Even now, Soviet work experience is of particular value for people already retired, or those citizens who are just about to retire.

Experience in the USSR is not a warm memory of the times of youth, but a practical significance for a person, which will affect his material well-being. In other words, length of service is of considerable importance for the size of the pension.

The length of Soviet service is the key to the assignment of a pension benefit, the assignment of a veteran title, a high percentage of valorization and the length of service indicator when calculating pension benefits.

Therefore, you must take advantage of every opportunity to include periods in your work experience that the legislation of the Russian Federation allows. And this is quite difficult to do, given the fact that the process of assigning pensions and, accordingly, calculating length of service, has already changed several times in the country.

A complete list of conditions under which Soviet experience gives the right to recalculate a pension

Let's look at the periods that are necessarily included in the length of service of the USSR, depending on the time frame of production and intended purpose.

What is insurance experience

Companies and individual entrepreneurs must pay insurance premiums for their employees (individual entrepreneurs also for themselves). By transferring payments to the budget, they become insurers for individuals. This obligation is established, in particular, by the Federal Law of December 15, 2001 No. 167-FZ and the Federal Law of December 29, 2006 No. 255-FZ. Insurers are also arbitration managers, notaries, lawyers, etc. (Article 6 No. 167-FZ, Article 2.1 No. 255-FZ). Individual individuals can pay insurance premiums at their own discretion, for example, self-employed citizens (Article 29 No. 167-FZ).

The insurance period is the sum of the periods during which contributions for the relevant type of insurance were sent to the budget, and other periods listed in legislative acts. The insurance length indicator is important for determining the amount of the following payments to a citizen:

- old age insurance pension;

- benefits for temporary disability (sick leave) and maternity benefits.

Insurance experience for pension insurance

From birth, an individual has an individual account opened in the Pension Fund. This account records all pension insurance payments made by the employer or other person, including the citizen himself. The period during which contributions to the Pension Fund were paid will constitute the main part of the insurance period when calculating the pension.

Important!

There is a limit on the amount of insurance coverage from which an individual has the right to receive an old-age insurance pension. Until 2015, the condition for receiving a pension was a five-year insurance period. By 2024, the length of service required to receive a pension will be 15 years (Article 8 of Federal Law No. 400-FZ dated December 28, 2013 “On Insurance Pensions”). The transition period to increase the minimum insurance period is currently ongoing:

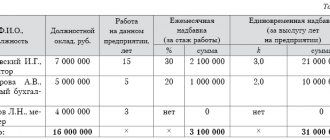

| Year of pension assignment | Minimum insurance period |

| 2020 | 11 years |

| 2021 | 12 years |

| 2022 | 13 years |

| 2023 | 14 years |

| 2024 and later | 15 years |

The pension due to a citizen is calculated on the basis of the individual pension coefficient. Its value, in turn, depends on the insurance period.

The rules for calculating the insurance period for the purposes of pension insurance are established by Federal Law No. 400-FZ “On Insurance Pensions”, as well as the Decree of the Government of the Russian Federation dated October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions.” An employee’s insurance period includes not only work activity, but also other periods of life. The full list is specified in Article 12 of Federal Law No. 400-FZ. Let us give some examples of them:

- military service;

- periods of being on sick leave and receiving appropriate benefits;

- period of receiving unemployment benefits;

- the period of care of one of the parents for the child until he reaches one and a half years old (no more than six years in total);

- length of stay in custody or in places of detention of persons brought to criminal liability without justification, etc.

It is necessary to take into account that such periods cannot be included in the insurance period if before or after them no insurance contributions were paid to the Pension Fund for the individual.

An employee can work part-time. In this case, insurance premiums will be paid by each policyholder. However, only one of the periods can be included in the insurance period. The period for calculating the insurance period is taken based on the individual’s application.

If a citizen worked abroad, and this period was taken into account when determining a pension in another country, such a period is not included in the insurance period.

Counting Features

When calculating (using an online calculator or manually, it doesn’t matter), the employer must adhere to the established requirements:

- Maintaining calendar order. The dates that are included in the work book (for individual entrepreneurs - in the tax return) are taken into account. If two or more periods coincide, the most profitable one is taken into account.

