SZV-M report: who submits it and when

SZV-M reporting must be submitted monthly no later than the 15th day following the reporting month. If the deadline for submitting the form falls on a holiday or weekend, it must be submitted on the next business day.

The current regulations do not prohibit taking it earlier, in the current month. However, the employer must be sure that it will not hire a new employee before the end of the month. Otherwise, there will be a fine for providing incomplete information. The deadlines for submitting SZV-M in 2021 for individual entrepreneurs with employees do not differ from the generally approved ones.

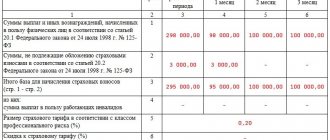

We will provide the deadlines for the completion of SZV-M in 2021 in the form of a table:

| Reporting period (2020) | Deadline |

| January | 17.02.2020 |

| February | 16.03.2020 |

| March | 15.04.2020 |

| April | 15.05.2020 |

| May | 15.06.2020 |

| June | 15.07.2020 |

| July | 15.08.2020 |

| August | 17.09.2020 |

| September | 15.10.2020 |

| October | 16.11.2020 |

| November | 15.12.2020 |

| December | 15.01.2021 |

Monthly reporting SZV-M in 2021 must be provided by all insurers (organizations and individual entrepreneurs) in relation to insured persons who work under employment contracts and with whom civil contracts have been concluded, if insurance premiums are paid from their remuneration. The form is submitted to the territorial office of the Pension Fund of the Russian Federation in which the reporting organization is registered.

Is it necessary to report if there are no employees or persons working under GPC agreements?

The SZV-M form is also required to be provided by those companies that do not have a single employee registered. According to current legislation, the general director is also an employee.

IMPORTANT! In accordance with the new requirements of the Pension Fund of Russia, even if the manager is the only founder of a legal entity, even if he is the only employee, reports must be submitted for him. Such clarifications are contained in the message of the Pension Fund of the Russian Federation.

Who, when and where submits information

Let's start with what the SZV-M form is and for whom it is mandatory. Based on clause 2.2 of Art. 11 of Federal Law No. 27-FZ dated April 1, 1996, employers are required to submit monthly reports on all employees, including part-time workers and persons dismissed during the reporting period. For this purpose, a separate form was approved by the resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p.

In addition to data about those employees who actually work, they also transmit information about persons with whom there are employment contracts, but who are on leave: at their own expense, annual leave, or parental leave. In other words, it is necessary to send information about persons whose employment relationship is confirmed by employment contracts or civil contracts.

The report must also be prepared by organizations with a single employee in the person of the founder, who does not receive payments under any agreement or with whom no agreement has been concluded. And although the instructions for filling out the SZV-M form do not contain any explanations on this matter, officials insist: “non-contractual” managers are also insured persons in the pension system and must be reported on.

The completed report is submitted to the Pension Fund office at the place of registration of the policyholder.

Who is exempt from reporting?

There are exceptions for certain categories of business entities and employees. Thus, the SZV-M report is not provided by:

- peasant farms where there are no hired workers;

- individual entrepreneurs, arbitration managers, privately practicing lawyers and notaries who pay fixed insurance premiums only for themselves;

- employers in relation to foreign citizens and stateless persons who are temporarily staying in Russia or working remotely, who are not covered by compulsory pension insurance;

- employers in relation to military personnel, employees of the Ministry of Internal Affairs and the Federal Security Service (with the exception of civilian employees), since compulsory pension insurance does not apply to them, and the state provides other guarantees for them.

Due dates

As for the deadlines for submission, there is a specific date when to submit the SZV-M - no later than the 15th day of the month following the reporting month.

IMPORTANT!

In connection with the announcement of non-working April, the government postponed the deadlines for submitting some reports and paying certain taxes (resolution No. 409 dated 04/02/2020). But it does not say anything about postponing the deadline for submitting personalized reporting, and the new regulatory act cannot be applied to SZV-M. At the same time, there are letters from the Ministry of Health and Social Development dated September 16, 2011 No. 3346-19 and the Pension Fund dated December 28, 2016 No. 08-19/19045, which indicate that the deadlines for submitting information are postponed if they fall on a non-working day. At the time of preparation of the material, the Pension Fund of the Russian Federation did not clarify whether it is permissible to “hide behind” such an explanation during the period of self-isolation and submit a report later.

