Zero reporting is considered to be in two cases:

- if there are no employees;

- if there is no activity.

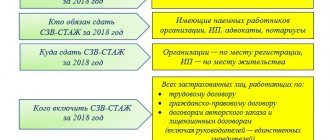

Let's figure out why in both cases it is mandatory to submit SZV-STAZH reports. Before March 1, it is necessary to submit information about the length of service of employees to the Pension Fund. In 2021, March 1 falls on a working Monday, so there will be no postponement of the reporting deadline. It is worth starting to compile information in advance so that in case of refusal of admission by the Pension Fund there is time to correct errors. The deadlines for all reporting are fixed, and zero SZV-STAGE in 2021 should also be submitted before the first of March.

In what cases are reports submitted?

The report involves submitting information about all employees who worked and accumulated seniority during the year, regardless of the number of days worked and payments earned. Thus, it is possible that the employee will have periods that will not be counted towards the length of service. So whether or not to take the zero SZV-EXPERIENCE - definitely pass! The report cannot be zero for the number of employees. It should include:

- employees hired under an employment contract;

- hired employees under a civil contract, service contract, author's contract, etc.;

- employees who are not registered accordingly, but perform work activities. As an example, the CEO is the only founder. Even if the director is not signed under an employment contract and does not receive salary payments, he is treated as an employee. The Pension Fund of Russia expressed its position in an appeal to employers dated 03/29/2018 No. L4-08-24/5721, referring to the guidance of the Ministry of Labor No. 17-4/10/B-1846 dated 03/16/2018.

Let's consider the option of whether it is necessary to take SZV-STAZH if there are no regular employees in the organization. According to Article 16 of the Labor Code of the Russian Federation, admission to work gives rise to labor relations even in the absence of a properly executed employment contract. Therefore, the experience report always contains at least one employee - the director of the organization. Employees who were fired during the year, who went on maternity leave and parental leave are required to be included in the report. Information about those dismissed is submitted at the end of the year in the same reporting as those employed, regardless of the date of dismissal. The exception is retired employees. They must submit a form no later than 3 calendar days from the date of receipt of the application for the provision of individual information.

ConsultantPlus experts discussed how to fill out and submit the SZV-STAZH for 2020. Use these instructions for free.

Under what conditions and who rents it?

Legal entities and individual entrepreneurs who have entered into an employment or civil contract with individuals are required to submit the report in question to the Pension Fund. It is important to comply with 2 conditions:

- The agreement/contract has not expired.

- There is an obligation to pay insurance premiums (even if there is nothing to charge contributions for, and employees walk at their own expense).

SZV-M is submitted monthly to the territorial Pension Fund at the place of registration of the enterprise as an insurer.

For more information about this, see “Who should take the SZV-M in 2021.”

Do I need to submit a report if there are no employees?

Small organizations represented by an individual entrepreneur or self-employed often do not have employees. Should individual entrepreneurs pass without employees SZV-STAZH - such an obligation does not arise for businessmen without hired labor. Small retail shops, law offices, hairdressers and other points of consumer services for the population are maintained by individual entrepreneurs themselves. In cases of self-employment and working individual entrepreneurs without employees, there is no need to submit a report for themselves. The length of service of a self-employed person is confirmed by the payment of insurance premiums and is counted from the moment of registration of an individual as an individual entrepreneur until the date of deregistration with the Federal Tax Service. Individual entrepreneur contributions are a condition for confirming his work experience, and SZV-STAZH in the absence of employees is not submitted by individual entrepreneurs. But as soon as an entrepreneur has an employee, he immediately becomes an insured, and he has the obligation to submit a report on his experience.

What does “zero” SZV-M mean in the Pension Fund of Russia

SZV-M is a form of personalized accounting. It is intended to reflect data about the insured employees of an organization or individual entrepreneur. Roughly, this designation stands for: Information about the Insured Incoming for the Month. The preparation of this report is carried out by the responsible person appointed by the manager.

As a general rule, if there are no employees at the enterprise and an employment agreement has not been signed between the manager and the organization itself, then we are talking about zero forms of SZV-M. At least, that's what accountants call these monthly reports.

Example of filling out zero reporting

Rodionova L.P. was on maternity leave for a child under 3 years old from the beginning of the year until November 19, 2020. On November 20, the employee returned to work and, having worked until the end of the month, went on unpaid leave for 4 days. In the example, we will consider how to fill out a zero SZV-STAGE for an employee who has returned after a long absence.

We fill in information about the policyholder: registration number of the Pension Fund of Russia, INN, KPP of the organization and abbreviated name.

In the “Reporting period” column we put the year for which we are submitting information.

In the upper right corner about the type of information:

- initial, if we submit for the first time during this reporting period;

- complementary, if something was not taken into account in the original;

- assignment of a pension, if we fill it out for an employee retiring.

