Before April 1, all tax agents will have to report the income of their employees for 2015. Moreover, this will need to be done using a new template. Read about how the form of the certificate has changed, as well as other nuances of filling it out, in our article.

Every year, employers must submit to the Federal Tax Service certificates of income received by employees over the past year. Despite the fact that there is still time until April 1, we advise you not to put off compiling income statements for individuals until the last few days.

Who must report on Form 2 personal income tax?

Any entrepreneur who has officially employed employees must annually submit a tax report in Form 2 of personal income tax. This must be done before April 1 of the year following the reporting year. In this case we are talking about 2015. The Tax Code provides for penalties for late filing. The amount is symbolic, 50 rubles. for each form. In addition, the head of the enterprise bears an administrative penalty in the form of a fine of 300-500 rubles. However, one should not relax, since systematic violation of tax reporting entails criminal liability with more severe sanctions.

Who needs to be indicated in Form 2 of Personal Income Tax?

It is necessary to fill out certificates for all employees. In addition, for persons who are not on staff, but received income from the enterprise. Income should be understood not only as monetary remuneration, but also as payment in kind (food, clothing, equipment, etc.), as well as bonuses and gifts. In some cases, one employee needs to fill out 2 or more personal income tax forms:

- if the person received income at different tax rates;

- if the person carried out activities in several branches of the enterprise located in different regions of the country.

Section 4 “Standard, social, investment and property tax deductions”

Section 4 needs to be completed only if the individual was provided with standard, property or social deductions.

The new form adds mention of investment tax deductions. This section contains the deduction code and its amount. If an employee received a property tax deduction through his employer in 2015, then in this section you must indicate the number of the notification confirming the employee’s right to the deduction, the date of issue of such a notification and the code of the Federal Tax Service that issued the notification. Starting this year, you can also receive a social tax deduction through your employer. Read more about this here: Therefore, the new certificate form has added a field for indicating notification details and for receiving a social deduction.

The code for the corresponding deduction is taken from the reference book “Codes of types of taxpayer deductions” (Appendix No. 2 to the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11 / [email protected] ).

Form 2 personal income tax cap

Personal income tax certificate header 2, a sample of which requires mandatory entries, should look like this:

- in the upper right corner the name of the application (Appendix 1 to the Federal Tax Service of Russia dated November 17, 2010 No. ММВ-7-3/611) and indicating the number and date of the last edition;

- under this data the name of the document, its attribute and the code of the federal tax system inspection are placed;

- Next, it is indicated for what period the certificate is issued, its serial number and the date of issue.

If most of the details are clear, then a few words should be said about the sign and number of the Federal Tax Service. There are two signs No. 1 and No. 2. According to the first criterion, forms 2 of personal income tax are submitted if the enterprise collected tax from employees. They must be submitted by April 1 of the year following the reporting year.

According to the second criterion, as is obvious, forms are submitted when the company did not withhold taxes from wages. They must be submitted by January 31 of the year for which the report is required. The Federal Tax Service is the number of the regional tax office. In order to determine which numbers to indicate in the document, use a convenient automatic search engine for all regions of the Russian Federation. You need to enter the four-digit code that comes after the fraction in the field.

Remember: it is incorrect to enter a two-digit code, which is the serial number of the INFS branch in the locality.

Section 3 “Income taxed at the rate of ___%”

The heading of this section indicates the personal income tax rate in respect of which this section is being filled out.

If during the reporting year an individual was paid income at different rates, this section is completed for each rate. This section contains information about income accrued and actually received by an individual in cash and in kind, as well as in the form of material benefits. The corresponding deductions, if any, are also given there (except for standard, social, investment and property tax deductions, for which the next section is provided).

As before, the table in section 3 must be completed monthly.

In the “Month” field, the serial number of the month of the tax period for which the income was accrued and actually received is indicated in chronological order.

