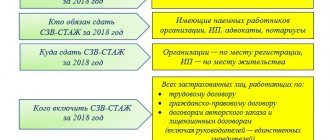

The concept of “total length of service” (GTS) cannot be found in the current legislation of the Russian Federation. This is a kind of rudiment of the old, Soviet pension system, when all working citizens received the right to payments. The TTS represents the entire set of work activities in time terms.

After the 2002 reform, the purpose of which was to bring the country’s pension system to the insurance model, the term “work experience” is practically not used. Pensions began to be calculated using new bases and formulas. The basis for its calculation was the insurance period, which should be understood as the periods during which special contributions were paid for a citizen to his personal account in the Pension Fund.

This responsibility rests with the employer. Since 2015, after another reform, material assets transferred to the Pension Fund have been transferred according to a special formula into special points, the number of which depends, first of all, not on the duration of the work itself, but on the volume of funds transferred directly to the Pension Fund.

Despite the above, it can still be taken into account for calculating pensions, especially for persons who began working before 2002.

What is included in work experience

It may include certain periods during which the citizen performed duties related to his work activity. In addition, this should also include other periods of time when the employee, being employed, was not engaged in the performance of official duties, but they were counted toward his length of service.

The OTS counted all “working” periods in the chronological period. If a citizen’s work experience was interrupted, then no reset occurred, since from the moment of new employment the OTS continued to flow further.

Periods included in the length of service

The following forms of activity should be included on a general basis in the period considered here:

Carrying out labor activities

Any official work, regardless of its nature, is included in the OTS. It should be noted that the location of the relevant activity matters. This should be the territory of the Russian Federation.

However, in some cases, the Pension Fund of Russia may also take into account the time spent working abroad , for example, in representative offices of Russian government agencies abroad or if there is a corresponding international (bilateral) agreement between our country and a foreign state.

Attention! For work to be counted, the employee must be officially employed. Periods of work without supporting documents are not counted.

Time of incapacity

This includes periods when the employee did not perform a labor function due to illness or caring for a sick family member, which should have been confirmed by sick leave from a doctor.

Being in MLS

In the case where a citizen was placed in a pre-trial detention center, but subsequently the criminal prosecution was terminated, then the entire period of stay there is included in the TTS. The same applies to being in prison after a conviction, if the prisoner was later rehabilitated.

Public Works

In this case, we are not talking about volunteering, but about paid work.

Unemployment

Provided that the citizen was registered with the Central Tax Service and had the appropriate official status.

Military service

The OTS includes service in the Armed Forces of the Russian Federation, as well as other structures equivalent to them.

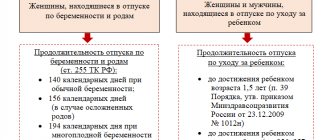

Maternity leave

Maternity leave is included in both the length of service and the insurance period.

Baby care

The OTS includes the time of care until the child reaches the age of three years, the insurance – 1.5 years.

Studying at a university or college

This time was taken into account in the corresponding calculation previously, but at the moment the training cannot be counted.

The procedure for calculating length of service

Continuous work experience is determined in accordance with the Rules for calculating the continuous work experience of workers and employees when assigning state social insurance benefits, approved by Resolution of the USSR Council of Ministers of April 13, 1973 No. 252 (hereinafter referred to as Rules No. 252).

Since no changes have been made to the Rules since 1991, they should be applied taking into account subsequently adopted legislative acts of the Russian Federation and international treaties with the participation of the Russian Federation.

In particular, one should take into account the provisions noted in the Letter of the Federal Social Insurance Fund of the Russian Federation dated October 25, 2002 No. 02-18/05-7418. Continuous length of service is determined by the duration of the last continuous work in a given organization. When transferring from one job to another, continuous length of service is maintained if the break in work does not exceed one month. In case of dismissal of one's own free will without good reason, continuous service is retained if the break in work does not exceed three weeks. Note!

