Issues discussed in the material:

- What is the procedure for returning insurance premiums?

- How to return insurance premiums to individual entrepreneurs

- Is it possible to sue the Social Insurance Fund if contributions are calculated incorrectly?

- How to process refunded insurance premiums

Many entrepreneurs and their accountants often wonder how to return insurance premiums? This attention is caused by changes in legislation. The fact is that until 2021, contributions were paid to the Social Insurance Fund and the Pension Fund of the Russian Federation, but now they are transferred to the tax authorities. Accordingly, the procedure for returning insurance premiums will depend on the year in which they were paid. In our article we will talk in detail about all the nuances relating to this issue.

How to fill out Form 23 PFR

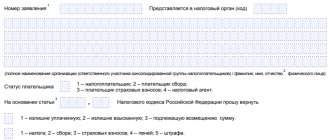

Form 23 of the Pension Fund of the Russian Federation is now in use; it has been in force since February 2016 and is called “Application for the return of the amount of overpaid insurance premiums, penalties, and fines.” It was approved by resolution of the Pension Fund Board of December 22, 2015 No. 511p.

Funds that were overpaid by an organization (IP) to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund can only be returned upon the payer’s statement about the resulting overpayment. If a fund employee has identified a paid surplus, the Pension Fund must inform the policyholder about this within 10 days. After which a joint reconciliation is carried out, in which each party reflects its data. Based on its results, the overpayment will be confirmed, or an updated calculation will be required.

To return overpaid funds to the Pension Fund, you must prepare an application in paper or electronic form by filling out Form 23 of the Pension Fund (the form can be downloaded below).

An application is submitted to the territorial branch of the Pension Fund of the Russian Federation at the place of registration of the payer of contributions within three years from the date of payment of the amount that resulted in the overpayment. In turn, fund employees make a decision on this application no later than ten working days from the moment they receive an application for the return of the overpaid amount. If the decision is positive, the excess amount will be returned within 1 month. If the Pension Fund fails to comply with the established deadlines, the payer must be returned the amount of the overpayment along with the accrued percentage of the penalty for each day of delay.

Constitutional Court of the Russian Federation: refund of overpayment of pension contributions is possible

Let's take a closer look.

Set-off and refund of overpayments on insurance premiums

First, let's remember the rules that need to be applied when returning or crediting insurance premiums.

If insurance premiums are overpaid or the tax office has over-collected insurance premiums, they can be returned or offset against future payments.

The procedure for offset and return of overpaid amounts of insurance premiums depends on the type of contributions and the period for which the overpayment occurred. From January 1, 2021, the administration of insurance premiums is carried out by the tax inspectorate according to the rules of Articles 78 and 79 of the Tax Code. Let's note the main ones:

- the amount of overpaid insurance premiums is subject to offset against the corresponding type of contributions. That is, overpayment of medical contributions is not allowed to be offset against arrears of pension contributions;

- the overpayment will be returned only after the existing debt has been repaid for the corresponding penalties and fines;

- if overpaid pension contributions are reflected in personalized reporting and posted to the personal accounts of individuals, the tax authorities will not return the overpayment.

Forms of documents for offset or return of overpaid (collected) insurance premiums to the Pension Fund before January 1, 2021 were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 22, 2015 No. 511p.

When filing a return, you must take into account that this procedure involves a statute of limitations. It is valid for 3 years from the date of payment of contributions. Refunds can only be made during this period.

About an individual personal account with the Pension Fund of Russia

Employers transfer insurance contributions to the Russian Pension Fund - 22% of wages.

An individual personal account (IPA) is information about accumulated points, length of service, earnings and insurance premiums that the insured person has accumulated to date.

The employer submits information to the Pension Fund, and the Pension Fund takes into account the information in the accounts.

Legal dispute

The company disputes the provisions of paragraph 6.1 of Art. 78 Tax Code of the Russian Federation. The dispute reached the Constitutional Court.

Thus, in 2014, the company overpaid contributions to compulsory pension insurance and demanded a refund of the overpayment. The Pension Fund refused because information about overpaid contributions was recorded in the individual accounts of employees.