In the “Income Code” field, indicate the corresponding income code, selected from the “Taxpayer Income Type Codes”. Please note: when filling out section 3 of the certificate, you must use the income codes and deduction codes approved by the Federal Tax Service Order No. ММВ-7-11 dated September 10, 2015 / [email protected] That is, the income codes and deduction codes have also changed.

The “Amount of Income” field reflects the entire amount of accrued and actually received income according to the specified income code. Opposite those types of income for which appropriate deductions are provided, or which are not subject to taxation in full, the corresponding deduction code is indicated.

If among the income paid to an individual there is income that is completely exempt from personal income tax, then such income should not be included in this section. The list of such income is given in Article 217 of the Tax Code of the Russian Federation. They do not need to be reflected in the certificate if they are not taxable regardless of the amount. This is also confirmed by the reference books “Income Codes” and “Deduction Codes”. They do not include payments such as, for example, maternity benefits, compensation related to the issuance of allowances in kind, etc. These incomes are not subject to personal income tax in full (clauses 1 and 3 of Article 217 of the Tax Code of the Russian Federation). This conclusion also follows from Letters of the Ministry of Finance of the Russian Federation dated April 18, 2012 No. 03-04-06/8-118, dated April 4, 2007 No. 03-04-06-01/109, Federal Tax Service dated February 26, 2006 No. 04-1-03/ 105.

We would like to dwell in more detail on income not subject to personal income tax within certain amounts. For example, in addition to salary and vacation pay, an employee was paid financial assistance in the amount of 5,000 rubles. This payment is not taxed if its amount during the year does not exceed 4,000 rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation). We believe that the company should include in section 3 of the 2-NDFL certificate financial assistance in the full amount and a corresponding deduction (non-taxable amount) in the amount of 4,000 rubles.

But there is an opinion that the 2-NDFL certificate does not need to include payments that fall within the non-taxable limit. And if the amount exceeds the limit, then include only the excess amount.

We do not share this opinion. The fact is that indicating only taxable payments in the 2-NDFL certificate will not reflect the real amount of income received by the employee. Moreover, it is quite likely that during the course of a year a person will receive financial assistance first from one employer (for example, 5,000 rubles), and then from another. Let’s say that upon dismissal he was given a 2-NDFL certificate, which indicated financial assistance in the amount of 1000 rubles. (5000 rub. – 4000 rub.). Having found another job, he receives financial assistance again. Let's assume, again in the amount of 5,000 rubles. According to the law, in such a situation, the employee must pay personal income tax on an income of 6,000 rubles. (5000 rub. + 5000 rub. – 4000 rub.). However, due to the lack of complete information in the 2-NDFL certificate from the previous employer, the accountant at the employee’s new place of work will withhold personal income tax only from 2,000 rubles. (1000 rubles + 5000 rubles – 4000 rubles). As a result, the tax base for personal income tax will be distorted.

To avoid possible conflicts, it is better to indicate information about the payment of standardized income in the 2-NDFL certificate in two columns:

- in the “Amount of Income” column – the total amount of payment, including the non-taxable amount;

- in the column “Deduction amount” - the amount of non-taxable income.

This approach is also shared by officials, as evidenced, for example, by Letter of the Federal Tax Service dated 08.08.2008 No. 3-5-04/ [email protected]

The main part of form 2 personal income tax

Certificate 2 of personal income tax for 2015, a sample is presented at the end of the article, consists of 5 main points:

- information about the enterprise;

- information about the employee;

- income for the reporting period at a rate of 13% or 9%;

- tax deductions;

- total income.

