Property that the recipient is not obliged to pay for or return is considered to be transferred free of charge (clause 1 of Article 572 of the Civil Code of the Russian Federation).

Transfer property valued over RUB 3,000 free of charge. commercial organizations are prohibited. As for donations to non-profit organizations and citizens, there are no such restrictions. If the transaction amount exceeds 3,000 rubles, draw up a written gift agreement. If it does not exceed, the contract can be concluded orally. This procedure follows from Articles 574 and 575 of the Civil Code of the Russian Federation.

Accounting

Income from the gratuitous transfer of goods (materials) does not arise in accounting (PBU 9/99 and PBU 5/01). Other expenses take into account the cost of transferred goods (materials), as well as expenses associated with their transfer (clause 11 of PBU 10/99).

In this case, make the following entries:

Debit 91-2 Credit 41 (10)

– reflects the cost of goods (materials) donated free of charge;

Debit 91-2 Credit 10 (60, 69, 70, 76...)

– expenses associated with the free transfer of goods (materials), for example, for delivery, are taken into account.

Form of the contract of donation of fixed assets

A gift agreement, the subject of which is fixed assets, represents a gratuitous transfer of them into the ownership of the recipient. Article 574 of the Civil Code contains certain requirements for the form of concluding such transactions. Thus, paragraph 2 establishes a mandatory written form for the gift agreement:

- movable property, the donor of which is a legal entity, and the value of the gift exceeds 3,000 rubles;

- containing a promise of donation after a certain period of time;

- real estate that is subject to state registration.

For your information

The current Civil Code does not impose requirements for mandatory notarization of real estate donation agreements. However, practice shows that this is necessary, since it is the notary who can verify the validity of the concluded agreement and explain to the donor the consequences of the transaction.

A gift agreement must be concluded in cases where the gratuitous transfer of fixed assets is carried out by a non-profit organization or an individual. At the same time, the form of the document does not depend on the value of the fixed assets being donated if the donor is an individual who is not an individual entrepreneur.

If the donation is made by a non-profit organization and the value of the transferred fixed asset does not exceed three thousand rubles, then the agreement can be concluded orally ; in other cases, when the value of the gift exceeds the specified amount, the transaction is concluded in writing .

BASIC: income tax

The cost of goods (materials) and expenses associated with their gratuitous transfer are not taken into account when calculating income tax (Clause 16, Article 270 of the Tax Code of the Russian Federation). This also applies to accrued VAT.

Due to differences in accounting and tax accounting, a permanent difference is formed, which leads to the emergence of a permanent tax liability (clauses 4 and 7 of PBU 18/02). It must be taken into account simultaneously with the write-off in accounting of the value of property and other expenses associated with the gratuitous transfer (clause 7 of PBU 18/02).

Do the following wiring:

Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”

– a permanent tax liability is reflected.

This procedure follows from the Instructions for the chart of accounts.

Legislator's position in 2021

According to the legislation in force in the Russian Federation in 2021, citizens have the right to transfer their own property free of charge by concluding a gift agreement or donation agreement.

One of the main conditions of such transactions is gratuitousness, which presupposes the complete absence in agreements of any conditions on counter-property and other types of obligations of the donee party, and the object of a donation can be almost any property that is not prohibited for such transfer by the legislation of the Russian Federation, including the main facilities.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

It is worth noting that the transfer of fixed assets as a gift must be documented in the existing accounting records of the organizations that act as parties to the agreement at the time of the transaction. So, the donor must formalize the actual write-off, that is, the disposal of the donated amount, and the donee must record its receipt (receipt into the account). Since when concluding a gratuitous deed of gift and transferring according to the deed of fixed assets, the donor does not derive any economic benefit, it follows that according to accounting, she does not have any income.

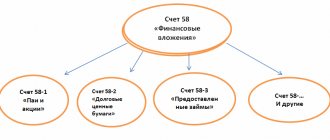

To carry out accounting entries for the receipt and disposal of fixed assets, the parties to the gift agreement use the so-called chart of accounts for accounting the financial and economic activities of organizations, in which any business transaction taking place in the organization is recorded by the corresponding entries for credit and debit.