The normative provision contained in subparagraph “i” of paragraph 7 of Rules No. 252 is recognized as not subject to application by courts, other bodies and officials as contrary to the Constitution of the Russian Federation, by the ruling of the Constitutional Court of the Russian Federation dated March 4, 2004 No. 138-O. In accordance with subparagraph “and” of paragraph 7 of Rules No. 252, the length of service is interrupted upon repeated dismissal of one’s own free will without good reason, if 12 months have not passed since the date of the previous dismissal for the same reason.

Thus, if you re-dismiss within a year at your own request without good reason, continuous service is maintained.

Continuous work experience is maintained if the break in work does not exceed two months:

- upon admission to another job of persons who worked in the regions of the Far North and equivalent areas, after dismissal from work upon expiration of the employment contract;

- when applying for work in the Russian Federation after being released from work in institutions, organizations and enterprises of the Russian Federation abroad or in international organizations;

- when entering work in the Russian Federation, citizens who have moved from countries with which the Russian Federation has entered into agreements or treaties on social security, after being released from work in institutions, organizations and enterprises of these countries. The two-month period in this case is calculated from the date of arrival in the Russian Federation.

Continuous work experience is maintained during a break in work of up to three months:

- upon entry to work of persons released from enterprises, institutions and organizations in connection with their reorganization or liquidation or implementation of measures to reduce the number or staff of workers, as well as upon entry to work of workers and employees dismissed from units, institutions, organizations and from enterprises of the Armed Forces of the Russian Federation in connection with the implementation of measures to reduce them in accordance with decisions of the Government of the Russian Federation;

- when entering work after the end of temporary incapacity for work, which entailed, in accordance with current legislation, dismissal from the previous job, as well as when entering work after dismissal from work due to disability or after dismissal of disabled people for other reasons (except for cases in which, in accordance with Rules No. 252 do not preserve continuous work experience), which do not establish more preferential conditions for maintaining continuous work experience. The three-month period in these cases is calculated from the date of restoration of working capacity. The day of restoration of working capacity is considered to be the day the medical advisory commission (MCC) issued an opinion on this, respectively, or the day on which disability was established;

- when entering a job after dismissal due to a discovered incompatibility of the employee with the position held or the work performed due to health conditions that prevent the continuation of this work (according to a medical report issued in the prescribed manner); employees dismissed from internal affairs bodies (based on Article 64 of the Regulations on service in internal affairs bodies of the Russian Federation, approved by Resolution of the Supreme Council of the Russian Federation of December 23, 1992 No. 4202-1 “On approval of regulations on service in internal affairs bodies of the Russian Federation and text of the oath of an employee of the internal affairs bodies of the Russian Federation");

Continuous work experience is maintained during a break in work of up to six months:

- employees released in connection with the reorganization, liquidation of associations, enterprises, organizations and institutions located in the Far North, as well as in areas where bonuses are paid in the manner and on the terms determined by the Resolution of the CPSU Central Committee, the Council of Ministers of the USSR and the All-Union Central Council of Trade Unions of April 6 1972 No. 255 “On benefits for workers and employees of enterprises, institutions and organizations located in the Arkhangelsk region, the Karelian Autonomous Soviet Socialist Republic and the Komi Autonomous Soviet Socialist Republic”, taking into account the fact that the provisions of this Resolution in relation to the Republic of Karelia were canceled by the Decree of the Government of the Russian Federation of February 25, 1994 No. 155 “On the classification of certain territories of the Republic of Karelia as regions of the Far North and equivalent areas.”

Thus, this provision applies to the Arkhangelsk region and the Komi Republic, with the exception of the regions of the Far North and areas equivalent to them, as well as the Koygorodsky and Priluzsky districts of the Komi Republic (based on paragraph 14 of the Resolution of the Council of Ministers of the RSFSR dated February 4, 1991 No. 76 " On some measures for the socio-economic development of the Northern regions").