Data about the enterprise comes down to filling out four points:

| Item No. | Name | How to fill out |

| 1 | Tax agent information | The title of the section and the column to be filled out are not provided. |

| 1.1 | TIN/KPP for an organization or TIN for an individual | It is necessary to indicate the individual taxpayer number and the reason for registration code if the certificate is issued by a legal entity. For individual entrepreneurs, it is enough to indicate only the TIN. Information can be double-checked on the tax website. |

| 1.2 | Name of organization/Last name, first name, patronymic of an individual | Indicate the name of the company or write the full name of a private entrepreneur. |

| 1.3 | OKTMO code | The all-Russian classifier of municipal territories can be viewed here. |

| 1.4 | Telephone | Provide the organization's working phone number. |

In the employee information section you must indicate:

| Item No. | Name | How to fill out |

| 2 | Information about the individual - recipient of the income | The title of the section and the column to be filled out are not provided. |

| 2.1 | TIN | It is necessary to indicate the individual taxpayer number of the employee to whom the certificate is issued. |

| 2.2 | Full Name | The full name of the employee to whom the certificate is issued is indicated. |

| 2.3 | Taxpayer status | There are three main statuses. We put the number “one” if the recipient of the certificate is a citizen of the Russian Federation, and the number “two” - for non-residents. The number “three” is for foreigners who are recognized as highly qualified specialists in accordance with the Law “On the Legal Status of Foreign Citizens”. |

| 2.4 | Date of Birth | The date, month and year of birth of the employee to whom the certificate is issued is indicated. |

| 2.5 | Citizenship (country code) | There is a unified federal coding system for states, according to which the code of the Russian Federation is 643. For other countries, codes can be found here. |

| 2.6 | Identity document code | For a passport, this code is 21; if another document is used to confirm your identity, its digital code can be viewed here. |

| 2.7 | Series and document number | The series and serial number of the identity document are indicated. |

| 2.8 | Residence address in the Russian Federation | In this paragraph you need to indicate the postal code, region code, district, city, town, street, house, building and apartment. The region code can be found here. The populated area column is filled in only if the person does not live in the city. |

| 2.9 | Address in country of residence | Filled out for non-residents, see the country code here. |

In paragraph 3 you need to indicate the percentage of taxation, either 13% or 9%. The income table looks like this:

| Month | Revenue code | Amount of income | Deduction code | The amount of the deduction |

| Indicated by number | 2000 – employee; 2001 – director; 2530 – payment in kind. | The accrued salary is indicated | Enshrined in Appendix No. 4 to the order of the Federal Tax Service of Russia dated November 17, 2010. | The deduction amount is indicated |

Next comes the section on standard deductions:

| Item No. | Name | How to fill out |

| 4 | Standard, social and property tax deductions | The title of the section and the column to be filled out are not provided. |

| 4.1 | Amounts of tax deductions provided to the taxpayer | The table must indicate deductions for the birth of a child. According to the new rules, we are talking about codes 114-125. Main deductions: 114 – for the first child, deduction amount – 1400 rubles; 115 – for the second, deduction amount – 1400 rubles; 116 – for the third child, deduction amount – 3000 rubles; 117 – for a disabled child, deduction amount – 3000 rub. |

| 4.2 | No. of the Notification confirming the right to a property tax deduction | The notice is provided by the employee and issued by the tax office. |

| 4.3 | Date of issue of the Notification | Indicated in the order of day, month, year. |

| 4.4 | Code of the tax authority that issued the Notification | You can check it here. |

The last paragraph of the main body summarizes all the information above. It includes information about:

| Item No. | Name | How to fill out |

| 5 | Total amounts of income and tax at the end of the tax period at the rate | The title of the section and the column to be filled out are not provided. |

| 5.1 | Total income | The total income for 12 months is indicated. |

| 5.2 | The tax base | Total income excluding tax deductions at a rate on personal income of 13%. |

| 5.3 | Tax amount calculated | The amount of tax that must be withheld from your salary. In order to find out, you need to multiply the amount indicated in the tax base column by 13%. |

| 5.4 | Amount of tax withheld | The amount that the employer withheld from the salary must be equal to the amount of tax accrued. |

| 5.5 | Tax amount transferred | Indicated for income starting from 2011, equal to the amount of tax accrued. |

| 5.6 | Amount of tax over-withheld by the tax agent | If it turns out that excess personal income tax funds have been withheld, this must be indicated. You can return them within three months, then you need to prepare Form 3 of personal income tax. |

| 5.7 | Amount of tax not withheld by the tax agent | The amount that was erroneously undercharged for personal income tax. |

Section 1 “Data about the tax agent”

This section displays information about the tax agent.