BASIS: VAT

The gratuitous transfer of goods (materials) is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Therefore, VAT must be charged on it (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). However, in some cases, the sale of goods (performance of work, provision of services) is not subject to VAT. For example:

- provision of free assistance in accordance with the Law of May 4, 1999 No. 95-FZ;

- transfer for advertising purposes of goods, the cost of acquisition (creation) of which, taking into account input VAT, does not exceed 100 rubles. for a unit.

For more information about this, see How to calculate VAT for the gratuitous transfer of goods, works, and services.

If the gratuitous transfer of goods (materials) is subject to VAT, make the following entry:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on the free transfer of goods (materials).

The amount of VAT accrued on the value of property transferred free of charge does not reduce the tax base for income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

Input VAT on costs associated with the transfer of goods (materials) should be deducted (clause 1 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). Along with this, other conditions required for deduction must be met. In this case, do the wiring:

Debit 68 subaccount “VAT calculations” Credit 19

– accepted for deduction of input VAT on costs associated with the free transfer of goods (materials).

Accounting for donation of fixed assets

Fixed assets intended for gratuitous donation are subject to appropriate documentation both in the organization that transfers them and in the organization that receives them. The transferring party displays the donation in accounting as a disposal (write-off) of property , and the receiving party puts it on the receipt .

Accounting in the transferring organization

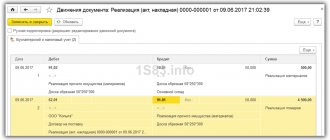

When concluding a gift agreement, the donor organization records in accounting the disposal of fixed assets in the general manner after the transfer of property to the donee and the drawing up of a transfer and acceptance certificate. This operation is reflected in accounting regardless of whether the transfer of ownership of the donated fixed assets was registered or not.

The disposal of fixed assets , when transferred free of charge, is confirmed by the following documents:

- act of acceptance and transfer of fixed assets in the established form OS-1 (OS-1a, OS-1b);

- gift agreement;

- invoices for the donated object and expenses associated with its disposal;

- notification of the receiving party about the acceptance of the fixed asset for accounting;

- payment orders and other documents confirming payment of expenses that arose during the transfer of property.

The donation of fixed assets is considered a free sale. Therefore, in accounting, this operation is reflected in the sales account and the accounting entries are similar to those for the sale of fixed assets. Only in this case the sale occurs at a zero price and, accordingly, the transferring organization (donor) incurs a loss, which consists of the residual value of the disposed fixed assets, as well as expenses associated with their transfer and other costs provided for in the gift agreement.

In accounting, transactions on the disposal (write-off) of an item of fixed assets are reflected in the following entries:

- Debit 01 “OS” sub-account “Disposal of fixed assets” Credit 01 sub-account “Assets in operation” - book value (initial) value of the fixed asset;

- Debit 02 “Depreciation of fixed assets” Credit 01 subaccount “Disposal of fixed assets” - the amount of accrued depreciation on a fixed asset (at the time of its transfer);

- Debit 91 “Other income and expenses” subaccount 2 “Other expenses” Credit 01 subaccount “Disposal of fixed assets” - the residual value of the donated fixed asset as part of other expenses;

- Debit 91-2 “Other expenses” Credit 60 “Settlements with suppliers and contractors” - the cost of costs for the gratuitous transfer of fixed assets;

- Debit 91 -2 “Other expenses” Credit 68 “Calculations for taxes and fees” subaccount “Calculations for VAT” - VAT accrual for the gratuitous transfer of fixed assets.

The gratuitous transfer of ownership of the object of donation is equivalent to its sale (Article 146 of the Tax Code). Therefore, a legal entity acting as a donor under a donation agreement for fixed assets is a payer of value added tax (hereinafter referred to as VAT). And since the cost of the sold property is zero, the tax will be calculated from the market price of the same or similar object without taking into account VAT.

If in the accounting records the donated property was listed at a value that included paid VAT, then the base for calculating the tax will be equal to the difference between the established market price of such property including VAT and its residual value.