- employees of enterprises and (or) facilities, other legal entities located on the territory of closed administrative-territorial entities, released in connection with their reorganization or liquidation, as well as when the number or staff of these employees is reduced (based on paragraph 4 of Article 7 of the Law of the Russian Federation dated July 14, 1992 No. 3297-1 “On a closed administrative-territorial entity”) (to members of the Federation Council and deputies of the State Duma upon termination of parliamentary powers (based on paragraph 2 of Article 25 of the Federal Law of May 8, 1994 No. 3-FZ “On the status of member of the Federation Council and the status of deputy of the State Duma of the Federal Assembly of the Russian Federation").

Continuous work experience is maintained during a break in work of up to one year:

- citizens dismissed from military service (based on paragraph 5 of Article 23 of the Federal Law of May 27, 1998 No. 76-FZ “On the status of military personnel”).

Continuous work experience is maintained regardless of the duration of the break in work:

- upon entering a job after dismissal of one's own free will due to the transfer of the husband or wife to work in another area;

- upon admission to work after dismissal of one's own free will in connection with old-age retirement or after the dismissal of an old-age pensioner for other reasons, except for cases of dismissal that do not give the right to maintain continuous length of service (in accordance with the Rules). This rule also applies to pensioners receiving pensions on other grounds (for example, for long service), if they are simultaneously entitled to an old-age pension;

- one of the parents or other legal representative of an HIV-infected minor who quit to care for him and provided that he enters work before the minor reaches the age of 18 (based on Article 18 of the Federal Law of March 30, 1995 No. 38-FZ “On preventing the spread of Russian Federation of the disease caused by the human immunodeficiency virus (HIV infection)");

- veterans of military operations discharged from military service on the territory of other states, veterans performing military service duties in a state of emergency and during armed conflicts, as well as citizens whose total duration of military service in preferential terms is 25 years or more.

Continuous work experience is not maintained if the employee was dismissed from his previous job:

- for systematic failure to fulfill, without good reason, the duties assigned by the employment contract or internal labor regulations;

- absenteeism (including absence from work for more than three hours during a working day) without good reason or showing up at work while intoxicated;

- the entry into force of a court verdict by which a worker or employee is sentenced to imprisonment, correctional labor outside the place of work, or to another punishment that precludes the possibility of continuing this work;

- loss of trust on the part of the administration in the employee directly servicing monetary or commodity assets;

- the commission by an employee performing educational functions of an immoral offense that is incompatible with the continuation of this work;

- requirement of the trade union body;

- as a disciplinary sanction imposed in the order of subordination or in accordance with the regulations on discipline;

- the employee commits other guilty actions for which the law provides for dismissal from work;

In addition to the time of work, the continuous work experience also includes:

- service in the Armed Forces, in state security bodies and internal affairs bodies, in the people's militia and partisan detachments, if there is a break between the day of release from service and the day of admission to work or study at a higher or secondary specialized educational institution (including preparatory department ), to graduate school, clinical residency, courses, college or school for advanced training, retraining and training did not exceed three months;

- For female military personnel dismissed from the Armed Forces and state security agencies due to pregnancy or childbirth, the time of service, as well as the periods during which they were paid maternity benefits and child care benefits, are included in the continuous work experience when condition of entering work or study before the child reaches the age of one and a half years;

The Letter of the Ministry of Labor of the Russian Federation dated May 14, 2004 No. 2535-VYa states that the period of actual work taken into account for calculating benefits for temporary disability and maternity leave includes periods of military service and service in internal affairs bodies.

- time of work or practical training in paid jobs and positions during the period of study at a higher or secondary specialized educational institution, postgraduate study and clinical residency, regardless of the length of breaks caused by training;

- time of study in colleges and schools of vocational education (technical, vocational schools, nautical schools, factory training schools, etc.), if the break between the day of graduation from college or school and the day of entry to work did not exceed three months;

- time of study in courses and schools for advanced training, retraining and training, if the assignment to courses or school was immediately preceded by work as a worker or employee, or admission to these courses or school was preceded by service in the Armed Forces, in government bodies security and internal affairs, militia and partisan detachments;

