the extra-budgetary fund. This rule applies only if the employee himself is ill. For example, when calculating maternity leave or monthly child care benefits, the payment amounts are fully compensated by Social Insurance.

If the organization is a participant in the Social Insurance pilot project, then sick leave and benefits are paid directly from the Fund. But those companies that do not participate in the pilot project must reimburse the costs themselves.

If the amount of benefits exceeds accrued contributions

It was discussed above what affects the reduction in the size of the policyholder’s monthly contribution. But a situation arises when the contribution is greater than the expenses. Then the policyholder has two ways to develop the situation, indicated by tax legislation:

- The right to offset the received excess amount against future contributions (if it fits within the current billing period).

- The right to receive a refund when contacting the Social Insurance Fund department with a package of documents.

Although the change in legislation has designated the tax authorities as the administrator of insurance premiums, the application should be submitted to the territorial social insurance fund (Law No. 255-FZ of December 29, 2006).

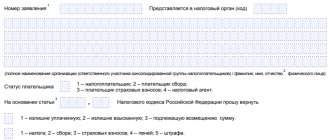

Form 23-FSS. Application for refund of overpaid insurance premiums

“Form 23-FSS RF” is a special unified standard document that is filled out in cases where an enterprise or organization wants to return overpaid funds to extra-budgetary funds (Pension Fund, Social Insurance Fund, etc.). Such situations are not uncommon; as a rule, this occurs as a result of the “human factor”: accounting errors, incorrect calculations, or simply inattention, as well as failures in accounting programs.

What happens if you don't return the money?

In cases where legal entities or individual entrepreneurs do not require the return of excessively transferred funds, employees of extra-budgetary funds can, at their discretion, independently decide to credit such amounts to the transfer of future contributions or to pay off existing debts and fines with them.

Should I return the entire amount?

Sometimes the overpayment is quite significant, but the payer does not feel a great need for a full refund.

A completely reasonable question arises: is it possible to partially return the paid amount or distribute it in some non-trivial way. The answer is simple: yes, the law in no way limits the right of the payer to dispose of overpaid funds as he pleases.

For example, you can demand the return of only a certain percentage of the amount, and use the rest to pay off arrears, fines and penalties, you can set aside part of it for future payments, etc.

What to do if the money has already been credited by fund employees

If, before the application was received, the money had already been used to cover fines and penalties, then it will be possible to return only the amount that turns out to be the difference between the excessively overpaid funds and the money spent for these purposes. If the funds were offset against future payments, then there should be no problems with their full return.

Deadlines for the return of overpaid funds

According to the law, the possibility of returning money paid in excess is strictly limited to a period of three years. Applications received after this will not be accepted.

If the application arrived in a timely manner and the facts indicated in it are true, then the return of funds must occur within a month after its receipt by the employees of the extra-budgetary fund with which the incident happened. At the same time, if the fund violates its obligations and is overdue for the return of funds, then by writing a corresponding statement, for each day of delay, you can demand interest in the amount of 1/300 of the refinancing rate (if representatives of the organization refuse to pay voluntarily, you can safely go to court ).

An important clarification: if the fact of overpaid contributions was revealed during reconciliation, then the period for their return is counted from the date of signing the reconciliation act.

Rules for filling out form 23-FSS of the Russian Federation

There are a few important things to keep in mind when filling out the form.

- Firstly, any errors when specifying the organization’s details can lead to very unpleasant consequences, so you need to pay especially close attention to them.

If everything is more or less clear with the TIN, KPP and other parameters, then many people have difficulty with the line called “OKATO code” (stands for All-Russian Classifier of Objects of Administrative-Territorial Division). Today, it is necessary to put the OKTMO code in this line (in other words, the All-Russian Classifier of Municipal Territories), which can be found, for example, on the tax service website.

- Secondly, when demanding the return of money, it is necessary to indicate its purpose (i.e., put the amount exactly in the cell to which it belongs).

- And the third important point: if an application to the fund is submitted not by the applicant personally, but by his representative, detailed information about him must be entered in a special section of the application.

- First of all, at the top of the document on the right you should enter the position of the head of the territorial branch of the FSS, his last name, first name, patronymic.

- Further, in the application itself, it is necessary to indicate in detail the information about the payer: the full name of the company (with a deciphered organizational and legal status), registration number with the body monitoring the payment of insurance premiums and a subordination code (both of these values are assigned to each payer by the FSS - you can find them on the organization's website).

