The report to the Pension Fund SZV-STAZH, the sample of which is planned to be updated, must be submitted by all categories of employers by March 1, 2019. Currently, the document form approved by Resolution of the Pension Fund of January 11, 2017 No. 3p is in force, but changes will occur in it in 2019.

The employer is obligated to submit this type of report even in cases where the hired labor of at least one person is used. The main indicator for determining the need to submit a report is whether the enterprise or individual entrepreneur has valid labor contracts with individuals or civil servants’ agreements.

How SZV-STAZH has changed

Since 2021, personalized reporting forms, the procedure for filling them out and the electronic format have been updated. Among these changed forms is SZV-STAZH (Resolution of the Pension Fund Board of December 6, 2018 N 507p).

The following amendments have been made:

- The form no longer contains the “page” attribute: we no longer indicate the serial number of the page.

- The duplication of the policyholder’s registration number in the Pension Fund of the Russian Federation, as well as his Taxpayer Identification Number (TIN) and checkpoint, has been removed. Now this data is specified only once.

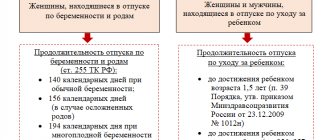

- Column 8 of the form is not filled out if column 11 contains the code “CHILDREN” (parental leave for a child under 3 years of age granted to a grandmother, grandfather, other relative or guardian).

- The wording of clause 1.5 has been expanded: the number of persons for whom SZV-STAZH is taken includes the heads of organizations that are the only founders (participants).

- In column 14 of the report, you need to enter the date of dismissal of the employee: previously, an “x” sign was placed here.

- If SZV-STAZH registers an employment center for the unemployed registered there, in column 14, opposite the citizen’s last name, the mark “BEZR” is placed.

Now let's move on to the details of filling out the SZV-STAZH for 2021.

How to fill out the accompanying inventory

You cannot send the SZV-STAZH form alone to the Pension Fund. It is mandatory to fill out an accompanying list of submitted documents. Without it, the report will be returned. For the inventory, use the unified form EDV-1.

Form EDV-1 was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 and has not changed in 2021.

The structure of the accompanying inventory contains five sections:

- Details of the policyholder. We fill in the same order. We indicate the registration number of the organization or separate division. Then enter the tax identification number and checkpoint. And only then enter the short name of the organization.

- Reporting period. We indicate for what period we submit information to the Pension Fund. We select the type of information from the proposed options: initial, corrective or canceling.

- List of incoming documents. It is necessary to indicate the number of insured persons for whom information is sent to the regulatory authority.

- Data on the policyholder on the presence of debts on insurance, funded pensions and other tariffs of insurance contributions. The report contains a separate table to reflect information about debt repayment.

- Section to reflect the grounds for early receipt of a pension.

The accompanying inventory is signed by the head of the insured organization. Or another responsible person vested with appropriate authority.

SZV-STAGE for 2021: useful tips

To prepare and pass the SZV-STAZH, you need to take into account the requirements of various regulatory documents. For example, you can find out about the deadline and forms of submission, addresses for submitting SZV-STAZH from Art. 11 of the Law “On Individual Accounting in the Pension Insurance System” dated April 1, 1996 No. 27-FZ. And the procedure for filling out and the composition of the report, as we have already found out, are determined in the Resolution of the Pension Fund Board of December 6, 2018 No. 507p. So that you do not wander through the texts of various regulations, we have concentrated the necessary information in a visual form:

In addition to the basic information presented in the figure, we will additionally give a few more tips:

- If during 2021 you have already submitted SZV-STAZH for employees retiring (type of information “Pension Assignment”), in SZV-STAZH (type “Initial”) at the end of 2021 these workers must be included again, regardless of whether the employee quit or continues to work.

- If you hired people from prison, information about them must be included in the SZV-STAZH, since the time worked is counted towards their length of service (Article 1 of Law No. 27-FZ).

- If the individual entrepreneur does not have any activities or employees in 2021, but performs the functions of a manager under the contract, SZV-STAZH is not submitted, since the individual entrepreneur pays contributions for himself (PFR letter dated July 27, 2016 No. LCH-08-19/10581 on analogies with SZV-M).

Form

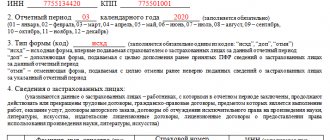

The report, the form of which was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018, contains 5 sections:

- information about the policyholder - the organization that submits the report;

- reporting period;

- information about the periods of work of insured persons - the tabular part of the report, which describes information separately for each employee;

- information on accrued insurance contributions to the Pension Fund;

- information on pension contributions paid under early non-state pension agreements.