- time of work as chairmen of collective farms of workers and employees sent (recommended) to collective farms in accordance with decisions of party or Soviet bodies, if the break between the day of termination of work on the collective farm and the day of entering work as a worker or employee did not exceed the time limits established by the Rules in depending on the reason for dismissal;

- time of continuous work as a member of a collective farm in the event of termination of the collective farm's activities in connection with the transfer of land to a state farm or other state enterprise (organization) subject to the conditions established by paragraph 4 of the Regulations on the procedure for transferring lands and public property of collective farms to state farms when transforming them into state farms and on the procedure settlements with collective farmers, approved by Resolution of the Council of Ministers of the USSR and the CPSU Central Committee of May 3, 1957 No. 495;

- time of forced absence due to improper dismissal, if the employee is reinstated;

From the contents of Letter No. 3186-YuL of the Ministry of Labor and Social Development of the Russian Federation dated July 14, 2004, it follows that the time of forced absence is included in the period of actual work taken into account for calculating benefits for temporary disability, pregnancy and childbirth. In accordance with Article 394 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), an employee who was fired illegally, by decision of the body considering an individual labor dispute, must be reinstated at his previous job with payment of average earnings for the entire period of forced absence.

- pregnant women and women with children under three years of age, dismissed due to the liquidation of organizations, if it is impossible for them to find a suitable job and provide assistance in employment by the employment service, the time from the date of their dismissal until the child reaches the age of three years (basis - clause 1 of the Decree of the President of the Russian Federation of November 5, 1992 No. 1335 “On additional measures for the social protection of pregnant women and women with children under three years of age, dismissed due to the liquidation of organizations”), the time of participation in paid public works, subject to the conclusion fixed-term employment contract, while citizens are subject to the legislation of the Russian Federation on labor and social insurance (based on paragraphs 13, 14 of the Regulations on the organization of public works, approved by Decree of the Government of the Russian Federation of July 14, 1997 No. 875 “On approval of the regulations on the organization of public works ");

- a break in the work of spouses of members of the Federation Council and deputies of the State Duma who were dismissed due to the relocation of a member of the Federation Council or a deputy of the State Duma to exercise their powers in the relevant chamber of the Federal Assembly of the Russian Federation (based on paragraph 5 of Article 25 of the Federal Law of May 8, 1994 No. 3-FZ “On the status of a member of the Federation Council and the status of a deputy of the State Duma of the Federal Assembly of the Russian Federation”);

- leave granted to women to care for a child until the child reaches the age of three (based on Article 256 of the Labor Code of the Russian Federation).

Does not count toward continuous work experience, but does not interrupt it:

- time of study at a higher or secondary specialized educational institution (including at the preparatory department) or stay in graduate school or clinical residency, if the break between the day of release from work and the day of enrollment did not exceed the deadlines established by the Rules, depending on the reason for dismissal, and the break between the day of graduation or early dismissal from an educational institution (graduate school, clinical residency) and the day of entry to work did not exceed three months. Those who graduated from an educational institution (graduate school, clinical residency) or were expelled early from an educational institution (graduate school, clinical residency) before July 1, 1973 and entered work before October 1, 1973, have continuous work experience regardless of the length of the break between the day of graduation from the educational institution ( graduate school, clinical residency) or early dismissal from an educational institution (graduate school, clinical residency) and the day of entry to work;

- the time spent abroad by family members of workers, employees and military personnel sent to work in institutions, organizations and enterprises of the Russian Federation abroad or in international organizations or to serve, if the break between the day of return to the Russian Federation and the day of entry to work did not exceed two months;

- off-season break, if an employee at a given enterprise, institution, organization worked the previous season in full, entered into an employment contract to work in the next season and returned to work within the period established by the contract.