The courts sided with the Pension Fund of Russia, finding that the return of overpaid funds is impossible, since information about the paid contributions has already been recorded in the individual personal accounts of the insured persons - the company's employees. They refer to the ban on the return of insurance payments, which, until January 1, 2021, was provided for in Federal Law No. 212-FZ dated July 24, 2009.

The Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation considered a cassation appeal against the decisions of the courts, which refused to satisfy the company’s complaint and oblige the branch of the Pension Fund of the Russian Federation to return overpaid insurance premiums for compulsory pension insurance.

Rights violation?

The company believes that such an inability to dispose of overpaid insurance premiums raises questions regarding compliance with payers of the right of ownership of their property guaranteed by the Constitution of the Russian Federation.

And the forced seizure of property in the form of amounts of fiscal payments, carried out in an improper procedure, violates the constitutional guarantees for the protection of property rights enshrined in Art. 8 and 35 of the Constitution of the Russian Federation. Therefore, the applicant requests that the challenged norms be checked for compliance with the Constitution of the Russian Federation.

It turns out that this deprivation of payers’ ability to dispose of overpaid insurance premiums for periods before 01/01/2017 should be adjusted.

What does the Constitutional Court “say”

In Resolution No. 32-P dated October 31, 2019, the Constitutional Court of the Russian Federation recognized that organizations and individual entrepreneurs have the right to demand the return of overpaid insurance premiums even if the overpayment was taken into account in the individual personal accounts of employees. In this case, the period of occurrence of the overpayment does not play a role.

The Constitutional Court of the Russian Federation recognized the contested norm as contrary to the Constitution of the Russian Federation and gave instructions that the legislator make the necessary changes. Until such changes are made, the Constitutional Court of the Russian Federation prohibits refusing to return insurance contributions to employers.

We will wait for amendments to the Tax Code.

If there is a debt to the Pension Fund

If an organization or individual entrepreneur has a debt to the Pension Fund, it will be repaid from the overpaid amount. That is, the Fund will first reconcile your payments, then the amount of arrears will be deducted from the amount of your overpayment. And the remainder (if anything remains) will be returned to the policyholder.

However, you will not always get your money back. It is impossible to return the surplus if it was deposited and paid in the RSV-1 form and distributed to the individual accounts of employees. In this case, an offset may be made against future payments by the policyholder.

In Form 23 of the Pension Fund of the Russian Federation, the form contains the payer’s data, the name of the overpayment amount and the details for which the refund will be made.

When does an overpayment of insurance premiums occur?

Application for refund of overpayment of insurance premiums

Obligations to pay insurance premiums arise for employers who act as insurers in relation to employees, as well as for individual entrepreneurs who combine the functions of the policyholder and the insured person and pay premiums “for themselves.”

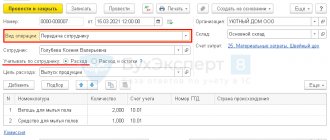

Payment of contributions is carried out on the basis of calculations, reflected in the form according to the order of the Federal Tax Service No. ММВ-7-11/551 dated 10.10.16 ( the form can be downloaded here ), monthly until the 15th day of the month following the reporting month.

The payer may overpay insurance premiums in the following cases: (click to expand)

- Error when paying insurance premiums . If, when filling out a payment order, the organization’s accountant made a mistake, as a result of which an amount greater than that indicated in the DAM was paid into the budget, then in this case the payer’s overpayment of contributions is recognized.

- Errors in calculation of contributions. The reason for overpayment of contributions may be an incorrect method of calculating payments, namely an incorrect determination of the calculation base (employee income), billing period, etc. An overpayment occurs provided that an error has led to an overestimation of contribution obligations.

- Errors when filling out the RSV . The payer may make a mechanical error when filling out the RSV (Calculation of Insurance Premiums) form, which may result in an overpayment.

Refund of overpayment of insurance premiums is carried out based on the payer’s application in the prescribed manner.

Is it possible to collect interest from the Social Insurance Fund if contributions were collected illegally?

There was such a case in the judicial practice of the Ural District. An on-site inspection of the Social Insurance Fund discovered a shortage of payments for accidents at the enterprise and presented a demand for its payment. The organization complied with this requirement, but then decided to challenge it and filed a lawsuit demanding the return of the excessively collected amount, as well as interest accrued on it.

