Business lawyer > Accounting > Accounting and reporting > What administrative expenses include: accounting features, write-off methods

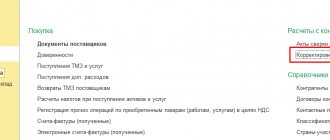

Paragraph 20 of PBU 10/99 determines that any enterprise has the right to independently determine in its accounting policies how to recognize expenses, including management expenses. They can become part of the cost by type of business activity: production or sale of goods, provision of services, performance of work (letter of the Ministry of Finance No. 07-05-06/191 dated 02.09.208). When developing accounting policies, you should be guided by the Instructions for the chart of accounts.

What is included in the article management of an apartment building

As practice shows, some management companies are confused in the concepts of “costs of management services” of housing legislation and “ management expenses ” of accounting and tax accounting. Therefore, in the old fashioned way, the costs of management services for apartment buildings are added to account 26 “General expenses”. But this is not true. Let's try to figure this out.

What is a service for managing apartment buildings?

In accordance with clause 2 of Article 162 of the Housing Code of the Russian Federation, the management company, under an agreement for the management of apartment buildings, on the instructions of the owners of premises in this building, for a certain fee, undertakes to perform work and provide services for the management of an apartment building .

This does not mean one service, but a whole range of works and services, the implementation of which is the responsibility of the management company under the house management agreement. Clause 4 of the MKD Management Rules lists a list of works and services for managing the house. School for a young programmer from RosKvartal.

Cost accounting for apartment building management services

Since September 1, 2014, in Article 162 of the Housing Code of the Russian Federation, management services have been allocated as a separate category. And this is quite justified, since clause 3 of the Rules for the Management of Apartment Buildings states that the Management Company carries out management of each individual apartment building. According to this definition, each individual apartment building is considered as an independent management object.

Therefore, management services are the main activity of the management company, similar to the service for the maintenance and repair of common property in apartment buildings . Consequently, expenses for management services for apartment buildings should be reflected on account 20 “Main production”, and not on account 26 “General business expenses”.

After all, in essence, a management company enters the housing and communal services market to manage apartment buildings. This is the source of income for the management company. Therefore, she must do everything that is specified in the management agreement with the owners of the premises in the apartment building in relation to the performance of work and the provision of utilities for the proper maintenance of the common property in the house.

If we carry out a comparative classification of the works and services of a management company, then priority management services will take the most honorable place among all others.

It is logically incorrect to place the costs of managing apartment buildings on account 26 “General business expenses.” Since the Instructions for using the chart of accounts (Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000) states that “Account 26 “ General business expenses ” is used to summarize information about the expenses of the management company for management needs not directly related to the production process.

Account 26 “General business expenses” can be used if the management company, in addition to managing the apartment building, is also engaged in other types of activities not related to management. In this case, the costs of managing the management company will be accumulated on account 26, and then distributed to the corresponding sub-accounts to account 20 according to the share of revenue from each type of activity.

All of the above are the rules for maintaining separate accounting for VAT in relation to VAT-taxable and non-VAT-taxable works and services and serve as the basis for the formation of the accounting policy of the management company. How to conclude a resource supply agreement for residential premises.

Reflection of costs for managing apartment buildings on account 26 “General expenses”

We will not be mistaken if we say that this method is used by many management companies that put the costs of maintaining and repairing common property at account 20, and the costs of managing apartment buildings at account 26.

Putting expenses into account 26 is half the battle. But then the real puzzle begins, where to put the expenses collected in this account. According to clause 9 of PBU 10/99 “Expenses of the organization” and the Instructions for using the chart of accounts (Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31.

2000), costs for management services for apartment buildings, which are reflected in account 26 “General business expenses”, can be written off monthly in 2 ways:

- as conditionally constant - Dt 90-2 “Cost of sales”;

- in the cost of work or services - Dt 20, 23, 29.

These expenses in this way can only be written off for the management of apartment buildings, but not for the maintenance and repair of common property and for utilities .

