Real estate accounting

Real estate accounting is carried out in accordance with these acts:

- Accounting regulations established by Order of the Ministry of Finance No. 26 n dated March 30, 2001.

- Guidelines for accounting for OS No. 91.

the write-off of buildings and other real estate in accounting ?

Accounting should not contradict general rules. There are conditions for real estate to be included in the list of fixed assets (hereinafter referred to as fixed assets):

- Real estate is necessary for conducting the main activities of the company (sale of products, provision of services).

- The facility will be in operation for longer than a year.

- The company does not plan to resell.

- The facility is expected to provide financial benefits. In this case, its acquisition will be considered justified.

The list of these conditions is given in paragraph 4 of PBU 6/01. These rules apply to all fixed assets to which real estate belongs. Accounting is carried out based on the cost of the object. This cost is formed based on the company’s actual expenses for purchase, assembly, and production. All taxes and government fees are deducted from this amount. However, registration fees may be included as expenses because they are associated with the purchase. That is, expenses for state registration of real estate will be written off as current expenses. Write-offs are carried out in accordance with general accounting rules.

Question: In 2021, an organization acquired and registered a property that is used in transactions subject to and exempt from VAT. VAT was accepted for deduction in 2021. In what order should VAT be restored for periods of use of the property in VAT-free transactions in 2019? View answer

Purchasing objects taking into account the new rules is not considered a capital investment.

They are recognized as OS objects on the date of appearance of documents confirming their readiness for operation.

These may be documents such as a transfer and acceptance certificate, permission to put the facility into operation. Depreciation will be calculated on a general basis from the first day of the month following the month in which the property was accepted for accounting. In 2011, the procedure for accounting for objects was changed. In particular, new regulations abolished these conditions:

- Documents on registration of the object are optional.

- Actual operation is not necessary.

- Depreciation is not charged if the property remains on account 08.

How to reflect in accounting transactions for the acquisition of real estate (industrial building) ?

Since 2011, property has been accepted for accounting as fixed assets if it meets these requirements:

- Compliance with the provisions of paragraph 4.5 of PBU 6/01.

- Capital investments are completed.

- There are documents confirming readiness for use.

Registration for inclusion of property in the OS is optional. Depreciation of property will depend on when it is recorded. The month of acceptance for accounting is the month in which investments were completed and the object began to meet the characteristics specified in paragraph 4 of PBU 6/01. For depreciation, it is not necessary to transfer papers for registration. The object can be accepted into the OS on the date of signing the transfer and acceptance certificate.

Taxes and Law

In accordance with paragraph 1 of Art. 823 of the Civil Code of the Russian Federation, civil obligations providing for payment in installments for goods are classified as a commercial loan.

In the general case, the rules of Chapter 42 “Loan and Credit” of the Civil Code of the Russian Federation (clause 2 of Article 823 of the Civil Code of the Russian Federation) apply to a commercial loan.

Thus, a commercial loan agreement may contain a condition that the buyer pay interest in an amount corresponding to the price of the goods starting from the day the goods are transferred by the seller (paragraph 2, clause 4, article 488 of the Civil Code of the Russian Federation).

Accounting

Organizations using the simplified tax system keep accounting records in the generally established manner (part 1 of article 2, part 2 of article 6 of Federal Law dated December 6, 2011 N 402-FZ “On Accounting”, letter of the Ministry of Finance of Russia dated October 23, 2012 N 03-11 -09/80).

The accounting procedure for fixed assets is regulated, in particular, by PBU 6/01 “Accounting for Fixed Assets” (hereinafter referred to as PBU 6/01) and the Methodological Guidelines for the Accounting of Fixed Assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n (hereinafter referred to as the Methodological Guidelines). instructions).

Thus, according to clause 4 of PBU 6/01, in order to accept an asset for accounting as part of fixed assets, the following conditions must be simultaneously met:

a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization, or to be provided by the organization for a fee for temporary possession and use or for temporary use;

b) the object is intended to be used for a long time, that is, a period of more than 12 months or a normal operating cycle if it exceeds 12 months;

c) the organization does not intend the subsequent resale of this object;

d) the object is capable of bringing economic benefits (income) to the organization in the future.

As we can see, the condition of full payment of the cost of the acquired property, as well as state registration of ownership rights for accepting the object for accounting as a fixed asset, do not matter.