- The next step is to enter the TIN, KPP, as well as the legal address of the enterprise. If it differs from the actual one, then the actual one should also be indicated.

The application is drawn up in two copies, one of which is transferred to the specialist of the extra-budgetary fund, and the second, as potential evidence, remains in the hands of the payer. In this case, the employee of the institution is obliged to stamp both documents.

Below is an example of filling out Form 23-FSS of the Russian Federation - Application for the return of amounts of overpaid insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation.

See also: Underestimation of MTPL payments

Instructions for filling out Form 23-FSS

The second part of the document concerns the actual funds. First, you need to enter the required amounts in the appropriate boxes. Then enter the details of the organization’s bank account, as well as the OKATO code (explanations for it were given above)

The line entitled “Personal Account Number”, marked with an asterisk, is filled in only by those organizations that have a personal account with the Federal Treasury.

In conclusion, the document must be signed by the head of the organization, as well as the chief accountant.

If the director simultaneously performs the functions of the chief accountant, then he must again sign in the second line.

The telephone number next to each name is indicated in case the institution's employees have any questions for the applicant. Lastly, the date and stamp (if any) are placed on the document.

If the application is written by a person who is a representative of the applicant, then he needs to fill out the lines below, including indicating personal passport details and the document on the basis of which he is acting.

When an organization has the right to reimburse money from the Social Insurance Fund

It is not always necessary to apply for restoration of expenses through an extra-budgetary fund. To determine the amount to be reimbursed, an organization needs to compare two indicators:

- the amount of accrued insurance premiums for VNIM;

- the amount of expenses incurred to pay for sick leave, benefits and maternity leave at the expense of Social Insurance.

If the costs of paying social benefits exceed the accrual of contributions for VNIM, then reimburse the difference to the Social Insurance Fund. If there is no excess, the employer has the right to reduce the next VNIM payment by the amount of sick leave.

IMPORTANT!

When calculating the amount to be reimbursed, do not take into account the amount of benefits that the employer pays at his own expense (for the first three days of the employee’s illness).

Written appeal

The application form for reimbursement of expenses for hospital and other social benefits is not approved by law. But the fund, using an internal letter, clarified what the application form should look like and how to fill it out correctly.

At the top of the document there must be data from the FSS body to which the application is being submitted:

- name of the branch;

- last name, first name, patronymic of the head of this department.

Below is information about the employer who acts as the insurer of his employees:

- Business name;

- legal address of the organization;

- TIN;

- checkpoint;

- insurance number.

The following are attached to the application:

- certificate of settlement;

- a document proving the validity of sick leave expenses.

Example of a refund application

Form 23-FSS RF

?Form form No. 23-FSS

All Russian business entities that make payments to their employees must be registered with the domestic Social Insurance Fund and pay the appropriate contributions. The procedure for making such contributions, as well as the procedure for their calculations, is regulated by the laws of the Russian Federation. In the event of an overpayment, to resolve such a situation, the relevant enterprise must fill out an application in Form 23-FSS of the Russian Federation.

General provisions on contributions to the Social Insurance Fund

Starting from January 1, 2021, the main document regulating the procedure, amounts and timing of making contributions to the Social Insurance Fund of Russia in terms of social insurance for disability and maternity will be the Tax Code of the Russian Federation.

However, at present, the procedure for returning insurance premiums overpaid by an enterprise or individual entrepreneur is regulated by the provisions of Article 26 of Federal Law No. 212-FZ of July 24, 2009 (not applicable starting from 2021).

As follows from the literal content of the above legislative requirement, the payer of contributions who has made a transfer in excess of the required amount has the right to a refund of excess amounts of money.

It is important to remember that, due to the direct indication of paragraph 11 of Article 26 of the Federal Law of July 24, 2009 N 212-FZ, the return of overpaid transfers is made by the Social Insurance Fund of Russia only on the basis of a written application from the person who made the overpayment.

A similar provision is contained in Article 431 of the Tax Code of the Russian Federation and will come into force in 2021.

The relevant entity must notify the Social Insurance Fund of the Russian Federation by filling out and submitting an application in Form 23-FSS of the Russian Federation.

Application form

On February 17, 2015, the Social Insurance Fund of the Russian Federation issued Order No. 49, which approved and introduced into use the official form of Form No. 23-FSS.

Currently, the blank form can be obtained from the following sources:

Form 23-FSS RF

It should be noted that the Social Insurance Fund of the Russian Federation developed the specified form 23-FSS of the Russian Federation, but did not approve the procedure and methodology for its preparation.

