Due to the active use of bank cards when making payments in retail networks, acquiring services are becoming increasingly popular. After all, acquiring service allows a trading company to expand its circle of clients and thereby increase sales of goods and services.

In this article you will get acquainted with the specifics of providing and processing acquiring services, as well as the features of their reflection in accounting.

How is acquiring carried out in accounting?

In accounting reports, the receipt of non-cash money is reflected depending on the time of its receipt in the company’s account.

If the funds arrived on the same day on which the purchase was made, then the transactions will look like this:

- DT 62 – KD 90: sales revenue;

- DT 90 – KD 68.3: VAT on revenue, with a general tax collection system;

- DT 51 – KD 62: funds credited to the company’s account;

- DT 91.2 – KD 51: bank commission written off as expenses.

Typically, credit institutions do not transfer funds to the company’s account on the same day the purchase was made. This procedure takes from 2 to 5 days. Then the report should indicate account 57 “Transfers in transit”.

In this case, the wiring is divided into two parts:

- DT 57 – CT 62: documents transferred to the bank;

- DT 51 – CT 57: crediting money to the organization’s account.

If the company carries out retail trade, then the postings will look like this:

- DT 57 – CT 90: profit from sales;

- DT 90.3 – CT 68.2: VAT on sales;

- DT 51 – CT 57: receipt of money to the company’s account;

- DT 91.2 – CT 57: bank commission.

If a company operates under VAT, then the tax deduction will be taken from the full cost of the product or service, taking into account the bank commission.

Here's an example:

At the outlet, goods worth 60 thousand rubles were sold. The company operates under VAT, while the bank commission, according to the acquiring agreement, is 2.2%. The money is transferred to the organization’s account within 2 days, again - the procedure for receiving funds is established by the agreement with the bank.

Then in accounting it will look like this:

- DT 57 – CT 90 – 60 thousand rubles: money received from the sale of goods, services;

- DT 90.3 – KT 68.2 – 6,000 rubles: VAT is charged, provided that it is 10% (can be 0% or 18%, depending on the products sold);

- DT 51 – CT 57 – 60 thousand rubles: money credited to the company’s account;

- DT 91.2 – CT 57 – 600 rubles: bank commission for acquiring.

That is, VAT is calculated on the full amount of the product or service indicated on the price tag, without deducting a percentage.

Refund of money received via payment card

If a client, for one reason or another, refuses a product or service paid for with a plastic card, the seller is obliged to return the money to him. In this case, the refund must be made to the card; funds cannot be returned in cash from the cash register.

When transferring money for returned goods, the seller must issue a cash receipt with the calculation sign “return of receipt”. This check must be issued on the cash register of the organization or individual entrepreneur who accepted the money from the buyer when selling the goods. The Russian Ministry of Finance recalled this in letter dated 07/04/17 No. 03-01-15/42312 (see “The Ministry of Finance explained how to issue a cash receipt when returning goods by the buyer”).

In accounting, when returning money to a customer’s card, they most often use a reversal of transactions created at the time of purchase. Simply put, the cancellation of revenue is shown in two transactions. The first is for the debit of account 90 and the credit of account 62, the second is for the debit of account 62 and the credit of account 57. Then, after debiting money from the supplier’s bank account, a posting is made to the debit of account 57 and the credit of account 51.

Features for UTII

If before July 1, 2021, retail outlets operating under UTII (unified tax on imputed income) and PSN (patent tax system) could do without a cash register, now this rule applies to everyone. Regardless of the current tax system.

So, if an organization operates according to UTII, then the transactions will be reflected as follows:

Goods worth 20,000 rubles were purchased. The purchase was paid for by card. Then in the accounting reports it will look like D 62 K 90.1 - revenue is reflected. I D 57 K 62 – documents transferred to the bank. Since they will only arrive at the organization’s account after some time.

Firms operating under a simplified tax collection system can record revenue on the day money is received into their account from the bank. Without using count 62.

Next, you need to reflect the costs associated with the deduction of interest by the bank. Here you need to use account 91 (other income and expenses) and account 57 (transfers in transit). Then the wiring will look like this:

- D 51 K 57 – money was received into the organization’s account from the acquiring bank;

- D 91 K 57 – commission for bank services has been written off.

