In accordance with paragraph 2 of Article 431 of the Tax Code of the Russian Federation and part 2 of Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ, for the amount of accrued social benefits,

paid at the expense of the Social Insurance Fund, insurance premiums payable per month are reduced.

According to paragraph 9 of Article 431 of the Tax Code of the Russian Federation and part 2 of Article 4.6 of Law No. 255-FZ, the excess of the amount of benefits over the amount of contributions,

accrued for the same month, you can:

- offset against the payment of insurance premiums in the following months;

- reimbursed from the Social Insurance Fund by returning to the current account.

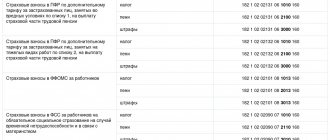

Insurance premiums for disability and maternity from 2021

From 2021, pension, medical and insurance contributions for temporary disability and maternity will be administered by the tax authorities. The Federal Tax Service will need to submit reports on these types of insurance premiums as part of a single calculation approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551.

Insurance premiums for industrial accidents and occupational diseases (that is, “injury” contributions) will continue to be controlled by the Social Insurance Fund. For this type of insurance premiums, starting from 2021, the FSS divisions will need to submit a calculation using the new form 4-FSS, which was approved by Order of the FSS of the Russian Federation dated September 26, 2016 N 381. This calculation will only include information on contributions “for injuries.”

What documents are needed to reimburse sick leave under the Social Insurance Fund in 2021?

In the case of a claim for reimbursement of expenses for ordinary sick leave, the list of documents is similar to a maternity certificate of incapacity for work. To receive a refund, you must fill out an application, a calculation certificate and a transcript.

Remember that the first 3 days of illness are paid from the funds of the organization or entrepreneur, and only payment for days starting from the fourth can be requested for compensation.

If the policyholder applied a reduced rate or calculated Social Insurance contributions at a zero rate in 2017-2019, then a copy of the sick leave certificate with the benefit calculation is additionally attached to the application and attachments.

Other insurers provide copies of supporting documents only at the request of Social Insurance as part of the audit.

Reduction of insurance premiums for benefits in 2017

How to reimburse the costs of paying employees sickness benefits due to maternity from 2021? These contributions are controlled by tax inspectors. Does this mean that you need to contact the Federal Tax Service for compensation? Let's look at these issues in more detail.

In 2021, as before, employers (organizations and individual entrepreneurs) have the right to reduce the monthly payment of insurance premiums for disability and maternity by the costs incurred to pay insurance coverage to employees. This is provided for in paragraph 2 of Article 431 of the Tax Code of the Russian Federation. So, in particular, the following can be included in expenses (Part 1, Article 1.4 of the Federal Law of December 29, 2006 No. 255-FZ):

- temporary disability benefits (from the fourth day of illness);

- maternity benefits;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for child care up to one and a half years;

- social benefit for funeral.

If the amount of accrued benefits does not exceed the amount of insurance contributions, then you will not need to apply to the Social Insurance Fund in 2021. It will be enough to reduce the monthly payment by the amount of accrued benefits.

In this case, the costs of benefits to policyholders will need to be reflected in Appendix No. 3 to Section 1 of the unified calculation of insurance premiums in the form approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551.

Policyholders (organizations or individual entrepreneurs) will reduce insurance premiums for the benefits specified in this application. The total amounts of insurance premiums for temporary disability and maternity will need to be shown in section 1 of the uniform calculation form for insurance premiums, approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551.

Having received such a calculation, tax authorities will report data on the claimed compensation to the Federal Tax Service of Russia. And based on the results of the inspection, the FSS will decide whether to approve the offset or not. If the result is negative, the Federal Tax Service will send the policyholder a demand for payment of the missing contributions. If the result of the check is positive, the expenses will be accepted, and the Federal Tax Service, if necessary, will offset or return the difference between contributions and expenses. This procedure is provided for in Part 1. 1.1, 5.8 tbsp. 4.7 Federal Law dated December 29, 2006 No. 255-FZ.