The cost of utility services for consumers must necessarily be equal to the cost of their acquisition (clause 38 of the Rules for the provision of utility services, approved in the RF Regulation No. 354 of 05/06/2011).

If 1 cubic meter of water is purchased for 100 rubles, then it can only be sold for 100 rubles.

It is impossible to increase the share of expenses from account 26 “General business expenses” from above, since the cost of acquisition and sale of utility assets will not match.

If we turn to judicial practice in the field of application of benefits under paragraph 30, paragraph 3 of Art.

149 of the Tax Code of the Russian Federation, then in the overwhelming majority of cases, the courts believe that operations for the sale of work/services for the maintenance and repair of common property in apartment buildings are exempt from VAT at a cost equal to the cost of their acquisition from the Russian North Ossetia (Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District of June 18 2014 in case No. A17-2773/2013).

If you write off the cost of management services from account 26 “General expenses” to the cost of services for the maintenance and repair of common property, you will get the difference due to distributed management costs.

In this case, tax inspectors will be able to reasonably present claims to the management company. It turns out that from the point of view of housing legislation, coupled with the Tax Code, this approach may cause criticism from the tax authorities.

Since MKD management is the main activity of the management company, expenses for this item should be formed on account 20 “Main production”. At the same time, account 20 has advantages for reflecting the costs of managing apartment buildings over the usual way of reflecting these expenses on account 26. Therefore, it still makes sense to reflect expenses correctly in accounting.

Let's list these advantages:

- the costs of managing a specific apartment building can be reflected on the account without reference to methods of distribution of expenses depending on the area of the apartment building, the wage fund and other criteria;

- savings on VAT. If the company’s accounting policy recognizes the management of apartment buildings as a separate service, then there is no need to divide the incoming VAT on work and services purchased for the purposes of managing the house into taxable and non-VAT-taxable transactions (clause 4 of Article 170 of the Tax Code of the Russian Federation). All VAT on the MKD management service can be deducted, since it is subject to VAT in full.

Accounting policy of the management company

Since 2015, in order to comply with the Information Disclosure Standard (RF Government Decree No. 731), management companies must keep separate records of income and expenses. This is necessary in order to correctly reflect the required data in the annual report of the management company. Technical documentation of MKD: what does it include?

Source: https://dcvesta.ru/chto-vhodit-v-statyu-upravlenie-mnogokvartirnym-domom/

Automation of management accounting

Management accounting programs allow you to solve problems of process automation, control and reporting. Universal and effective solutions are the “WA: Financier” line of software products. They can be used at enterprises with different specifics and volumes of document flow at enterprises in Moscow and other regions of Russia. They are effective for use in organizations with a dedicated financial service, as well as in companies that operate with aggregated data received from external systems.

General operating expenses in housing and communal services

For more than a year now, the formation and optimization of management of multi-apartment residential buildings has been taking place in Russia. One of the most important problems that require a prompt solution is the low awareness of the population in matters of maintenance and repair of residential premises, the provision of housing office services, and other issues related to the management of management organizations.

Order of the State Construction Committee of the Russian Federation No. 303 of 2000 defines general operating expenses as the costs of management and coordination of work on the maintenance of the housing stock.

These costs include the costs of financing management companies, which create favorable conditions for their normal operation. These costs are not related to fees for the maintenance and repair of apartment buildings, and are quite varied. The general operating expenses group includes the following types of expenses:

- economic and administrative needs;

- payment of wages to employees;

- organization and execution of work;

- other needs.

The above expenses are included in receipts for payment and are posted in one column in the personal account along with payment for the maintenance and repair of residential buildings. For a more detailed study of these costs and regulation of tariff rates for them, it is worth reading the Resolution of the State Construction Committee No. 9 of 1999.

Apartment building management fee

Article 162 of the Housing Code of the Russian Federation establishes a list of measures for selecting a management company. Based on the article, a management agreement for an apartment building is signed. The parties to its signing are the owners of the apartments and the management of the management organization. The elected organization must have a license to conduct management activities in multi-apartment buildings.