Let's say we are talking about an amount of 30,000 rubles. Then in D 51 K 57 we indicate this figure. The financial institution acting as an acquirer charges a percentage of 2.5% for services. Then we calculate this percentage from 30,000 rubles. It will be 750 rubles.

Acquiring and retail sales

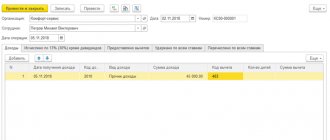

When conducting retail sales, payment by acquiring is reflected in the “Report on Retail Sales” document. In this case, everything is done automatically. Data on such payment are displayed on the “Non-cash payments” tab.

This document created the transactions shown in the figure below.

How to conduct operations in a budget institution

Plastic card payments may be reflected differently, depending on the type of organization. Acquiring is a bank service for individual entrepreneurs, LLCs and enterprises that helps make non-cash payments to the company’s account. It can be used by LLCs or individual entrepreneurs who have a bank account.

The main difficulty is that budgetary organizations already have a personal account with the Federal Treasury. But the legislation does not prohibit paying not with cash, but with plastic cards in budgetary institutions. The money will go to your existing account.

If we need to reflect in the report the costs of purchasing/renting a terminal, then the reflection of the transactions will be as follows:

| Operation | Debit | Credit | Budget |

| The terminal has been accepted for registration | 3B 01 | – | 60,000 rubles |

| Rent for the terminal has been charged (once a month) | 2 109 90 224 | 2 302 24 730 | 700 rubles |

| Terminal rent listed | 2 302 24 830 | 2 201 11 226 | 700 rubles |

| Services provided for which income was transferred | 2 205 31 560 | 2 401 10 130 | 80,000 rubles |

| VAT charged (if any) | 2 401 10 130 | 2 303 04 000 | 8,000 rubles (if it is 10%) |

| The service was paid for by the consumer using a bank card | 2 201 23 510 | 2 205 31 660 | 80,000 rubles |

| The amount is credited to the personal account | 2 201 11 000 | 2 201 23 000 | 80,000 rubles |

| Commission charged for bank services (2.5%) | 2 109 90 226 | 3 302 26 730 | 2,000 rubles |

| Interest transferred to the bank (2.5%) | 2 302 26 830 | 2 201 11 226 | 2,000 rubles |

Use of cash register systems in acquiring

Sellers who accept bank cards for payment are required to use online cash registers. Indeed, according to paragraph 1 of Article 1.2 of the Federal Law of May 22, 2003 No. 54-FZ, cash register equipment is used in calculations. Payments, among other things, mean the receipt and issuance of money by bank transfer (Article 1.1 of Law No. 54-FZ). And using a payment card is a type of non-cash payment. Thus, when acquiring, it is necessary to punch out cash receipts and transfer information to the fiscal data operator (FDO).

An important detail: if the client pays using a card, the seller is obliged to issue him not one, but two checks. The first is a regular cashier's check, which looks exactly the same as if the buyer paid cash. The second is a cash terminal receipt (slip). It must indicate all the necessary details, in particular, the electronic terminal identifier, date, amount, currency of the transaction, etc. The slip also requires the cashier's signature. The client’s signature is required only if he does not enter the PIN code of his card (clause 3.3 of the Central Bank Regulations dated December 24, 2004 No. 266-P*).

Retail wiring

In accounting, goods sold at retail and paid for by card are reflected in account 57. A separate sub-account 57.3 is opened for it.

It refers to active accounts: then the debit indicates the actual amounts of purchases, including settlements with clients (correspondence with account 62). And for a loan – the actual amount credited to the company’s account.

How to carry out acquiring in retail trade in accounting:

- Dt 57 Kt 90.01: sales revenue;

- Dt 90.03 Kt 68.2: accrual of VAT on the sales amount;

- Dt 51 Kt 57: crediting of funds made via non-cash payment;

- Dt 91.2 Kt 51: indicate the amount of interest withheld by the bank for the acquiring service, let’s say 2.7%.

Each bank sets its own percentage, depending on the monthly turnover of the company.

How do payments occur using cards?

Recently, suppliers of goods and services are increasingly providing customers with the opportunity to pay using plastic cards.