Let us remind you that the report is one of the documents that must be given to employees upon dismissal. In this case, the form includes data only for the current month about a specific citizen. It is permissible to fill out the SZV-M online, print it, sign it and give it to the employee.

Read more: Filling out SZV-M upon dismissal of an employee

Where and in what form to take SZV-M in 2021

Form SZV-M is submitted to the territorial body of the Pension Fund of the Russian Federation in which the policyholder is registered (Clause 1, Article 11 of Law No. 27-FZ). At the same time, each branch separately submits information about employees and persons who perform work (provide services) under civil contracts. Please note that when filling out the document, the TIN of the main company is indicated, and the checkpoint of a separate division.

According to paragraph 2 of Art. 8 No. 27-FZ, a company with less than 25 insured persons may provide reporting in the form of documents in writing (on paper). The rest are required to submit reports electronically. In 20120, the Pension Fund fines those organizations that do not comply with the format required by law for submitting reports by 1,000 rubles. Below are instructions for filling out the form.

You can fill out a monthly report quickly and free of charge in the special program “PU Documents 6”. It is available for download on the official website of the Pension Fund in the “Free programs for employers” section.

You can also fill out a report in online services on the websites of accounting software developers - My Business , Kontur , Nebo and others. Some sites allow you to do this freely, but usually the services require a fee (up to 1000 rubles).

Delivery methods

If the number of insured persons exceeds 25 people, then the information is submitted only “in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation” (Clause 2 of Article 8 of the Federal Law of 01.04.1996 No. 27-FZ). But employers have the opportunity to fill out the SZV-M online for free on the Pension Fund website after registering in the system.

If there are less than 25 employees with contracts, the employer submits information in written (on paper) or electronic (through special programs) form.

Instructions for filling out section I of the SZV-M report

The form consists of 4 sections, each of which is required to be completed. The filling instructions will help you figure it out. In section 1 the following details of the policyholder should be indicated:

- registration number in the Pension Fund of Russia. It is indicated in the notification from the Pension Fund received upon registration. You can also find it out at the local branch of the Pension Fund of Russia, the tax office, or on the website nalog.ru;

- name (short);

- in the “TIN” field, you should indicate the code in accordance with the received certificate of registration with the tax authority;

- Individual entrepreneurs do not fill out the “Checkpoint” field. When filling out the form, organizations indicate the checkpoint that was received from the Federal Tax Service at their location (separate units indicate the checkpoint at their location).

Sample of filling out section I

SZV-STAZH for 2021 in 1C programs

- To correctly generate records of experience, it is also recommended to check and, if necessary, clarify the settings of the types of accruals with which the program makes accruals for hours worked and unworked. For types of accruals (section Settings

-

Accruals

) that register accruals for working a full shift within the time limit, as well as for unworked full shifts, the

PFR type of experience

(indicated on the

Time Accounting

of the accrual type form - Fig. 8). The type of experience in the program is filled in automatically, but if necessary, it can be clarified.

Rice.

8 For types of accruals that record regular periods of work, this field indicates the value Included in the length of service for early assignment of a pension

. This means that the period of work must be reflected in the records of length of service, and if the insured person has some special grounds for pension provision (special working conditions, basis of length of service, etc.), then this period of work should be determined as length of service "special work" If there are no grounds for preferential pension provision (the details of special conditions for the organization, division, position, staff unit of the employee are not filled in), then this period is taken into account in the records of experience as a period of normal work.

If some periods of work should not be included in the length of “special work”, but should be counted into the insurance period, then for the corresponding types of accruals the value Included in the insurance period

. For such periods, the details of special conditions will not be filled in in the length of service records, even if they are indicated for the organization, division, position, or staff unit of the employee.