Next, we enter the details of the employee for whom we are applying for zero experience: full name, periods of work and non-working periods. In our example, from the beginning of the year to November 19, the employee was on maternity leave; during this period, in the columns “Calculation of insurance experience”, “Additional information” we enter the code “DLCHILDREN”. The period from November 20, 2020 to November 30, 2020 is working, we leave it without explanation. From December 1 to December 4 is a period of leave without pay, we explain it with the code “NEOPL”. Similarly, we fill out all personnel deviations until the end of the calendar year.

To send the reports, we sign them with the manager and seal them with a seal. Organizations with no more than 25 employees have the right to submit SZV-STAZH in paper form. When submitting electronically, a digital qualified signature is used.

ConsultantPlus experts discussed how to fill out SZV-STAZH and SZV-M upon dismissal. Use these instructions for free.

Let's recap the basics

The initial regulatory document that the employer should rely on is Federal Law No. 27-FZ dated April 1, 1996 “On individual (personalized) accounting in the compulsory pension insurance system.”

In addition, it is worth carefully studying:

- Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p, which defined new reporting forms (SZV-STAZH, SZV-KORR, SZV-ISKH);

- Order of the Ministry of Labor dated December 21, 2016 No. 766n (as amended on June 14, 2018) approved the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons.

The SZV-STAGE form is information about the insurance experience of all employees with whom the employer has an employment relationship for the reporting period. The reporting period for the form is a year, the deadline for submission is no later than March 1 of the following reporting year.

Depending on the type of information submitted, the forms can be:

- “Initial” - when the data is submitted for the first time;

- “Additional” - if you need to enter new or correct erroneous data in a previously sent SZV-STAZH report;

- “Pension assignment” - if the employee has submitted an application for retirement.

SZV-STAZH is submitted together with the ODV-1 form, which includes a list of forms submitted to the Pension Fund and summary data about the insurer organization.

Submit all forms SZV-STAZH “Initial” “Supplementary” “Pension Assignment” and the EDV-1 form from the KP.

To learn more

Penalty for failure to submit zero reports

For failure to submit zero reports, late submission, incomplete or distorted information, liability in the form of a fine is imposed on the official in the amount of 300 to 500 rubles (Article 15.33.2 of the Code of Administrative Offenses).

Providing an incomplete report threatens with a fine of 500 rubles for each insured person (clause 2 of Article 8, clause 2.1, 2.2 of Article 11, Article 17 of Law No. 27-FZ of April 1, 1996).

The fine for providing a report on paper for organizations with 25 or more people is 1,000 rubles (Part 4, Article 17 of Law No. 27-FZ dated April 1, 1996). When submitting the report, attach the accompanying statement EFA-1.

Read more: “How to fill out the EFA-1 form”

It will not be difficult for an experienced personnel officer to pass the SZV-STAZH when the LLC has zero reporting. Compliance with filing deadlines and inclusion of information about all employees who worked in the past calendar period will protect the organization from fines and employees from problems when applying for a pension.

Failure to comply with delivery deadlines and format

Information on the SZV-STAZH form for 2021 had to be submitted before March 1 of the current year. After checking the reports, the Pension Fund may send the employer a request to correct certain errors. This must be done within five days from the date of receipt of the notification. The date of submission of personalized information is considered to be the date of their dispatch, which is confirmed either by the EDF operator, or by the post office, or by the territorial office of the Pension Fund of Russia. If primary reporting or corrected information is submitted in violation of the established deadlines, the organization will face a fine of 500 rubles for each insured employee.

If an employer files a report for 25 or more people, it must do so electronically using a qualified electronic signature. For failure to comply with this requirement, the employer may face a fine of 1,000 rubles. If there are fewer employees, then the reports can be sent by mail or delivered in person to the territorial office of the Pension Fund.

Zero form SZV-STAZH.

Questions are often asked about the zero form of this type of reporting. They were caused by the long silence of the Pension Fund when making a decision; moreover, the agency has already changed its decision regarding the zero form of the monthly SZV-M report.

So, if during the reporting period there were no employees in the organization, employment and/or civil contracts were not concluded, there is no need to take the SZV-STAZH. The verification program simply will not miss such a report, because the mandatory elements of the file are SNILS and full name, and the Pension Fund will return it to the employer. However, if during the reporting period there were valid contracts with employees, but no remuneration was paid, the SZV-STAZH form must still be submitted.

Information on employees under the GPC agreement.

A common misconception is that employees with whom civil legal relations have been built are not included in the report. This is wrong. Using the SZV-STAZH form, information is submitted for all employees (insured persons) with whom both labor and civil law contracts are valid in the current period.

This requirement also applies to cases where there were no payments during the reporting period. Then in column 11 “Additional information” you should put the label NEOPLDOG. The duration of the contract for such employees is indicated either in the contract itself or in the certificate of completion of work.

The SZV-STAZH form is subject to the requirement that information on employees on GPC contracts be placed higher than information on employees with employment contracts.

