The net assets (NA) of a company are a basic indicator that characterizes the overall welfare of the company, and also shows the potential value of everything that the company has. Having a correct idea of the size of a company’s NAV is also important for a potential investor, since the higher the value of the indicator, the greater the income from investing in such a company can be. That is why it is important to remember a number of essential points that will help you avoid making mistakes when calculating your net assets.

The net assets of an enterprise are...

net assets are the difference between the total value of the firm's assets, the rights it has, and the total amount of its liabilities. In other words, the NAV level shows what amount would remain at the company’s disposal if it were necessary to urgently pay off all existing debt obligations (regardless of the planned repayment period).

This indicator allows you to clearly assess the current financial position of the company: whether it is developing at the expense of its own funds, whether it has a sufficient financial “safety cushion” or whether it operates primarily at the expense of credit resources and, therefore, is characterized by a high level of obligations assumed, and therefore risks. .

In addition, in extreme cases, the value of the indicator in question in a company may even be negative. For more information, see the article “What are the consequences of negative net assets?”

In practice, any company (both JSC and LLC) often encounters some typical situations when it becomes necessary to correctly calculate the amount of net assets . What exactly could these situations be?

Details

Net assets are the difference between the value of a company's property and its debt obligations. This indicator can be either positive or negative. If it is greater than zero, it means that the company has enough assets to meet its debt obligations; if it is less, there is a shortage. The indicator makes it clear how stable the financial position of the organization is.

A negative indicator is one of the prerequisites for the liquidation of an organization, especially if it is below the minimum allowable amount of the authorized capital for the second year in a row (clause 11 of Article 35 of the Federal Law of December 26, 1995 N 208-FZ).

In what cases should net assets be calculated?

Firstly, it is necessary to identify net assets in order to keep the organization afloat and prevent its forced liquidation as required by the Civil Code of the Russian Federation. The point is that if a company for 2 financial years in a row has private equity, which in terms of value is less than the authorized capital (hereinafter referred to as the authorized capital) of such an organization, then its financial situation is considered critical. The situation must be corrected immediately, otherwise the company will have to be liquidated (Clause 4, Article 90 of the Civil Code of the Russian Federation).

Important! This shortcoming can be corrected in two ways: either reduce the amount of equity capital, leveling it with assets, or directly increase net assets .

Consequently, in the practice of any company, calculating net assets is an urgent task that has to be solved regularly, albeit with different frequency. In order to prevent a crisis state of the company’s asset structure, when it is necessary to take emergency measures, changes in the company’s NAV should be timely monitored.

Secondly, several circumstances, upon the occurrence of which the company is also obliged to calculate the value of net assets , are prescribed in the Law “On LLC” dated 02/08/1998 No. 14-FZ. In particular, this procedure is carried out if any LLC participant decides to leave the company’s owners. As a general rule, such a participant must be returned the value of his share in the organization in monetary terms (Clause 2, Article 23 of Law No. 14-FZ). The specified value of the share should be calculated based on the value of the company's NA in proportion to the share (as a percentage) of the participation of such owner in the company's business.

The second such circumstance is the situation when the owners decide to increase the company’s capital at the expense of the company’s funds. In this case, there is a limitation: if the amount by which the owners want to increase the capital is less than the value of current net assets minus the authorized and reserve capital, then the increase in the capital will not be allowed in accordance with clause 2 of Art. 18 of Law No. 14-FZ.

Thirdly, there is another typical situation when an organization needs to calculate the cost of its NA. It is typical for both JSC and LLC: it is the payment of dividends to participants. Due to the provisions of the law, an organization in the form of an LLC cannot pay dividends if its net assets are below the value of the authorized capital (clauses 1, 2 of Article 29 of Law No. 14-FZ). For a JSC, the situation is almost the same: dividends cannot be paid if the value of the private equity capital is less than the sum of the authorized and reserve capital (clause 4 of Article 43 of the Law “On JSC” dated December 26, 1995 No. 208-FZ).

Please pay attention! In addition to the above situations, others are possible when a company has to calculate this indicator, for example, at the request of a potential investor. At the same time, it is important to make the calculation as accurate and transparent as possible, and therefore document it.

Thus, in the daily practice of any company, there is a high probability of the need to calculate the value of the company’s NA. But how to calculate net assets correctly, without forgetting anything?

Analysis of indicators

Having completed the arithmetic calculations, we move on to analyzing the result obtained. With a positive amount of net assets in the balance sheet, we can conclude that the company is profitable and has high solvency. And, accordingly, the higher the indicator, the more profitable the enterprise.

Negative net assets are an indicator of the low solvency of an enterprise. In other words, a company with a negative NAV will most likely go bankrupt soon; the company will simply have nothing to pay off its debts. However, in such a situation, exceptional circumstances must be taken into account. For example, the company has just been formed and has not yet covered its costs, or the company received a large loan for expansion.

An increase in net assets can be achieved by increasing the authorized, reserve or additional capital or by reducing the founder’s debts to the enterprise.

