» IP management » TIN

When starting his entrepreneurial activity, each individual entrepreneur must clearly decide what he plans to do. This information must be registered with the tax authorities. Each entrepreneur is assigned his own economic activity code. It is he who is linked to the taxpayer number. Very often, to confirm the status of their counterparties and for other purposes, many are interested in how to determine the type of activity of an individual entrepreneur using the TIN.

- 2 Methods for determining OKVED by TIN

- 3 Tax service online service

At what address is the individual entrepreneur registered?

Entrepreneurs are registered at their place of residence; the applicant indicates this address in form P21001. Place of residence means an apartment, room or residential building where a person lives as an owner, tenant or on other legal grounds.

If a foreigner who does not have a permanent place of residence in the Russian Federation receives the status of an individual entrepreneur, he indicates in the application his place of residence, that is, his temporary registration address. You cannot indicate for registration the location of an office or production facility, that is, non-residential premises.

Should an individual entrepreneur have a legal address?

Considering that the current legislation of the Russian Federation does not have a clear interpretation of the concept of the legal address of an individual entrepreneur, there are no rules for its use. Therefore, in all reporting documents that individual entrepreneurs send to government agencies, the Federal Tax Service, extra-budgetary funds and other organizations, they indicate their actual residential address. Therefore, if an individual entrepreneur has rented an office or opened his own store, he does not need to register the address of the location of these objects with the Federal Tax Service.

At the same time, in advertising campaigns, on the website or business cards, you can easily indicate the actual address of an individual entrepreneur. But the individual entrepreneur is not required to indicate his place of residence address, registered with the Federal Tax Service, anywhere, except in official documentation.

Answering the question whether an individual entrepreneur needs a legal address, we can safely say that no. Conventionally, such an address is the address registered with the Federal Tax Service and other government agencies.

Who might need an IP address and why?

The need to find out the location of an individual entrepreneur may arise from both an organization and a citizen. Most often this is due to the filing of a claim or statement of claim.

Even if the counterparty of a legal entity is an individual entrepreneur, in case of violation of any contractual obligations, it is necessary to follow the pre-trial procedure for resolving the dispute. To do this, you need to send a claim to the entrepreneur. If he has not fulfilled the conditions set out in it, he can go to court. In this case, a copy of the statement of claim must also be sent to the defendant’s address by registered mail. A receipt of service is attached to the claim to certify that the defendant has been properly notified of the proceeding.

An individual can also send a claim to an individual entrepreneur when providing poor-quality services or selling defective goods. But it is not necessary for him to comply with the pre-trial procedure; the citizen has the right to immediately file a claim, also sending a copy to the defendant.

Change of address and IP

If the registration of an individual entrepreneur changes, he does not have to inform the tax authorities about this. The Federal Tax Service will receive this information from the Federal Migration Service within 10 days from the date of change of address.

After the information is received by the Federal Tax Service, its employees will make appropriate changes to the unified state register of individual entrepreneurs. Within 15 working days, the entrepreneur will be able to check the changes made on the tax website.

If, during the process of changing registration, an individual entrepreneur changes city or district of residence, he will automatically be transferred to another representative office of the Federal Tax Service. At the same time, his OGRN and TIN will remain the same. Therefore, re-registration will not be required.

How to find out the IP address

Information about the place of registration of the entrepreneur is entered into the Unified State Register of Entrepreneurs, but there is no free access to it. This information relates to the personal data of citizens and is subject to the protection of Law 152-FZ. Accordingly, it will not be possible to find the registration address of an individual entrepreneur by TIN on the Federal Tax Service website. Using this information, you can only obtain information about what types of activities the entrepreneur is engaged in.

It is also impossible to find out the location using the details of cash receipts, strict reporting forms or receipts, since the law does not oblige individual entrepreneurs to indicate this information to them. But there are still two ways to find out the registration address of an individual entrepreneur.

From the contract

The first method is the simplest and most logical. When performing work or providing services, the parties usually sign a contract. The final section of the document contains the details and addresses of the parties, telephone numbers, and email addresses. Therefore, when signing an agreement, you must carefully check the information about the entrepreneur and, if necessary, use the specified data. If for some reason there is no address in the contract, or the document is lost, you can use the second method.

Request from the tax authority

Based on clause 5 of Art. 6 of Law 129-FZ, the tax office provides information about the place of residence of a particular individual entrepreneur upon request. To do this, you should contact the Federal Tax Service with the appropriate application and identification document.