The company is selected by holding a general meeting of premises owners. The company signs agreements for the provision of certain services with each of the owners on the terms adopted by a decision of at least 50% of the apartment owners.

The agreement stipulates a number of obligations listed below:

- the totality of common property that is subject to the management and address of the building;

- service and maintenance provided by the organization;

- determining the amount and timing of payment for services and work on managing an apartment building, including housing and communal services, maintenance and repairs;

- the procedure and time frame for fulfilling the company’s obligations and control over their implementation.

Traditionally, services and works related to the management of an apartment building include:

- storage and maintenance house documentation;

- drawing up contracts with contractors to perform certain works and monitoring their quality;

- concluding agreements with water, heat and electricity suppliers;

- issuing invoices and collecting funds from owners of residential premises, collecting debts from debtors for services provided;

- checking the supplied utilities to customers;

- dispatch services to residents and registration of citizens;

- providing residents with various certificates;

- bringing information to homeowners about changes in tariffs;

- making proposals to homeowners for major and current repairs.

Housing and communal services expenses

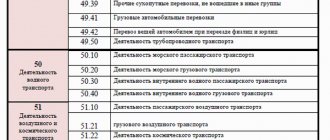

Housing and communal services is a diversified system that covers about 30 different types of activities. Housing and communal services are divided into several large sub-sectors:

- housing;

- providing consumers with resources;

- improvement of cities, towns and villages.

Financial resources of housing and communal services enterprises are formed from financial resources coming from the budget and consumers. The improvement of settlements is financed from the budget, and the provision of consumers with resources is financed from consumer funds.

Housing and communal services enterprises ensure the delivery of utility resources to consumers. Housing and communal services enterprises ensure that utility resources of the required quality are delivered to consumers. The service fee includes payment for:

- cold and hot water supply supplied to the consumer through a pipeline network;

- drainage of household waste using sewer networks;

- electricity supplied to the consumer in the required volume;

- gas supply – round-the-clock provision of gas of the required quality;

- heating - maintaining air temperature in apartments, within the framework of the relevant governing documents.

Tariffs for housing and communal services may vary depending on the region, since they are regulated by local municipal authorities. Housing and communal services enterprises do not have the right to inflate housing and communal services tariffs above those established in the region.

Tariff for management of apartment buildings

The Housing Code of the Russian Federation provides for one of the methods of managing an apartment building - the direct method of management. The procedure for choosing this form of management may be applicable for apartment buildings with at least 12 apartments. This method of management is chosen on a general basis - through a meeting of apartment owners.

One of the main conditions for choosing this method of managing apartment buildings is the choice of a management organization.

It consists of apartment owners who are responsible for the maintenance and repair of common property, ensuring the supply of utilities and fulfilling other obligations in accordance with the terms of the agreement adopted at the meeting.

With this management option, the supply of utilities is carried out to the recipient upon the conclusion of an agreement for each owner of “square meters” personally. A written contract is not required.

The advantages of choosing this form of management are:

- direct contacts between apartment owners and service providers;

- the ability of the home owner to make claims to suppliers bypassing intermediaries.

Disadvantages of this form of management:

- the management company is not responsible for participating in capital repair programs for housing;

- evasion of the obligation to incur additional expenses for billing other than one’s own resources, collection of debts and bankruptcy.

Conclusion

Like any other enterprise located on the goods market, management companies, first of all, take care of their economic stability and making a profit.

For their part, they periodically try to impose in the terms of the contract an increase in tariff rates for the repair of common property in an apartment building. Companies cite a range of reasons.

Such reasons include - rising prices in the region, tariff rates for enterprises - contractors, tariffs for municipal housing set by municipal authorities.

For most management companies, plans to increase tariffs are working well and bringing in multimillion-dollar profits. In accordance with the Civil Code of the Russian Federation, the terms of the contract are not changed by one of the parties to the contract. All terms of the agreement are governed by the provisions of the Housing Code.

Termination of such an agreement or changes in its terms are established bilaterally. The amount of payment for residential premises is regulated by the Housing Code, however, in case of controversial situations regarding price indexation, Art.

