- home

- Services

- Zero reporting

- Zero reporting to the Pension Fund

When an enterprise or individual entrepreneur does not operate, zero reports are submitted to the pension fund. This can happen for various reasons:

- the enterprise is registered before the beginning of the reporting period;

- the company has only a director, workers will be hired later;

- during the reporting period, no payments were made either to the bank account or to the cash register;

- The company temporarily suspended its activities, and all employees were put on leave without pay.

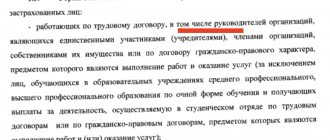

Zero reporting to the Pension Fund must be submitted by enterprises and individual entrepreneurs registered as an employer, but which have no employees or have not received payments.

Mandatory reports to the Pension Fund of Russia

There are several forms required to be submitted to the Pension Fund of the Russian Federation in 2021 - SZV-M, SZV-STAZH, SZV-TD, etc. In addition to mandatory reporting, Pension Fund employees have the right to request other information. For example, information about the insurance experience of specialists for past periods. The forms and deadlines for providing such data are usually reflected in a written request for information. The main reports are personalized, therefore zero reporting to the Pension Fund in 2021 is not provided for by current legislation. In any organization there is always a director who works even when there is no activity. Reporting is filled out for him.

Still have questions? ConsultantPlus experts discussed how to fill out the SZV-STAZH in 2021. Use these instructions for free.

How to fill out zero reporting from the Pension Fund of Russia

Any legal entity or enterprise, regardless of its form of ownership or type of taxation, has certain rights and obligations. One of the main obligations to the state is the timely submission of relevant documents and reports to state control bodies. If an enterprise does not receive the required income during the reporting period, this does not relieve it from fulfilling this obligation.

If for some reason the enterprise did not conduct business activities for the specified period, but is still listed as an employer, then zero reporting is submitted to the Pension Fund of the Russian Federation.

When filling out the zero reporting form for submission to the Pension Fund, you must indicate the exact number of insured persons. Most often, this is one director of the company, if there is no activity. You also need to fill in the name of your organization, the period for which you created the report, and the address of the company. RSV-1 must be filled out in two copies. One of them will remain with you with the seal of the Pension Fund. If you decide to send the report by mail, then you keep one completed report for yourself, and instead of the Pension Fund stamp, keep the receipt from the post office.

Zero reporting to the Pension Fund must be submitted every month before the 15th. For example, a completed form is submitted before:

- May 15,

- August 15,

- 15th of November,

- February, 15.

Note 1

In addition to the Pension Fund, you should remember about reporting to statistical authorities, tax authorities and the social insurance fund.

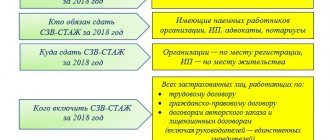

Position of the Pension Fund

The Pension Fund constantly informs employers about the specifics of submitting reports. The Pension Fund of Russia has repeatedly issued clarifications on whether it is necessary to take SZV-STAZH with zero reporting; the latest of them expressed an unequivocal position that it is necessary to report even if an employment contract has not been concluded with the director - the only founder, and there are no other employees in the organization . There is a peculiarity in drawing up a report in this situation. An SZV-M is submitted to the sole founder-manager without an employment contract every month.

The SZV-TD form is not required to be issued to a manager with whom there is no employment contract. This personalized report is submitted only if an employment relationship arises in the form established by the Labor Code of the Russian Federation.

Responsibility for late submission of reports

Incorrect, untimely sending or failure to submit zero reporting at all threatens the enterprise with penalties in accordance with Article 80 of the Tax Code of the Russian Federation.

A fine may also be assessed if there is no information letter explaining that the company is temporarily not operating.

In the case of PFR reporting, the fining party is the fund itself. The cost is purely symbolic: failure to submit zero reports for one quarter is punishable by a fine. However, if such negligence is repeated, the amount increases tenfold.

In addition, the company's current account may be blocked, but the company is unlikely to notice this, given that during downtime, transactions on the current account should not occur. In this situation, the enterprise loses not only money, but also, what is much more important, favorable attitude from government agencies, which should not be abused.