Reports on the founding director.

Many questions arise when submitting information to the director of an organization, who is its sole founder. The position on this issue is expressed in the letter of the Ministry of Labor of the Russian Federation dated March 16, 2018 No. 17-4/10/B-1846: “policyholders who do not have employees and the head of the organization is the only participant (founder), member of the organization, owner of its property, are obliged provide information about insured persons using the SZV-M and SZV-STAZH forms.” It does not matter whether there were payments and rewards in favor of the employee during this period.

Main place of work and combination.

Is it possible to reflect the employment of the insured person at the main place of work and part-time work in one form? Do I need to count both lengths of service? There is only one answer - no. The reporting should indicate only one period, for example, at the main place of work. However, if in the main job the employment contract ends in the middle of the year, and in a part-time job it is extended, then you can specify a period that is longer. Double length of service will not be taken into account when calculating the pension.

Reflection of the stake share.

If we are talking about part-time employment under normal working conditions, the share of the rate does not need to be indicated. This information is required for those categories of workers to whom the territorial factor applies (the Far North or areas equivalent to it). For them, in column 8 “Territorial conditions (code)” one of the codes MKS, RKS, MKSR, RKSM and the share of the rate are indicated. If the employee’s schedule involves a full-time work day with a part-time week, then the territorial code and the number of days worked should be entered in the report. If a full day, but an incomplete week - the number of days worked and territorial conditions. To be fully employed, you don’t need to write anything other than code in column 8.

A share of the bet is also required:

- for doctors - in column 12 “Base (code)” indicate the appropriate code (27-SM, 27-GD, 27-SMHR, 27-GDHR);

- for teachers - in column 12 “Base (code)” indicate the appropriate code (27-PD, 27-PDRK).

New codes in column 11 “Additional information”.

From January 1, 2021, five new codes have appeared to indicate the position being filled:

- ZGDS - in the case of a person holding a government position in a constituent entity of the Russian Federation, replaced on a permanent basis;

- DDG - in case of a person holding a government position in the Russian Federation;

- LSS - in case a person holds a position in the state civil service of the Russian Federation;

- ZMS - in case a person fills a municipal service position;

- Personal health insurance - in case a person holds a municipal service position on a permanent basis.

Not all personnel officers are faced with these codes, because they only concern institutions of state, regional or municipal government. The same requirement applies here as for data on employees at the GPC: the entry on the position must be in first place, the remaining information is indicated below.

How to fill out

The procedure for drawing up is fixed by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p in Appendix 5. The form is filled out both in paper and electronic form. Corrections and blots are not allowed. The pages are numbered in order. The reporting is signed by management and certified by a seal (if used by the institution). In this article we will look at a special case - the rules for submitting this report without payroll. We talked in detail about filling out the regular SZV-STAZH form in a special material.

Zero form and suspension of activities

Let’s say right away that the question of whether it is necessary to take zero SZV-M in 2018 does not yet find a clear answer in practice. And the point is this.

Economic entities may be faced with a situation where they need to suspend activities. In this case:

- there is staff;

- he does not perform labor functions;

- The accounting department does not calculate insurance premiums.

As a result, it is not clear whether it is necessary to submit a zero SZV-M in 2021, in which the “Information about insured persons” block should be left empty.

There was no clear answer to the question of whether zero SZV-Ms are surrendered for a long time, since the opinions of the Pension Fund and its territorial bodies often contradicted each other. Thus, initially in 2021, it was permissible to send a report to the fund without a block of information about the insured persons. That is, in essence, the delivery of a zero SZV-M:

However, according to another, more widespread opinion, a report must be submitted if there are insured persons. Namely:

1. Those working under an employment or civil contract.

2. Receiving income from the enterprise.

If the company's activities are temporarily suspended for 2021, employees will still continue to be insured. Submission of the SZV-M form with their listing in this case is required.

How to fill out correctly if there is no salary

The Pension Fund accepts only correct reports. Instructions on how to fill out the SZV-STAZH if there are no employees, but there is a director without a salary (with or without an employment contract):

- The introductory part contains all organizational information about the institution - full (short) name, TIN, KPP, registration number in the Pension Fund. The number of pages is indicated in the header and information about zero content is indicated.

- It is worth noting that in the previous version of the form, the registration data of the organization (TIN/KPP and registration number in the Pension Fund of Russia) were duplicated in the header of the document and in the introductory part. Now such information is indicated only once. Also, the abbreviation “Page” is no longer used. and, accordingly, the page number.

- Next, the reporting period is indicated - year.

- The tabular part contains information about the business activities of the insured persons. Information is entered about each employee. If a zero form is submitted for the founder, then the table indicates his business activity only within the given organization.

- Next, accrued and paid pension contributions (contribution period) are noted. The fact of payment is reflected in yes/no points. In the zero form, these items are not filled in.

After filling out all the necessary lines, the reporting is certified by the signature of the head of the institution.