When a company writes off accounts receivable (hereinafter referred to as receivables), a corresponding act is drawn up. The paper may be requested during tax audits. The execution of the act falls, as a rule, on the shoulders of the chief accountant; it is his signature that must appear on the document. The formation of the act must be treated with full responsibility. Let's look at how to compose it correctly and why it is needed.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Accounts receivable

These are debts to the company. For example, they may arise if the goods are sent and received by the counterparty, but have not yet been paid for. This also includes prepayments, advances, employee debts to the organization, and overpayments of taxes. An enterprise can accumulate quite a lot of debts of this kind.

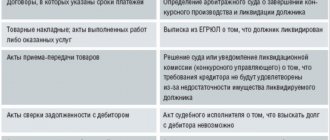

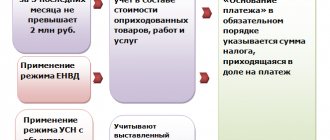

Debts that cannot be repaid are called bad debts. According to clause 77 of the Regulations on Accounting and Reporting, approved by Order of the Ministry of Finance of July 29, 1998 No. 34n, debts for which the statute of limitations has expired or which are not subject to collection (the debtor company was liquidated, for example) should be written off.

Postings for writing off short circuits and faults

Since 2021, the amount has been hanging on account 1210 and more than 3 years have passed. I should write it off as dubious and put it on expenses. The amount was excluding VAT. Please tell me what transactions need to be made and what article (line) to attach to the CIT declaration. Do I have the right to write off in 2021 or should I take the supplementary test and write off in 2021? The same situation is in account 3310 with the amount from 2021. I have to put it on income. What transactions, line in the declaration and when should you write off in 2021 or in 2021?

answer:

Pakhanov Sergey -

NK RK

Article 230. Income from doubtful obligations

2. Income from a doubtful liability is recognized in the tax period in which the three-year period has expired, calculated:

1) for doubtful obligations arising under credit (loan, microcredit) agreements - from the day following the day the remuneration becomes due in accordance with the terms of the credit (loan, microcredit) agreement;

2) for doubtful obligations arising under leasing agreements - from the day following the day the lease payment becomes due in accordance with the terms of the leasing agreement;

3) for doubtful obligations arising from accrued income of employees - from the day the income of employees is accrued in accordance with paragraph 1 of Article 322 of this Code;

4) for doubtful obligations not specified in subparagraphs 1) - 3) of this paragraph:

from the day following the expiration date of the obligation for purchased goods (works, services), the fulfillment period of which is determined; from the date of transfer of goods, performance of work, provision of services under the obligation for purchased goods (works, services), the fulfillment period of which is not defined.

Article 248. Deduction for doubtful claims

1. Unless otherwise established by paragraph 7 of this article, the following requirements are considered dubious claims:

1) arising in connection with the sale of goods, performance of work, provision of services to legal entities and individual entrepreneurs, as well as non-resident legal entities operating in the Republic of Kazakhstan through a permanent establishment, structural unit of a legal entity, and not satisfied during the three-year period calculated in accordance with paragraph 4 of this article;

4. In the cases provided for in subparagraph 1) of paragraph 1 of this article, doubtful claims are subject to deduction in the tax period in which the three-year period, calculated:

from the date of the latest of the following dates: the day following the day of expiration of the deadline for fulfilling the requirement for sold goods (work, services), the deadline for which has been determined; the day of assignment of the right of claim for sold goods (works, services), the execution period of which is not defined.

Conclusion: if the statute of limitations for doubtful debts has expired (more than 3 years), then you cannot accept this type of deduction (income) for expenses (income).

In order to write off doubtful debts, you will need to create a debt adjustment

In the new document, indicate the type of transaction, select the counterparty for whom the debt will need to be written off

After this, you will need to fill out the accounts receivable tab if the counterparty has accounts receivable, accounts payable if the counterparty has accounts payable

After filling out the necessary tabs, you will need to indicate the accounts receivable (payable) account

Next, in the accounting account tab, you will need to fill out an account for writing off receivables (payables)

In order for the amounts to fall into the TNF 100.00, you will need to indicate the subconto of the cost (income) item.

After this, check the reflection of the subconto data in the TNF

With this setting, the amount in the document will be reflected in the Federal Tax Service

The correct procedure for writing off receivables

According to the law, you can’t just write off DM. The following procedure must be followed:

- The manager must issue an order to carry out an inventory of settlements with suppliers, customers and other debtors and creditors.

- The audit indicated above is being carried out. Based on its results, an act is drawn up in the INV-17 form, where the actual amount of the debt will be indicated. It will need to be written off.

- The head of an enterprise or company issues an order to write off the debt.

- The accountant makes a write-off. The grounds will be an inventory act and an accounting certificate. The procedure is accompanied by the creation of a corresponding act.