424 of the Civil Code of the Russian Federation, which states that the terms of the contract are fulfilled at the prices specified in the agreement of the parties.

General operating expenses in housing and communal services Link to main publication

Source: https://okommunalke.ru/voprosy/obshheekspluatatsionnye-rashody-v-zhkh

Organization of management accounting

All types of reporting that accompany management accounting are sources of information for analysis. In synthesis with the reports used in budgeting, they are the basis for:

- decision making,

- assessing the financial condition of the company, its solvency and liquidity,

- forecasting development dynamics in the future,

- investment attractiveness,

- identifying bottlenecks and developing measures to eliminate them,

- adjustments to plans,

- monitoring the execution of plans,

- cost optimization,

- rational distribution of income,

- preventing cash gaps (current shortage of funds),

- system resource management,

- optimizing the amount of inventory,

- determining the sufficiency of own funds for the implementation of investment projects,

- the need to attract borrowed funds for the successful implementation of new technologies and the purchase of fixed assets;

- identifying promising areas of development,

- analysis of deviations of actual indicators from planned ones in order to monitor the execution of budgets and adjust them to achieve set goals;

- implementation of measures aimed at improving financial performance results in general.

The main goal of management accounting is to find reserves to improve the efficiency of the enterprise. All information obtained through automation of management accounting should be in demand by managers at all levels, be of economic interest to them and be the basis for making rational decisions that contribute to the further positive development of the company.

Article management of an apartment building, what does it include - Portal about housing and communal services

What is MKD management in the receipt.

What do we pay for in the column “Management of apartment buildings”?

The management fee for apartment buildings (MKD) is charged by the management company. This is the only line of the receipt from which funds are sent to the accounts of the management company or other management organization. In essence, this is payment for services provided by the company to the residents of the house.

“MKD management” includes not only work in the house and yard. This also includes administrative functions. All this is described in detail in the agreement that the management company concludes with residents. The cost of all services must also be specified there.

Most often, receipts separate the concepts of “MKD management” and “maintenance and current repair of MKD”.

The second is more understandable for residents - it includes all seasonal work in the house, for example, patching the roof, repairing facades or cosmetic work in the entrances.

This also includes street lighting, garbage removal, and cleaning of entrances. We talked about this in more detail in the article “What is included in the maintenance of the common property of an apartment building.”

But besides this, the Criminal Code carries out a lot of administrative work. This, as a rule, requires a serious staff of specialists in various fields.

By “MCD management” we mean the following:

- storing technical documents for houses, making changes to them as necessary;

- preparation of papers for work with contractors, if they will be carried out on the territory of the house;

- work with resource suppliers: water, electricity, heating. The management company enters into contracts with them and is the executor of the utility service - it accepts payments and sends them to the account of the resource company;

- working with residents’ payments also involves working with debtors, including collection of debt in court by company lawyers;

- quality control of provided public services;

- passport office: registration of citizens, registration at the place of residence, issuance of certificates;

- Dispatching service;

- providing information on major repairs, supervising the contractor’s work;

- disclosure of information to owners, filling in the GIS housing and communal services system with information.

Information work with residents is added to this rather large list. For example, the management company is obliged to notify owners about changes in tariffs or talk about the possibilities of special accounts for major repairs.

What is home management?

Ways to manage an apartment building

Management of an apartment building is a coordinated activity of the owners of premises in an apartment building, or persons involved by them, aimed at organizing “providing favorable and safe living conditions for citizens, proper maintenance of common property in an apartment building and adjacent territory, resolving issues of use of common property, as well as providing utilities for citizens living in such a house” (Part 1 of Article 161 of the RF Housing Code).

Owners of premises who decide to manage the house are offered one of the following three methods (Part 2 of Article 161 of the Housing Code of the Russian Federation):

- direct management by owners

- management of the management organization

- homeowners association management.

The first method, direct management by owners, is practically inapplicable in large apartment buildings. Since any decision of the owners should in this case be made only at their general meeting. The regularity of such meetings in buildings with more than 20 apartments is already unlikely. Therefore, we will not dwell in detail on this option.