However, taking into account the recommendations of the Social Insurance Fund for the preparation of applications, set out in Order No. 335 dated September 17, 2012, we can come to the conclusion that the acceptable ways to fill out the form are:

All letters, signs and symbols in the form 23-FSS of the Russian Federation must be in black.

In addition to using colored ink, it is also unacceptable to have the following form on the form:

It is important to remember that the following information must be indicated in the completed form 23-FSS of the Russian Federation:

Also, the form must reflect both the amount of overpayment and the details of the policyholder’s bank account to which the Fund should transfer the excess funds received.

The director of the enterprise and the chief accountant must sign the completed document in accordance with Form 23-FSS of the Russian Federation.

It should be emphasized that it is necessary to certify the signature of the head of the company with a seal impression only if it is available. This provision is consistent with the fact that it is currently not obligatory for an organization to have such details.

filling out form 23-FSS of the Russian Federation

Instead of a conclusion, it should be noted that filling out and submitting an application to the FSS authorities in themselves does not guarantee an unconditional return of excess amounts. The decision on a particular action is made by the Foundation based on the reliability and completeness of the information.

What documents to submit for reimbursement

To restore funds through the Social Insurance Fund, you will have to prepare a special package of documents. Fill out the following papers:

- The policyholder's application for compensation in 2021 of the established form.

- Certificate of calculation recommended by the letter of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016 No. 02-09-11/04-03-27029.

- Explanation of expenses or calculation according to Form 4-FSS.

- Copies of supporting documents. These are copies of certificates of incapacity for work, birth certificates of children, death certificates, certificates of registration in the early stages of pregnancy, and so on. That is, those documents on the basis of which social benefits were paid.

IMPORTANT!

Submit a certificate of calculation and breakdown of expenses, in accordance with letter No. 02-09-11/04-03-27029 of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016, to Social Insurance if you are applying for reimbursement of funds for periods occurring after January 1, 2017. Calculation 4-FSS is submitted to reimburse costs incurred in periods before 01/01/2017.

Copies of supporting documentation must be provided to only two categories of policyholders. These are for those who apply the 0% tariff from 01/01/2017 according to Art. 427 Tax Code of the Russian Federation. And for those who, before December 31, 2016, applied a reduced tariff under clauses 8-10 of Part 1 of Art. 58 of Law No. 212-FZ. Other employers create copies at will.

We recommend providing copies of documents to the Foundation. This will significantly speed up the consideration of the application and increase the chances of a positive decision by inspectors from the extra-budgetary fund.

Procedure for the return of overpaid insurance premiums to the Social Insurance Fund

To refund overpayments on insurance premiums in 2021, you need to take into account some changes:

- Applications for the return of overpaid amounts for contributions for the period before 01/01/2017 should be submitted to the Social Insurance Fund. And the refund will be carried out by the tax authority (Article 21 of the Federal Law No. 250-FZ);

- Before returning the overpayment, the tax service checks for any arrears of federal taxes, since insurance premiums are equal to federal payments. For contributions made before 01/01/2017, the overpayment is returned to the fund.

The application can be completed by hand or typed on a computer. You can send an application in the following ways:

- Personally;

- Electronically via the Internet;

- Through your representative.

Also, the law does not limit the right of an organization to use overpaid funds at its own discretion. For example, you can return a certain percentage of the overpayment, and with the rest of the amount pay off fines, arrears, you can save some for future payments, etc.

If the overpayment has already been used to pay off fines, then only the remaining difference between the overpayment and the paid fines can be returned. If the money was spent to pay for future contributions, then you can return it in full without any problems.

Delivery methods

The sender, at his discretion, may choose one of the following methods of delivering the application and necessary certificates to the insurer:

- Electronic means of communication.

This method has its advantages and disadvantages. This is definitely the fastest and easiest way, but you need to make sure that the email is received by the recipient. You can send an application this way if the sender has a registered electronic signature.

- Personal meeting with an FSS employee and submitting an application to him.

A more reliable method, but for this you will have to spend time and appoint an employee who will do this.

- Through a representative.

- By registered mail via Russian Post.

Then the sender will have a guarantee that the addressee will receive it personally.

Important information about deadlines

There is no deadline for filing a refund claim. The policyholder has the right to apply for any reporting period if there are documented grounds. There are no restrictions on the number of applications for FSS reimbursement for two years or more. The policyholder is not limited in terms of terms.

