The procedure for calculating and paying insurance premiums is regulated by the Tax Code. It is necessary to report on all types of insurance premiums to the Federal Tax Service using a single Calculation form for all employer-insurers (approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551). The exception is contributions for “injuries”, which are controlled by the Social Insurance Fund; separate reporting is prepared for them (it is submitted to the Social Insurance Fund). The report on insurance premiums (DAM) reflects data on all amounts from which a business entity is obliged to make deductions in favor of state social insurance systems for individuals.

What it is

The name dividends is given to a citizen’s income associated with equity participation in a particular organization. The source for payments is the net profit received by the organization.

However, the concept of dividends is absent in the LLC law. But part of it is devoted to the distribution of net profit between participants.

A whole chapter on dividends is included in the law related to “Joint Stock Companies”.

Attention! According to Tax legislation, limited liability companies and joint stock companies are to some extent combined with each other. Dividends are considered any type of income received by a person from participation in such companies.

Dividends and insurance premiums

Are insurance contributions to the Pension Fund, Social Insurance Fund, TFOMS, and FFOMS paid on dividends? Dividends are not payments under employment contracts, but nevertheless, dividends are not indicated in the list for which insurance contributions to the Pension Fund are not charged.

Subject to insurance premiums

for payers of insurance premiums making payments and rewards to individuals, payments and other remunerations accrued by payers of insurance premiums in favor of individuals

within the framework of labor relations and civil contracts

, the subject of which is the performance of work or the provision of services, are recognized (Article 7 of the Federal Law RF dated July 24, 2009 No. 212-FZ).

Therefore, in order to calculate insurance premiums, payments to an individual must be made either within the framework of the person’s employment relationship with the policyholder, or this person must perform work or a service for the policyholder under a civil contract (contract, paid services, etc.).

Let's look at what dividends are.

Art. 43 Tax Code of the Russian Federation

It is established that

a dividend is any income

received by a shareholder (participant) from an organization

when distributing profits

remaining after taxation (including in the form of interest on preferred shares) on shares (shares) owned by the shareholder (participant) in proportion to the shares of shareholders (participants) in the authorized (share) capital of this organization.

According to Art. 67 Civil Code of the Russian Federation

Participants in a business partnership or company have the right to participate in the distribution of profits.

In accordance with Art. 28 of the Federal Law of the Russian Federation of 02/08/1998 No. 14-FZ “On Limited Liability Companies”

The company has the right to make a decision quarterly, once every six months or once a year on the distribution of its net profit among the participants of the company.

The decision to determine the part of the company's profit distributed among the company's participants is made by the general meeting of the company's participants.

Part of the company's profit intended for distribution among its participants

, is distributed in proportion to their shares in the authorized capital of the company.

The joint stock company pays dividends on placed shares, the payment procedure for which is established by Art. 42 of the Federal Law of the Russian Federation of December 26, 1995 No. 208-FZ “On Joint Stock Companies”

.

At the same time, according to Art. 2 of the Federal Law of the Russian Federation of April 22, 1996 No. 39-FZ “On the Securities Market”,

the right of the share owner to receive part of the profit of the joint-stock company is realized in the form of dividends

.

Thus, the payment of dividends is not subject to a reciprocal obligation

shareholder (participant) of the company to perform work, provide a service both within the framework of labor and civil law relations.

It follows that payments in the form of dividends do not satisfy the concept of an object of taxation by insurance premiums

, given in Art. 7 of Law No. 212-FZ.

FSS of the Russian Federation on its official website

, answering the policyholder's question, indicated that dividends are paid to shareholders as owners of shares.

Moreover, even the fact that the shareholders are employees of the company does not matter in this case

.

Thus, for dividends

, which are paid to shareholders working in the organization,

insurance premiums

for compulsory insurance in case of temporary disability and in connection with maternity

are not charged

.