What needs to be done to reimburse benefits from the Social Insurance Fund

1) First you need to find out what exactly the money that you want to be reimbursed from the Russian Social Insurance Fund was spent on.

Through contributions to compulsory social insurance in case of temporary disability and in connection with maternity, the FSS of Russia reimburses:

- Sick leave.

- Maternity benefits.

- Child care benefits up to 1.5 years.

- Funeral benefits.

Maternity benefits and child care benefits up to 1.5 years old are fully reimbursed by the Social Insurance Fund.

As for sick leave, the organization can pay them: either entirely at the expense of the Social Insurance Fund, or partially at the expense of the Social Insurance Fund and partially at its own expense.

2) Reduce contributions by the amount of benefits.

If the amount of benefits does not exceed the amount of contributions, then you can offset the benefits in full.

3) Decide what is more profitable and convenient for you: offset or reimburse.

4) Prepare documents to the Social Insurance Fund for reimbursement or offset.

If the amount of benefits exceeds accrued contributions

In 2021, the amount of benefits paid for any month of the reporting period may be greater than the contributions to the Social Insurance Fund accrued for the same month. Then the policyholder has the right (clause 9 of Article 431 of the Tax Code of the Russian Federation):

- or offset the excess against upcoming payments of contributions to the Social Insurance Fund within the billing period;

- or contact the FSS department for the allocation of the necessary funds to pay insurance coverage.

In order to receive money into your current (personal) account to reimburse (pay) expenses for benefits in 2021, you must contact your branch of the Federal Social Insurance Fund of Russia, and not the Federal Tax Service. This follows from paragraph 2 of Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ.

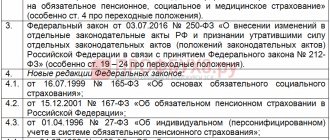

The list of documents that need to be submitted for reimbursement to the FSS branch of Russia was approved by order of the Ministry of Health and Social Development of Russia dated December 4, 2009 No. 951n. However, keep in mind that on November 28, 2016, Order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n came into force, which amended this list. Next, we list the documents that will need to be submitted taking into account the amendments made by the specified order of the Ministry of Labor.

Refunds for periods up to 2021

If an organization or individual entrepreneur applies to the Social Insurance Fund in order to receive money into a current account for reimbursement of benefits and such compensation applies to periods before 2021, then the Social Insurance Fund division must submit:

| A written application, drawn up in any form, containing the required details: - name and address of the organization; - registration number; — an indication of the amount of funds required to pay the insurance coverage. |

| Calculation in form 4-FSS for the period confirming the accrual of expenses for the payment of insurance coverage until January 1, 2017. |

| Copies of documents confirming the validity of expenses (for example, sick leave certificates) given in Part 3 of List No. 951n. |

If the territorial body of the Federal Social Insurance Fund of the Russian Federation does not order a check of the correctness and validity of expenses, it will transfer the funds within 10 calendar days from the date of submission of the above documents (Part 3, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ).

Refunds for periods after January 1, 2021

As we have already said, in connection with the entry into force of the Order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n from 2021, the list of documents required for compensation has been adjusted. To receive a refund to your current account in the Social Insurance Fund, you will need to submit:

| A written application, drawn up in any form, containing the required details: - name and address of the organization; - registration number; — an indication of the amount of funds required to pay the insurance coverage. |

| a statement of calculation, which reflects: - the amount of debt of the policyholder (Social Insurance Fund of the Russian Federation) for insurance premiums at the beginning and end of the reporting (calculation) period; - the amount of insurance premiums accrued for payment, including for the last three months; — the amount of additional accrued insurance premiums; — the amount of expenses not accepted for offset; — the amount of funds received from the territorial bodies of the Social Insurance Fund of the Russian Federation to reimburse expenses incurred; - the amount of returned (credited) overpaid (collected) insurance premiums; - the amount of funds spent for the purposes of compulsory social insurance, including for the last three months; - the amount of insurance premiums paid, including for the last three months; - the amount of the insured's debt written off. |

| Copies of documents confirming the validity of expenses. |

The FSS will send a copy of the decision to allocate funds to the policyholder to the tax authorities. Within three working days from the date of entry into force of the relevant decision (Part 4.1, Article 4.6 of the Federal Law of December 29, 2006 No. 255-FZ).

