When is an application for deregistration of UTII required?

The application of the taxation regime called UTII is voluntary, however, in order to start working on it, it is necessary to register with the tax authorities. Therefore, when a taxpayer decides to leave UTII, he must also notify the tax authorities about this and go through the procedure of deregistration with the Federal Tax Service.

Voluntary departure from UTII may be due to the following factors:

- termination of activities on the UTII - this happens, for example, if the payer has ceased to provide services transferred to UTII, or territorial authorities have removed its activities from the list of services falling under this regime;

For more details, see: “What is the procedure for deregistering a UTII payer who has ceased activity?”

- switching to another mode.

You can learn more about what else can affect leaving UTII from this material.

Pay attention to one more situation: the taxpayer does not fall under any of the above grounds, but simply moved the place of business. Does this entail the obligation to deregister with the Federal Tax Service?

Look for the answer to this question in the publication “The Ministry of Finance explained how to pay UTII when moving a store to a new location .

See also the article: “Deregistration of UTII in 2018–2019: conditions and terms.”

Filling procedure

Let's look at the procedure for generating a declaration when closing an individual entrepreneur in 2020 using an example and provide a sample for filling it out.

An entrepreneur from the city of Shatura, Moscow region, Anna Petrovna Zakharova provided hairdressing services in a small salon. This type of activity relates to the provision of household services. In July 2021, she decided to stop working and on the 20th she was deregistered as an individual entrepreneur. She fired her employees in the second quarter, so she no longer paid contributions for their insurance in July. For herself this month she had to pay an additional 5,000 rubles, since the rest of the insurance premiums had been paid earlier.

In the table we list all the data that is necessary to fill out the UTII declaration when closing an individual entrepreneur in 2021.

Table 1. Information for drawing up a declaration on UTII

| Parameter | Meaning | Where to get |

| Physical indicator (PF). For the provision of household services, this is the number of employees, including individual entrepreneurs | 1 (Individual entrepreneur Zakharova worked without employees in the third quarter) | Article 346.29 of the Tax Code of the Russian Federation |

| Basic return (BR) – imputed income per unit of physical indicator. | 7 500 | |

| Deflator coefficient K1. Adjusts income depending on the level of inflation | 2,005 | Order of the Ministry of Economic Development dated December 10, 2019 No. 793 |

| Reduction factor K2. Established by municipal authorities. | 0,8 | Decision of the Council of Deputies of the Shatura District dated December 7, 2016 No. 3-07/325 |

| Number of days in the month of closure (K days) | 31 | |

| Number of days worked (K neg days) | 20 | |

| UTII rate | 15% (may be reduced by decision of local authorities) | Article 346.31 of the Tax Code of the Russian Federation |

Tax for a month not fully worked is calculated using the formula:

FP x DB x K1 x K2 x Rate / K days x K negative days.

The amount of UTII can be reduced by insurance contributions that were made in the reporting quarter. The entrepreneur in the example has no employees, so he will deduct from the tax amount all contributions paid for himself. If there were employees, the tax due to this deduction could only be reduced by half.

Next, we’ll look at how to generate a UTII declaration when closing Zakharova’s individual entrepreneur and present a sample of how to fill it out. The order is as follows - first sheet, section 2, section 3 and section 1. Section 4 is not filled out, since it is not relevant in 2021.

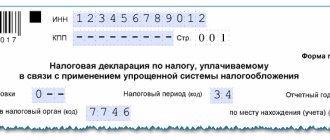

Title page

On the first sheet we indicate the following parameters:

- adjustment number – “0–” (primary feed);

- tax period – 23 (III quarter);

- reporting year – 2020;

- tax authority code – 5049 (Interdistrict Federal Tax Service No. 4);

- registration place code – 320 (Appendix No. 3, code for the place of activity);

- Full name IP;

- telephone;

- number of report pages – 5, attachments – 0.

In the lower part on the right we put the code “1” - this means that the report is signed directly by the entrepreneur. There is no need to write your full name again. We cross out all other cells, indicating only the date of completion.

Section 2

In this section we will calculate the tax amount. In the lines we indicate the following data:

- 010 – activity code “01” from Appendix No. 5;

- 020 – address of the place of provision of services;

- 030 – OKTMO;

- 040 – OBD indicator

- 050 – K1;

- 060 – K2.

Data for filling out lines 040-060 must be taken from Table 1.

In line 070, information is entered in the following columns:

- 2 – physical indicator “1”;

- 3 – the number of days that individual entrepreneur Zakharova worked in July – “20”.

- 4 – calculation of the base for the month using the above formula – 7761.