Therefore, in the situation under consideration, the purchasing organization reflects the asset as part of fixed assets at the moment when all the above conditions are met. Such a moment, in our opinion, is the date of signing the act of acceptance and transfer of fixed assets.

By virtue of clause 52 of the Methodological Instructions, real estate objects, the ownership rights to which are not registered in the manner prescribed by law, are accepted for accounting as fixed assets with allocation in a separate sub-account opened to the fixed assets accounting account, for example, the sub-account “Fixed assets, rights to which are not registered."

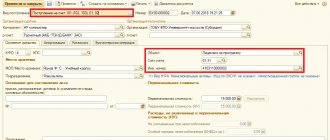

Consequently, on the date of signing the act of acceptance and transfer of fixed assets, an entry is made in the accounting of the purchasing organization:

Debit 01, subaccount “Fixed assets, rights to which are not registered” Credit 08

— the acquired building is included in fixed assets as of the date of signing the act.

After receiving a certificate of state registration of ownership of the building, the following entry is made in the accounting records:

Debit 01, subaccount “Building” Credit 01, subaccount “Fixed assets, rights to which are not registered”

— the building is taken into account after state registration of ownership of it.

Based on clause 7 of PBU 6/01, fixed assets are accepted for accounting at their original cost.

In turn, clause 8 of PBU 6/01 indicates that the initial cost of fixed assets acquired for a fee is recognized as the amount of the organization’s actual costs for acquisition, construction and production, excluding VAT and other refundable taxes (except for cases provided for by the legislation of the Russian Federation) .

The actual costs for the acquisition, construction and production of fixed assets are:

- amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use;

— amounts paid to organizations for carrying out work under a construction contract and other contracts;

— amounts paid to organizations for information and consulting services related to the acquisition of fixed assets;

— customs duties and customs fees;

— non-refundable taxes, state duty paid in connection with the acquisition of fixed assets;

— remunerations paid to the intermediary organization through which the fixed asset was acquired;

— other costs directly related to the acquisition, construction and production of fixed assets.

In this case, the procedure for settlements between the buyer and seller established in the contract (monthly, according to the schedule) does not matter for the formation of the initial cost of the property.

Based on clause 1 of PBU 15/2008 “Accounting for expenses on loans and credits” (hereinafter referred to as PBU 15/2008), this provision also applies to expenses associated with fulfilling obligations under commercial loans received.

Expenses for paying interest on a commercial loan are reflected in accounting in the reporting period to which they relate (clause 6 of PBU 15/2008).

As a general rule, expenses on a commercial loan are recognized as other expenses, with the exception of that part of them that is subject to inclusion in the cost of an investment asset (clause 7 of PBU 15/2008).

Small businesses, with the exception of issuers of publicly offered securities, as well as socially oriented non-profit organizations have the right to recognize all costs on loans as other expenses (paragraph 4 of clause 7 of PBU 15/2008).

In the situation under consideration, the buyer, a commercial organization, is not a small business entity, therefore, the procedure for accounting for interest will depend on whether or not the acquired building is an investment asset.

Paragraph 7 of PBU 15/2008 provides that an investment asset is understood as an object of property, the preparation of which for its intended use requires a long time and significant costs for acquisition, construction and (or) production.

An organization can independently approve the criteria of “long time” and “significant expenses” in its accounting policies for accounting purposes.

If an object of property meets the criteria approved in the accounting policy for classifying an object as an investment asset, then for accounting purposes the object (building) specified in the question should be recognized as an investment asset.

In this case, the interest accrued under the terms of the agreement, subject to the conditions specified in clause 9 of PBU 15/2008, is included in the cost of the investment asset. In other words, the original cost of the building.

Interest payable by the borrower ceases to be included in the cost of the investment asset from the first day of the month, following the month of termination of the acquisition, construction and (or) production of the investment asset (clause 12 of PBU 15/2008). Thus, interest on loans (credits) is included in the initial cost of an investment asset only before it is registered as a fixed asset. The remaining interest payable is applied to other expenses.

If the building specified in the request does not meet the definition of an investment asset, then all interest costs should be classified as other expenses.

At the same time, according to specialists from official bodies (see, for example, letters of the Ministry of Finance of Russia dated 06/30/2011 N 03-11-06/2/101, dated 07/02/2010 N 03-11-11/182, Federal Tax Service of Russia dated 02/06 .2012 N ED-4-3/1818), in the case of acquiring a fixed asset with an installment plan, the costs of paying interest for the provision of such an installment plan should be taken into account as part of the costs of acquiring fixed assets.

