If an organization uses a car, even a rented one, waybills must be issued to account for fuel and lubricants. Previously, they were generated in a third-party program or a specialized program for 1C waybills was purchased.

Starting with release 3.0.74, it became possible to generate waybills in 1C 8.3 Accounting. But is this suitable for all organizations? Let's figure out what waybills are provided in 1C and how to keep records of them.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Waybill in 1C 8.3 Accounting

Fuel and lubricants account

Regardless of whether waybills are accounted for in 1C, the previously used fuel and lubricants account 10.03 is divided into subaccounts:

- 10.03.1 - for accounting for fuel and lubricants in a warehouse and if waybills are not generated in 1C Accounting;

- 10.03.2 - for accounting for fuel and lubricants in vehicle tanks and automatically writing them off when generating waybills in 1C Accounting.

Read more about the fuel and lubricants accounting scheme when using waybills and without them in 1C Accounting.

Possibilities and limitations of using standard sheets

Accounting for waybills in 1C 8.3 Accounting is possible only for non-transport enterprises: to account for fuel consumption for personal and company vehicles.

To be able to generate waybills in standard Accounting, go from the Main to the Functionality settings and check the Waybills on the Inventory .

Waybills checkbox allows you to:

- print an advance report when providing a cash receipt for refueling a car;

- draw up and print a waybill from 1C Accounting 3.0 using Form No. 3 or a simplified form (before using it, approve it in the accounting policy);

- automatically calculate and recognize expenses for fuel and lubricants according to the waybill;

- control the remaining fuel in the car tanks on account 10.03.2.

If the box is checked, then when registering an advance report for refueling a car and when purchasing fuel and lubricants using ruble fuel cards, use account 10.03.2.

When purchasing fuel using coupons, statements and regular supplies in tanks, use account 10.03.1. In this case, waybills are not generated, and fuel and lubricants are written off manually, even if the Waybills is selected.

In the waybill when posting fuel and lubricants by check, you cannot highlight VAT and write it off as non-acceptable expenses in the NU. The entire amount of the check is taken into account in the cost of fuel and lubricants.

Algorithm of actions of an accountant

Similar to other industrial inventories of the enterprise, fuel and various types of lubricants are taken into account in accounting based on their actual cost. Expenses are an element of section II of PBU 5/01. Fuel can be included in accounting based on two types of papers that are attached to the expense report:

- Gas station receipts (if fuel is purchased on the route in cash).

- Fuel coupons (when purchased by bank transfer according to an agreement between the enterprise and the supplier company).

In addition, drivers can purchase gasoline or diesel fuel on the road using a company-issued fuel card. When using this method, accounting is carried out upon receipt by the enterprise of a report on the amount of fuel poured into the tank from the card issuer. For write-off, two methods are used (section III of PBU 5/01):

- average cost;

- FIFO (cost of previously purchased quantities of inventory).

The third method specified in the PBU (separate calculation of the cost of all inventory units) is not used in accounting for fuel and lubricants. The first method is most often used by accountants. In this case, the cost of the balance is summed up with the cost of receipt, and then divided by the total balance on the day of registration (in kilograms or liters).

Accounting

Accounting is carried out in the “Fuel” subaccount (10-3) of the “Inventories” account (10) as follows:

- debit – receipt;

- loan - write-off.

Algorithm: the pre-calculated amount of fuel is multiplied with the cost of accounting for a unit in inventory. The result is written off - Dt 20 (or other material accounts, as well as 44) Kt 10-3.

Tax accounting

There are several nuances regarding the procedure for determining costs for vouchers.

First. It is necessary to determine the type of expenses that include the fact of write-off (material or other). Clause 5, clause 1, Article 254 provides for their inclusion in material costs. Condition - inventory assets (fuel, oils, lubricants, and other specialized materials) must be used for technological needs. Other primary documents - the movement of vehicles performing non-production tasks - are included in other expenses.

For those enterprises where the transportation of goods and passengers is the main activity, 100% of the costs of fuel and lubricants written off in tax accounting for driver vouchers are material.

Second. Is it necessary to standardize expenses in tax accounting? The legislator does not directly say that 100% of expenses can be recognized as such based only on their actual consumption. The Ministry of Finance confirms in numerous letters that the amount of fuel can be calculated in accordance with Order No. AM-23-r. That is, justifying costs, the amount of which is determined mathematically.

So, consumption can be determined both by standard quantity and by actual costs. It should be remembered that paragraph 6 of the above order establishes that subjects have the right to independently develop, approve by local acts and adjust consumption rates.

There is no direct explanation in this regard in the code. If they are established by the organization independently, exceeded and accounted for as incurred in excess of the norm, the tax authority has the right not to consider them expenses of the reporting period.

Accounting for waybills in 1C 8.3 Accounting

On January 28, Druzhnikov Georgy Petrovich provided a check to the cash register for refueling official vehicles with Gasoline AI-95 fuel in the amount of 35 liters in the amount of 2,100 rubles. On the same day, he reported on the waybill and fuel consumption.