Lines 080 and 090 are not filled in in our example, since Zakharova was deregistered in July.

In line 100 we will reflect the final base, in line 105 - the UTII rate, and in line 110 - its amount: 7761 × 15% = 1164.

Section 3

This section identifies deductions and calculates the amount of tax that must be paid for the quarter. Let's fill the lines like this:

- 005 – “2”, since there were no payments to individuals;

- 010 – tax before deduction (line 110 of section 2);

- 020 – dash;

- 030 – the amount of insurance contributions of the individual entrepreneur for himself (5,000) – we will deduct it from the tax;

- 040 – dash, cash deduction was previously reflected here;

- 050 – the amount of UTII tax payable after deducting contributions. It turns out that there will be no additional tax.

Section 1

The calculation results will be reflected in section 1. There are only 2 lines:

- 010 – OKTMO;

- 020 – the amount of UTII that the former entrepreneur must pay for the last quarter (in our example, 0).

A sample of filling out the UTII declaration upon termination of business activity.

When closing an individual entrepreneur on UTII, the finished liquidation declaration is signed and sent to the Federal Tax Service, in which the entrepreneur was registered as a payer of imputed tax. The method can be any - in person or with a representative (a notarized power of attorney is required), by mail or electronically with an electronic signature.

What deadlines must be met to submit an application for withdrawal from UTII?

When leaving the UTII, the payer must submit an application for deregistration within 5 days from the moment he stopped working for UTII. At the same time, the procedure for calculating the period for deregistration of UTII is different:

- if the activity is terminated by the taxpayer himself, then the countdown begins from the moment of its actual completion;

- if deregistration is due to reasons beyond the payer’s control, then the 5 days are counted differently.

How - you will learn from this material .

Having received such an application, the tax authorities, in turn, are obliged to remove the payer from the register within 5 days from the date of its submission. After deregistration, the Federal Tax Service sends a corresponding notification.

You can find out more about it here .

It also happens that the “imputed” person does not meet the deadline specified for filing the application. Then the tax office will not comply with it within the 5-day period allotted by law.

When the Federal Tax Service will deregister such a payer, this material .

Having withdrawn from tax registration, it is important not to forget to submit a UTII return.

Which inspectorate should you submit your latest report to, is described in the material “Deregistered under UTII? . ”

Reasons why it's time to deregister

- The organization on UTII has ceased operations.

- You changed the tax system.

- You have violated the requirements from paragraphs. 1 and 2 of paragraph 2.2 of Article 346.26 of the Tax Code of the Russian Federation.

Violated means exceeded the average number of employees during the previous year and the share of participation of other organizations in the company’s activities.

The average number of employees for companies on UTII should be no more than 100 people. This restriction does not apply to consumer cooperatives: they are subject to a different law. And to business societies that have established cooperatives or their unions.

The share of participation of other organizations should not exceed 25%. This restriction does not apply to companies whose authorized capital was formed by public organizations of disabled people, and the share of employees with disabilities is 50% or more.

Submit reports in three clicks

Elba will calculate taxes and prepare business reports based on the simplified tax system, UTII and patent. It will also help you create invoices, acts and invoices.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

How to fill out an application for deregistration of UTII for an LLC

In the UTII-3 form, companies must indicate the following data:

- information about the reason for refusal of UTII; at the same time, it is important to reflect the correct details that characterize it, depending on the termination of one of several types of activity;

- Name;

- Kind of activity;

- place of business;

- other data.

“UTII Form 3: application for deregistration of an organization” will help you fill out UTII-3 accurately .

We close the individual entrepreneur on UTII

After working as an individual entrepreneur for some time, you have the right to close it at any time. This may happen due to further reluctance to engage in business and joining the ranks of hired workers. Or perhaps you want to become a founder of an LLC. In any case, it is necessary to responsibly approach the issue of closing your own individual entrepreneur.

This process is accompanied by the submission of reports to the tax office and the repayment of existing debt.

You need to pay off your debts with:

- Tax Service (for unpaid UTII);

- Off-budget funds (pension and health insurance);

- Banks (for existing loans);

- Employees (in terms of wages and other income);

- Business partners (if you have concluded agreements under which you have not made payment or shipped goods).

However, if you, having the status of an individual entrepreneur, do not pay off your existing debt, this will not become an obstacle to closing your business.

According to the law, the individual entrepreneur is liable for his debts with all his property. This means that all non-payments will be transferred to the individual. If the debt is large, then your creditors have the right to go to court, which can seize the property.

To close an individual entrepreneur on UTII, this process will need to be documented.