In addition to the form, the Resolution of the PFR Board approved the procedure for filling it out. In 2021, this procedure has undergone minor changes: a new code “VIRUS” has been introduced, which is entered in column 10 if the corresponding codes are entered in columns 9 or 12. This code is used when filling out reports regarding employees of medical organizations and their departments working with COVID -19.

Otherwise, the procedure for filling out the SZV-STAZH form has not changed.

Made a mistake? Use free instructions from ConsultantPlus experts to correctly fill out and submit the correction form. If you don't do this on time, you will pay a fine.

to read.

Report on separate divisions: to pass or not?

A separate SZV-STAZH for a separate unit must be drawn up if in 2021 2 conditions were met simultaneously:

- Directly in the division itself, employees were accrued and paid wages.

- The division has a separate current account.

When completing Section 1 “Information about the policyholder”, you must indicate the checkpoint of the department. Such a report must be submitted at the location of the separate unit.

If the conditions are not met, information on department employees must be included in the SZV-STAZH submitted at the location of the company.

Who rents

All economic entities that have employees are required to submit reports to the Pension Fund. Not only organizations, but also individual entrepreneurs, lawyers, notaries, and detectives are required to submit it.

IMPORTANT!

Having an employment contract with an employee is not the only condition. A report should be submitted to the Pension Fund for employees working under civil contracts, as well as under copyright contracts and licensing agreements.

Reporting is generated not only for working citizens. You will also have to report on the unemployed. The responsibility falls on government agencies. The Employment Center reports to the Pension Fund on citizens officially recognized as unemployed.

IMPORTANT!

If the organization’s staff includes a manager, who is also the only founder, then you will still have to submit a SZV-STAZH.

Submission form SZV-STAZH

The policyholder can report to the Pension Fund of the Russian Federation using the SZV-STAZH form, drawn up on paper or electronically, if the condition on the number of insured persons is met. Threshold value ─ 25 people:

- if the number is 25 people and exceeds this limit, the policyholder has no choice: he is obliged to report on the TKS;

- if the number is 24 people or less, SVZ-STAZH can be presented in any of the specified ways.

The electronic SZV-STAZH must be signed with an enhanced UKEP. The paper report must be certified by the manager’s signature and seal (if the policyholder has one).

How to punish for violations and mistakes

Fines are provided for under Article 17 of the law on personal registration of insured persons and under the Code of Administrative Offenses.

| Violation | Fine |

| The report was not submitted on time | 500 rubles for each insured person |

| An error was made | 500 rubles for each employee whose information is found to contain errors |

| The format for providing information in electronic form is broken | 1000 rubles |

| The procedure for submitting SZV-STAZH when registering an employee for retirement was violated | 50,000 rubles (Part 1 of Article 5.27 of the Administrative Code) |

IMPORTANT!

Information from the SZV-STAZH reporting must coincide with the monthly SZV-M form and the quarterly DAM. If information about the employee was not received by the Pension Fund on a monthly basis, then the controllers will have a discrepancy. There is a fine for failure to provide information. The form and sample for filling out the SZV-M report (experience) can be found in the special material “Submitting reports: instructions for filling out the SZV-M.”

How many sections to fill

The number of sections to fill out depends on the type of information provided:

Each type of information has its own set of sections:

- In the SZV STAZH with the “Initial” and “Additional” types, you need to fill out sections 1, 2 and 3.

- In SZV-STAZH with the “Pension Assignment” type, all 5 sections are filled out.

If you are preparing a year-end report, you only need to fill out the first 3 sections.

Filling out a report upon dismissal

Upon dismissal, the employee is issued a SZV-STAZH only with his personal data (clause 4 of article 11 of Law No. 27-FZ). If this requirement is violated, Rostrud will impose a fine (key provisions are posted on the Rostrud website).

IMPORTANT!

It is advisable to keep a log of issued forms so that written confirmation from the employee of receipt of the document is preserved.

The SZV-STAZH is filled out for a resigning employee in almost the same way as for existing employees. The differences concern only two points:

- the first is filling out the reporting period (if leaving in 2021, indicate the current year);

- the second is column 7 in part 3 (the last working day or the date on which the contract (labor or civil law) was terminated is entered in this column).

Here is an example of filling out SZV-STAZH when dismissing an employee in 2021:

How to fill out the form

Let's look at the first 3 sections of the form - these are the ones that policyholders will have to fill out at the end of the year.

Section 1

The most common part of the form to fill out. It must reflect the minimum required set of information about the policyholder: its registration number in the Pension Fund of Russia, INN, KPP and short name.

Section 2

This is the shortest section in terms of information. It reflects the reporting period. In our case, this is the calendar year 2021.