Similarly, insurance contributions to the Pension Fund, Federal Compulsory Compulsory Medical Insurance Fund and Federal Compulsory Compulsory Medical Insurance Fund are not charged on dividends.

.

Are there any taxes?

Here we must rely on Chapter 34 of the Tax Code. We need a specific 420 article. There is a base that is subject to insurance premiums in any case.

This list includes the following types of charges in relation to individuals:

- Based on agreements on the alienation of exclusive rights to the results of intellectual activity.

- Under copyright contracts.

- According to GPC agreements, which describe the work and services.

- Within the framework of labor relations.

None of these items include payments to participants made from net profit. Therefore, it is fair to conclude that insurance premiums are not applied to dividends. The same rule applies to insurance contributions to the Social Insurance Fund associated with compulsory insurance against accidents and illnesses.

It is also useful to read: Insurance contributions from vacation pay

Registration

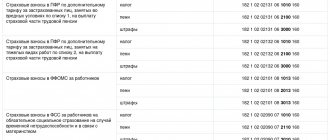

Appendix No. 3 reflects the expenses incurred by the payer of insurance contributions for the purposes of compulsory social insurance in case of temporary disability and in connection with maternity.

Column 1 reflects the number of cases (number of recipients for lines 060, 061, 062) of payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity since the beginning of the billing period, with the exception of lines 040, 050.

In column 2, lines 010 - 031, 070 indicate the number of paid days; on lines 060 - 062 - the number of payments made; on lines 040, 050, 090 - the number of benefits paid.

Column 3 reflects the amount of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity on an accrual basis from the beginning of the billing period.

Column 4 reflects the amount of expenses incurred by the payer for the payment of insurance coverage on an accrual basis from the beginning of the billing period, made from funds financed from the federal budget: in excess of the established norms for persons affected by radiation exposure, payment for additional days off to care for disabled children , as well as additional costs for the payment of benefits for temporary disability, pregnancy and childbirth, associated with the inclusion in the insurance record of the insured person of service periods during which the citizen was not subject to compulsory social insurance in case of temporary disability and in connection with maternity.

Line 010 reflects the expenses incurred by the payer for the payment of benefits for temporary disability, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity, including benefits paid in favor of working insured persons who are citizens of the EAEU member states (without accounting for the costs of paying benefits for temporary disability in favor of working insured foreign citizens and stateless persons temporarily staying in the Russian Federation) and the number of cases of awarding benefits for temporary disability.

Line 011 reflects the expenses incurred by the payer for the payment of benefits for temporary disability to persons working part-time, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity, including benefits paid in favor of working insured persons who are citizens member states of the EAEU, and the number of cases of assignment of benefits for temporary disability (without taking into account the costs of paying benefits for temporary disability in favor of working insured foreign citizens and stateless persons temporarily staying in the Russian Federation) and the number of cases of assignment of benefits for temporary disability.

Line 020 reflects the expenses incurred by the payer for the payment of benefits for temporary disability, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity, working foreign citizens and stateless persons temporarily staying in the Russian Federation (with the exception of highly qualified specialists in accordance with Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation” and the number of cases of temporary disability benefits.

Line 021 reflects the expenses incurred by the payer for the payment of benefits for temporary disability, made from funds of compulsory social insurance in case of temporary disability and in connection with maternity, and the number of cases of assignment of benefits for temporary disability to foreign citizens and stateless persons working on external part-time jobs. temporarily staying in the Russian Federation (with the exception of highly qualified specialists).

Line 030 reflects the expenses incurred by the payer for the payment of maternity benefits, made from funds from compulsory social insurance in case of temporary disability and in connection with maternity, and the number of cases of assignment of maternity benefits.

Line 031 reflects the expenses incurred by the payer for the payment of maternity benefits to persons working part-time, made at the expense of compulsory social insurance in case of temporary disability and in connection with maternity, and the number of cases of assignment of maternity benefits.

