Official employment of citizens involves their insurance in the Social Insurance Fund in case of loss of ability to work for one reason or another. The employer has the obligation to submit reports to the Fund in the manner prescribed by law. This process is regulated by Federal Law No. 125 dated July 24, 1998. “On compulsory social insurance.”

How can an organization confirm its main activity in the FSS of the Russian Federation ?

It is possible to provide reporting in different ways:

- by contacting the Foundation branch in person;

- entrust the application to the Foundation branch to a trusted person;

- send the report by mail with a list of attachments;

- submit the report electronically.

The latter method has a number of features and advantages. There are several options for submitting FSS reports electronically: through a representative; through an electronic operator, for example, “Tensor”, etc.; using so-called cloud accounting; directly on the FSS website.

What are the subtleties of submitting reports to the Social Insurance Fund ?

Submitting reports through the official website of the Social Insurance Fund is the easiest and most profitable method:

- there is no need to purchase additional expensive software and costs for its maintenance, or pay for cloud services;

- communication with the Foundation is carried out promptly;

- reporting data does not fall into the hands of third parties, the exchange takes place only between the Fund and the employer;

- You can submit reports while in the office, rationally using working time;

- finished reports are stored in the form of files directly on the Social Insurance Fund portal, the possibility of its loss is practically excluded.

How to protect electronic document flow ?

Reporting is generated in the same accounting program in which records are kept at the enterprise, for example, “1-C Accounting”, and is transmitted in the form of an encrypted file to the government agency’s website using an electronic digital signature (EDS). The report can also be generated directly on the Foundation’s website.

Let us remind you! If the average number of insured persons for the last reporting period is 25 people or less, the organization can submit a report on paper, in other cases - only electronically.

Basic concepts and terms

When getting started with the reporting gateway, with the instructions provided to policyholders by the Fund, it is necessary to know the terminology used in the exchange of credentials.

Fund - FSS. The policyholder is an individual or organization obligated to provide reports to the Social Insurance Fund in accordance with current legislation. An authorized representative is an individual entrepreneur or organization authorized to submit reports on behalf of the policyholder. Participants in EDI (electronic document management) are the organization (its representative) and the Foundation. Certification center (CA), CA accreditation - an organization or individual entrepreneur working with EDS key certificates, creating and issuing these certificates. They receive this right based on the results of accreditation, that is, recognition of the legality of their work at the federal level. FSS also has its own CA. An electronic signature (ES), an electronic signature key, an ES verification key is an analogue of the physical signature of a representative of an organization, usually its head. The electronic signature is created using a key, a unique series of symbols. It is verified using another unique key - a verification key, tightly linked to the key of the electronic signature itself. Electronic signature verification key certificate is a document from a certification center or its authorized representative confirming that the electronic signature verification key belongs to the owner of the certificate. A qualified electronic signature verification key certificate is a certificate created by an accredited CA or a federal executive body that has such powers. ES tools are encryption tools and techniques that allow organizations to work with ES. Electronic document and document flow – a document of a certain electronic format and their combination. The electronic signature is certified. Calculation, calculation file, file identifier - a quarterly report on contributions to the Social Insurance Fund and expenses for social benefits of the organization, its electronic file version and a unique number assigned by the system to this file. Receipt of receipt of payment (with or without errors) is an electronic document certified by the electronic signature of the Fund, in which the report submitted by the organization is encrypted. May indicate errors in the report indicators, with their description, if any. It also contains information about previous report submissions. Software – specialized programs used for data transfer. Verification protocol – information about reporting processing, its stages and results. The gateway for receiving payments is the FSS website, on which organizations upload reports and work with them, interact with the FSS body in the process of submitting reports. Electronic document storage is a place on the gateway where all electronic document flow transmitted through it is stored.

(According to the text of FSS order No. 19 as amended on 09/11/17).

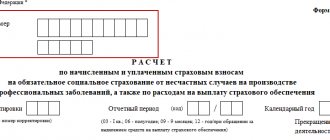

What is reporting form 4-FSS

The current form and procedure for filling out Form 4-FSS with an example and explanations were approved by FSS Order No. 381 dated September 26, 2016, as amended by FSS Order No. 275 dated June 7, 2017. The main difference from the previous form is the exclusion of sections on contributions for disability and maternity, which have been transferred to a single calculation of insurance premiums, which the Federal Tax Service now accepts from employers.