By the decision of the Arbitration Court in this case (No. A50-29761/2018 dated 06/06/2019), the FSS demand was declared invalid and illegal. Thus, the court satisfied the taxpayer's claim. The FSS tried to build its defense, referring to the provisions of Art. 26.12 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” and insisted that these payments were overpaid and not collected. This means that there is no basis for calculating interest.

Illegal assessment of taxes and fines. How to prove it in court?

The above law states that acts of bodies monitoring the payment of insurance premiums do not have the same signs of compulsoryness that acts of tax authorities have, therefore the positions of the Constitutional Court of the Russian Federation, set out in the ruling dated December 27, 2005 No. 503-O, and the position of of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 16551/11 dated April 24, 2012.

But the court, even after the appeal, did not change its statement that the fund’s requirement to pay the additional accrued amount of the fee, which was identified during the on-site inspection, is the basis for considering it excessively collected, and not excessively paid, thereby taking the side of the policyholder.

For your information. According to clauses 1, 2 of Art. 26.1 of Federal Law No. 125-FZ, if a fact of non-payment or incomplete payment of insurance premiums on time is revealed, then this arrears must be collected. The collection procedure is provided for in Art. 26.6 and 26.7 of Federal Law No. 125-FZ.

Subtleties of documentation

Form 23 of the Pension Fund of the Russian Federation (the form can be downloaded on the website) contains current data: • Taxpayer (name of the organization, its address and contact details, checkpoint, tax identification number); • the amount that was overpaid follows the contact information about the payer, fines, penalties and penalties relate to it, they are determined by an algorithm within the framework of the current law; • the size of the indicators and the direction in which they follow – the Pension Fund of the Russian Federation, the Social Insurance Fund, the Federal Migration Service and so on, followed by the numbers of personal and correspondent accounts, data on the full names of the responsible persons, signatures; • at the end there is direct data about the representative of the payer - the person paying the insurance premiums, confirmed by a signature and company seal. Thus, compiling and completing the form is a simple task if you follow the basic requirements and algorithm. Competently filling out the form guarantees the absence of problems and difficulties with current legislation.

| Download Form 23 PFR |

Reconciliation of calculations

If an overpayment is detected, a joint reconciliation of insurance premium payments can be carried out. Such reconciliation is carried out either at the proposal of the territorial branch of the fund, or at the initiative of the organization. To conduct a reconciliation at the initiative of an organization, it needs to submit an application for a reconciliation to the FSS of Russia and the Pension Fund of the Russian Federation. The results of the reconciliation are documented in a document. This is stated in Part 4 of Article 26 of the Law of July 24, 2009 No. 212-FZ.

To formalize the results of the reconciliation, the following is used:

- form 21-PFR - if the reconciliation of calculations was carried out with the territorial branch of the Pension Fund of the Russian Federation;

- Form 21-FSS of the Russian Federation - if reconciliation was carried out with the territorial branch of the FSS of Russia.

Tip : Try to reconcile your accounts at least once a year. This will allow you to timely determine the presence of an overpayment and take the necessary measures to offset (return) the excess amounts transferred. In addition, a preliminary inventory of obligations (including to extra-budgetary funds) is an indispensable condition for the preparation of annual financial statements (Article 11 of the Law of December 6, 2011 No. 402-FZ, clause 27 of the Accounting Regulations and reporting).

Refusal of the regulatory authority to return the overpayment

The supervisory authority has the right to refuse to refund the overpayment of insurance premiums to the payer due to the following grounds:

- The payer has arrears on insurance premiums. The overpayment amount is not refundable if the applicant has arrears in contributions (arrears, penalties, fines). In this case, the overpayment is credited to repay the debt, and the balance of the amount (if any) is credited to the payer’s account.

- The payer contacted the regulatory authority later than the established deadline . According to current legislation, the payer has the right to apply to the Federal Tax Service/Fund for the return of the overpayment within 3 years from the date of occurrence of such an overpayment. If the application occurs after the established period, the issue of refund is resolved in court.

- The organization/individual entrepreneur provided distorted data on the amount of overpayment . If, based on the results of a desk audit, information about an overpayment received from the payer is found to be unreliable, the Federal Tax Service/Fund has the right to refuse to return the funds to the applicant.