For types of accruals that record special periods of service, the type of service must be indicated. This is necessary to automatically fill in the code with which the length of service will be generated for the period in which these types of accruals will be accrued (in accordance with the PFR parameters classifier) (Table 1).

Table 1. Types of Pension Fund experience indicated for types of accruals

| Period recorded by accrual | Type of Pension Fund experience | Reporting code |

| Leave without pay | Leave without pay | NEOPL |

| Staying on paid leave | Staying on paid leave | DLOTPUT |

| Additional leave for employees combining work and study | Additional leave for employees combining work and study | ACCEPTANCE |

| Additional leave for citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant | Add. vacation for victims of the accident at the Chernobyl nuclear power plant | Chernobyl Nuclear Power Plant |

| Period of temporary incapacity for work | Temporary disability | VRNETRUD |

| Maternity leave | Decree | DECREE |

| Child care leave up to 1.5 years | Children | CHILDREN |

| Parental leave from 1.5 to 3 years | Parental leave (CHILDREN) | DLCHILDREN |

| Additional days off for persons caring for disabled children | Additional days off for persons caring for disabled children | DOPVIKH |

| Periods of work corresponding to the transfer, in accordance with the medical report of a pregnant woman at her request, from a job that gives the right to early assignment of an old-age labor pension to a job that excludes the impact of unfavorable production factors, as well as the period when the pregnant woman did not work until the issue of her employment in accordance with the medical report | Transferring a pregnant woman to “light” work | MEDNETRUD |

| Transfer of an employee from a job that gives the right to early assignment of an old-age pension to another job that does not give the right to the specified pension, in the same organization due to production needs for a period of no more than one month during a calendar year | Translation according to production necessary for a period of no more than one month from a job that gives the right to early retirement to another job that does not give this right | MONTH |

| Off-the-job training | Off-the-job training | QUALIFY |

| Performance of state or public duties | Performance of state or public duties | SOCIETY |

| Days for donating blood and its components and rest days provided in connection with this | Days for donating blood and its components and rest days provided in connection with this | SDKROV |

| Downtime caused by the employer | Downtime caused by the employer | SIMPLE |

| Downtime due to the fault of the employee, unpaid periods of suspension from work (preclusion from work), unpaid leave of up to one year provided to teaching staff, one additional day off per month without pay provided to women working in rural areas, unpaid time to participate in strike and other unpaid periods, except for periods with codes DLDETI and Chernobyl NPP | Unpaid period | NEOPL |

| Suspension from work (preclusion from work) through no fault of the employee | Suspension from work (preclusion from work) through no fault of the employee | SUSPENDED |

| Inter-shift rest time | Shift rest time | WATCH |

Periods are recorded in a special way in the program (Fig. 9):

- the period of work of the insured person under a civil law contract (reporting code NEOPLDOG), the period of work under an author's contract (code NEOPLAVT), payments and other rewards for which are accrued in the following reporting periods, parental leave until the age of three years, provided grandmother, grandfather, other relatives or guardians actually caring for the child (code DETIPRL), filled in manually;

- transfer, in accordance with the medical report of a pregnant woman at her request, from a job that gives the right to early assignment of an old-age labor pension to a job that excludes the impact of unfavorable production factors, as well as the period when the pregnant woman did not work until the issue of her employment was resolved in accordance with with a medical report (code in reporting MEDNETRUD). In the Personnel Transfer

on the

Main

for this case, check the box

for the period of transfer to maintain the preferential period of the Pension Fund of Russia

and in the

Type of Pension Fund of Russia experience

, indicate the type of experience

Transfer of a pregnant woman from work, the right to early retirement, to a job that excludes the impact of adverse production factors

; - transfer of an employee from a job that gives the right to early assignment of an old-age pension to another job that does not give the right to the specified pension, in the same organization for production reasons for a period of no more than one month during the calendar year (reporting code MONTH). In the Personnel transfer

for this case, check the

For the period of transfer, maintain the preferential period of the Pension Fund of Russia

and in the

Type of Pension Fund of Russia experience

, indicate the type of experience

Transfer by production.

necessity for a period of no more than one month of work that gives the right to early retirement, for another job that does not give this right .