To keep records of warehouse operations, it is necessary to carefully record the movement of products in the warehouse. Primary documentation provides great assistance in this, which includes all the papers accompanying commodity units when moving from the supplier to the warehouse and from the warehouse to the consumer.The procedure for accounting for goods in a warehouse varies depending on the methods of storing materials and on some other factors, such as, for example, the frequency of receipt of materials at the warehouse. Read about warehouse accounting of goods here.

It is necessary to understand that any document flow with the participation of government bodies, be it the Social Insurance Fund, the Pension Fund of the Russian Federation or the tax office, is a very important matter. Timely submission of all reports guarantees the entrepreneur no problems in the future, as this once again proves the responsibility with which the businessman approaches his business.

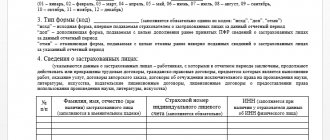

SZV-STAZH without employees: to submit to the Pension Fund or not

SZV-STAZH is taken by all organizations with hired employees. According to the law, SZV-STAGE cannot be zero. Even if the organization has only a general director, who is the only founder, zero reporting is submitted under SZV-STAZH for organizations under the simplified system for 2021 or under other taxation systems. The annual form SZV-STAZH does not provide for submitting a report with empty fields; it is necessary to indicate the data of the person who actually works. If you do not fill out the tabular part (there will be no records about the insured persons), then the report will not pass the logical control of the Pension Fund of Russia and will not be accepted.

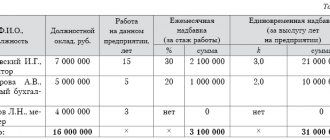

Another question that worries the management of organizations that do not conduct business activities is whether it is necessary to submit a zero SZV-STAZH for 2021 if there were no payments - yes, and here it is necessary to take into account the peculiarities of filling out the data. If the organization employs the only founder as a general director without an employment contract, he does not receive a salary. In this case, what should I put in column 11 of section 3 of the SZV-STAZH report? If there are no payments of insurance premiums for the employee, when taking leave without pay, o. is entered in this column. But if an employment contract has not been concluded with the general director, then leave at his own expense is not issued to him. Experts recommend that in such a situation, too, bet on insurance premiums. Pension Fund specialists will not have any questions regarding the lack of insurance contributions for the period of service specified in the report. This is what the SZV-STAZH report looks like for the sole founder-manager:

How to fill out RSV-1

The RSV-1 zero calculation is submitted to the Pension Fund in accordance with the established form. It must contain and be filled in:

- title page;

- sections 1 and 2 (subsections 2.1 and 2.5) with dashes in the columns where calculations of the amounts of contributions accrued to extra-budgetary funds were previously entered;

- section 6.8, column 7, which reflects the reasons for submitting zero reports. So, if the code NEOPL was indicated, this means that the employees were on leave without pay.

An explanatory note can be attached to the RSV-1 calculation, in which you need to disclose the situation why zero reporting is submitted.

Zero form SZV-M in the Pension Fund of Russia

If the company has at least one employee with whom an employment contract or a civil law contract has been concluded, then the SZV-M must be taken. Moreover, the position of this employee does not matter. This clause directly applies to directors and management companies.

The reporting includes information about insured persons with whom employment contracts or civil servants' agreements were concluded during the reporting period. Even if in the current month there is no obligation to calculate and pay insurance premiums for such employees, SZV-M will have to be submitted. For example, if employees went on a long vacation at their own expense, then they are reported to the Pension Fund on a general basis.

IMPORTANT!

If the report contains information about the insured person with an error, a fine of 500 rubles will be issued for this. A similar penalty is provided for each specialist who was forgotten to be indicated in the reporting form.

We described the reporting rules in more detail in a separate material, “SZV-M reporting: step-by-step instructions for filling out.”

To avoid sanctions, prepare zero reporting to the SZV-M Pension Fund. This will have to be done in the following cases:

- The activities of an individual entrepreneur or company have been suspended.

- The activity is seasonal and it is low season.

- The company has no employees, only the director.

- An employment contract has not been concluded with the sole director.

- There are no accruals in favor of employees.

- Other cases provided for by law.