Accounting at the host organization

When receiving fixed assets as a gift, the recipient must reflect this transaction in accounting. To begin with, the initial cost of each individual object of donation is established, which is determined by the market price on the date of their arrival . The current market price must be confirmed by relevant documents or determined through an examination. The initial cost of donated fixed assets may also include the actual costs of the receiving organization for their delivery and bringing them into working condition (if such costs exist).

Additionally

To register fixed assets received under a gift agreement, the receiving party will need the same package of documents as the transferring party to reflect the disposal of donated objects in the accounting records.

Operations for the capitalization of fixed assets received free of charge are reflected in the following entries:

- Debit 08 “Investment in non-current assets” subaccount 4 “Purchase of fixed assets” Credit 98 “Deferred income” subaccount 2 “Gratuitous receipts” - the market value of a gratuitously received fixed asset;

- Debit 01 “OS” Credit 08 “Investment in non-current assets” subaccount 4 “Acquisition of fixed assets” - putting into operation the donated object at its original cost;

- Debit 98 “Deferred income” subaccount 2 “Gratuitous receipts” Credit account 91 “Other income and expenses” subaccount 1 “Other income” - depreciation (reflection of the market value of gratuitously received fixed assets as part of other income);

- Debit 20 “Main production” Credit 02 “Depreciation of fixed assets” - depreciation on a fixed asset received free of charge.

If there were actual costs for delivering the fixed asset and bringing it into working condition, then they are reflected in the following entries:

- the above costs - Debit 08 “Investment in non-current assets” Credit 60 “Settlements with suppliers and contractors” and others;

- VAT on costs - Debit 19 “VAT on acquired assets” subaccount 1 “VAT on acquisition of fixed assets” Credit 60 “Settlements with suppliers and contractors” and others.

Transfer of property between related organizations: tax optimization

General provisions

As a general rule, the value of gratuitously received property (work, services) or property rights is included in non-operating income. An exception is made only for individual cases. They are given in Article 251 of the Tax Code of the Russian Federation. Thus, the value of property received by an organization is not subject to income tax: - from an owner who owns at least 50 percent of its authorized capital; - from a dependent enterprise in which it owns at least 50 percent of the authorized capital; - from foreign investors in the form of investments to finance capital investments for industrial purposes. Let us recall that in accordance with paragraph 6 of Article 2 of the Law of the Russian Federation of December 27, 1991 No. 2116-1 “On the income tax of enterprises and organizations,” non-operating income did not include the amounts of funds transferred between the main and subsidiary enterprises, provided that the share of the main enterprise constitutes more than 50 percent in the authorized capital of subsidiaries. Thus, the Tax Code of the Russian Federation has significantly expanded the possibilities of gratuitous transfer. In many organizations, the authorized capital is divided equally between two shareholders (participants). Consequently, from January 1, 2002, any of them or two of them can immediately transfer or receive property free of charge without paying income tax. It should be taken into account that the possibility of gratuitous transfer of property provided for in the Tax Code of the Russian Federation contradicts civil law. According to Article 575 of the Civil Code of the Russian Federation, donations are not allowed in relations between commercial organizations. An exception is made only for gifts worth no more than 5 minimum wages. Since the Tax Code of the Russian Federation allows for gratuitous transfer without restrictions on value, it can be used. However, if the transferring party has an overdue debt to the budget or is in a state of bankruptcy, then the gift agreement may be declared invalid at the request of the tax inspectorate or creditors. In this regard, it is better to receive property free of charge from those organizations that are in a normal financial position. Please note that you should not transfer property free of charge until shares or shares in the authorized capital have been fully paid for. A shareholder or member of a company has the right to vote to make decisions after making a contribution to the authorized capital. If he does not pay for the shares or shares, the contribution to the authorized capital will not be made. Therefore, it is not possible to determine the proportion of this contribution.

What property should be donated free of charge?

When planning a transaction for a gratuitous transfer, you should take into account what is meant by property in Article 251 of the Tax Code of the Russian Federation. Let us recall that in accordance with Article 38 of the Tax Code of the Russian Federation, property for tax purposes means objects of civil rights (with the exception of property rights) that are classified as property under the Civil Code of the Russian Federation. According to Article 128 of the Civil Code of the Russian Federation, this includes things, including money and securities and other property, including property rights. Thus, works and services, information, results of intellectual activity, and intangible benefits are not considered property.