In the “OKTMO Code” field, the code of the municipality on the territory of which the organization or a separate division of the organization is located is indicated. Codes according to OK OK 033-2013 (OKTMO). When filling out the “OKTMO Code” indicator, for which eleven familiar spaces are allocated, no characters are entered in the free familiar spaces to the right of the code value if the OKTMO code has eight characters. For example, for an eight-digit OKTMO code the value “12445698” is indicated.

Next, indicate the telephone number, INN, KPP and the name of the tax agent. If the organization has a separate division and the citizen received his income through this division, then the checkpoint at the location of the division is indicated on the certificate.

Certificate 2 personal income tax with confirmation

When applying for a loan or preparing documents for traveling abroad, you will need to submit a 2nd personal income tax certificate. This is a problem for those who work unofficially, since the director of the enterprise will not give them such paper.

Some law firms offer to buy 2 personal income taxes. On the one hand, this is convenient, on the other, it can lead to disastrous consequences. The Law clearly states that Form 2 of personal income tax is issued exclusively to persons from whose salaries the company withheld taxes. Therefore, providing a purchased form is a forgery of documents.

Personal income tax certificate 2 is not enough, fill it out in the prescribed manner and endorse it with a wet stamp. Any bank can easily check whether real tax deductions were made according to the certificate. If the information is not confirmed, the bank's security service will deal with the person who provided such a document.

When contacting a law office, ask how it plans to confirm the certificate. The lawyer must give a clear and specific answer. If he starts talking at length about his experience, connections and positive feedback, feel free to turn around and leave. The purchased certificate will not be verified.

Unwithheld tax will have to be reported twice.

A certificate must be generated for each individual who received income in 2015 from which personal income tax was withheld.

But even if the tax was not withheld due to the lack of such an opportunity (for example, the payment of income was made in kind), then such income still needs to be reported. Moreover, twice. First, such income is reflected in the 2-NDFL certificate with sign “2”, which is submitted no later than March 1. Then the same income is shown in certificate 2-NDFL, but with the sign “1”. This certificate is submitted along with the others - no later than April 1. Officials explain that it is necessary to re-submit a certificate for such income (Letter of the Ministry of Finance of the Russian Federation dated December 1, 2014 No. 03-04-06/61283). And the instructions for filling out the 2-NDFL certificate provide an example from which it can be seen that for income from which personal income tax was not withheld, the company must submit information twice.

However, the courts do not agree with this approach. As the arbitrators indicate, certificates with attribute “2” contain all the necessary information to be indicated in the certificate with attribute “1”. Therefore, if the tax agent within the established time frame informed the inspectorate about the impossibility of withholding personal income tax by submitting a certificate of income in Form 2-NDFL with attribute “2”, then a repeated certificate with attribute “1” need not be submitted (Resolution of the Federal Antimonopoly Service of the Ural District dated 05.23.14 No. Ф09-2820/14, dated 09.24.13 No. Ф09-9209/13).

Another thing is that, perhaps, hardly anyone will want to bring the case to court. Therefore, in order to avoid additional problems, we would recommend re-submitting a certificate of non-withheld tax, indicating “1” in it.

What else you need to know about personal income tax certificate 2

In order to answer the question of how long personal income tax certificate 2 is valid, it is necessary to understand the nature of this document. It confirms the employee’s wages for the reporting period. In legal terms, it refers to ascertaining certificates that confirm facts that are not subject to change.