The quarterly calculation of accrued and paid insurance premiums in Form 4-FSS has significantly decreased in volume. In fact, only section 2 of the old form, dedicated to contributions for injuries, which remained under the jurisdiction of the Social Insurance Fund, was preserved.

Sequence of work with the gateway

The procedure for working with the gateway is simple and accessible. Before starting to send electronic documents, the organization takes a number of sequential actions:

- Registration on the FSS website.

- Applying to the FSS body for an assignment of expanded rights to use the portal and obtaining such rights.

- Download the necessary software on the FSS website.

- Installation of the Foundation certification authority certificate.

- Installing a certificate from the organization's certification authority.

- Preparation of calculations in an accounting program or on the Social Insurance Fund website.

- Using digital signature to sign a file.

- Sending a report through the gateway.

- Receipt of receipts and FSS protocols until the successful acceptance of the report by the Fund. Correcting errors - if necessary.

Let us remind you! The deadline for submitting electronic reports is until the 25th day of the month following the reporting quarter, and on paper – similarly until the 20th day.

Receiving a receipt

The report will be processed within 24 hours. To receive a receipt you must complete the following steps:

- In the arm.exe program, open the tab "Sent reports"

- Select the line with the report and click the button "Update report information"

- If a receipt for the report has been received, a tab will open "Check receipt"

, where information on the verified report will be available

Errors and their consequences

There are two types of errors when working with the FSS reporting gateway:

- Problems with the physical key carrier, electronic certificate, as well as problems associated with errors in the operation of the certification center that issued the certificate, as well as user errors in the organization when working with keys and electronic signatures. They can be eliminated by re-sending the report, in compliance with all established rules, and contacting the certification center to reissue the certificate. This type of error is the most unpleasant and dangerous due to violation of reporting deadlines. The date of submission of the report is considered to be the day the document was submitted without errors. If the report was submitted with errors, it will not be accepted by the system. If the errors are subsequently corrected, the filing date is considered to be the day the corrected report was sent, not the original one.

- Calculation errors of the accounting service. The FSS report contains control ratios and figures, violations of which are automatically detected by the system. The nature of the errors is visible to the user and is given in the form of “hints”: what exactly should be changed and why. The user is obliged to correct false information. After this, the report is sent to the FSS again.

Important! On the last day set aside by law for reporting, the reception gateway experiences significant load and may work in slow mode. It is advisable to submit calculations in advance.

Violation of deadlines for submitting reports, ignoring the requirements for correcting errors in the information provided, threatens the organization with penalties.

Summing up

The electronic gateway for receiving reports to the Social Insurance Fund is one of the most convenient and economical ways to submit payments to the Fund. In order to use it, the organization must have an electronic signature, an analogue of the physical signature of the responsible person, with the help of which electronic reporting is certified. Electronic signature can be obtained from authorized federal centers along with a certificate confirming its legitimacy.

When interacting with the FSS, it is necessary to study the terms enshrined in the Fund’s order No. 19 in order to work correctly together with it.

Before you start using the gateway, you must register on the website, obtain a number of extended user rights and install certificates from the organization’s CA and the FSS. The file can be prepared directly on the website or in the policyholder’s accounting program.

In order to avoid violation of reporting deadlines and subsequent penalties, it is recommended to submit the report 2-3 days before the expiration of these deadlines.

Filling out table 1

The first section of form 4-FSS is devoted to the calculation of insurance premiums if there was an accident or occupational disease. The filling procedure is as follows:

- Indicators for contributions are indicated in rubles on an accrual basis from the beginning of the year and broken down by month of the last quarter of the reporting period.

- Start filling out table 1 of form 4-FSS with columns 4-6, then enter the data in column 3 on an accrual basis.

- Table 1.1 is filled out only by those employers who sent their employees for temporary work with other employers under a contract, as provided for in clause 2.1 of Art. 22 of Federal Law No. 125 of July 24, 1998. All other policyholders do not need to fill out and submit this sheet.

Filling out tables 3 and 4 of form 4-FSS

These tables are not included in the list of required ones. They are filled out by those employers who spent social security funds in the reporting period, namely:

- paid benefits for accidents and injuries;

- paid for treatment of workers in hazardous industries in sanatoriums;

- financed preventive measures for labor protection;

- purchased personal protective equipment.

If the organization did not have such expenses during the reporting period, then there is no need to fill out and submit this sheet. On the same sheet with Table 3 there is Table 4, which provides information on cases of occupational diseases and industrial accidents for the reporting period. If such incidents were recorded by acts, this table indicates the number of injured workers.