This conclusion is made by the employees of these departments on the basis of the provisions of clause 23 of the Regulations on maintaining accounting and financial reporting of the Russian Federation, approved by order of the Ministry of Finance of Russia dated July 29, 1998 N 34n, which establishes that the actual costs incurred for the acquisition of property include paid interest under the commercial loan provided upon acquisition.

It turns out that accounting issues of interest on loans (credits) are currently regulated by two regulatory legal acts of the same hierarchical level. As follows from the explanations of the financial department (letter of the Ministry of Finance of Russia dated August 23, 2001 N 16-00-12/15), in this case, a regulatory act that came into force later has priority over an act that came into force earlier than the first. Therefore, when accounting for interest, it is advisable for an organization to be guided by the provisions of PBU 15/2008.

Based on what is stated in the accounting of the organization purchasing the building, if this property is not recognized as an investment asset, the following entries must be made:

Debit 08 Credit 60

— non-current assets reflect the contractual value of the building (including VAT)*(1);

Debit 08 Credit 60 (76)

— other costs are included in the initial cost of the property;

Debit 68, subaccount “Calculations for state duty” Credit 51

— the state fee for registering ownership of the building has been paid;

Debit 08 Credit 68, subaccount “Calculations for state duty”

— the cost of state duty is included in the initial cost;

Debit 01, subaccount “Fixed assets, rights to which are not registered” Credit 08

— the acquired building is included in fixed assets as of the date of signing the transfer and acceptance certificate;

Debit 01, subaccount “Building” Credit 01, subaccount “Fixed assets, rights to which are not registered”

— the building is taken into account after state registration of ownership of it;

Debit 60 Credit 51

— payment was made to the seller according to the payment schedule;

Debit 91, subaccount “Other expenses” Credit 66, (67), subaccount “Interest on commercial loan”

— interest accrued under the terms of the agreement;

Debit 66, (67), subaccount “Interest on commercial loan” Credit 51

— interest paid for installment payment.

If the acquired building meets the definition of an investment asset, then the following entries are made in accounting:

Debit 08 Credit 60

— non-current assets reflect the contractual value of the building (including VAT)*(1);

Debit 08 Credit 60, (76)

— other costs are included in the initial cost of the property;

Debit 68, subaccount “Calculations for state duty” Credit 51

— the state fee for registering ownership of the building has been paid;

Debit 08 Credit 68, subaccount “Calculations for state duty”

— the cost of state duty is included in the initial cost;

Debit 08 Credit 66, (67), subaccount “Interest on commercial loan”

— interest accrued under the terms of the contract is taken into account in the initial cost of the building;

Debit 66, (67), subaccount “Interest on commercial loan” Credit 51

— interest paid for installment payment.

Debit 01, subaccount “Fixed assets, rights to which are not registered” Credit 08

— the acquired building is included in fixed assets as of the date of signing the transfer and acceptance certificate;

Debit 01, subaccount “Building” Credit 01, subaccount “Fixed assets, rights to which are not registered”

— the building is taken into account after state registration of ownership of it;

Debit 60 Credit 51

— payment was made to the seller according to the payment schedule;

Debit 91, subaccount “Other expenses” Credit 66, (67) subaccount “Interest on commercial loan”

— interest accrued under the terms of the agreement;

Debit 66, (67), subaccount “Interest on commercial loan” Credit 51

— interest paid for installment payment.

Tax accounting

Organizations that have chosen “income reduced by the amount of expenses” as an object of taxation reduce the income received by the expenses referred to in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

Subclause 1, clause 1, art. 346.16 of the Tax Code of the Russian Federation determines that a taxpayer applying the simplified tax system has the right to take into account expenses for the acquisition, construction and production of fixed assets, as well as for the completion, additional equipment, reconstruction, modernization and technical re-equipment of fixed assets (taking into account the provisions of paragraph 3 and paragraph 4 of Art. 346.16 Tax Code of the Russian Federation).

For the purposes of Chapter 26.2 of the Tax Code of the Russian Federation, fixed assets include assets recognized as depreciable property in accordance with Chapter 25 of the Tax Code of the Russian Federation.

Since the building was acquired during the period of application of the simplified tax system, it must be taken into account at its original cost, which is determined in the manner established by the legislation on accounting (paragraph 9, paragraph 3, article 346.16 of the Tax Code of the Russian Federation), that is, in accordance with the norms of PBU 6/01, PBU 15/2008.