Income tax

Based on the content of the concept of “property,” we can conclude that the gratuitous transfer of work, services, and intellectual property does not fall under Article 251 of the Tax Code of the Russian Federation. Please note that, according to Article 572 of the Civil Code of the Russian Federation, under a gift agreement, one party (the donor) transfers free of charge to the other (the donee): - the property; — property right (claim) to oneself or a third party; - releases the donee from property obligations to himself (to a third party). Therefore, the gratuitous transfer of the right of claim (receivables) is also not regulated by Article 251 of the Tax Code of the Russian Federation. This means that when transferring receivables free of charge, the organization must take into account its amount when taxing profits. In connection with the above, it can be argued that the gratuitous transfer of fixed assets, raw materials, materials, finished products, goods, securities and cash will not be subject to income tax (subject to other conditions specified in Article 251 of the Tax Code of the Russian Federation). When transferring intangible assets, disputes may arise with the tax authorities, since, in accordance with Articles 38 of the Tax Code of the Russian Federation and 128 of the Civil Code of the Russian Federation, they are objects of civil rights, but are not property. Please note that the transferring organization cannot include in expenses for calculating income tax the cost of gratuitously transferred property, as well as the costs associated with such transfer. This is indicated in subparagraph 16 of Article 270 of the Tax Code of the Russian Federation. In our opinion, the cost of finished products should be understood as its cost, the cost of purchased goods, raw materials and materials - the costs of their acquisition, etc. This follows from the provisions of paragraph 8 of Article 250 of the Tax Code of the Russian Federation. Thus, when they are received free of charge, income is assessed at a level not lower than the costs of production (purchase) of goods.

Example 1 CJSC Soyuz in April 2002 donated finished products to LLC Mir. In the tax accounting of Soyuz CJSC, the amount of costs for the production of transferred products is equal to 100,000 rubles. When calculating income tax for six months of 2002, Soyuz CJSC cannot take into account expenses in the amount of 100,000 rubles for tax purposes.

When transferring fixed assets free of charge, it is logical to exclude the amount of accrued depreciation from expenses. This conclusion was made due to the fact that when receiving depreciable property free of charge, income is determined in an amount not lower than the residual value.

Value added tax

In accordance with Article 146 of the Tax Code of the Russian Federation, the gratuitous transfer of goods is subject to VAT. An exception to the rules is the gratuitous transfer of funds. According to Article 38 of the Tax Code of the Russian Federation, a commodity is any property that is sold or intended for sale. However, money cannot be sold, that is, it is not a commodity. In this case, you do not need to pay VAT. Please note that the transfer of securities, as well as their import into Russia, is not subject to VAT. This is established in subparagraph 12 of paragraph 2 of Article 149 and subparagraph 10 of paragraph 1 of Article 150 of the Tax Code of the Russian Federation. When transferring goods free of charge, the tax base is calculated based on prices determined in the manner prescribed by Article 40 of the Tax Code of the Russian Federation (excluding VAT and sales tax). However, the transferring organization has the right to deduct the amount of VAT paid upon the acquisition of such property, since it was intended for a transaction subject to VAT. At the same time, when transferring goods, a positive difference may arise between the amounts of accrued VAT and those accepted for deduction. Therefore, the option of transferring funds is preferable to transferring other property.

Example 2 LLC “Planeta” entered into a donation agreement with LLC “Gamma” and donated raw materials. At market prices, the cost of the transferred raw materials is 300,000 rubles (excluding VAT and sales tax). LLC "Planeta" will charge VAT to the budget in the amount of 60,000 rubles (300,000 rubles x 20%). The transferred raw materials were purchased for 270,000 rubles, including VAT - 45,000 rubles. Since the raw materials were fully paid for at the time of transfer, Planet LLC deducts VAT on them in the amount of 45,000 rubles. When transferring raw materials free of charge, Planet LLC must pay VAT to the budget - 15,000 rubles (60,000 - 45,000).