You must provide the tax office with:

- Closing Statement;

- A receipt for a fee of 160 rubles;

- Certificate of absence of debts to extra-budgetary funds;

- Liquidation declaration.

You have the right to provide reports:

- Personally;

- Through an assistant (in this case you will need a notarized power of attorney for another person);

- Through a special company (there are intermediaries who, for a fee, formalize the closure of a business. If you deal with the process yourself, you only pay 160 rubles as a fee. When contacting an intermediary, the cost of the issue will be much higher and depends on the region).

The most important of the above documents is the UTII declaration. We’ll talk about it in more detail. Let's consider when it is necessary to submit a declaration and what needs to be indicated in it.

How an individual entrepreneur should fill out an application for deregistration of UTII

In the application, the individual entrepreneur indicates the following information:

- about yourself - last name, first name, patronymic;

- the reason for termination of activity on the imputation, indicated by codes from 1 to 4.

What else needs to be reflected in this form is discussed in the article “UTII Form 4: application for deregistration of individual entrepreneurs.”

So, deregistration must be accompanied by mandatory notification of this fact to the tax authorities. “Withdrawal from UTII” will help you understand how to do this correctly .

Form 4 UTII 2021

The application form 4 UTII is filled out by individual entrepreneurs. This is what an unfilled UTII-4 form looks like:

Filling out the form is the same. Don’t worry if you won’t be able to download a free sample of filling out Form UTII-4 in 2021: most often an example is not required, since there is nothing superfluous in the form.

What is this tax and what are the conditions for its application in 2021?

The single tax on imputed income is calculated instead of the main taxes on estimated income, the amount of which is established (imputed) by the state.

Individual entrepreneurs can work under it in relation to types of activities specified by the state. Reference! The tax rate varies from 7.5 to 15% depending on the type of business activity and category of taxpayer.

It is installed by municipal organizations. In order for an enterprise to apply imputation, its activities must meet the following conditions:

- The share of participation of other companies cannot exceed 25% of the authorized capital. The restriction does not apply to those companies whose authorized capital is formed by contributions from public organizations of disabled people.

- The maximum number of company employees is 100 people.

- An enterprise is a cooperative or business society established by a consumer union or consumer society (until 01/01/2021).

An entrepreneur using imputation does not pay the following taxes:

- VAT (if the activity is not related to export).

- Personal income tax.

- Property tax, if it is not determined for the object as its cadastral value.

Types of activities for which a single tax is applied

Municipalities independently compile a list of activities for which a single tax can be used. In accordance with Part 2 of Article 346.26, Chapter 26.3 of the Tax Code of the Russian Federation, a single tax can be applied to the following types of activities:

- Providing veterinary and household services.

- Providing lease of land plots for parking of vehicles and paid storage of cars on them.

- Carrying out maintenance, repairs and car washes.

- Transportation of goods and passengers, if the organization has no more than 20 vehicles for these services on its balance sheet.

- Retail trade in pavilions and stores, the sales floor area of which does not exceed 150 m2, as well as through a stationary network in the absence of trading floors, and through a non-stationary retail network.

- Public catering organizations, both through catering establishments with a sales area of no more than 150 m2 for each of them, and without halls.

- Providing advertising services using outdoor advertising structures and vehicles.

- Organizations of temporary residence and accommodation of companies and entrepreneurs in premises with an area of up to 500 m2.

- Leasing of retail space located outside of the trading floors of stationary and non-stationary trade facilities, and land plots for their placement, including for catering.

From 01/01/2020, it is prohibited to apply a single tax to companies selling shoes, medicines and fur clothing. These product groups require mandatory labeling. Article 346.27, Chapter 26.3 of the Tax Code of the Russian Federation in the new edition does not classify them as goods permitted for retail trade by companies using imputation.

Notification of the transition to the simplified tax system in Kontur.Extern

If the taxpayer decides to use the simplified taxation system (STS) for accounting from January 1, 2021, then by December 31, 2021, it is necessary to send to the territorial office of the tax inspectorate an application for the transition, the form of which was approved by order of the Federal Tax Service dated November 2, 2012 No. MMV-7 -3/829.

When filling out an application using Extern funds, you must open the “Federal Tax Service” tab on the start page, and then click “Create new”. Next, you need to select “Notification of transition to the simplified tax system” from the list or use the quick search.

Search for a notification for the transition from UTII to simplified tax system

After which the user will see a form to fill out.

Information about the name of the company (full name of the individual entrepreneur), INN-KPP, tax office department will be filled in by the system automatically. If necessary, the taxpayer can choose another territorial branch of the Federal Tax Service.