This type of mutual settlement is called acquiring. When acquiring, the supplier enters into an agreement with the bank, and the bank installs an electronic device (POS terminal) in the office or store that allows you to read information from the client’s cash card. In addition, the bank opens an account for the supplier into which the proceeds will be received. At the time of payment, the required amount is debited from the client’s card, and after some time (usually a day or two) is credited to the seller’s bank account.

If trade is carried out via the Internet, buyers most often pay directly on the supplier’s website without using a POS terminal. In this case, the client fills out a special secure payment form and indicates information about his card in it. After this, the money is debited from the card and credited to the supplier’s account. This payment method is conventionally called Internet acquiring.

For acquiring services (including Internet acquiring), the bank charges the supplier a fee in the form of a percentage of the payment amount. The percentage is withheld immediately at the time of payment, and the proceeds go to the seller’s account minus the interest.

Bank commission accounting

The interest transferred to the bank for using the acquiring service is set by the bank itself. Each organization has its own. At Sberbank, the interest rate for non-cash payments is 1.6% and higher.

The commission depends on the direction in which the organization operates, how much monthly turnover is, what type of acquiring service is used: trade, mobile (wireless terminal) or Internet acquiring.

The postings indicate the percentage specified in the agreement with the bank. Or rather, the amount in rubles that makes up this percentage.

For example, a financial institution has set a commission of 2.2%. The goods were sold for the amount of 3,000 rubles. Then 2.2% of this amount will be 66 rubles. This figure is indicated in expenses Dt 91.2 Kt 51.

The table shows 3 banks and their acquiring commission amount that you must pay:

| Bank | Trade | Internet |

| Tinkoff | 2.1% – 2.79% – basic tariff; 1% – 5.8% – for gastrointestinal tract services; 1.55% – 5.6% – for airlines. Tariffs are calculated based on monthly turnover | From 2.19% |

| Dot | 1.3% to 2.3% | 2, 8% |

| Module | 1.65-1.9% – standard and 1.8-2.5% depending on the payment system | From 1 to 4% |

There is no need to pay for setting up the terminals; the costs reflect only the amount of rental or purchase of the device.

Preliminary setup of accounting for acquiring transactions

First of all, we need to check whether we have all the settings for using acquiring in the 1C: Accounting 3.0 program.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Go to the "Main" section and select "Functionality".

On the “Bank and cash desk” tab and set the flag in the “Payment cards” setting. In our case, this part of the functionality was already enabled earlier. We cannot disable it for the reason that the program already reflected reports on retail sales and bank card transactions.

Postings depositing money into the current account of an individual entrepreneur – an individual entrepreneur deposits money into a current account – postings

Payments to suppliers can be made in cash and through a bank account. Transactions with “real” money are limited to an amount of 100 thousand.

How to transfer money to an individual entrepreneur’s current account and reflect it in accounting Also, the transfer of funds is necessary for settlements not only with clients, but also with suppliers.

Although having a settlement account for individual entrepreneurs is not mandatory in our country, it makes financial transactions much easier.

As an advantage, it can be noted that you can transfer money to current accounts without thinking about restrictions: there are no restrictions on the amount. Accounting entries for private funds of an individual entrepreneur - Accounting entries for private funds of an individual entrepreneur Dt 75 Kt 51 - it seems not entirely reasonable, since according to the chart of accounts this is an account of settlements with the founders, and founders are only in organizations - SO IT IS OBLIGATED.

Depositing personal funds into an individual entrepreneur's current account

An individual entrepreneur is an individual, not a legal entity. He can freely manage the money in his current account. The law allows you to transfer money to a personal account, withdraw it from an ATM, or top up your current account with cash or a card.

In the first two cases, everything is clear: earned - spent. And in what cases you need to top up your current account and how best to do it - we’ll figure it out in the article.

Why deposit personal money into a current account?

Ivan registers as an individual entrepreneur and opens a coffee shop.

Nobody knows about the coffee shop - so far only random passers-by and friends drop by. It’s good that Ivan brews delicious coffee - people are starting to recommend it. But in the first month of work, expenses are still higher than income. It's time to pay the rent: Ivan replenishes his current account with personal money.

In six months, Ivan recoups half of his investment and even hires a barista. The barista convinces the entrepreneur that buying a new coffee machine is a smart move because the coffee will taste even better. And if you launch an advertising campaign, there will be a line in the coffee shop. Ivan agrees and again deposits cash into the checking account.