On January 30, a waybill was issued for the driver Druzhnikov G.P. and fuel consumption was recorded.

Step 1. Decide on the fuel and lubricants receipt document using the diagram

In the example, the receipt of fuel and lubricants is carried out through an accountable person - for this case, use the document Waybill in the Purchases .

Step 2: Prepare supporting references

To correctly use the Waybill , check the data in the Vehicles .

In the Fuel , select the name of fuel and lubricants from the Nomenclature directory to record its receipt and consumption.

In the Consumption rate , fill in how much fuel the car consumes in winter or summer, depending on when it is used most often or the current time of year.

Also check that the driver has entered current driver’s license information in the Individuals .

Without this data, the waybill will not be processed.

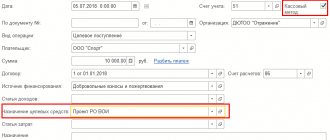

Step 3. Fill out the header of the document Waybill

Indicate the fueled vehicle and driver in the Employee from the Individuals directory.

The consumption rate will be filled in automatically from the vehicle card; change it if necessary. For example, in the summer, fuel consumption according to the standard will be less.

If you select a positive response to the change in the standard and record the document, the Consumption Rate will change in the Vehicles and will be used in the following documents.

the cost account and its analytics using the link of the same name. By default, the Main Cost Account and the default item for waybills are filled in. Change them manually if necessary.

Step 4. Enter data on the purchased fuel and lubricants

On the Fuel , register the data of the driver’s report on refueling the car, selecting exactly how the fuel was purchased: using a fuel card or other funds (cash, bank card). If the documents are issued in the name of the Organization, this tab is not filled in.

Information about the purchased fuel and its balance in the tank will be displayed at the bottom of the document.

Based on these data, click the Print – Advance report (AO-1) to print the accountant’s report, the number of which you need to correct manually. When generating an expense report in this way, there is no continuous numbering. In addition, you will have to control the numbering of the Advance Report documents and, if necessary, correct the serial number in it manually.

For a fuel card, a report in Form AO-1 is not generated from the document.

Step 5. Enter data to calculate fuel consumption

On the Route , register all trips on the vehicle. Fill in either Odometer readings or Distance in km (the blank indicator will be calculated automatically).

Field data Consumption, l is calculated using the formula:

If the actual fuel consumption differs from the calculated one, correct it manually.

After entering the information, fuel consumption will also be automatically calculated and the remaining fuel in the tank will be recorded.

Step 6. Generate transactions for receipt and write-off of fuel and lubricants

Write-off of fuel and lubricants in the waybill is carried out only in quantitative terms. The amount will be calculated at the end of the month.

Step 7. Reflect the data of the next trip and generate transactions

If there is fuel in the tank (account balance 10.03.2), regardless of how the receipt is processed, the balance will be reflected at the bottom of the document. Enter route information for the current day.

Create the wiring.

Step 8. Calculation of fuel and lubricant costs in total terms

If waybills were reflected during the month, at the end of the month the credit amount for account 10.03.2 will be determined. The cost of written-off fuel and lubricants according to waybills is always calculated using the average, even if the accounting policy settings provide for the Method of estimating inventories - By FIFO .

Go to the routine operation Adjustment of item cost and check the calculation of the amount.

Cost of 1 unit. = 2,100 / 35 = 60.

The cost of 27.267 liters of decommissioned AI-95 gasoline = 60 * 27.267 = 1,636.02.

Primary documents

For primary accounting purposes, the following are recognized:

- petrol;

- DT;

- gas (liquefied, compressed, petroleum).

As well as specialized lubricants and liquids for technical purposes (motor oils, antifreeze, special lubricants).

Before leaving for a route, an amount of fuel called the standard amount is poured into the tank of the vehicle. For each brand of car separately, this quantity is determined in accordance with the norm approved by the local act (order) of the enterprise. The issued fuel is entered into a special driver’s travel sheet - a voucher. It indicates the amount of fuel at the time of leaving the garage, mileage (km) and the remaining gasoline, diesel fuel or gas in the tank upon completion of the shift task. The voucher is the main accounting document confirming the amount of fuel and lubricants consumed by the driver en route for subsequent write-off.

Accounting departments of enterprises (organizations, institutions) where motor transport is directly related to the main activity (transportation of passengers, cargo, etc.) must use primary paper documents in daily work, the form and details of which are approved by order of the Ministry of Transport. The number of this document is 152, it was approved on September 18, 2008 (taking into account changes made by subsequent orders - dated January 18, 2017 No. 17, dated November 7, 2017 No. 476).

form Travel sheet for a passenger car (Form No. 3)

If vehicles are used at an enterprise for management purposes, or to organize production, waybills developed on the basis of two legislative acts can be used to record and control its work:

- Law No. 259-FZ (clause 14, article 2);

- Law on Accounting and Reporting No. 402-FZ.

form Truck Waybill (Form No. 4-P)

As a rule, in entrepreneurial activities, enterprise management uses the form approved by Goskomstat Resolution No. 78: form 3 for passenger vehicles, form 4-P for trucks.