- Citizenship of the Russian Federation. If a person has the right to payment under the laws of a foreign state and there is no correlation with the norms of the Russian Federation, the period will not be taken into account in the calculation.

- Farming. Citizens working on private farms who are farmers will be able to include the time of such activity in their length of service, subject to contributions to the funds.

- Activities for an individual - subject to the implementation of activities under an agreement and payment of fees.

- Copyright agreement - subject to deduction of contributions to the funds.

- No retroactive effect. This means that if previously the period was included in the length of service, if the legislation changes, it may be included in the insurance period.

Social insurance experience

The periods of payment of social insurance contributions form the main part of the insurance period taken into account when calculating benefits:

- Maternity benefit.

If a woman’s work experience is less than six months, the amount of the monthly benefit cannot be more than the minimum wage (Article 11 of the Federal Law of December 29, 2006 No. 255-FZ), which from 2021 is 12,130 rubles. If the period worked is greater than or equal to one half a year, payments will be calculated based on 100% of average earnings.

- Temporary disability benefit.

Depending on the length of the insurance period, the amount of benefits is determined:

- up to 5 years of experience - the benefit is determined as 60% of average earnings;

- experience from 5 to 8 years - 80% of average earnings;

- 8 years of experience or more - 100% of average earnings.

When calculating sick leave payments, there is also a limitation of 6 months of insurance experience: less than this period, benefits are accrued in an amount not exceeding the minimum wage.

The procedure for calculating length of service for determining maternity benefits and sick leave is established by Art. 16 of the Federal Law of December 29, 2006 No. 255-FZ and Order of the Ministry of Health and Social Development of Russia of February 6, 2007 No. 91. The period of contribution includes the periods of deduction of contributions, as well as other periods listed in Part I of the Order.

Unlike pension insurance, with social insurance the length of service does not include periods of work under the GPC. There are other discrepancies between these types of insurance experience. For example, social insurance does not take into account periods of official unemployment, unjustified detention, etc.

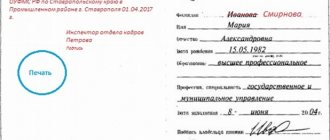

How to confirm other periods included in the length of service

A number of periods are taken into account for which contributions are not deducted, but the periods themselves are taken into account in the insurance period. How can I confirm them? Thanks to the legislator - answers to such questions exist:

- Military and other equivalent service - information from the military ID, certificates from the military registration and enlistment office, military unit, papers from the archive, work books. The offset occurs based on the actual duration of the period, without preferential calculations.

- Period of absence due to illness - documents from the employer or the Social Insurance Fund regarding the time of payment of sickness benefits.

- Time to care for a child up to 1.5 years old - birth documents, certificate of cohabitation, etc.

- Time registered with the employment service - a certificate from this organization.

- Time spent in custody - documents that need to be obtained at the FSIN institution.

- Caring for a disabled person of 1 year, a disabled child, a person over 80 years old - with the help of papers recording the fact and duration of disability - an ITU extract, and to confirm age - a passport, birth certificate.

- Spouses of diplomatic representatives during their stay outside the Russian Federation - with the help of certificates from the institutions that sent the employee to work.

- Spouses of military contractors who serve in places where there is no opportunity for employment confirm the period:

- until 01/01/2009 - certificates from military units, military registration and enlistment offices;

- after 01.01.2009 - certificates from the military unit, military registration and enlistment offices and certificates from the employment service.

- In case of service outside the state - only a certificate from the military unit or military registration and enlistment office.

Thus, the article provides an answer to the question: how to calculate length of service using a work book (the calculator and the rules for working with it are discussed above), and also provides a list of periods included in the calculation.

What is the difference between insurance experience and labor experience?

The term “work experience” is used quite rarely in current practice. Until 2002, it was used to calculate pension payments. Its main difference from the insurance period is the absence of connection with the payment of insurance contributions to the Pension Fund. The amount of work experience depends only on work activity, i.e., the period reflected in the work book of an individual. Nowadays, length of service is used to determine a citizen’s length of service in the period before January 1, 2002, the period of work in difficult climatic conditions, when determining benefits and allowances, and in some other cases.