Online magazine for accountants

Additionally, a document from the second parent’s place of work confirming that this payment has not been accrued again is provided.

- When compensating the costs of paying a monthly allowance when a child reaches one and a half years old, you need to focus on Federal Law No. 255 (Part 6 and Part 7 of Article 13). It reflects the necessary documents.

- The Social Insurance Fund may reimburse funeral benefits.

AttentionA copy of the death certificate will be required for a refund. The document is provided by the civil registry office. It must be certified.

Sample of a certificate-calculation Certificate-calculation A certificate must be submitted, which provides the calculation of certain indicators for the reporting period.

New certificate-calculation from 2021: form and sample

The certificate will replace the 4-FSS calculation

As you can see, in connection with the entry into force of the Order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n, from January 1, 2021, a new document will need to be submitted to the FSS divisions as part of the documents for reimbursement of expenses: a statement of calculation. It will need to show various information about insurance premiums. This certificate will replace the previously submitted calculation in Form 4-FSS, which was required to receive compensation.

Why do you need a certificate?

Why do officials from the Social Insurance Fund need a calculation certificate starting in 2021? Let me explain. As we have already said, from 2021, organizations and individual entrepreneurs (employers) will report on insurance premiums for temporary disability due to maternity as part of a single calculation of insurance premiums, which was approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ 551. This calculation will be submitted to the tax office. Accordingly, the FSS authorities may not have data on these insurance contributions. They will take this information from the new calculation certificate. However, keep in mind that FSS divisions at any time have the right to request information from tax inspectorates about insurance premiums accrued and paid by policyholders. This is provided for in clause 2.2 of part 1 of article 4.2 of the Federal Law of December 29, 2006 No. 255-FZ.

Calculation certificate form

As for the form of the certificate-calculation, the legislation does not provide that it must be officially approved. Therefore, it can be assumed that policyholders will be able to draw up a calculation certificate using an independently developed form. The main thing is that such a certificate includes all the necessary information, which is mentioned in paragraph 2(1) of the List approved by Order of the Ministry of Health and Social Development of Russia dated December 4, 2009 No. 951n (as amended by Order of the Ministry of Labor of Russia dated October 28, 2016 No. 585n). Below we provide a possible example of a calculation certificate, the form of which you can download.

The FSS authorities can develop a recommended form of calculation certificate that policyholders can use. However, a mandatory form of payment certificate is not provided for by law. Therefore, policyholders will be able to use a self-developed form of certificate-calculation.

Return Features

Reimbursement of expenses received from Social Insurance is necessarily reflected in the calculation of insurance premiums, which is submitted to the tax office.

The amounts should fall into line 080 of Appendix No. 2 of the report form. The data is filled in monthly and on a cumulative basis.

We discussed the nuances of filling out the report in the article New reasons why tax authorities will stop calculating contributions in 2019.

Insurance premiums accrued after 2021 are paid to the territorial tax office where the employer is registered. If there is an overpayment in insurance contributions for compulsory social insurance in 2021, you can do the following:

- leave the overpayment for payment of contributions of future periods;

- write an application to the tax office for a refund of the resulting overpayment.

Clause 1.1 art. 78 of the Tax Code of the Russian Federation indicates that it is impossible to offset the overpayment of one contribution (that is, one BCC) against the payment of other contributions or taxes (that is, other BCCs).

One of the previous sections already contains an application form for the return of overpayments on disability insurance premiums as of 01/01/2017.

There is no need to attach any documents to the application.