About how to correctly draw up a report and in what situations it is necessary: “In what cases is a “zero” SZV-M drawn up and submitted.”

What do you submit if you report zero to the Pension Fund?

First of all, the RSV-1 form is submitted. It is submitted at the end of the reporting and billing period, even if the enterprise or individual entrepreneur has temporarily suspended its activities. This is stated in the letter of the Ministry of Labor of the Russian Federation dated September 29, 2014 under number 17-4/ОOG-817. If no economic activity was carried out and no payments were made to individuals, and therefore no insurance premiums were accrued, a zero calculation of RSV-1 must be submitted to the Pension Fund office at the place of registration. However, from 2021, instead, you need to submit a calculation of insurance premiums to the Federal Tax Service. Therefore, the last report for 2021 on RSV-1 must be submitted in writing by 02/15/17, and electronically by 02/20/2017.

In addition, starting from 2021, enterprises and individual entrepreneurs must submit the SZV-M reporting form.

Responsibility for the absence of zero reports to the Pension Fund of Russia

Russian organizations are subject to significant fines for failure to submit mandatory reports to the Pension Fund. Thus, for untimely submission of SZV-STAZH, the company will be fined 500 rubles for each insured person who should be indicated in this form. That is, if there are 10 people in the company, you will have to pay 5,000 rubles for late submission of SZV-STAZH.

The form is submitted monthly, so if the deadlines are violated several times, the amount of the fine increases. Many companies, fearing fines, do not take risks and submit zero reports. To figure out whether it is worth sending zero reports, let us recall the conditions for filling them out.

for the sole founder-manager

Resources for submitting zero reporting to the Pension Fund

If time is limited and you do not have time to fill out the necessary data and prepare lists for zero reporting, then you can use one of the specialized computer resources. Such services perform work on the report for a low price and are in demand in such situations. In order for the resource to create a report, the entrepreneur needs to fill in the basic details and codes of the organization, and then the program itself will create a zero reporting of the Pension Fund of the Russian Federation and send the finished task to the email of the individual entrepreneur or his organization.

You should also choose the form of the enterprise - a legal entity or an individual entrepreneur, because there are certain differences between the forms. The cost of such assistance is quite reasonable and you can pay for it in any convenient way.

Need advice from a teacher in this subject area? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Such resources will be especially beneficial for young companies that do not have the services of an accountant. Instead of studying all aspects of creating reports, it is easier for an entrepreneur to pay for finished work.

Should I submit a report if the organization did not work?

If a company or entrepreneur did not work during the reporting period or sent its employees on unpaid leave, SZV-STAZH, with zero reporting of LLCs and individual entrepreneurs, must be submitted. The insurance period for all employees of the organization (IE) continues to accrue, despite the interruption in the economic activity of the employer.

ConsultantPlus experts analyzed the main legislative changes in 2021 for an accountant of a budget organization. Use this manual for free.

to read.

NPO reporting to Rosstat

The list of reports and deadlines for each non-profit organization can be found on the website of the Federal State Statistics Service by filling out the appropriate fields: TIN, OGRN or OKPO. A number of federal statistical surveillance forms are submitted only when an observable event occurs.

If the statistical form itself indicates that it is submitted only upon the occurrence of a certain event, then zero statistical reporting is not submitted to Rosstat (Letters dated 04/08/2019 No. SE-04-4/49-SMI, dated 05/17/2018 No. 04-04-4/48-SMI, dated 01/22/2018 No. 04-4-04-4/6-SMI).

Special reporting of NPOs to the Ministry of Justice of the Russian Federation

There are special reports for NPOs that must be submitted to the Ministry of Justice of the Russian Federation. The composition of the reporting depends on the type of NPO and is posted on the website of the Ministry of Justice of the Russian Federation.

For example, for public associations, form OH0003, notification of continuation of activities, is filled out.

Information about NPOs that are foreign agents is submitted more frequently. For example, zero reporting includes a report on the activities of an NPO and information about its personnel. Such NPOs must submit an audit report, even if there was no activity.

NPOs that are foreign agents, as well as structural divisions of a foreign non-profit non-governmental organization are required to conduct an audit (Clause 1, Article 32 of Law No. 7-FZ).