The fund will consider the appeal within 10 calendar days and refund the funds. But only on condition that the policyholder has provided the entire package of necessary documents.

IMPORTANT!

The review period will be extended if Foundation controllers request additional information. Or, upon request, a desk or field inspection will be scheduled. The money will be refunded only after the inspections are completed.

Deadlines for refunding overpayments

It is established by law that it is possible to return overpaid funds only for a period of up to 3 years. If the application is submitted on time and all data is checked for reality, then the return of overpaid amounts occurs within a month from the date the fund receives the application.

In case of violation of the terms for the return of the overpayment, a statement is written demanding payment for each day of delay in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation. If the issue is not resolved peacefully, you can file a claim in court.

It is worth noting that the period for returning the overpayment is considered from the date of signing the reconciliation report, if the fact of overpaid amounts was revealed during the reconciliation.

How to submit a contribution report to the tax service

Before submitting documents for compensation, you must provide a tax report on contributions. The filling out procedure is regulated by Appendix No. 2 to the Order of the Tax Service dated October tenth two thousand and sixteen No. MMB-7-11/551. This document consists of a title page and three sections. The calculation is filled out strictly in black, blue or purple ink. Letters must be capitalized only. If the document is filled out electronically, use Courier New font, size 16-18. Then the completed sheet must be printed.

Payments must be submitted by the thirtieth day of the month following the reporting month. For example, for nine months of 2021, the document must be received by the tax service no later than October 30, 2021.

If the company has more than twenty-five employees, the report should be submitted strictly electronically. For small companies, you can fill out a paper version of the document.

Report form

There are two ways to submit a report to the tax office:

- the head of the organization or his authorized representative personally visits the Federal Tax Service;

- A registered letter with a list of attachments is sent to the address of the tax service.

Tax authorities transmit to the Social Insurance Fund information about how many contributions have been accrued and paid for social security within the following time frames:

- no later than 5 days from the date of submission of the electronic report;

- no later than 10 days from the date of submission of the report on paper.

How to make an application

According to the recommendations of representatives of Social Insurance, an application to the Social Insurance Fund contains the required details:

- name and address of the location of the policyholder;

- policyholder registration number;

- the amount of funds claimed for reimbursement.

The procedure for completing the form is fixed in letter No. 02-09-11/04-03-27029 of the Federal Social Insurance Fund of the Russian Federation dated December 7, 2016.

Features of filling out an application

To return overpaid funds, fill out an application in Form 23-FSS. It is important not to miss important points:

- close attention should be paid to correctly filling out the organization’s details, since errors in them can lead to unpleasant consequences;

- in the line “OKTMO code” you need to enter the OKTMO code, information on which is available on the tax service website;

- When returning funds, you must indicate their purpose. The amount is entered in the cell to which it relates;

- if the application is submitted by a representative of the applicant, then in a special section you need to fill out information about him.

Form 23-FSS of the Russian Federation can be downloaded from the link.

Who should compile

The application is drawn up by the employer himself. This happens regardless of whether he is an individual entrepreneur or a legal entity. It is submitted to the FSS along with other documents.

First, they are checked by the fund, then transferred to the tax office for a more thorough check. For this reason, you must not make mistakes in documents or indicate false information in forms. As a result, a decision is made to refuse or to issue the requested amount to the organization.

Types of insurance payments

Insurance payments assigned to a citizen in the event of loss of ability to work due to an occupational illness or accident during work are of two types:

- one-time;

- monthly.

The amount of payments depends on the average earnings of the insured person, which is calculated based on his total income for a certain period of time. To calculate the amount of insurance payment, it is necessary to multiply the average income of a citizen by the degree of loss of ability to work.

The last component of the algorithm is determined by a specially created commission after conducting a medical and social examination (otherwise MSA). In addition, when calculating the amount of payments, salary bonuses and regional coefficients are taken into account.

In the event of the death of an insured citizen, a one-time payment of 1 million rubles is received by his close relatives. In this case, the amount is divided between each family member in equal shares.

According to Article 11 of Federal Law No. 125 of July 24, 1998, monthly payments are subject to adjustment taking into account the level of inflation in the country.

In addition, the legislation establishes maximum amounts of compensation in favor of employees who have lost their professional performance. In 2021, the maximum payment amount reaches 72,290 rubles 40 kopecks, and in 2021 – 75,182 rubles.

Documents attached to the application for insurance payment to the Social Insurance Fund

How to evict a person from an apartment - https://uristboss.ru/pravo-sobstvennosti/kak-vyselit-cheloveka-iz-kvartiry/.