A request for information about the location of a specific entrepreneur can only be submitted by an individual. Moreover, you do not have to do this yourself; you can ask any other person to obtain information. But you cannot send a request by mail. In the request, the applicant must indicate his full name and passport details, as well as all information he has about the entrepreneur: last name, first name, patronymic, INN, OGRNIP.

Information is provided in the form of an extract from the Unified State Register of Individual Entrepreneurs, which indicates the full name of the entrepreneur, registration number and detailed address. The response to the request is generated no longer than five days in the usual manner or within one day in case of an urgent request. If there is no information about the entrepreneur in the Unified State Register of Individual Entrepreneurs, or the data provided by the applicant does not correspond to the data contained in the Register, the tax authority provides him with a corresponding certificate.

Important! In accordance with paragraph 5 of Art. 6 of Law 129-FZ, an entrepreneur also has the right to obtain information about persons who requested information about his place of residence. To do this, he needs to submit a request to the tax authority at the place of registration.

The essence of foreign economic activity and tax identification number

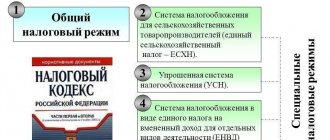

All areas of business that individual entrepreneurs can engage in in Russia are listed in the All-Russian Classifier of Types of Economic Activities, OKVED. From time to time they may change slightly, which leads to the printing of new editions of the classifier. From January 1, 2017, the latest edition has already come into force, namely OK 029-2014 (NACE Revision II).

In addition to the economic activity code, each individual entrepreneur is assigned a unique 10-digit code that identifies him as a taxpayer. An individual tax number (TIN) carries not only information about who it was assigned to, but also about which tax authority carried out the registration and other information. Including, knowing the TIN, you can find out the code of economic activity of an individual entrepreneur. It is indicated in the registration application even before the tax number is generated. Therefore, using the TIN you can find out OKVED.

Do I need to pay for an extract?

The amount of the fee for providing information in paper form is determined by Resolution No. 5n dated January 15, 2015. For issuing an extract in the usual manner, you need to pay 200 rubles, and for urgent receipt of information - 400 rubles. You can request data in several copies, and each one is paid for separately. If the tax authority does not have information about payment at the time of application, the information will not be provided, so it is advisable to present a receipt along with the application.

You can find out the registration address of an individual entrepreneur using the TIN for free if the data is provided electronically. In this case, the information is transmitted in real time through the State Services portal or an Internet service on the Federal Tax Service website.

An extract is received in paper form if it needs to be submitted to a government agency or another person, since a copy received via the Internet and printed on paper will not be accepted in these cases. If information is needed for personal use, for example, sending a claim or statement of claim, then it can be requested electronically.

It is impossible to find out the legal address of an individual entrepreneur using the TIN online, because for an entrepreneur there is no such thing. Only a legal entity can have a legal address, and an individual entrepreneur is not one.

Check any organization or individual entrepreneur

OKVED-2

- Agriculture, forestry, hunting, fishing and fish farming

- • Crop and livestock farming, hunting and provision of related services in these areas

- • Forestry and logging

- • Fishing and fish farming

• Coal mining

- • Food production

- • Providing electricity, gas and steam; air conditioning

- • Water intake, purification and distribution

- • Building

- • Wholesale and retail trade in motor vehicles and motorcycles and their repairs

- • Activities of land and pipeline transport

- • Activities to provide places for temporary residence

- • Publishing activities

- • Activities related to the provision of financial services, except for insurance and pension services

- • Real estate transactions

- • Activities in the field of law and accounting

- • Renting and leasing

- • Activities of government bodies to ensure military security, compulsory social security

- • Education

- • Activities in the field of health

- • Creative activities, activities in the field of art and entertainment

- • Activities of public organizations

- • Activities of households with hired workers

- • Activities of extraterritorial organizations and bodies

New organizations

| GUNGQING LIMITED LIABILITY COMPANY "GUNGQING" Cultivation of grains (except rice), leguminous crops and oilseeds 679385, Jewish Autonomous Region, Leninsky district, village. Bijan, st. Sovetskaya, 3, floor 1 |

| AESTHETICS S LIMITED LIABILITY COMPANY "AESTHETICS S" Providing services to hairdressing and beauty salons 664050, Irkutsk region, Irkutsk, Marshal Zhukov Ave., 68, apt. 308 |

| BUYAN-ERDENE LIMITED LIABILITY COMPANY "BUYAN-ERDENE" Market research and public opinion research 670000, Republic of Buryatia, Ulan-Ude, st. Baltakhinova, 36, office 214-268 |

| PRINT LIMITED LIABILITY COMPANY "PRINT" Other types of printing activities 214004, Smolensk region, Smolensk, st. Kolkhoznaya, 8, apt. 133 |

| ANO "SESEN" AUTONOMOUS NON-PROFIT ORGANIZATION FOR POPULARIZATION AND PROMOTION OF ETHNIC CULTURES "SESEN" Activities for organizing conferences and exhibitions 107150, Moscow, st. Ivanteevskaya, 17, bldg. 1, apt. 21 |