Line 040 reflects the costs incurred by the payer to pay a one-time benefit to women who registered with medical organizations in the early stages of pregnancy.

Line 050 reflects the costs of paying a lump sum benefit for the birth of a child.

Line 060 reflects the cost of paying monthly child care benefits, reflecting the number of recipients.

Line 061 reflects the cost of paying monthly benefits for caring for the first child, reflecting the number of recipients.

Line 062 reflects the cost of paying monthly benefits for the care of the second and subsequent children, reflecting the number of recipients.

Line 070 reflects the costs of paying for additional days off to care for disabled children.

Line 080 reflects the costs of paying insurance premiums to state extra-budgetary funds, calculated from the payment of additional days off for caring for disabled children.

Line 090 reflects the costs of paying social benefits for funerals or reimbursement of the cost of a guaranteed list of funeral services.

Line 100 indicates the sum of lines 010, 020, 030, 040, 050, 060, 070, 080, 090.

Line 110 indicates the amount of accrued and unpaid benefits, with the exception of the amounts of benefits accrued for the last month of the reporting period, in respect of which the deadline for payment of benefits established by the legislation of the Russian Federation was not missed.

Whether reflected in reports or not

Dividends are usually paid to participants regardless of whether the company has an employment relationship with the recipients. Payments are made without reference to the place where the person works.

These incomes do not relate to wage-related items. They are not included in workplace earnings. Therefore, the information does not need to be included in calculations related to insurance premiums.

Reference! Recalculation of obligations is carried out if an error is made due to which some information is still included in the document.

How to fill out the calculation

The Federal Tax Service describes how to fill out the report step by step, issuing relevant regulations and orders for this purpose. The current report form is also always publicly available. There are basic points that must always be taken into account.

At first glance, the document seems voluminous because it combines two forms related to contributions. Many pages remain specific and are not completed in all situations.

A title page with three sections is the main elements in the document. Some sections contain additions.

The required parts to fill out are:

- Title page.

- First section.

- First application.

- Second appendix to the first section.

- Third section.

If the company has insured persons, then the calculation is provided in this order. Moreover, when there have been any deductions over the past 3 months.

Filling out some subsections and additional columns is determined by the specifics of a particular company. 1.3 is an example of a section that applies to companies with additional tariffs for insurance premiums. The eighth appendix to the first section is required if the income was received by temporarily staying foreigners.

The calculation will be zero if there were no transfers to the company.

There are additional requirements that must be adhered to when filling out the document:

- Rubles and kopecks are a mandatory unit of measurement for amounts.

- When filling by hand, the ink should be purple, black, and blue.

- Instead of text, dashes are placed in the columns if there is no information at all. Zeros can be used.

- In electronic form, you need to follow a certain format, then it is easier to avoid violations.

- There is a separate section for listing all information related to terminated employees.

- When the document is completely filled out, the pages must be numbered.

Dividends do not have any impact on insurance premium calculations. There is also no need to reflect this information in other papers. After all, payments are not related to labor relations; no other charges are applied to them at all.

What else to consider when filling out the document

Separate divisions calculate and transfer insurance premiums independently. But the report is drawn up only if representatives of the head unit have vested the employees with the appropriate powers. Then only accruals and contributions associated with a specific unit are indicated.

Discrepancies with 6-NDFL

After receiving the reports, tax authorities begin to conduct desk audits, during which the reliability and correctness of the reflected data is assessed. This is realized, inter alia, through inter-document reconciliation of information in different declarations and other reports. In particular, in terms of accruals in favor of individuals, the Calculation for insurance premiums and the Calculation of 6-NDFL for income tax are compared.