Section 3

This is the most complex section in terms of volume and type of information. The data is placed in a table, which consists of 14 columns:

You do not need to fill out all fields. For each insured person, it is required to indicate the full name, SNILS and periods of work in 2021. That is, you need to fill out columns 2, 3, 5, 6 and 7. In the remaining columns, codes and other information are entered as necessary.

Information about the length of service reflected in the tabular section is filled out on the basis of personnel documents: orders for hiring and dismissal, time sheets, contract agreements, work books, etc.

When filling out section 3, the following rules must be taken into account:

- The full name of the insured person is reflected in the nominative case.

- A separate line is filled in for each insured person.

- If contracts of a different nature (labor, copyright, civil law) were concluded with the same employee in the reporting year, information on each type of contract must be reflected in separate lines and a special code indicated in column 11. In this case, the employee’s full name and SNILS do not need to be filled in again.

- If an employee was on staff for some periods within a year, but did not work (sick, on vacation, on maternity leave, etc.), such periods must be reflected in columns 6 and 7 in separate lines and special codes in column 11.

- Fill out column 14 only for employees dismissed on December 31, 2018: indicate this date in this column instead of the “x” symbol that we put in the old form.

Due dates

The form must be submitted no later than March 1 of the year following the billing period. Since in 2021 March 1 is a Monday, a working day, the deadline for submitting the report will not be postponed. The report must be submitted no later than March 1, 2021.

We recommend preparing and sending information to the Pension Fund in advance. This will protect the institution from penalties. If an error is discovered in the reporting, there is time to correct it and submit an adjustment report. Otherwise, the organization will be punished with a ruble.

| Employee category | Deadline and where to apply |

| Current employees | Until 03/01/2021 - to the Pension Fund of Russia (*within five days from the date the request was received by the employee) |

| Those working under civil contracts (in case of calculation of insurance premiums) | |

| Fired in 2020 | |

| Those leaving in 2021 | In the hands of the resigning employee on the day of dismissal + to the Pension Fund of the Russian Federation in the next reporting period (until 03/01/2022) |

| All employees during liquidation and reorganization of the enterprise | In the hands of those dismissed on the day of dismissal + to the Pension Fund of the Russian Federation within one month from the date of the interim liquidation balance sheet or transfer act |

| Retiring | To the Pension Fund of the Russian Federation within three calendar days from the date of the employee’s application for a pension |

| Individual entrepreneur without employees | They don't rent |

Submission of the SZV-STAZH report to the Pension Fund of the Russian Federation is possible only together with the EDV-1 form, which contains information on the policyholder.

Errors in SZV-STAZH

All SZV-STAZH reports submitted to the Pension Fund are checked to identify errors. Among the most common errors: incorrect indication of the period of employment, distortion in the data of the insured person, use of an incorrect electronic signature, and others.

In the fund, identified errors are divided according to the degree of “criticality” ─ from 10 to 50. Reports with codes 10 ─ 20 will be accepted by the fund. Correction of such errors is optional. Reports with codes 30 ─ 40 will also be accepted, but partially. The policyholder will need to provide corrective data, since the original SZV-STAZH contains inaccurate information. If the report contains errors related to code 50, the fund will not accept it.

The nature of the error affects whether the fund will be able to take into account the information provided in the individual personal accounts of specific insured persons. The type of submission of corrective data by the policyholder depends on this (SZV-STAZH with the “Additional” type, SZV-KORR with the “Corrective”, “O” type of information).

Personalized accounting information forms

There are several types of forms in which personalized accounting information is submitted. The names of the forms and the cases in which they should be submitted are presented in the table:

| Form name | Description of the reporting form | Form type |

| SZV-STAZH | Annual reporting on employee experience | Initial Supplementary Assignment of pension |

| EDV-1 | Accompanying document, submitted along with the forms SZV-STAZH, SZV-KORR, SZV-ISKH | Original Corrective Cancel |

| SZV-ISH | Information provided for the first time for the payer as a whole for reporting periods up to 01/01/2017 | |

| SZV-KORR | If it is necessary to adjust the data recorded on individual personal accounts of insured persons for periods starting from 1996 | Corrective Cancelling Special |

Penalties for failure to submit a report

There are several fines associated with the circumstances in which the violation was committed:

The organization submitted the report in full, but the deadline for submission was missed - 500 rubles, according to information from each employee whose submission was overdue;

The report was submitted on time, but not all workers were included in it - 500 rubles for each person whose information was not included in the report.

The report was submitted on time, data on all employees was included in it, but an audit showed that some of them were untrue - 500 rubles for each person whose information was provided incorrectly.

Attention! In addition, a fine has been established for submitting a report on paper, while the organization is obliged to send it only electronically. Its amount is 1000 rubles.