Attention! All available documents confirming the write-off must be attached to the report, since tax authorities very carefully check this area of accounting.

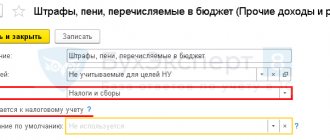

The purpose of the act is to become the basis for recognizing non-operating expenses when calculating income tax payments, according to subparagraph. 2 p. 2 art. 265 of the Tax Code of the Russian Federation, and for entering information into the accounting of an enterprise or company.

How to submit a report

An accounts receivable report implies documentation that provides information on all summaries. The report should show the total amount of overdue payments. In most companies, a report on accounts receivable is prepared once a month.

All information in the documentation is distributed into groups. Grouping criteria may vary, the most common of which are as follows.

- Sellers.

- Buyers.

- Product category.

The following forms are typical for a report based on accounts receivable.

- Debt represented in the form of monetary currency.

- Debt presented in the form of barter.

- Overdue debt, which may be in the form of cash or barter.

In addition, any report must contain the following data.

- Product and buyer information.

- Debt repayment terms.

- Interest on a loan or late payments.

If there are any difficulties in collecting funds, they must be indicated in the report. In addition to the above data, the report may contain additional information. For example, we can cite a situation when we are talking about a barter transaction.

The report indicates the type of product and its volume instead of a monetary amount. Using the accounts receivable report, the company's finance department will be able to calculate the optimal course of monetary policy. When analyzing the reporting document, a legal entity determines the approximate amount of work for debt collection processes.

How to account for accounts receivable is discussed in this video:

For the head of the organization, the report is also important. With its help, you can analyze changes in the production and activities of the company and, in connection with this, change the planned volumes of purchases of equipment or products.

What opportunities does reporting offer?

A report on receivables or payables makes it possible to track financial interaction with other companies and employees of your organization. Reporting must be carried out without fail, this contributes to management activities, and also allows you to plan the future course of credit policy.

With the help of a reporting document, it becomes possible to be aware of the following parameters of the organization’s work.

- The accounts receivable report helps you track changes in production, as well as calculate the total amount of money spent and earned.

- The reporting document will allow you to create an objective picture of the organization’s calculations. An example would be a situation where a company unexpectedly needed additional funds. Where you can get them from will allow you to find out the accounts receivable report. If the head of the company decides to take out a loan, the reporting document will help calculate the period for which the loan agreement should be issued. If the company has the opposite situation, that is, there is a large amount of cash, the accounts receivable report will help to optimally distribute the money.

- Documentation of accounts receivable or credit will help plan further expenses and income of the organization.

The report will greatly facilitate the determination of the amount of funds expected from debtors. In turn, this will allow you to plan the amount of taxes and total profit. The documentation contains information about the total amount of monetary debt and the general direction of payment. - The document will allow a more objective assessment of the client. Based on the accounts receivable report, you can create a list of customer reliability, depending on how they pay their debts. This will allow you to determine the overall solvency of the company and find out the circle of the most conscientious payers. This will also make it possible to terminate the cooperation agreement with those organizations that often delay payment under the purchase and sale agreement.

- If the organization has a planned credit policy, the report will allow you to find out the degree of its effectiveness. In case of large losses, the head of the organization will be able to notice the emerging problem much earlier and take appropriate actions to solve it.

- The accounts receivable report allows you to timely demand payment under the agreement from debtors. The documentation clearly shows overdue payments, for which it is time to take special measures to collect them. For example, go to court or talk directly with the debtor.

- The report will allow you to find out in advance which companies have accumulated a large amount of debt. This will make it possible to avoid conflict situations, additional monetary penalties and preserve the reputation of your organization.

Analysis of accounts receivable for the report. Photo: encrypted-tbn0.gstatic.com

The head of any company should understand that a report on accounts receivable is needed not only for formality.

With the help of this documentation, you can react much earlier to changes in the dynamics in relationships with clients and customers; the report will allow you to plan the company’s activities based on clearer and more specific data.

How to organize a budget

As mentioned above, a special program 1C – Enterprise has been developed for these purposes. Based on it, you can create a report on accounts receivable. To do this, it has the following functions.

- 1C allows you to generate forecasts on the financial condition of the company by analyzing the available information.

- 1C creates financial reports and can maintain a management balance sheet, which is based on objective values. This allows you not only to calculate and analyze profit, but also to compare its values with past indicators.

- Allows you to compare budgets for different periods.

- Helps analyze for deviations.

- The program automatically compares the debts of your clients and your credit obligations for three periods for certain periods and calculates the final amount for specific periods.

How to make a report on accounts receivable in 1C, see this video:

1C has built-in all the necessary formulas for the above calculations.