When independently checking reports, before submitting them to the Federal Tax Service, it is necessary to compare data on income accruals in 6-NDFL and DAM for the corresponding reporting period. The income tax calculation indicates the total amount of income subject to personal income tax. Such taxable income also includes dividends. To compare the data, it is necessary to compare the base for deductions for insurance premiums with the amount in 6-NDFL, taking into account the following control ratio:

Page 050 subdivision 1.1 adj. 1 to section 1 of the DAM form (base for calculating insurance premiums) = Page. 020 form 6-NDFL (total amount of income) – Page. 025 form 6-NDFL (dividends).

The indicator from 6-NDFL may be equal to the numerical value of the base in the DAM or be greater than it. If the value from 6-NDFL is less than line 050 from the RSV, tax authorities will consider this an error and ask for clarification. The rule according to which dividends must be subtracted from the total amount of accruals in 6-NDFL (dividend payments are not indicated in the Calculation of Insurance Contributions) is established in the list of inter-document control relationships. They are given in the Letter of the Federal Tax Service dated December 29, 2017 No. GD-4-11/ [email protected] This ratio does not apply to companies that have separate divisions, as well as to individual entrepreneurs on PSN or UTII.

Features of calculation and payment

Profit is distributed not only from the current year, but also across previous reporting periods. For example, if previously income was not distributed in different directions. The general meeting of shareholders or members must make a final decision as to whether the matter is worth pursuing at this time.

The decision must be formalized using a protocol form. Otherwise, the accounting department will not be able to draw up documents and record the business transaction at all.

Dividends are also not included in the 4-FSS report.

You need to know exactly how much profit you're making in order to make decisions about how it's distributed. It is much easier to look at the financial statements; in other cases, it is difficult to find answers.

Section 3 of the accounting report should describe such phenomena in detail. The presence of a bracket indicates an undistributed loss. All amounts must be indicated for a specific date. If the amount was not distributed in previous periods, then information about it is also displayed in full.

Important! Determining net profit for a specific period is the most important issue. The income statement should contain a detailed description of the required figures.

Errors and other nuances

When calculating profits, one cannot do without the human factor. For example, some areas of activity are not taken into account at all. Net profit is distorted even with the slightest errors and problems.

To ensure that the numbers correspond to reality, the founder and chief accountant make adjustments.

After eliminating the errors, two situations arise:

- Understatement of net profit. The recalculation was carried out, but an additional amount of income appeared. There are no problems; the income received is simply distributed for specific needs.

- Dividends are overpaid, results are overstated. Net profit of the next period is reduced due to overpayment in the current one. Owners receive smaller amounts for redistribution.

Net assets in this case are the difference between the company's current assets and debts. According to the final line of the third section, this information is displayed in the balance sheet.

Retained earnings influence such phenomena. You need to find out in advance what requirements for net profit are established at the legislative level. Usually this is equal to the authorized capital, or net profit must be greater than it. Sometimes there are problems with this, because many companies have an authorized capital of no more than 10 thousand rubles.

Only when problem situations are prolonged do negative consequences arise, such as liquidation of the company and other serious punishments. Until the authorized capital is paid, dividends are also not transferred to anyone, this is the basic rule. Therefore, the value of net assets requires additional control.

Corporate legislation and the charter of a legal entity must fully describe the procedure for paying dividends. The state cares little about how exactly the money is distributed. That is why it is so important to gather meetings of the founders, for which official documents are then drawn up.

An oral decision is acceptable, but it also causes problems. There is a high probability that one of the participants will go to court to restore their rights. You cannot refer in court to a decision that is not recorded in writing. And business transactions are recorded on the basis of primary documents. At the same time, the accountant himself is deprived of the right to distribute and pay dividends. This still requires a decision from the general meeting.

At the same time, the organization itself can not only pay dividends, but also receive them. Therefore plays the role of tax payer or agent depending on the circumstances. 6% is the maximum rate if the profit is related to Russian sources, 15% if it is from foreign sources. A 30% rate is imposed on the income of those persons who are not recognized as official residents of the state.

It is also useful to read: Contributions of individual entrepreneurs to the Pension Fund of Russia