Rice. 9

To automatically fill in the code of territorial conditions “VILLAGE” (work in agriculture), select the checkbox in the organization’s accounting policy The organization is engaged in crop production, livestock farming and fish farming

.

In the department card and staffing position (if it is maintained), check the box Work in the field of crop production, livestock farming and fish farming

. The “VILLAGE” code is indicated on the basis of lists of relevant works, industries, professions, positions, specialties, in accordance with which an increase in the amount of the fixed payment to the old-age insurance pension and disability insurance pension is established in accordance with Part 14 of Art. 17 Federal Law dated December 28, 2013 No. 400-FZ.

On filling out information about experience in the form SZV-STAZH for 2021 in other 1C programs: 1C:BP 3.0, 1C:ZKGU 3.

Source: 1C:ITS.

Instructions for filling out section III of the SZV-M report

In section 3, you must indicate the type code of the transmitted report. It can take 3 values:

- “output” - the original form that the enterprise submits for the specified reporting period for the first time;

- “additional” is a complementary form. This code must be specified if the original report has already been submitted, but it needs to be corrected. For example, a new employee appeared or incorrect data was submitted for him;

- “cancel” is a canceling form. This code should be used if any employees need to be completely excluded from the original report submitted. For example, the report contains data on an employee who quit and no longer worked in the current period.

Sample of filling out section III

Instructions for filling out section IV of the SZV-M report

The last section is presented in the form of a table, which contains a list of employees who have concluded labor contracts at the enterprise in the current period, including GPC agreements. The table consists of four columns:

- the first one contains the serial number of the line;

- in the second - full name. employee in the nominative case. If the patronymic is missing, it is not indicated;

- in the third - SNILS (employee registration number in the Pension Fund of Russia). This is mandatory information;

- in the fourth - TIN (employee registration number with the Federal Tax Service). As stated in Resolution of the Board of the Pension Fund of the Russian Federation No. 83p, this column is filled in if the policyholder has the necessary information.

You can enter data into the table either in alphabetical order or randomly.

At the end, the report must be signed by the general director or entrepreneur indicating the position and full name. The date of compilation of the form is also indicated here and a stamp is affixed if it is used in the company. Since the SZV-M form does not provide for the possibility of signing the report by a representative of the policyholder, it must be submitted personally either by the director of the organization or by the entrepreneur.

Sample of filling out section IV

A sample document completely completed according to the instructions looks like this:

Common mistakes when filling out SZV-M

| Error | It should be | How to fix |

| There is no information about the insured person | When filling out the form, you must indicate all employees with whom an employment contract or civil service agreement has been concluded (even if the person worked for only one day). Information must also be submitted if there have been no accruals or payments to the employee at the Pension Fund of the Russian Federation, but he has not been fired. | Supplementary reporting is submitted, which indicates those employees who were not reflected in the original form. In the third section we put the form code “ADP”. |

| There is an extra employee present | The presence of records of redundant employees (for example, fired) is equivalent to false information. | A cancellation form must be provided indicating only the excess employees. In the third section we put the form code “OTMN”. |

| Incorrect employee tax identification number | Although the absence of the TIN itself when filling out the form will not be an error, nevertheless, if it is indicated, enter it correctly. | Two forms are provided at the same time: a cancellation form - for an employee with an incorrect TIN and, along with it, a supplementary one, in which the correct information is indicated. |

| Incorrect SNILS of an employee | As with the TIN, the absence of a code is not an error, but incorrect information can result in a fine. | If the report is not accepted, it must be corrected and resubmitted as outgoing. If only correct information is accepted, corrections are provided to employees with errors in a supplementary form. |

| Incorrect reporting period | You must enter the correct month and year code. | It is necessary to re-submit the form with the status “outgoing”, correctly indicating the reporting period. |

Where is SZV-M located?

The report is located in the menu “Salaries and personnel - Insurance premiums - Information about insured persons, SZV-M”.

The report can also be found in the list of regulated reports.

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

Let's create a new report.