If a foreign owner imports property into Russia for gratuitous transfer, then VAT will be paid by him at customs. A foreign company may have difficulties with the offset of VAT paid, especially if it is not registered for tax purposes in Russia and does not receive income that is subject to VAT on its territory.

Road user tax

When transferring goods free of charge, you do not need to pay road user tax. In accordance with Article 5 of the Law of the Russian Federation dated October 18, 1991 No. 1759-1 “On Road Funds” (as amended on December 30, 2001), tax is imposed on revenue received from the sale of products (works, services). At the same time, a gratuitous transfer is equated to a sale only in cases where this is directly stated in the law (chapter of the Tax Code of the Russian Federation), which regulates the procedure for collecting a certain tax. This is stated in Article 39 of the Tax Code of the Russian Federation. However, tax legislation does not provide for the classification of gratuitous transfers as sales when calculating the tax on road users.

Accounting for gratuitous transfer of property

Non-operating income includes assets received free of charge, including under a gift agreement. This is indicated in paragraph 8 of the Accounting Regulations “Income of the Organization” PBU 9/99, approved by Order of the Ministry of Finance of Russia dated 05/06/99 No. 32n (as amended on 03/30/2001). When receiving and using assets free of charge, the following entries are made: DEBIT 08, 10... CREDIT 98-2

— reflects the market value of assets received free of charge;

DEBIT 98-2 CREDIT 91-1

- the cost of assets is recognized as income (as the cost of material assets is written off as expenses or depreciation of fixed assets is charged).

The accounting regulations do not indicate how to reflect gratuitously received funds. In our opinion, the following entries can be made: DEBIT 51 CREDIT 98-2

- funds received free of charge;

DEBIT 98-2 CREDIT 91-1

- cash is recognized as income.

Please note that when receiving property to finance capital investments from foreign investors, it is necessary to use account 86 “Targeted financing”. According to paragraph 12 of the Accounting Regulations “Expenses of the Organization” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/99 No. 33n (as amended on 03/30/2001), the list of non-operating expenses is open. Note that the gratuitous receipt of property refers to non-operating income. Therefore, in accounting, the cost of gratuitously transferred property may be classified as non-operating expenses. When transferring funds free of charge, the following entry will be made: DEBIT 91-2 CREDIT 51

- funds are transferred free of charge.

Receiving property from the owner

In accordance with subparagraph 11 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, taxation does not take into account property received by a Russian organization from an enterprise (citizen) that owns at least 50 percent of its authorized capital. Please note that property is not taken into account for taxation only if it is not transferred to third parties within one year from the date of its receipt. Transfer should be understood as both gratuitous transfer and sale. This condition does not apply to cash. When receiving property free of charge, it should be taken into account that its cost is not included in expenses. In accordance with Article 252 of the Tax Code of the Russian Federation, expenses are any expenses if they are incurred to carry out activities aimed at generating income. However, when receiving property free of charge, the organization does not incur costs. Therefore, its value should not reduce taxable profit. In connection with the above, it is advisable to transfer funds free of charge, which can be spent for any purpose at any time. If the organization needs additional financial resources, then an alternative to donation may be to allocate funds by increasing prices if goods produced by the organization are sold within the group.

Example 3 JSC Strela sells its products to the trading company of the holding company of which it is a part. Therefore, prices can be regulated. To improve the financial position of Strela CJSC, its shareholders decided to increase sales prices by 10 percent for the first half of 2002. In 2001, the average price for lumber including VAT was 1,800 rubles per cubic meter. The sales volume for the first half of 2002 is 6,000 cubic meters. At the same time, Strela CJSC will receive additional funds from buyers in the amount (including VAT): 1800 rubles/cubic meter. m x 10% x 6000 cu.m. m = 1,080,000 rubles. The price increase excluding VAT will be: 1800 rubles/cubic meter. m x 10%: 1.2 = 150 rubles/cubic. m Let us determine the increase in tax liabilities as a result of price increases: - for the tax on road users: 150 rubles/cub. m x 6000 cu.m. m x 1% = 9000 rubles. - for income tax: (150 rubles/cubic m x 6,000 cubic m - 9,000 rubles) x 24% = 213,840 rubles. — according to VAT: 150 rubles/cub. m x 6000 cu.m. m x 20% = 180,000 rubles. The total amount of additional taxes accrued by Strela JSC will be: 9,000 + 213,840 + 180,000 = 402,840 rubles. The amount of additional funds received by Strela JSC minus taxes will be: 1,080,000 - 402,840 = 677,160 rubles. Thus, of the funds received from the trading company of the holding as a result of the price increase, Strela CJSC will be able to keep at its disposal only 62.7 percent (677,160 rubles: 1,080,000 rubles x 100%). Tax losses will be 37.3 percent (100% - 62.7%). If a shareholder of Strela CJSC, owning 50 percent of the shares, donates funds in the amount of 1,080,000 rubles, then there will be no tax losses.