Calculation of the value of an organization's net assets (formula)

On November 4, 2014, the Procedure for calculating net assets , approved by Order of the Ministry of Finance of the Russian Federation dated August 28, 2014 No. 84n (hereinafter referred to as Procedure No. 84n), came into force, which introduced a new algorithm for calculating the value of the net assets of business entities.

In accordance with Procedure No. 84n, the formula for calculating net assets can be presented as follows:

CA = Auch - Obligatory,

Where:

NA is the value of net assets as of a specific settlement date;

Auch is the total amount of assets at the disposal of the company that can be taken into account when calculating the NAV;

Obligation is the total amount of the company’s liabilities, which, according to the law, can participate in the calculation of net assets .

As can be seen from the formula, not all assets and liabilities of the company must be taken into account when determining the value of the NAV.

Thus, receivables from participants (owners) for payment for shares or for contributions to the company’s management company cannot be included in the calculation. In addition, if the organization has any property that it accounts for off-balance sheet accounts, then it should also not be taken into account when calculating net asset .

And from the company’s total liabilities, deferred income should be subtracted, which the organization recognized due to the provision of government assistance to it or in connection with the receipt of property free of charge. The resulting amount of liabilities will participate in calculating the cost of the asset.

Questions and answers on the topic

No questions have been asked about the material yet, you have the opportunity to be the first to do so

Definition

Net assets are a value determined by subtracting the amount of its liabilities from the total assets of the organization. Net assets are the amount that will remain to the founders (shareholders) of an organization after the sale of all its assets and the repayment of all debts.

The net asset indicator is one of the few financial indicators, the calculation of which is clearly defined by the legislation of the Russian Federation.

- Old and new balance sheet lines, 66 n

Where do the financial statements contain information about the value of net assets?

net assets as accurately as possible, one must have a reliable basis for calculation. Where can I get such a base? In the company's financial statements. Most of the indicators that are necessary to calculate NAV are contained in the company's balance sheet.

A balance sheet is required to calculate net assets , since all assets involved in the calculation must be taken at the value indicated in the balance sheet (clause 7 of Order No. 84n).

For more information about what information from the balance sheet is needed to calculate net assets, see the article “The procedure for calculating net assets on the balance sheet - formula 2015”, as well as in the publication “Net assets - what is it in the balance sheet (nuances)?”.

Please pay attention! The balance sheet, as a rule, is compiled by the company based on the results of the past year. However, if it is necessary to calculate the value of the company’s equity capital as of the current date, then for this it is advisable to draw up interim financial statements, including an interim balance sheet as of the last day of the previous month. Then the value of net assets will reflect the current situation in the company as accurately as possible.

How can you document the calculation of a company's net assets?

The legislator does not require the company to draw up any special document confirming the correctness of the calculation of the value of its NAV. At the same time, the value of the indicator itself is subject to reflection in the financial statements, namely in section 3 of the Statement of Changes in Capital (line 3600).

However, if a potential investor requires the value of net assets , then it would not be amiss to provide him not only with the value of the indicator, but also with its calculation. How to do it?

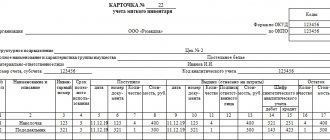

It is best to issue a detailed transparent calculation of the company’s NAV value in the form of a local reference document containing all the necessary calculation tables. There is currently no standard form for such a certificate. However, until 2014, a standard form for calculating the value of the private equity of a joint-stock company was in effect (approved by the order of the Ministry of Finance of the Russian Federation “On the assessment of the net assets of a joint-stock company” dated January 29, 2003 No. 10n and the Federal Commission for the Securities Market of the Russian Federation No. 03-6/pz).

This form can be downloaded from our website.

Despite the fact that the specified order is no longer valid, the form of such a form can be taken as a sample when drawing up a certificate of calculation of the company’s NAV for an investor.

Certificate of nominal value of LLC share - sample

Such a certificate is drawn up according to the same rules as a certificate of the actual value of the share. It is quite possible to combine them.

To do this, you need to indicate in an additional paragraph the data on the nominal value of the share. It is also possible to prepare a separate certificate, a sample of which can be downloaded from the link.

***

Thus, there is no single form of certificate on the actual value of the share, but it is drawn up according to the rules provided for in Art. 9 Federal Law No. 129. According to similar rules, a certificate of the nominal price of the share is drawn up.

Results

, any organization, be it a JSC or an LLC, faces a situation where it is necessary to determine the cost of the asset Companies must constantly monitor the current value of this indicator in order to prevent a crisis situation in the enterprise, the most negative consequence of which could be its liquidation. You should also know the current value of net assets when paying dividends or when paying a participant who decides to leave the company the value of his share in the organization. Therefore, you need to remember that all the necessary basis for calculating net assets as of the current date can be obtained by preparing interim financial statements at the end of the previous month. In addition, the correct calculation of the amount of net assets is important for the investor.

For this purpose, it is advisable for the organization to draw up the most detailed and transparent certificate calculating the value of such a company indicator. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.