Civil servant experience

How to calculate Legal experience includes time periods of performing duties within the walls of various government bodies. This is an activity in any legal office in positions that require a mandatory legal education. It also includes the time interval for performing work functions in other positions related to the sphere of maintaining the rights of citizens and business entities.

Example:

the period of receiving compulsory social insurance benefits during the period of temporary disability.

What is Managerial Work Experience?

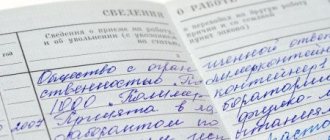

1. In the tabular part of the Work Activity form, indicate information about the employee’s previous places of work.

From January 1, 2010, the insurance period, along with periods of work and (or) other activities, includes periods of military service, as well as other service provided for by Law No. 4468-1 of February 12, 1993 (clause 1.1 of Article 16 of the Federal Law dated December 29, 2006 No. 255-FZ). During military service, citizens are not subject to compulsory social insurance in case of temporary disability and in connection with maternity. Periods of military service under conscription and contract are taken into account when calculating benefits after a former soldier gets a job under an employment contract.

Accounting for general experience (read more...)

What is work experience in a specialty?

Work experience in a specialty is the period during which a person performed work under an employment contract in a specific position or group of similar positions.

Today there is the concept of “insurance period”. It includes periods of both work and service in government positions. The length of service is determined by the work book. However, the insurance period is not equal to the work experience in the specialty, since it includes any work, in any position. Experience in a specialty includes time spent in a specific position or group of positions. For example, length of service as a judge includes time spent as a judge and time spent in certain other positions, such as an assistant judge.

What else is included in the work experience in a specialty?

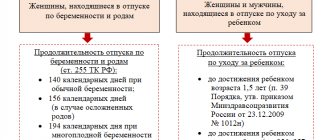

- Maternity and childcare leave for up to three years.

- Leave without pay.

- All periods of sick leave when a person works in an organization in a certain position.

As for the qualification requirements for work experience in the specialty, they are prescribed for certain positions. For example, for those applying for a job in internal affairs bodies (Part 7, Article 36 of the Law “On Service in Bodies...” dated November 30, 2011 No. 342-FZ), in an insurance company (Clause 2 and 3.1 of Article 32.1 of the Law “On Organization...” dated November 27, 1992 No. 4015-1). Qualification requirements for work experience in the specialty are also established for notaries (clause 2, part 1, article 2 of the Fundamentals of Legislation on Notaries dated 02/11/1993 No. 4462-1), lawyers (part 1, article 9 of the Law on Advocacy dated 31.05. 2002 No. 63-FZ), judges, etc.

In addition, work experience in the specialty is required to obtain a certificate of admission of SROs to perform certain types of construction and engineering work. According to Part 8 of Art. 55.5 of the Town Planning Code of Russia, in order to obtain a certificate, a requirement is also established: work experience in the relevant specialty for at least 5 years.

Accounting for general experience in the 1C: Salary and Personnel Management program 8 (revision 2.5)

General experience 2. In the tabular part of the General experience form, enter information about the employee’s length of service.

From the draft document published on the official website of the Eurasian Economic Union, it follows that a citizen will be able to apply for a pension when he reaches the age of retirement both in his country of residence and in the state where he works. He will be able to receive money from both states for the time actually worked. That is, the length of service gained while working in the Russian Federation is taken into account by the Pension Fund, and the period when he had work experience for a pension in his homeland will be taken into account by the competent authorities in the field of pensions in another country.

Work experience is divided into the following types: general and special. Special experience is part of the general experience. A special type of special experience is length of service.

Work experience is the total duration of labor or other socially useful activity (and other periods included in the length of service) of a citizen. Work experience has legal significance when assigning labor pensions for old age, disability, loss of a breadwinner, appointment to a position, etc.

For reference: the time citizens spend in military service is counted towards length of service and length of service in their specialty (in the industry) (part two of Article 5 of the Law of the Republic of Belarus “On Military Duty and Military Service”).

Length of service is a type of work experience, namely, special work experience with special working conditions or length of special professional activity, with which pension and labor legislation relates the provision of pensions and benefits.

For reference: when calculating special work experience for assigning an old-age pension for work with special working conditions, lists of industries, works, professions, positions and indicators that give the right to such a pension, approved by the Council of Ministers, are used (Article 14 of the Law of the Republic of Belarus dated April 17, 1992 No. 1596-XII “On pension provision”).

Belarusian legislation provides for the employer the opportunity to provide employees who have work experience in one industry with an additional payment for length of service. The establishment of this kind of additional payment is an incentive measure that encourages the employee to have a long-term employment relationship with enterprises belonging to the same industry.