Please note that in practice a situation may arise when it is necessary to transfer certain property, for example: - if there is an excess of raw materials (materials) in the owner’s warehouse that a subsidiary organization needs, or if the finished products of the transferring organization are raw materials for the receiving organization; — in the presence of finished products, usually exported by the owner, who has difficulties with VAT refunds (with regular VAT payments to the budget of a subsidiary); - when transferring existing production facilities to a subsidiary organization to improve production management, etc. In these situations, in order to reduce taxes from the transferring organization, you can first receive funds from the owner and then purchase the necessary property from him. It should be borne in mind that prices for such transactions may be checked by the tax authority for compliance with market prices. In addition, funds are withdrawn from the owner’s circulation for some time to carry out this operation, and a tax on road users must be assessed. Let's compare the tax consequences of the gratuitous transfer of property and funds with the subsequent purchase of the necessary property.

Example 4 Nadezhda LLC's main participant is Kontakt CJSC, whose share in the authorized capital is 60 percent. The warehouse of Kontakt CJSC has finished products, which are the raw materials for the production of products from Nadezhda LLC. The cost of finished products, according to the tax accounting data of JSC Contact, is 600,000 rubles. When assessed at market prices, the cost of products including VAT is 960,000 rubles, including VAT - 160,000 rubles. For the production of finished products of Contact JSC, materials were used on which VAT was paid - 40,000 rubles. In April 2002, Contact JSC donated products to Nadezhda LLC. The parties to the gift agreement will have the following tax consequences.

Transferring organization (CJSC Contact) The amount of accrued VAT is 160,000 rubles (800,000 rubles x 20%). At the same time, VAT in the amount of 120,000 rubles (160,000 - 40,000) must be paid to the budget. Since expenses cannot include the costs of producing finished products, the additional amount of income tax will be 144,000 rubles (600,000 rubles x 24%).

Receiving organization (Nadezhda LLC) There are no tax consequences for the transaction. However, the costs do not include the cost of the products received (800,000 rubles). In this case, the additional amount of income tax compared to the purchase option will be 192,000 rubles (800,000 rubles x 24%). Raw materials received free of charge cannot be deducted for VAT; therefore, VAT in the amount of 160,000 rubles will be additionally paid to the budget. The total amount of taxes for the transferring and receiving parties will be 616,000 rubles (120,000 + 144,000 + 192,000 + 160,000).

Let's look at the tax consequences of another option. ZAO Kontakt donates funds in the amount of 960,000 rubles free of charge, then LLC Nadezhda buys finished products from ZAO Kontakt at the market price for 960,000 rubles, including VAT.

Transmitting organization (CJSC "Contact") The amount of VAT payable to the budget will be 120,000 rubles (160,000 - 40,000). Amount of tax on road users: (960,000 rubles - 160,000 rubles) x 1% = 8,000 rubles. Amount of income tax: (960,000 rubles - 160,000 rubles - 600,000 rubles - 8000) x 24% = 46,080 rubles.