The second method, managing a management organization, has advantages.

All the work is undertaken by a specialized organization: it develops plans for long-term development, tariff rates for services, enters into contracts for utility services, maintains accounting, and carries out preventive and repair work in the house. All that is required from the owners is to agree or disagree with what she is doing.

It is not uncommon that in large houses, after the creation of an HOA, the activity of the initiative group or elected board members fades away. As the easiest way out of this situation, a management company is invited, which actually replaces the HOA as the management body of the house.

As a result, owners often find themselves “hostages” of the management company, since they actually do not control the receipt and expenditure of funds, which, bypassing the HOA accounts, are directly paid to the management company.

In this case, it is difficult to influence the volume and quality of services provided, and termination of relations with the management company results in financial losses. The main differences are as follows:

- the owners retain (but do not always use) formal leverage over the management company (through the board and the general meeting of HOA members),

- The HOA, as a legal entity, can dispose of the common property of the house (for example, rent out non-residential premises).

Source: https://gkh-rf.ru/upravlyayuschie/statya-upravlenie-mnogokvartirnym-domom-chto-vklyuchaet

Objects of management accounting

Cost accounting is one of the most important tasks of enterprise management accounting. The objectivity and efficiency of information received by managers at all levels, especially in terms of costs, affects the effectiveness of the decisions they make. Therefore, the process of timely recording of resource use indicators is very relevant in the current activities of enterprises in Moscow and other regions of the Russian Federation. Its effective implementation is possible through the use of management accounting software. The set of management accounting objects can be combined into groups:

- Production resources;

- Economic processes;

- Income and expenses;

- Structural units (with localization of income and costs by place of origin (CF)).

Article management of an apartment building, which includes - housing and communal services

For more than a year now, the formation and optimization of management of multi-apartment residential buildings has been taking place in Russia. One of the most important problems that require a prompt solution is the low awareness of the population in matters of maintenance and repair of residential premises, the provision of housing office services, and other issues related to the management of management organizations.

Order of the State Construction Committee of the Russian Federation No. 303 of 2000 defines general operating expenses as the costs of management and coordination of work on the maintenance of the housing stock.

These costs include the costs of financing management companies, which create favorable conditions for their normal operation. These costs are not related to fees for the maintenance and repair of apartment buildings, and are quite varied. The general operating expenses group includes the following types of expenses:

- economic and administrative needs;

- payment of wages to employees;

- organization and execution of work;

- other needs.

The above expenses are included in receipts for payment and are posted in one column in the personal account along with payment for the maintenance and repair of residential buildings. For a more detailed study of these costs and regulation of tariff rates for them, it is worth reading the Resolution of the State Construction Committee No. 9 of 1999.

Everything you need to know about managing the common property of apartment buildings

Reading time: 6 minutes

Not everyone understands the term “managing an apartment building.” But it is precisely this that is designed to ensure the comfort of living and monitor the operation of the property.

Cleaning the local area, seasonal preparation of utilities, maintenance repairs of structures - all these activities are assigned to organizations whose activities are extremely important, although not always noticeable.

We propose to find out what such work includes, who should do it, who has the right to choose and change the method of management.

The concept, goals and methods of management functions in apartment buildings are determined by the housing legislation of the Russian Federation. This activity is designed to provide comfortable and safe living conditions in the apartment building, maintain its property in proper condition, supply residents with the necessary utilities and services, and also maintain the functionality of internal utility systems.

The general principles of such activities require compliance with technical and sanitary standards, and include measures to ensure:

- reliability and safety of the MKD itself;

- safety of life, health and property of apartment building residents;

- public accessibility of premises and other common property of residential premises owners;

- rights and legitimate interests of homeowners;

- uninterrupted operation of engineering systems and metering devices.

The management of an apartment building is carried out by an organization chosen by the owners at a specially convened meeting of residents. If this is a commercial company, its services are provided on the basis of a management agreement for an apartment building. But there are other forms of leadership, which will be discussed below.