IMPORTANT!

From 01/01/2021, policyholders do not fill out table 3 in the FSS calculation. Information is not entered into line 15 of Table 2 (FSS letter No. 02-09-11/05-03-5777 dated 03/09/2021).

How to check your sick leave certificate

At any time, an employee can open his personal account and view the status of his sick leave. In order to receive information, you must register on the State Services portal. In the login field you need to enter your phone number and password. After logging into your FSS personal account, you can view all electronic sick notes and find out the following information:

- How much benefit is accrued?

- Sick leave extended, opened or closed;

- On what dates are you considered disabled;

- Is the document drawn up correctly by the employer?

You can receive notifications about changes in sick leave status by email. In your FSS personal account, you can use the payment calculator function. You can independently calculate the approximate amount of sick pay. To do this, open the calculator in the upper right corner and fill in all the required fields.

The service will ask you about the reason and period of incapacity for work, as well as whether you were in a hospital and did not violate the regime. In addition, you will need to indicate the date when you started working at your last place of work, as well as the amount of wages you received over the last 2 years. It is worth noting that the result obtained depends on the regional coefficient.

After entering all the data, you should click on the “Calculate” button and the website will show the approximate cost that the accountant should charge you for the electronic sick leave.

Filling out table 2 of form 4-FSS

Table 2 is filled out by policyholders based on accounting data on the status of settlements with the Fund for contributions and expenses for the reporting period. The numbers are indicated in rubles.

In the left column, the amount of insurance premiums payable is entered in the context of the balance for the reporting period, accrued amounts and funds received from the Social Insurance Fund. In the right column, the policyholder indicates the expenses incurred by him for labor protection measures and payments for compulsory insurance. At the end, the debt to the Social Insurance Fund at the end of the reporting period is displayed.

Toll-free FSS hotline

The central office of the FSS is located in Moscow. Its opening hours are from 9.00 to 18.00, on Friday until 16.45. The reference telephone number that receives calls from Russia and abroad: +74956680333 operates in the operating mode of the FSS central office.

Please note that the number is not toll-free. Outgoing calls are charged according to the terms of the current tariff plan. In order to avoid unnecessary expenses and resolve the situation as quickly as possible, it is recommended that you contact local FSS offices with questions.

You can send a text message for free, attaching the necessary documents via fax. Fax number: +74956680234. During business hours, the fax will be received by an operator; the rest of the time the machine receives documents automatically. All received faxes are registered and sent for execution.

Hotline in Moscow

Phone number of the call center of the Moscow regional branch of the FSS: +74956501917. Fax: 4956502414. Email: [email protected]

Hotline in St. Petersburg

+78126778717 – reference number of the St. Petersburg regional branch of the FSS. Fax: 8123463583. Email: [email protected]

Hotline in the regions

The official website of the FSS - fss.ru - has complete information on hotlines in regional offices throughout the country, in:

- Republics;

- Autonomous okrugs;

- Cities;

- Edges and regions.

The service is created in such a way that when you hover your mouse over the location of a settlement on a map of the Russian Federation, the Hotline telephone number immediately appears.

Fines

If the company has not submitted 4-FSS, a fine for late submission will be charged even if the calculation in fact should be zero. The company or individual entrepreneur itself is subject to financial liability in an amount equal to the greater of two values:

- 1,000 rubles;

- 5% of the amount of contributions accrued for injuries during the reporting period, multiplied by the number of months of delay (incomplete months are also considered), but not more than 30% of the insured amounts.

Even if you are a few days late, you will have to pay a fine for a full month. Moreover, it is important for the policyholder to make the calculations correctly. Let's consider several situations using an example:

- The entrepreneur forgot to submit zero reporting. Since the contributions “for injuries” were zero, the fine will be 1,000 rubles.

- The organization provided reports to 4-FSS for the 1st quarter of 2018 only on May 19. The amount of contributions indicated in the calculation is 3,000 rubles. How much will you have to pay? (3,000*0.05) + (3,000*0.05) = 300 rubles. Since this amount is less than 1,000 rubles, the fine will be 1,000 rubles.

Additionally, a fine may be imposed on the responsible person in accordance with the Code of Administrative Offenses of the Russian Federation in the amount of 300–500 rubles. This type of liability applies only to legal entities; it does not apply to individual entrepreneurs.

If an organization submitted a report on paper, and the total number of employees for the previous year was higher than 25 people, then you will additionally have to pay a fine of 200 rubles for an incorrect reporting form.