New procedure for the return of insurance premiums for compulsory health insurance

On December 31, 2021, the Constitutional Court recognized the restriction of the employer’s right to receive from the budget overpaid funds for compulsory pension insurance (OPS) as inconsistent with the Constitution of the Russian Federation. The reason for the refusal is that information about the amounts paid is posted on the individual personal accounts of the insured persons. The government was obliged to correct the situation and ensure that overpayments of insurance premiums are offset in 2021, including for compulsory insurance.

The State Duma adopted amendments to the Tax Code of the Russian Federation aimed at establishing a new procedure for the reimbursement of insurance premiums for compulsory health insurance. Tax authorities will take into account the structure of the insurance payment tariff (its joint and several parts) and the fact whether a particular insured person has an insured event. If the employee has retired and a change in the information on the personal account will lead to a decrease in pension benefits, the amount of overpaid (collected) payments to the compulsory pension insurance will not be returned to the employer. In all other cases, the policyholder will receive compensation based on an application for the return of this amount. The new rules will begin to work on January 1, 2021, after the law is signed by the president. Until then, the Federal Tax Service authorities consider all applications for compensation individually, based on the position of the Constitutional Court of the Russian Federation.

Updated instructions from ConsultantPlus

To guarantee a refund and not be refused, use a ready-made solution (here is free access):

Go to instructions

Set-off and refund of overpayment of insurance premiums to the Social Insurance Fund

Explain what is the procedure for crediting and returning the amount of overpayment of insurance premiums to the Social Insurance Fund?

Clause 1 of Art. 26 of Federal Law No. 212-FZ[1] establishes that the amount of overpaid insurance premiums is subject to:

- offset against future payments of the payer of insurance premiums for insurance premiums;

- offset against debt repayment of penalties and fines for offenses provided for by this law;

- return to the payer of insurance premiums in the manner prescribed by this article.

The insurer is obliged to inform the payer of insurance premiums about each fact of excessive payment of insurance premiums that becomes known within 10 days from the date of discovery of such a fact.

If excess amounts are detected on the payer’s personal account, the FSS employee proposes to reconcile the data, which is drawn up in a joint reconciliation act in accordance with Form 21-FSS of the Russian Federation (Appendix 1 to Order No. 49 [2]).

If the reconciliation results confirm an overpayment, the institution submits a corresponding application to the Social Insurance Fund:

- on offset of the amount according to Form 22-FSS of the Russian Federation (Appendix 2 to Order No. 49 ). In this case, the payer determines against which payments the offset is made;

- on the return of the amount in accordance with Form 24-FSS of the Russian Federation (Appendix 2 to Order No. 49 ) indicating your payment details.

Please note:

An application for offset or refund of the amount of overpaid insurance premiums can be submitted within three years from the date of payment of the specified amount by virtue of Part 13 of Art. 26 of Federal Law No. 212-FZ .

In the joint reconciliation act and the payer’s statements, information about the types of social insurance controlled by the Social Insurance Fund ( federal laws No. 255-FZ [3], 125-FZ [4]) is reflected simultaneously.

Let us remind you that from 01/01/2015, at the request of the payer of insurance premiums, overpaid amounts of insurance premiums for one type of insurance can be offset against upcoming payments, payments to repay arrears on insurance premiums and debts on penalties and fines for another mentioned type of insurance ( clause. 21 Article 26 of Federal Law No. 212-FZ ). The admissibility of such an offset in relation to the amounts of overpayment between payments controlled by the Social Insurance Fund is clarified by the Ministry of Labor in Letter No. 17-3/B-451 dated September 24, 2014 .

Refund of the overpayment is made only on the basis of the payer’s application and after repayment of all debts he owes to the Social Insurance Fund, including penalties and fines in accordance with clause 12 of Art. 26 of Federal Law No. 212-FZ . Consequently, the amount remaining after offset will be credited to the institution’s personal account.

The amount of excessively collected insurance premiums is subject to return to the payer in the manner established by Art. 27 of Federal Law No. 212-FZ .