- When filling out the “Taxpayer Attribute” field, the following values are available:

- organizations and individual entrepreneurs submitting a notification simultaneously with registration documents

- newly created organizations and registered individual entrepreneurs, including organizations and individual entrepreneurs submitting a notification simultaneously with documents for registration, as well as organizations and individual entrepreneurs that have ceased to be payers of UTII

- organizations and individual entrepreneurs switching from other taxation regimes, with the exception of UTII taxpayers

- We set the transition date (from January 1, 2021).

- Since the simplified tax system regime provides for two objects of taxation, it is necessary to select one of them, which will be used in accounting throughout 2021: “income” or “income minus expenses.”

- Select the year for submitting the notification “2020”.

- Next, it is necessary to reflect information on the amount of income received for the first 9 months of 2021, as well as the residual value of fixed assets as of October 1 of the current year.

- Finally, the notification displays the contact phone number, as well as the position of the sender.

Notification form when switching from UTII to simplified tax system

After filling out all the required fields, you must click “Check” (the blue button is located in the lower left corner of the screen). The system will analyze the completed data and if there are no errors, the message “There are no errors or warnings, the report is ready to be sent” will appear.

System message

To send the completed notification to the Federal Tax Service, you must click “Proceed to Send”, after which the notification will be sent to the specified tax office.

Transition to PSN in the Kontur.Extern system

If the taxpayer decides to use the patent tax system (PTS) for accounting from January 1, 2021, then it is necessary to send to the territorial branch of the tax inspectorate an application for the transition in form 26.5-1, the form of which was approved by order of the Federal Tax Service dated July 11, 2017 No. MMV-7 -3/544.

In accordance with the Federal Tax Service letter No. SD-4-3/20310 dated December 9, 2021, taxpayers wishing to start using a patent from January 1, 2021 can submit appropriate applications until December 31, 2021.

It is worth recalling that the taxpayer has the right to combine tax regimes, however, for this, certain conditions must be met (see more details Combining two tax regimes)

To fill out an application for transfer in the Kontur.Extern system, you need to select the “FTS” tab on the start page, and then click “Create new”. Next, the taxpayer needs to select “Patent Application” or use the quick search.

Searching for an application to switch from UTII to PSN

In the newly opened window, you must indicate the code of the territorial branch of the Federal Tax Service, the period, and the format.

When choosing a format, two options are available:

- Order of the Federal Tax Service dated July 11, 2021 No. ММВ-7-3/544

- letter of the Federal Tax Service dated February 18, 2021 No. SD-4-3/2815

The taxpayer can copy data from the previous report by checking the special box.

Patent application

Next, the cover page of the application becomes available for completion.

The following fields will be automatically filled in on the title page: company name (full name of the individual entrepreneur), INN-KPP, OGRN (OGRIP) and tax office code. The taxpayer can change the information about the Federal Tax Service office where the application will be sent.

Next you need to specify:

- patent start and end dates

- region in which the activity will be carried out

- type of business activity in accordance with the OKVED classifier

- decide whether hired workers will be involved (if yes, then indicate the number)

- the value of the tax rate, as a rule, it is 6%, however, if you plan to use a different value, then you need to indicate the amount, as well as the clause and article of the regional law, if the patent falls under tax holidays, then you need to indicate 0% in the box

At the end, the contact phone number and sender information are indicated.

Title page of the application for the transition from UTII to PSN

After all required fields have been filled in, you must click on the “Check” button, which is located in the lower left corner of the screen.

If after the check the message “There are no errors or warnings, the report is ready to be sent” appears, then you need to click “Proceed to send”, after which the application is sent to the specified tax office.

System message

Features of the UTII-4 application for individual entrepreneurs

The procedure for filling out the form for deregistration by imputation for individual entrepreneurs and for legal entities is largely the same. The differences are as follows:

- When registering with the tax authorities, an individual entrepreneur is assigned only an INN, so the “KPP” field is missing;

- instead of the name, the full surname, first name and patronymic are written down; each word - on a new line, also indicate the OGRNIP of the entrepreneur;

- The person confirming the accuracy and completeness of the information in the application can be the entrepreneur himself. In this case, the full name and tax identification number are not provided again.

In both forms, all lines are filled out except the section for the tax officer. In the lines left blank, as well as in unfilled cells, put dashes.

Author of the article: Valeria Tekunova

Are you changing your tax regime? Work in the cloud service for small businesses Kontur.Accounting: the service is suitable for organizations and individual entrepreneurs on OSNO, STS, UTII and for combining modes. Easily keep records, pay salaries, pay taxes and contributions. The system generates reports automatically; all you have to do is send them via the Internet. Explore the capabilities of the service with a free trial of 14 days.