This rule is applied in those sectors of the national economy where current legislation allows the summation of periods of seasonal work when calculating continuous work experience;

- the time spent in a medical-labor dispensary, provided that the break between the day of release from the medical-labor dispensary and the day of entry to work did not exceed one month;

- time of serving correctional labor without imprisonment at the place of work;

- the time during which a citizen receives unemployment benefits, a scholarship, takes part in public works, the time required to move in the direction of the employment service to another area and find employment, as well as the period of temporary disability, maternity leave, military conscription fees, involvement in events related to preparation for military service, with the performance of state duties (based on paragraph 2 of Article 28 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation”);

- spouses of military personnel serving under contract - the entire period of residence with their spouses until 1992, regardless of the location of military units, since 1992 - in areas where they could not work in their specialty due to lack of employment opportunities and were recognized in the established orderly unemployed, as well as the period when the spouses of military personnel were forced not to work due to the health of their children related to the living conditions at the place of military service of the spouses, if, according to the conclusion of a health care institution, their children needed outside care (based on paragraph 4 of Article 10 of the Federal Law dated May 27, 1998 No. 76-FZ “On the status of military personnel”).

4. Determine the maximum daily allowance.

When calculating benefits, one should take into account the provisions of Article 8 of Law No. 202-FZ, which established the maximum amount of benefits for temporary disability, as well as for pregnancy and childbirth for a full calendar month in the amount of 12,480 rubles (clause 2). And in areas where regional wage coefficients are established, the maximum benefit amount is determined taking into account these coefficients (clause 3).

The maximum amount of daily benefit for insured events occurring on January 1, 2005 and later is calculated based on the amount of the maximum benefit by dividing 12,480 rubles by the number of working days in the month of incapacity.

Due to the fact that the maximum amount of daily (hourly) benefit is determined for each month of incapacity (Letter of the Federal Social Insurance Fund of the Russian Federation dated February 18, 2002 No. 02-18/05/1136 “On benefits for temporary disability and pregnancy and childbirth”), according to insured events that occurred in 2004 and continuing in 2005, payment of benefits for temporary disability, pregnancy and childbirth until December 31, 2004 should be made taking into account the limitation of benefits to the maximum amount of benefits in the amount of 11,700 rubles, and from January 1, 2005 - in in the amount of 12,480 rubles. Such clarifications are given in paragraph 2 of the Letter of the Federal Social Insurance Fund of the Russian Federation dated January 18, 2005 No. 02-18/07-306 “On Articles 7 and 8 of the Federal Law “On the Budget of the Social Insurance Fund of the Russian Federation for 2005”.

5. Determine the amount of benefit.

The benefit is calculated by multiplying the lesser of the amounts received in paragraph 3 and paragraph 4 by the number of working days missed as a result of disability.

So, benefits are calculated as follows:

- the average daily benefit is calculated based on the employee’s actual earnings, taking into account continuous service;

- the maximum amount of the average daily benefit is calculated based on the amount of the maximum benefit (12,480 rubles: the number of working days in the month of incapacity for work);

- the benefit is calculated by multiplying the lesser of these amounts by the number of working days missed as a result of disability.

This procedure is used when calculating benefits for temporary disability, as well as for pregnancy and childbirth.

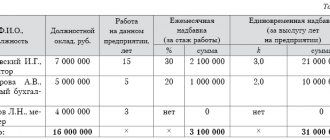

Example.

The employee of the organization was ill from April 22, 2005 to April 29, 2005. Her continuous work experience is 8 years. During the billing period (from April 1, 2004 to March 31, 2005), the employee:From 04/01/2004 to 12/31/2004 - was on maternity leave; From January 11, 2005 - went to work; From 02/16/2005 to 02/20/2005 - she was on a business trip.

The employee’s salary from January 1, 2005 was 10,000 rubles; in March, the salary was increased by a factor of 1.2. In addition, in March, a quarterly bonus was paid for the first quarter (provided for in the Bonus Regulations) - 1000 rubles and a one-time bonus for International Women's Day - 500 rubles (not provided for in the Bonuses Regulations).

- We will determine whether the employee has the right to calculate benefits from average earnings or whether it should not exceed 720 rubles for a full calendar month.