An application for the return of the amount of excessively collected insurance premiums may be submitted by the payer of insurance premiums in writing or in the form of an electronic document within one month from the day it became known about the fact of excessive collection of insurance premiums from him, or from the date the court decision came into force. If the refund of the amount of overpaid insurance premiums is made in violation of the established deadline, the FSS charges interest on the amount of overpaid insurance premiums for each calendar day of violation of the refund deadline. The interest rate is taken equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation, which was in effect on the days when the repayment deadline was violated ( Part 17, Article 26 of Federal Law No. 212-FZ ).

These rules also apply to the offset or return of amounts of overpaid penalties and fines by virtue of clause 24 of Art. 26 of Federal Law No. 212-FZ .

If, as a result of reconciliation, the overpayment is not confirmed, the institution should submit an updated calculation with correct information on accrued and paid insurance premiums.

Question

How are operations for the return and offset of overpayments of insurance premiums controlled by the Social Insurance Fund reflected in the accounting records of state (municipal) institutions?

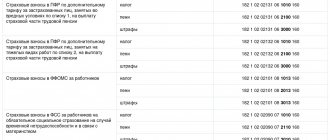

In the accounting records of institutions, operations to return overpayments of insurance premiums to the personal account are reflected in accordance with the provisions of clause 104 of Instruction No. 162n [5], clause 132 of Instruction No. 174n [6], clause 160 of Instruction No. 183n [7].

The offset of payments within the framework of one type of social insurance will be reflected on the basis of the provisions of clause 18 of Instruction No. 157n [8] by a corrective accounting entry prepared using the “red reversal” method.

The offset of the amount of overpayment for one type of insurance against payments for another type of insurance is reflected by a corrective accounting entry prepared using the “red reversal” method and an additional accounting entry.

In the accounting of state and municipal institutions, operations to offset and return overpayments of insurance premiums are drawn up on the basis of a certificate (form 0504833) and are reflected in accordance with the decision adopted by the Social Insurance Fund as follows:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Refund of overpayment to the institution's personal account | |||||

| 1 304 05 213 | 1 303 02 730 1 303 06 730 | 0 201 11 510 | 0 303 02 730 0 303 06 730 | 0 201 11 000 | 0 303 02 000 0 303 06 000 |

| Offsetting overpayments for the same type of social insurance against upcoming payments, repayment of arrears and debt on fines and penalties | |||||

| Corrective entry (using the “red reversal” method) | |||||

| 1 303 02 830 1 303 06 830 | 1 304 05 213 | 0 303 02 730 0 303 06 730 | 0 201 11 610 | 0 303 02 000 0 303 06 000 | 0 201 11 000 |

| Offsetting overpayments for one type of social insurance against payments and repayment of arrears, debts on fines, penalties for another type of insurance | |||||

| 1. Corrective entry (using the “red reversal” method) | |||||

| 1 303 02 830 1 303 06 830 | 1 304 05 213 | 0 303 02 730 0 303 06 730 | 0 201 11 610 | 0 303 02 000 0 303 06 000 | 0 201 11 000 |

| 2. Additional entry accordingly for another type of social insurance | |||||

| 1 303 06 830 1 303 02 830 | 1 304 05 213 | 0 303 06 830 0 303 02 830 | 0 201 11 610 | 0 303 02 000 0 303 06 000 | 0 201 11 000 |

Example

In a budgetary institution, a reconciliation report from the Social Insurance Fund revealed an overpayment of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity in the amount of 14,000 rubles, which was formed from funds from income-generating activities. Based on the submitted application and the decision made by the Social Insurance Fund, the specified amount was offset against the debt on fines and penalties accrued based on calculations for compulsory social insurance against industrial accidents and occupational diseases.

In the accounting records of the budgetary institution, based on the decision of the Social Insurance Fund, a certificate will be generated (form 0504833) and the following entry will be made:

| Contents of operation | Debit | Credit | Amount, rub. |

| A correction entry for insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity is reflected (using the “red reversal” method) | 2 303 02 830 | 2 201 11 610 18 (Article 213 KOSGU) | (14 000) |

| An additional entry for insurance premiums for compulsory social insurance against industrial accidents and occupational diseases is reflected. | 2 303 06 830 | 2 201 11 610 18 (Article 213 KOSGU) | 14 000 |

[1] Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

[2] Order of the Federal Social Insurance Fund of the Russian Federation dated February 17, 2015 No. 49 “On approval of document forms used when offsetting or returning amounts of overpaid (collected) insurance contributions, penalties and fines to the Social Insurance Fund of the Russian Federation.”