Eviction from municipal housing - https://uristboss.ru/pravo-sobstvennosti/vyselenie-iz-municipalnogo-zhiliya/.

How to register land under the dacha amnesty - https://uristboss.ru/pravo-sobstvennosti/kak-oformit-zemlyu-po-dachnoj-amnistii/.

The following are the papers that the insured person must provide to the territorial department of the fund along with a completed application form for receiving insurance payments:

- a conclusion on the degree of disability of a citizen, issued by the institution that carried out the medical examination;

- a certificate of the average monthly earnings of the injured person;

- a document certifying the existence of an employment relationship with the employer (for example, an employment contract, a copy of the work record book);

- report of an accident during work;

- applicant's passport;

- power of attorney (if the applicant acts through a representative).

A certificate of the average income of a citizen is usually issued by the accounting department at the place of his employment. However, in its absence, the insured person can send an application to the Social Insurance Fund to receive the necessary data from the Pension Fund of Russia.

The documents listed above are sent to the fund department in the form of originals or notarized copies.

Instructions for filling out form 23-FSS

When filling out an application for a refund of overpaid insurance premiums, it is important to consider:

- In the upper right corner, fill in the position and full name of the head of the territorial branch of the FSS.

- The body of the application indicates all the data about the payer: full name and legal form, registration number and subordination code assigned by the FSS.

- Next, fill in the lines with the TIN, KPP, legal and actual addresses.

- The next part of the document relates directly to funds. The required amounts are entered into a specific cell. Then the details of the organization’s bank account and the OKTMO code are entered.

- The line with an asterisk “Personal account number” is filled in only by enterprises that have a personal account with the Federal Treasury.

- At the end of the document the signature of the manager and chief accountant is affixed. If there is no accountant in the organization, then the director signs again. Lines with telephone numbers must be filled in so that in an emergency the applicant can be contacted.

- A stamp, if available, and the date the document was completed are affixed.

- If the information is provided by a representative of the organization, then the lines with his data are filled in below - a passport and a document confirming his representation.

Form 23-FSS: Application for refund of overpaid insurance premiums - example of filling:

What to do if the money has already been credited by fund employees

In cases where legal entities or individual entrepreneurs do not require the return of excessively transferred funds, employees of extra-budgetary funds can, at their discretion, independently decide to credit such amounts to the transfer of future contributions or to pay off existing debts and fines with them.

If, before the application was received, the money had already been used to cover fines and penalties, then it will be possible to return only the amount that turns out to be the difference between the excessively overpaid funds and the money spent for these purposes. If the funds were offset against future payments, then there should be no problems with their full return.

Overpayment: how to get money back from the Social Insurance Fund

The payer may not wait for a message from the Social Insurance Fund about excess contributions, but rather write an application for a refund as soon as he himself discovers the overpayment.

The application form for the return of amounts overpaid to the FSS is contained in Appendix No. 3 to Order No. 49 of the FSS of the Russian Federation dated February 17, 2015. Application 23-FSS is used both for the return of overpayments of contributions, penalties and fines for “disability and maternity” and “ injuries." The period during which such an application can be submitted is three years from the date on which the excess amount was paid to the Social Insurance Fund.

The overpayment is subject to return from the social insurance fund within a month from the date it receives the application from the payer. If the FSS violates this deadline, although the decision is positive, it can be required to pay interest in the amount of 1/300 of the refinancing rate for each overdue day.

Important: if an organization or individual entrepreneur has a debt with the Social Insurance Fund for fines or penalties, then it will first be repaid by offset from the overpayment amount, and only then the remainder of the funds will be returned to the contribution payer’s account (Clause 2 of Article 27 of the Law of July 24 .2009 No. 212-FZ).

Example.

Almaz LLC, transferring insurance premiums in case of temporary disability and in connection with maternity for June 2021 in the amount of 1,000 rubles, erroneously indicated a large amount in the payment order - 2,000 rubles.

When presenting a report on Form 4-FSS for the first half of 2021, Almaz indicated the correct accrual amount and an overpayment of 1,000 rubles; an application on Form 23-FSS of the Russian Federation was also completed and sent to the FSS with a request to return 1,000 rubles overpaid to the fund .

The FSS found out that Almaz LLC owed fines in the amount of 200 rubles, so 200 rubles of the overpayment were offset against the debt. As a result, Almaz received 800 rubles from the social insurance fund as a refund of overpaid insurance premiums.