The length of service may differ in the number of years from the insurance period. For example, a citizen worked under an employment contract for 5 years. After his dismissal, he operated as an individual entrepreneur for 2 years, and after that, for three years he worked under a GPC agreement, also with the payment of insurance premiums. In this case, the individual’s work experience will be equal to only 5 years - the time of official employment. And the insurance period will be 5 + 2 + 3 = 10 years - the period during which contributions were received into the budget.

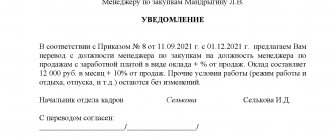

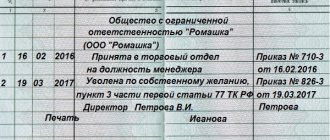

If there is no labor

An employer may be faced with a situation in which:

- no workbook;

- the work book is available, but there are no records in it for any periods of the person’s work;

- erroneous or incorrect information has been entered.

In the listed cases, in order to calculate the length of service correctly and confirm the period, you need a written work agreement. It must be drawn up in accordance with the laws in force at that time;

- collective farmer's workbook;

- certificate provided by the employer (or government agencies);

- extracts from orders;

- extracts from personal accounts;

- salary slip.

Why is it important to correctly calculate your insurance period?

Incorrect calculation of length of service may result in claims from authorized bodies. Thus, the period of an employee’s work in the organization is reflected in the SZV-STAZH form, submitted annually to the Pension Fund of Russia. For providing false information, the employing company is subject to a fine of 500 rubles. for each insured employee. In addition, a fine is provided for officials - from 300 to 500 rubles.

As for length of service for social insurance purposes, the amount of benefits depends on it. Consequently, distortion of the duration of an individual’s work may lead to an error in calculations. As a result, the amount claimed for reimbursement from the Social Insurance Fund will be incorrect. If an incorrect length of service inflates the benefit amount, an arrears in insurance premiums will appear when the error is discovered. Arrears, in turn, entail the obligation to pay fines and penalties to the budget. Also, if the insurance period is incorrectly indicated in the PVSO register in the regions participating in the Direct Payments project, then the regional branch of the Social Insurance Fund will incorrectly calculate the amount of the benefit.

How to calculate the insurance period if an employee refuses a paper work book

What if in 2021 an employee submits an application asking to provide information about his work activities electronically? In this case, you need to give the employee his paper work record book and inform him that now he is responsible for its safety. There is a slight change in the article of the Labor Code: the number of documents that an employee presents when applying for a job includes not only a work book, but “and/or information about work activity.” The same changes are expected in Order of the Ministry of Health and Social Development No. 91, which determines how and on the basis of what documents the insurance period is calculated. Let us remind you that an employee can receive information about his work activity from the employer (there will be information only about the last place of work), as well as in the multifunctional center, the Pension Fund and in his personal account on the government services website. The employer, in turn, will receive this information only from the hands of the person applying for the job. After the calculations are completed and the insurance period is entered into the personal T-2 card, the documents are returned to the employee. Information on labor activity as part of the new SZV-TD reporting will also be included in the procedure for forming the insurance period for the assignment of benefits.

How to use the calculator

There is a special program for calculating length of service using a work book - these are so-called online calculators. They serve to calculate the duration of activity, taking into account the time of incapacity for work according to the work book. You must enter data carefully to avoid calculation errors.

Let's look at step by step how to use our online work history calculator.

Step 1. In the “Date of hire” field, from the drop-down calendar, select (in accordance with the work book data) the required date, month, year.

Step 2. In the “Date of dismissal from work” field, select the required date, month, year from the drop-down calendar.

Step 3. If you work for more than one employer, or have other time to be included in the calculation, select the “Add period” field.

Step 4. From the drop-down calendar, again select the desired dates in the “Date of hiring” and “Date of leaving work” fields (which periods should be included in the calculation are listed below).

Step 5. Click the "Calculate" field.

In the “Result” position you will see the total of the calculation in years, months and days. The values calculated by the work record calculator can be copied and saved.