[3] Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity.”

[4] Federal Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against industrial accidents and occupational diseases.”

[5] Instructions for the use of the Chart of Accounts for Budget Accounting, approved. By Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

[6] Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

[7] Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

[8] Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Source: Journal “Explanations of executive authorities on the conduct of financial and economic activities in the public sector”

Who makes the return decision?

The body making the decision on the return of overpaid insurance contributions, penalties and fines depends on the reporting period for which the policyholder filed an application for overpayment. When applying for reporting (calculation) periods that expired before 01/01/2020, the decision is made by the authorities of the Pension Fund - for payments to compulsory pension insurance and the Social Insurance Fund of the Russian Federation - for payments for temporary disability and injuries.

This happens in agreement with the Federal Tax Service. To do this, within 10 working days from the date of receipt of a written application for

refund of the overpayment, the authorized bodies make a decision and no later than the next working day send a notification to the territorial tax authority at the place of registration of the policyholder for the actual transfer of overpaid amounts of insurance contributions, penalties and fines (letter of the Ministry of Finance dated 06/09/2017 No. 03-15-05/36284). There are still 30 days for this.

The decision to return overpaid deductions, penalties and fines for reporting (calculation) periods formed after 01/01/2017 is made by the tax authority (Article 78 of the Tax Code of the Russian Federation). The algorithm is fully consistent with the return of overpaid taxes.

Wiring used

Money received as a result of the return of an overpayment must be taken into account. They are recorded on account 69. In particular, these postings are used:

- DT69 KT51. The posting is recorded when the contribution is paid. Overpayments are reflected in debit.

- DT51 KT69. Return.

Overpayments that are not recorded as expenses when establishing the tax base are not considered non-operating income.

Information on insurance premiums is consolidated on account 69 in the context of subaccounts opened by type of compulsory insurance. The following entries are made in the company's accounting:

- Dt 69 Kt 51 when paying the insurance premium. Amounts of overpayments at the enterprise are recorded as debit.

- Dt 51 Kt 69 upon return of the overpaid contribution.

Amounts of overpayments not taken into account in expenses when determining the taxable base are not included in non-operating income of the enterprise.

How to apply for an overpayment to the Social Insurance Fund

The FSS approved the application forms by order dated February 17, 2015 No. 49 (as amended on November 17, 2016)) in accordance with the norms of Part 1 of Article 21 of the Federal Law dated July 3, 2016 No. 250-FZ. It is impossible to issue a letter for refund of overpayment of insurance premiums in free form.

To return contributions for VNIM and injuries, you should contact the Social Insurance Fund with a prepared application for the return of overpayments on contributions in Form 23.

Who should return the fee?

| Type of contribution | Until January 1, 2021 | From January 1, 2021 |

| OPS, compulsory medical insurance | Pension Fund | Inspectorate of the Federal Tax Service |

| FSS | FSS | Inspectorate of the Federal Tax Service |

There is also such a contribution as a contribution in case of injuries and accidents. The FSS was responsible for it until 2021 and is now responsible.

IMPORTANT! There is no refund of overpaid pension contributions.

Refund of overcharged amounts

If the tax authorities excessively collect amounts for periods expired before 01/01/2017, the question arises of how to return the overpayment of insurance premiums from the tax office in 2021 in such a situation? The decision to return excessively collected payments to OPS and VNiM for these periods is made directly by the Pension Fund of Russia and the Social Insurance Fund. The norms of the Tax Code do not apply (letters of the Federal Tax Service of the Russian Federation dated July 27, 2017 No. ED-4-8/14778, dated June 20, 2017 No. GD-4-8/ [email protected] , letter of the Ministry of Finance dated July 19, 2017 No. 03-02-07 /2/ [email protected] ).

Things are different if the policyholder wants to know how to return the overpayment under the Social Insurance Fund in 2021 that arose after 01/01/2017. The procedure is determined by tax legislation. During this period, the decision is made by the tax authorities in accordance with the provisions of Article 79 of the Tax Code of the Russian Federation. It is enough to contact the Federal Tax Service Inspectorate in writing with a statement in the established form.

IMPORTANT!

There is no general algorithm for how to return insurance premiums from the Pension Fund in 2020. The Federal Tax Service will develop it after the amendments to the Tax Code of the Russian Federation enter into force.