But if Social Insurance decides to conduct an inspection before agreeing on the amount of compensation, then upon a separate request it will be necessary to show the Fund’s specialists the necessary documents. It can be:

- sick leave;

- children's birth certificates;

- certificates from medical institutions;

- payroll statements;

- orders for admission;

- certificates of earnings from previous places of work;

- other documents confirming the legitimacy of the application for compensation of expenses, as well as confirming the settlement amounts.

The specific list depends on the type of benefit being reimbursed.

Contributions for accidents are paid directly to Social Security, so there are no difficulties in this case. An application for the return of overpaid contributions is submitted to its branch of the Fund, and the Fund transfers the payment within 10 days.

The return of funds from the Social Insurance Fund for any reason (overpayment or reimbursement of expenses) is not considered income under any tax regime.

But you should pay attention to whether payments for social benefits were accidentally included earlier in expenses for tax purposes and whether they reduced the single tax under the simplified tax system of 6% or under other taxation systems.

If the amount of contributions accrued in a certain month does not exceed the amount of benefits accrued to employees, money can be returned from the Social Insurance Fund in several ways:

- Reducing the amount of contributions in subsequent months by the amount of overpayment of benefits until the difference is finally eliminated. Relevant for companies on OSNO that have made mandatory payments from their own funds.

- Refund of expenses. The most acceptable option is when, according to first estimates, the total amount of benefits paid cannot be repaid through the payment of contributions, as well as for enterprises using a special regime.

Steps that an employer needs to take to receive “real” money from the Social Insurance Fund:

- Within 10 days from the date of formation of the debt for the Social Insurance Fund, contact the branch of the Fund at the place of registration of the enterprise.

- Submit an application written in any form or according to the model used in this social insurance department.

- Submit a complete set of required documents, including calculations in Form 4 of the Social Insurance Fund.

Social insurance is obliged either to transfer the amount indicated in the application to the enterprise within 10 days, or to give a refusal within 3 days, followed by a check to clarify the information provided.

According to Article 41 of the Tax Code of the Russian Federation and Letter of the Ministry of Finance dated June 1, 2005 No. 03-03-02-02/80, money reimbursed by the Fund to the employer is not taken into account when calculating income tax and simplified taxation.

Funds compensated by the Fund are reflected only in Form 4 of the Social Insurance Fund during the period of their crediting to the enterprise’s account. For example, in the second quarter in April. This means that in Table 1 the amount is entered in the cell of the first month, and dashes are placed in the boxes for May and June.

The Social Insurance Fund proposes not to accumulate refund amounts in order to minimize the burden and free the employer from mandatory payments from his own funds.

Can expenses be offset against future payments?

In 2021, in regions that are not included in the pilot, it will remain possible to offset expenses against upcoming contribution payments. But only after the fund confirms these expenses.

How would this happen?

The company will indicate the assigned benefits in the new contribution calculation.

The Federal Tax Service will transfer the data on benefits to the fund (no later than five days from the day they received the calculation in electronic form and no later than 10 days from the day it was received on paper).

Based on this information, the FSS will conduct an inspection. Fund specialists will either confirm the expenses or refuse credit.

In any case, the fund will report its decision to the tax office within three days from the date it comes into force.

If the Social Insurance Fund confirms the expenses and their amount exceeds the contributions, the fund will return the difference or the Federal Tax Service will count it against future payments.

This procedure will remain in place until all regions switch to direct payments of benefits from the fund.

List of documents for reimbursement of child benefits

With compensation from the Social Insurance Fund for paid child benefits, the situation is similar - you need to fill out an application, a calculation certificate and attachments.

Supporting documents for such benefits may be:

- document on the birth (adoption) of the baby;

- documents confirming that the born (adopted) child is not the first of these parents;

- a certificate from the second parent’s place of work confirming non-receipt of benefits;

- a document confirming the status of a single parent;

- other documents.

Requirements for the provision of documents are similar to other grounds for compensation - only those who are entitled to preferential rates submit copies along with the application. Other fee payers provide documentation for verification only upon request.