Receiving organization (Nadezhda LLC) There are no tax consequences when receiving funds. When the received raw materials are written off for production, the amount of income tax will be reduced by 192,000 rubles (800,000 x 24%). The total amount of taxes for the transferring and receiving parties will be equal to: 120,000 + 8000 + 46,080 - 192,000 = - 17,920 rubles. Therefore, the option with the transfer of funds is more profitable by: (616,000 - (- 17,920)) = 633,920 rubles. Please note that the second option will be more profitable even if the receiving organization has no profit. In this case, the transferor will pay less taxes.

Please note that the gratuitous transfer option may not always be optimal. For example, an organization needs certain equipment that its owner has. However, there is no money for the purchase. The owner may have income tax benefits. In such a situation, it will be more profitable to lease the property to a dependent enterprise. In this case, the owner will receive additional income subject to minimal tax, and the organization will increase expenses. The purpose of the operation will also be fulfilled since the equipment has been transferred. When transferring property free of charge from the owner - an individual, the following features should be taken into account. Firstly, the transfer of any property will not be subject to VAT. On the other hand, if the owner acquires property, he will not be able to deduct the VAT paid. Secondly, the Civil Code of the Russian Federation does not contain a ban on donations between citizens and commercial organizations. That is, the gratuitous transfer of property from an individual cannot be challenged by the tax authority or creditors in accordance with the Civil Code of the Russian Federation.

Transfer of property to the owner

Based on subparagraph 11 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation, the value of property received by a Russian organization from a dependent enterprise in which it owns at least 50 percent of the authorized capital is not subject to income tax. Please note that when transferring property to the owner, the same schemes can be applied and similar problems can be solved as when transferring property from the owner to a subsidiary organization. However, the gratuitous transfer of property to the owner can be an effective mechanism for redistributing profits received instead of dividends (while respecting the interests of other shareholders and participants, or if the organization has only one owner). To pay dividends, you need to have net profit and pay income tax. To transfer funds free of charge to the owner, it is enough to have them in the account. These funds may be partially borrowed (credits and borrowings, accounts payable). Therefore, to pay remuneration to the owner under this scheme, there is no need to increase taxable profit.

A.S. Bogoslovsky, expert of AG "RADA" Material provided by the Analytical Group "RADA"

How to calculate VAT for gratuitous transfers

Calculate VAT on the day of transfer of property. To calculate the tax, figure out how the transferred property (work, services) was taken into account. There are two options:

Option 1. Accounting at cost, including the amount of input VAT

In this case, charge VAT on the difference between prices. To calculate, use the formula:

VAT accrued = (RC - PS) × CH , where:

- РЦ - market price of the transferred property including VAT and excise taxes;

- PS - the value of the transferred property according to accounting data (residual value after revaluations) including VAT;

- SN - estimated tax rate 20/120 or 10/110.

Option 2. Accounting at a cost that does not include the amount of input tax

In this case, calculate the VAT at the market price, taking into account excise taxes, do not include VAT in it. The formula is as follows:

VAT accrued = RC × Tax , where:

RC - the market price of the transferred property with excise taxes, but without VAT;

NA – VAT rate 20%, 10%, 0%.

How to determine the market price

The basis for calculating VAT for gratuitous transfers is market value. If the parties to the transaction are not interdependent, then the price indicated in the primary accounting documents used to document the transfer is recognized as the market price. Also, for the calculation, you can take the price at which you have already transferred similar property to other persons, or the price for such property from other open sources:

- stock quotes;

- data from information and pricing agencies;

- open information from the reports of other organizations.

When the parties are interdependent, the market price must comply with additional conditions (clauses 1, 3, 8-12 of Article 105.3 of the Tax Code of the Russian Federation).

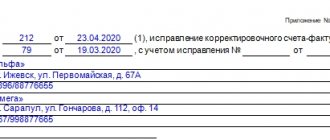

How to create an invoice for a free transfer

You must issue an invoice within five days after the property has been shipped, title has been transferred, work has been performed, or services have been rendered. In the document, indicate the market value of the transferred property or the price difference and the amount of VAT payable.

There are no special rules here. The only deviation is that one copy of the invoice is enough, since the recipient cannot receive a deduction and will not need the document. If it is issued, the recipient does not have to register the invoice in the book.

You, as the transferor, must record the invoice in the sales ledger in the quarter in which the gratuitous transfer occurs.