Let us note that the forms, systems and amounts of remuneration for workers, incl. and additional incentive and compensatory payments are established by the employer on the basis of a collective agreement, agreement and employment contract (Article 63 of the Labor Code of the Republic of Belarus (hereinafter referred to as the Labor Code)). However, for remuneration of employees of organizations financed from the budget and using state subsidies, the forms and systems of remuneration are established by the employer, and the amounts are established by the Government or an authorized body (part three of Article 63 of the Labor Code).

Thus, if the enterprise does not belong to the category of organizations financed from the budget and receiving government subsidies, the employer has the right to independently determine the conditions, procedure and amount of the provision of these additional payments.

Organizations can establish salary bonuses or other benefits to employees for long work experience in their specialty (in the industry), incl. payment of monthly bonuses for long work experience in the specialty (in the industry), as well as a one-time remuneration for long work experience at this enterprise. The sources of regulation of labor and related relations are collective agreements, agreements and other local regulatory legal acts concluded and adopted in accordance with the law (clause 3 of part one of Article 7 of the Labor Code), for example the provision on wages and material incentives (hereinafter - Position).

The Regulations must define the specific name of the bonus (for example, bonus for length of service in an organization, specialty (industry), etc.), as well as the procedure and conditions for paying these bonuses.

As an additional measure to secure highly qualified personnel at the enterprise, the employer may also provide for the payment of a one-time remuneration for long work experience in the organization. This will enhance the motivation of workers to accumulate production experience and will ensure, on this basis, an increase in qualifications and professional skills. The basis for the payment of a one-time remuneration may be a local regulatory act of the employer, for example, a regulation on the procedure for paying a one-time remuneration.

An employer may simultaneously have several local regulatory legal acts governing additional incentive payments, in this case - a regulation on the procedure for paying bonuses for the duration of continuous work in the industry and a regulation on the procedure for paying a one-time remuneration for a long period of work in a given organization.

Situation

The regulation on the procedure for paying bonuses for the duration of continuous work in the industry to LLC employees provides for a monthly bonus for the duration of continuous work in the specialty (in the industry) in the following amounts:

– from 5 years to 10 years – 20%;

– over 10 years – 30% of the tariff rate, official salary.

For reference: continuous work experience implies a period of work in a given organization and a period of previous work in the specialty (in the industry). Periods of work to be included in the length of service in the specialty (in the industry) are summed up regardless of the duration of the break in work. Work experience in a specialty (in the industry) is calculated in years, months and days.

The regulation on the procedure for paying one-time remuneration for length of service to LLC employees establishes the payment of a one-time remuneration for long service. Remuneration is paid to employees who have worked in this organization in the following amounts:

– from 5 to 10 years – 2.0;

– over 10 years – 3.0 tariff rate, official salary.

Let's look at the table. 1 and 2 using the example of calculations for some employees of the enterprise, how such allowances are calculated and reflected in accounting.

In accordance with the Regulations, the bonus for length of service at the enterprise is calculated once a year, so all calculations will be made for December of the current year (see Table 2).

Incentive payments are the above-tariff part of wages. They are established with the aim of creating incentives among employees for higher labor productivity (for high achievements in work and a high level of qualifications, professional excellence, the presence of an academic degree and title, etc.), for long-term performance of labor duties in a certain field of activity.

The amounts of remuneration and incentive payments calculated in accordance with Decree of the President of the Republic of Belarus dated January 23, 2009 No. 49 “On some issues of stimulating the sale of products, goods (works, services)” (hereinafter referred to as Decree No. 49) are included in costs in full (sub. 1.3 clause 1 of Decree No. 49).

If we refer to Art. 131 of the Special Part of the Tax Code of the Republic of Belarus (hereinafter - TC), then in the list of costs not taken into account for taxation, such payments as length of service, length of service are not included in this article.

Based on the above, accrued incentive payments (length of service, length of service) are considered expenses taken into account when assessing income tax in full.

For reference: the costs do not include payment for additional leaves for irregular working hours, for long work experience in one organization , incentive leaves that can be provided under a collective labor agreement by the employer (subclause 1.3, clause 1, article 131 of the Tax Code).

What is Managerial Work Experience?

Important! Exceptions for non-Russian citizens are established by Federal Laws or international treaties.

- Men reach the age of 60, women - 55 years. Certain categories of citizens have the right to apply for early pension payments (some of them are listed above). The age for men in civil service has now been increased to 61 years, for women - to 56 years. Thereafter, the age should be increased every 12 months (until 2032) until reaching 65 (for men) and 63 years (for women).

- Having CC in the current 12 months is a minimum of nine years, with subsequent increases every 12 months up to 15 years in 2024.

- The value of the individual pension coefficient in 2021 is at least 16.2, with a subsequent increase every 12 months up to 30 points in 2025.

What to do if you don’t have enough experience (read more...)