Then we can come to the conclusion that interest paid for installment payment in tax accounting can be included in the initial cost (if the property is recognized as an investment asset) until the property is registered as a fixed asset.

The position of the financial department is that the costs of paying interest for the provision of installment plans should be taken into account when determining the tax base as part of the costs of acquiring fixed assets in the manner established by clause 3 of Art. 346.16 of the Tax Code of the Russian Federation (see, for example, letters from the Ministry of Finance of Russia dated 06/30/2011 N 03-11-06/2/101, dated 07/02/2010 N 03-11-11/182).

In a similar manner, according to the Russian Ministry of Finance, it is necessary to take into account the VAT presented by the seller of real estate (see, for example, letters of the Russian Ministry of Finance dated 04/03/2012 N 03-11-11/115, dated 06/30/2011 N 03-11-06/2 /101), which corresponds to the procedure used in accounting.

However, as a general rule, interest expenses are recognized by organizations applying the simplified tax system, according to the rules of Art. 269 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation), which provides for the rationing of expenses in the form of interest on debt obligations.

In this case, it can be assumed that the interest included in the initial cost of the building is also subject to rationing. At the same time, clause 3.10 of the Procedure for filling out the Book of Income and Expenses of organizations and individual entrepreneurs applying the simplified taxation system (approved by Order of the Ministry of Finance of Russia dated October 22, 2012 N 135n, hereinafter referred to as the Procedure for filling out the Book of Accounts), provides that column 6 indicates the initial cost of an acquired (constructed, manufactured) fixed asset item during the period of application of the simplified taxation system, which is determined in the manner established by regulatory legal acts on accounting.

As you know, interest is not standardized in accounting. Therefore, we take the position that interest to be included in the initial cost of the building (if the building is recognized as an investment asset) is also not standardized for tax purposes. Unfortunately, we were unable to find any official explanations from authorized bodies on the issue of rationing (not rationing) of interest to be included in the initial cost of a fixed asset.

At the same time, interest on installment payments, taken into account as an independent expense on the basis of paragraphs. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation (interest taken into account in accounting as part of other expenses), for tax purposes are normalized taking into account the restrictions established by Art. 269 of the Tax Code of the Russian Federation.

In conclusion, we note that expenses for the acquisition of fixed assets, taken into account in the manner provided for in paragraph 3 of Art. 346.16 of the Tax Code of the Russian Federation are recognized as expenses on the basis of paragraphs. 4 paragraphs 2 art. 346.17 of the Tax Code of the Russian Federation, i.e. on the last day of the reporting (tax) period in the amount of amounts paid.

Moreover, if the rights to property, which is an object of fixed assets, are subject to state registration, then it is possible to recognize the costs incurred for tax purposes only from the moment of the documented fact of filing documents for registration of rights to them (paragraph 12, clause 3, article 346.16 of the Tax Code of the Russian Federation ).

Documentary confirmation of the submission of documents for registration in accordance with clause 6 of Art. 16 of the Federal Law of July 21, 1997 N 122-FZ “On state registration of rights to real estate and transactions with it” is a receipt issued by Rosreestr, which indicates the list of documents submitted, as well as the date and time of their submission.

The Ministry of Finance of Russia in letters dated 07/25/2007 N 03-11-04/2/188, dated 04/15/2009 N 03-11-06/2/65 also indicated that expenses for the acquisition (construction, production) of fixed assets can be taken into account “ "simplified" only after they are put into operation as they are paid for, and from the moment of the documented fact of filing documents for registration of these rights.

According to paragraph 2 of the above clause 3.10 of the Procedure for filling out the Accounting Book, the initial cost of the acquired (constructed, manufactured) fixed asset during the period of application of the simplified taxation system is reflected in column 6 in the reporting (tax) period in which the most recent one of the following events occurred : commissioning of fixed assets; submission of documents for state registration of rights to an object of fixed assets, payment (completion of payment) of expenses for the acquisition of an object of fixed assets. www.garant.ru

Acceptance of real estate for registration

The initial cost of the object will include these components:

- If the object is purchased: the cost of the property set by the supplier, as well as the costs of bringing the objects into a condition suitable for use.

- If the company is building real estate: funds paid to the contractor.