It follows from this that 2 personal income tax does not have a validity period, since the person’s income has already been received and cannot change. In addition, the certificate can be issued an unlimited number of times to the same employee. For the manager, the issuance of this document does not involve any risks, so it is not even necessary to ask employees for a statement explaining the reasons why they needed Form 2 of personal income tax.

December salary in January

Some employers pay December salaries in December, and some - in January, after the holidays.

Personal income tax from wages is transferred no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation). Accordingly, the question arises: is it necessary to reflect the December salary paid in January in the 2-NDFL certificate for the previous year? Let us turn to paragraph 2 of Article 223 of the Tax Code of the Russian Federation. It says that for the purpose of calculating personal income tax, the date of receipt of salary is the last day of the month for which it was accrued. It follows from this norm that the salary for December 2015 is reflected in the 2-NDFL certificate for 2015, even if the salary was paid only in January 2016.

This position is also shared by the Federal Tax Service in Letter dated 02/03/2012 No. ED-4-3/ [email protected] In the same letter, tax officials explain that in addition to the December salary paid in January, the certificate must also reflect the personal income tax calculated from this salary as transferred tax, despite the fact that it was transferred in January.

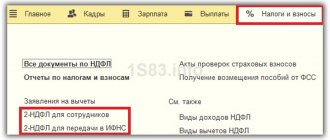

Tips for filling

To obtain a certificate, you can contact an accounting or legal office, but this service is paid. It is much easier to download sample 2 personal income tax at the end of the article and draw up your own document using the template. Naturally, when the staff consists of several dozen or even hundreds of people, it is problematic to issue certificates manually.

In this case, it is advisable to install a computer program that will help prepare documents quickly. It is enough to fill out all the fields once, then you will only have to change the numbers and last names, the rest of the statements will remain in the program’s memory.

If you decide to use a computer assistant, purchase paid software. It is constantly updated to keep up with changes in legislation.

Sample form of form 2 personal income tax 2015

Sample of filling out form 2 personal income tax 2015

Method of submitting a certificate

From January 1, 2021, tax agents who paid income to 25 people or more must submit 2-NDFL certificates electronically via telecommunication channels through an electronic document management operator (clause 2 of Article 230 of the Tax Code of the Russian Federation).

It is no longer possible to use “flash drives” and “floppy disks”. Previously, certificates had to be submitted via the Internet if there were 10 or more people. If a company paid income to less than 25 people in 2015, then it has the right to submit 2-NDFL certificates in paper form. In this case, it will be necessary to draw up an accompanying Register. Its form is given in Appendix No. 1 to the Procedure for submitting to the tax authorities information on the income of individuals and messages about the impossibility of withholding tax and the amount of tax on personal income (hereinafter referred to as the Procedure), approved by Order of the Federal Tax Service dated September 16, 2011 No. MMV-7-3 / [email protected] This Register is prepared in two copies, one of which remains with the inspectorate, and the other is returned to the tax agent.

“Paper” income certificates can be sent by mail with a list of attachments. Information on income for 2015 can be sent by mail before 24 hours on April 1, 2021 (Clause 8, Article 6.1 of the Tax Code of the Russian Federation).

Certificates submitted by a tax agent personally (through a representative) on paper are considered accepted subject to passing the “completion control”. And the document confirming the fact of submitting certificates is the corresponding Protocol for receiving information (its form is given in Appendix No. 3 of the Order of the Federal Tax Service No. MMV-7-3 / [email protected] ). This protocol is drawn up in two copies and signed by both the inspection official and the tax agent or his representative (if present). This is stated in paragraph 18 of the Procedure. The Federal Tax Service in Letter dated October 22, 2014 No. BS-4-11/ [email protected] reminded of this procedure.

Thus, if information is received in the presence of a tax agent (his representative), then the protocol must be signed by the tax agent. In this case, the tax agent’s seal is affixed to the protocol only if it is available.