To do this, it is necessary to exclude from the calculation period the time when the employee did not actually work, that is, the time she was on maternity leave (9 months). The period of being on a business trip is not excluded, but is considered actual time worked. Thus, the employee has the right to calculate benefits from average earnings, since she actually worked for 3 months in the calculation period.- Let's determine the average daily earnings. Average daily earnings are determined by dividing the amount of wages actually accrued for the billing period by the number of days actually worked during this period.

2.1. Let's determine the number of days actually worked in the billing period. The number of working days in the billing period is day 247 (Production calendar for 2004 and 2005). In fact, 53 days were worked, of which 15 days in January, 16 days in February (19 days - 3 days of business trip), and 22 days in March.2.2. Let us determine the amount of payments taken into account when calculating average earnings:

1) salary for January-March - (10,000 rubles + (10,000 rubles: 19 days x 16 days) + 10,000 rubles x 1.2) = 30,421.05 rubles.

2) the quarterly bonus is taken into account in proportion to the time worked - 1000 rubles: 247 days x 53 days = 214.57 rubles

The one-time bonus for International Women's Day (500 rubles) is not taken into account, since it is not provided for by the remuneration system and is not subject to UST on the basis of paragraph 3 of Article 236 of the Tax Code of the Russian Federation.

So, the average daily earnings will be: (30421.05 rubles + 214.57 rubles): 53 days = 578.03 rubles

- Let's determine the average daily earnings taking into account continuous work experience: 578.03 rubles x 100% = 578.03 rubles where 100% is the amount of benefits taking into account continuous work experience (8 years) in accordance with subparagraph a) paragraph 30 of the Resolution of the Presidium of the All-Russian Central Council of Trade Unions dated 12 November 1984 No. 13-6.

- Let us determine the maximum amount of daily benefit based on the limit in the amount of 12,480 rubles for a full calendar month: 12,480 rubles: 21 days = 594.29 rubles, where 21 is the number of working days in the month of incapacity (in April 2005).

- We will determine the amount of temporary disability benefits.

The benefit is calculated by multiplying the lesser of the amounts received in paragraph 3 and paragraph 4 by the number of working days missed as a result of disability. 578.03 rubles x 6 days = 3468.18 rubles, where 6 is the number of working days during the period of incapacity (from 04/22/2005 to 04/29/2005).At the same time, at the expense of the employer, a benefit is paid only for 1 day in the amount of 578.03 rubles (since April 23 is a day off), and a benefit in the amount of 2890.15 rubles is paid at the expense of the Federal Social Insurance Fund of the Russian Federation.

End of the example.

What is special work experience?

This term should be understood as the total period of labor activity in particularly difficult conditions. This especially includes working in hazardous industries and in unfavorable climatic conditions. In addition, special experience is also calculated for teaching staff, as well as doctors, paramedics and nurses, regardless of specialization.

Attention! The periods of time during which special work experience was carried out must have papers confirming these facts.

There is also such a concept as “continuous work experience”. It should be understood as the period when the citizen worked continuously. For a long time, the amount of temporary disability benefits, as well as some other payments, depended on this parameter. Currently, the fact of continuous work activity is not legally significant.

What to do if the decision is negative

A specialist, upon whose application a negative decision was made by the commission, should eliminate the problems for enrollment in the National Register:

- If a specialist worked in a non-construction company in construction positions, you can confirm your work experience in your specialty by providing a job description. A copy of the document will need to be first certified by the former employer.

- An employee of the National Association made a negative decision by mistake, having incorrectly calculated the applicant’s length of service. Since documentation verification is carried out manually, human error cannot be ruled out. In such a situation, you will need to re-examine the documents, ensure that you have the minimum acceptable length of service, and file a petition to review the negative decision.

- If, after a detailed study of the work record, it is determined that the employee’s length of service in the construction industry does not amount to the required minimum, the commission’s negative decision is justified. You will have to wait until all the conditions are met and then re-submit your application for enrollment in the National Register.