The barista was right: business is looking up. A year later, Ivan is already opening a second coffee shop and preparing documents to launch a franchise. But the renovation of a new premises and the services of a lawyer are expensive. There is not enough money in the current account, and the entrepreneur replenishes it again.

Ivan could have other reasons for replenishing: paying off debts to partners, settling accounts with employees, paying taxes and insurance premiums. It is important that Ivan makes all business-related expenses from his current account.

If you purchase equipment, pay suppliers and pay salaries using a personal card, there will be no expenses on your current account. This is bad if you pay tax on profits: expenses from a personal card cannot be taken into account as business expenses - the tax will be higher.

To avoid this, pay business expenses from the individual entrepreneur’s account.

How to transfer money to an individual entrepreneur's account

An individual entrepreneur can replenish a current account with personal money as it is convenient for him: through a bank, ATMs, transfer systems or from a card. The main thing is not to forget to indicate the correct purpose of the translation. And, of course, choose a bank that offers free cash deposits

Purpose of payment when replenishing an individual entrepreneur's current account

To prevent the tax authorities from considering the transfer as income, the purpose of the payment must explain that this is the entrepreneur’s personal money. You can indicate the purpose in free form. For example, “depositing your own funds” or “replenishing with personal money.”

If you don't do this, the tax office will think that you are evading taxes. The inspector will see that you received the transfer, but did not indicate it in the declaration. Even if you have paid regularly for several years before, the inspector is obliged to issue a fine. After the transfer, it is difficult to prove that it was personal money.

The money must be transferred on behalf of the owner of the current account - that is, the entrepreneur. The tax authorities will regard a transfer from a relative as income from business activities - you will have to pay tax on it.

How to deposit money into a current account

Transfers cost money, and you will have to pay twice: to the bank through which you send, and to the bank where the current account is opened. To find out how much a transfer will cost, check the rates on the bank's website or ask the cashier. There are four ways to top up your account:

- Transfer from card. You can transfer money to an individual entrepreneur's account from a card of any bank. This can be done in your personal account on the bank’s website or in the mobile application - just know the account number or card that is attached to it. The method works wherever there is Internet.

- Top up via ATM. The first option is to insert the card attached to your current account and top it up in the usual way. The second option is to find the “replenishment of current account” item in the ATM menu, indicate the login and password issued by the bank, then deposit money. Not all banks have this feature. Information about the commission for replenishing your account is displayed on the ATM screen.

- Replenishment at the bank cash desk. To top up through the bank's cash desk, you need to come to the branch with your passport. The sending bank charges a commission for the transfer. The cashier will give accurate information about the commission and help you correctly fill out your account.

- Translation through the translation system. These are companies that transfer money for interest - Contact, Unistream and others. The commission is usually around 2%. The translation can be made at the company's office or through the website. Tariffs are on the website, but you can also find out from the cashier. To make a transfer you will need a passport and current account number.

Tax on replenishing your current account with your own money

The law does not recognize an individual entrepreneur’s own money as income. The IRS will not require you to pay tax on such a transfer, but may ask where you received the money from.

Where can you spend personal money from your current account?

Once personal money is deposited into a current account, it ceases to be personal. Now it's business money. You can spend them on business expenses: pay rent and supplies, transfer salaries, purchase equipment.

If your bank allows, you can spend the money you earn on personal needs directly from your current account. For this purpose, banks offer corporate cards linked to a current account. Such a card can be given to employees so that they can purchase office supplies or pay for lunch with a client.

What you need to remember about depositing personal money into an individual entrepreneur’s account

- An individual entrepreneur can freely deposit personal money into a current account. Transfer of personal funds is not income. There is no need to pay tax on it.

- To prevent the inspector from collecting tax, you must indicate the correct purpose. If you are transferring your own money, write “depositing your own funds” in the destination.

- For replenishment through a bank, you pay a commission twice - when sending and when depositing. The exception is replenishment within the same bank.

- Money can be spent on all business-related transactions: salary transfers, settlements with partners, purchase of goods.

- There are four ways to replenish an individual entrepreneur’s account: by card, at an ATM, at a bank cash desk and through a transfer system.

Source: https://tvoedelo.online/ip/vneseniye-sobstvennykh-sredstv-na-schet