The highest incomes in the system of the Ministry of Finance and the Ministry of Economy were received by two economists. Taking into account the income of the spouse, nine officials had an income greater than that of the minister. In the system of the Ministry of Economic Development, the highest family income is that of the rector of the All-Russian Academy of Foreign Trade (VAFT), economist Sergei Sinelnikov-Murylev and his wife: about 79.2 million rubles. for 2020.

May 29, 2021, 02:00

The United States imported oil and petroleum products from Iran for the second time in 30 years. In March 2021, the United States imported oil and petroleum products from Iran, which is under American sanctions, according to updated statistics from the US Energy Information Administration (EIA). The supply volume amounted to 1.03 million barrels.

May 28, 2021, 11:37 pm

Russians' mortgage debts for the first time exceeded 10 trillion rubles. During the month, Russians issued more than 191 thousand loans worth 551 billion rubles.

Over the month, the debt increased by 2.9%, and over the year - by more than a quarter, 25.8%. A year earlier, in May 2021, the amount of debt amounted to 7.98 trillion rubles. May 28, 2021, 9:03 pm

Is it possible to find out the address only by full name?

Since the request for information is made in free form, you can indicate only known information about the entrepreneur. If the locality where he operates is small, then it may be possible to find out information about his place of registration. In a big city, it will be difficult to find out the address of an individual entrepreneur only by his full name. There is a high probability that there will be many entrepreneurs with the same personal data, especially if the surname is very common.

In this situation, you must first obtain additional information about the individual entrepreneur using an extract. The Federal Tax Service will generate a list of entrepreneurs with the specified personal data, their INN and OGRNIP. If there are several options, you can get an extract about the types of activities for each, and using this information, find the right entrepreneur.

Functions of the Federal Tax Service and the concept of tax audit

The Federal Tax Service, like any government body, is endowed with certain rights and responsibilities in relation to any business entities, which include individual entrepreneurs, as well as various legal companies. His responsibilities, as stated above, include monitoring the correct and timely accrual and transfer of all prescribed payments to the treasury.

Control over the accrual and payment of all mandatory payments is the main responsibility of the Federal Tax Service. It can be done in two ways:

- control by checking receipts of mandatory payments to the treasury;

- control through various tax audits.

In the first case, the Federal Tax Service carries out activities in which the bodies of this service carry out various established actions to control the bodies responsible for accepting special payments, for which individual entrepreneurs and other business entities transfer funds in the form of mandatory payments so that the funds do not go by treasury.

In the second case, the Federal Tax Service Inspectorate carries out activities in which the inspection bodies carry out various documentary controls of individual entrepreneurs and other legal entities in order to monitor the correctness of the accrual and subsequent payment of obligatory amounts of money to the state treasury. It must immediately be emphasized that such a tax audit of individual entrepreneurs is no different from that of other business entities that receive income and conduct business activities in the territory of our state.

This method of control is characterized by the fact that these measures can cover all areas of economic activity of an individual entrepreneur or other enterprise, starting with a bank account and ending with a documentary audit of goods and other material assets that constitute the object of taxation.

To summarize, we can say that such events are the activities of the Federal Tax Service aimed at monitoring documents and other material assets of individual entrepreneurs and other business entities. They are aimed at tracking the correctness of accrued payments by all business entities, as well as identifying inconsistencies (violations), which lead to incomplete accrual and subsequent payment of mandatory budget payments. Therefore, a tax audit of individual entrepreneurs is mandatory.

This activity of the Federal Tax Service is regulated by the Tax Code, Federal laws, letters and decrees of the Government of the Russian Federation, and the State Fiscal Service, therefore, when representatives of inspection bodies appear, business entities, and especially individual entrepreneurs, subject to control must know their rights and obligations, as well as the rights and obligations Inspectorate of the Federal Tax Service.

Individual entrepreneurs are the most vulnerable link, since in most cases they try to resolve issues with the inspection on their own. Some experts recommend that individual entrepreneurs seek help from professional lawyers who can act as a responsible person who will accompany any event held by the Federal Tax Service.