Typically, the company hired by the residents independently provides all necessary work and services. If, by decision of the owners, the management body of an apartment building is the council of apartment building residents, a third-party organization - a contractor - is often involved in the proper maintenance and repair of apartment building property.

Depending on the chosen method of governance and its features, the degree of responsibility of the management organization is determined.

Regulation of activities related to the maintenance of apartment buildings is carried out strictly in accordance with housing legislation. In particular, Section VIII of the Housing Code of the Russian Federation introduced the concept of management activities in an apartment building, and also established:

- rules for choosing the form of work organization;

- general requirements for this activity;

- procedure for concluding contracts;

- rules for creating conditions for conducting management activities, and so on.

- Issues that are not regulated by the Housing Code fall within the competence of by-laws. These include, for example:

- Due to the fact that the current legal system is at the stage of reform, every year the authorities have to make amendments to certain regulations governing the activities of managing the property of apartment buildings.

- In addition to direct regulatory regulation, relations regarding the maintenance of apartment building property are also regulated by concluded contracts for the provision of services.

Modern forms of property management of apartment buildings

What forms of organizing the maintenance of property of residential multi-storey buildings exist are determined by housing legislation. Owners of residential and non-residential premises in apartment buildings, by convening a general meeting of residents and discussing this issue, are required to choose one of the proposed methods. Otherwise, the law transfers the powers of choice to local governments.

According to paragraph 2 of Art. 161 LCD, methods of managing an apartment building can take the following forms:

- direct management of MKD property by its residents, provided that the number of apartments is no more than 30;

- creation or entry into a HOA, housing cooperative or other consumer association of homeowners;

- transfer of functions for maintaining property to a management company (MC).

Let's consider each proposed method in more detail.

When an apartment building is managed by the residents themselves

In the case of direct maintenance of apartment buildings by residents, the governing body is the general meeting. Based on his decisions, a service organization or other contractors are hired to maintain and repair common property.

Agreements with utility companies that provide energy and other resources and provide solid waste management services must be concluded separately by each owner of residential premises.

- To simplify the solution of management problems, the general meeting develops normative documents that can transfer the right to represent the interests of all owners to one of the residents or even a third party.

- All organizations that were involved under agreements concluded by decision of the general meeting or an elected representative are responsible for their activities directly to the homeowners.

Find out more about how an apartment building is directly managed.

The main stages of setting up and implementing automation of management accounting

The main stages of setting up and implementing automation of management accounting include:

- Development and approval of technical specifications

- Development of a company strategy with identification of goals and priority areas

- Analysis and diagnostics of the existing organizational structure, system of financial and economic relations, organization of production, planning and accounting systems.

- Creation of an information base for the implementation of a management system.

- Development of the company's financial structure and identification of financial responsibility centers.

- Development of a cost management system, classification of costs.

- Formation of a management reporting system.

- Construction of a budgeting system.

- Introduction of administrative accounting.

- Process automation.

At each stage of setting tasks and implementing automation of management accounting, appropriate regulations are developed that define norms and rules. They are displayed in specific Regulations, which are documents reflecting company policy.

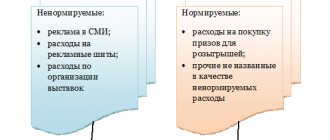

Advertising campaigns

Advertising of goods is the main method of information influence on the buyer, allowing to improve the quality of sales. This part of the costs includes payment for any services related to the promotion of products on the market, be it printing booklets or decorating shop windows.

The scope of an advertising campaign is regulated by regulations and directly depends on the volume of revenue:

- with an income of no more than 30 million rubles, it is allowed to use 5% of its amount;

- if the company received 30–300 million rubles from sales, then it is possible to use 1.5 million + 2.5% of the amount of income exceeding 30 million for advertising purposes;

- if revenue exceeds RUB 300 million. maximum advertising costs will be 8.25 million rubles. + 1% of the amount exceeding 300 million rubles.

Advertising costs can be included in business expenses only if the accounting department has primary documentation confirming the completion of work (services).