Other costs may be included in the expenses associated with the activities of the company. These expenses must be taken into account in the period in which they arose. Let's look at the transactions that are relevant when accepting a property:

- DT08 KT60. Accounting for expenses for the acquisition or construction of objects. It is assumed that these costs are included in the original cost.

- DT01 KT08. Acceptance of objects for accounting.

Postings are made on the basis of documents. For example, this is an act of acceptance and transfer of real estate.

Accounting for property reconstruction under the simplified tax system

Real estate reconstruction is an improvement of the property. Reconstruction costs are included as expenses. They are recognized as expenses from the date of operation of the facility. Expenses should be written off evenly until the end of the reporting period. Only those expenses that were actually paid are taken into account.

Formation of initial cost under OSNO

If the company uses OSNO, the initial cost includes these costs:

- The cost of constructed or acquired property.

- Interest on a loan taken for purchase or construction.

- Expenses to improve an object so that it becomes suitable for use.

- Other expenses associated with the acquisition (for example, commissions).

If a company uses OSNO, it is also not necessary to send documents for state registration for accounting and depreciation.

Maintaining accounting records of sources of property formation

The company's property is not created out of thin air - assets are acquired through sources of property formation. Economists identify three such sources:

- Own capital - this concept includes both the authorized capital formed at the time of creation of the enterprise, and additional and reserve capital - these funds accumulate during the operation of the company. Equity also includes profit received and targeted financing.

For more information about what can be included in a company’s equity capital, read the material “Equity on the balance sheet is...”.

- Borrowed funds - this includes bank loans and loans from counterparties.

Find out more in the article “Borrowed funds are…”.

- Liabilities - that is, accounts payable: money that the company owes to counterparties.

See also “How are accounts payable reflected in accounts?”

Accounting for the sources of formation of an organization's property is based on the basic accounting rule: the company's property in monetary value and the sources of its formation are equal. An increase in the sources of the company's property is reflected in the credit of accounts 60, 66, 67, 76 and capital and reserve accounts (Section VII of the Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n). The expenditure of sources is reflected in the debit of the listed accounts.

When forming the balance sheet, the property of the enterprise is reflected in the asset, and the sources of the company's property are its liabilities.

For more information on how to fill out a balance sheet, read the article “Procedure for drawing up a balance sheet (example).”

Features of accounting for objects from the seller

If the property has been sold, its value is written off. Sales revenue is recognized in these cases:

- The company has ownership of the object, confirmed by documents.

- The amount of proceeds from the sale is known.

- There are indications that the firm will benefit economically from the sale.

- The buyer received ownership of the object.

- The costs of the operation can be clearly established.

Income and expenses from write-offs will be credited to profit and loss.

Accounting entries

The selling company makes the following transactions:

- DT02 KT01. Write-off of depreciation accrued on an object.

- DT45 KT01. Write-off of residual value.

- DT62 KT91.1. Proceeds from sale.

- DT91.2 KT68. VAT accrual.

- DT91.2 KT45. Write-off of residual value.

- DT91.9. KT99. Fixation of profit.

Tax documentation must reflect sales income, expenses, and profit from the sale.

Results

The property of an enterprise and the sources of its formation are the two most important categories of accounting.

Property includes fixed assets, intangible assets, inventories, cash and non-cash money of the company, accounts receivable, financial investments and a number of other assets. Sources of property formation are capital and reserves, loans, credits, accounts payable, profit. The company's assets and liabilities must be equal. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for the purchase of objects

The company that purchased the property takes it into account regardless of whether the property is registered. Real estate is included in fixed assets, and therefore is included in a special depreciation group. From the first day of the month following the month of acquisition, depreciation begins to accrue. For tax accounting of objects, these conditions must be met:

- Papers have been sent for registration.

- The property has been put into operation.

As a rule, enterprises use the straight-line method of calculating depreciation. The rate is based on the useful life period. The time during which the property was used by the previous owner is deducted from this period. The useful life period can be determined by these methods:

- Based on total useful life.

- Remaining term.

If the second method is used, the company must have a document confirming the period of operation of the object by the previous owner. In the first option, the company sets the deadline independently. When purchasing real estate, the buyer must make these entries:

- DT08 KT60. Receipt of object.

- DT01 KT08. Acceptance of real estate for accounting as fixed assets.

- DT19 KT60. Allocation of VAT amount.

- DT68 KT19. Acceptance of VAT deduction.

Opposite each posting should be the date on which the accounting was completed.