How to calculate total work experience

The duration of an employee’s compulsory labor insurance is confirmed by such an important document as a work book. If the information specified in it is not entirely complete, then other supporting documents are used, such as:

- contracts;

- orders;

- certificates;

- salary slips.

To calculate, the following generally accepted rule is used: a period of 360 days is considered for one year, and a period of 30 days is considered for 1 month, regardless of calendar calculation.

The calculation procedure is quite simple. Based on documents containing relevant information, it is necessary to find out and write down the start/end dates of working periods. Then the duration of each of them must be determined with an accuracy of one day. After this, the resulting periods are summed up to the nearest year, month and day. This calculation has been used previously.

Engineering experience

The legal minimum is 3 years. But only the period after receiving the diploma is counted. If an individual works in parallel with receiving education on a part-time or full-time basis, such experience is not taken into account.

The exact list of specialties for which work is suitable for enrollment in engineering experience is not defined at the legislative level. As a rule, applicants are guided by the explanations of NOSTROY, according to which engineering experience includes work in the following positions:

- engineer;

- chief engineer;

- cost estimate engineer;

- surveyor engineer;

- masters;

- foreman;

- surveyor;

- site manager;

- head of the supply department.

It is important that the specialist’s job responsibilities comply with those specified in Art. 55.5-1 Civil Code of the Russian Federation requirements.

If a specialist has worked in several companies, they are listed in order from the last place of work to the first. The presence of engineering experience is confirmed by an employment contract, work book, order assigning new responsibilities to an employee, an extract from the service record or personal file, job description, service agreements.

How is length of service taken into account when calculating pensions?

The basis for assigning old-age benefits is reaching the required age. In 2021, it is 55.5 and 60.5 years for women and men, respectively . In addition, you must have a sufficient number of pension points. The insurance period, the period during which contributions were paid for the employee, also plays a significant role.

The OTS itself does not affect the assignment of a pension. However, given that the vast majority of people who are about to retire, as well as those planning to end their working career in the coming years, began working before 2002, this is of great importance for them. This is due to the fact that until 2002, pension rights were formed exclusively on the basis of the TTS, which will be taken into account when calculating material payments.

In addition, the special working period affects the right to preferential (early) receipt of pension payments for certain categories of persons.

Reference! After 2002, all citizens were registered in the compulsory pension insurance system, and therefore all periods that were discussed in the article above are counted only in the insurance period.

The length of total work experience is not considered by modern Russian legislation as the main factor for calculating old-age benefits (with the exception of periods of work before the pension reform of 2002). The insurance model of pension provision presupposes other grounds for receiving financial support in old age, depending, in addition to the length of work, on the volume of transfers to the Pension Fund.

Work experience in the specialty for civil servants

According to paragraph 2 of Art. 14 of the Law “On the Civil Service System” dated May 27, 2003 No. 58-FZ, the length of service in one type of civil service is added to the time spent working in another type of civil service or holding positions in the municipal or state service. According to clause 3, part 1, art. 6 of the Law “On the State Civil Service of the Russian Federation” dated July 27, 2004 No. 79-FZ, civil service experience is taken into account when calculating the length of service of a civil servant.

When calculating the length of service in the civil service, the employee’s period of work as a municipal employee is taken into account, and also vice versa (clause 4, part 1, article 5 of the law “On Municipal Service...” dated March 2, 2007 No. 25-FZ). This is explained by the uniformity of qualification requirements for both types of services.

According to paragraph 1 of Art. 12 of Law No. 79-FZ of July 27, 2004, for an applicant for a civil servant position or, by virtue of clause 3 of Art. 5 of Law No. 58-FZ, civil servants of a constituent entity of the Russian Federation must comply with qualification requirements. In particular, there must be work experience in the civil service or specialty. To fill the position of a municipal employee, similar requirements are presented to the applicant (Clause 1, Article 9 of Law No. 25-FZ).

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

ConsultantPlus has many ready-made solutions, including the procedure for calculating experience, including by specialty. If you don't have access to the system yet, you can sign up for a free trial online! You can also get the current K+ price list.