There are 3 types of employers, including legal entities and individuals, as well as individuals with individual entrepreneur status. Let us immediately note that the responsibility for maintaining work records rests only with organizations and entrepreneurs, and this process does not make a significant difference. However, due to the peculiarities of the activities of individual entrepreneurs, there are some nuances that should be taken into account. A sample of filling out a work book for an individual entrepreneur, given at the end of this material, will help the entrepreneur figure out how to do this correctly if he is hiring employees.

Legislative basis

Each individual registered as an individual entrepreneur, in accordance with Decree of the Government of the Russian Federation No. 132 of March 1, 2008, is required to fill out a work book for each hired employee.

In addition, the individual entrepreneur is assigned the functions of maintaining labor records and initial registration, if such a book has not been created for the employee. All these responsibilities are enshrined in the Labor Code of the Russian Federation.

It is important to know that labor records are not issued to employees of entrepreneurs who organize a business in the status of individuals; only entrepreneurs registered as individual entrepreneurs have the right to register for labor records.

Government Decree No. 132 establishes that every employee who has worked at an enterprise for more than 5 days must be registered in accordance with the Labor Code, and a record of employment with an individual entrepreneur must be made in the work book.

Responsibility of individual entrepreneurs for violation of the Labor Code of the Russian Federation

The generally accepted rules in the country regarding the maintenance and storage of fuel dispensers completely apply to individual entrepreneurs. Here's what entrepreneurs should keep in mind:

| What needs to be done | Amounts of responsibility |

| The manager appoints by his order (instruction) a person responsible for maintaining the distribution center | Fine 1000.0-5000.0 rub. or the activities of the individual entrepreneur will be suspended for three months (90 days). When an employee goes to court, the following decision is likely: to compensate for moral damages for the fact that the individual entrepreneur wrote down incorrect information in his TRC If the individual entrepreneur delayed the dispenser, entered incorrect information, especially regarding the reasons for dismissal, the employer cannot avoid paying the former employee lost earnings (clause 35, paragraph 4 of the Rules) |

| If violations of the IP Rules are detected, you will have to bear responsibility, expressed in monetary form. | |

| The individual entrepreneur is required to issue a fuel dispenser on the day of dismissal, which is the last day of work. All entries must already be made in it |

Important! All responsibility for compliance with the Rules regarding fuel dispensers rests entirely with the individual entrepreneur.

Rules for filling out employment forms for entrepreneurs

According to Article 66 of the Labor Code of the Russian Federation, the employer is obliged to maintain the employee’s work book. The rules for filling out this document are established by the Labor Code and other regulations.

There are a number of rules that must be followed when filling out the document, namely:

- When filling out the name of the organization, abbreviations are not allowed;

- The entry on the name of the individual entrepreneur is made in accordance with the certificate of registration of the individual entrepreneur;

- If the organization has a seal, it is necessary to certify the record with the seal;

- An individual entrepreneur must certify the employment entry with his signature.

An individual entrepreneur needs to make an entry in the employee’s work book only if they have an official labor relationship with him, that is, there is an employment contract. Only after official registration, that is, the signing of an employment contract by the parties, can an entry about employment be entered into the employee’s work book.

An entry into the labor record is made only after the employee has worked for 5 working days at the enterprise. But only if this work is his main one. Thus, if an employee works part-time, then no entry in the work book needs to be made.

If the person did not have a work book before, the employer is obliged to create one, fill it out and make the first entry. An individual entrepreneur can independently fill out an employee’s work book, or, if there is a personnel officer on staff, then the maintenance of work books is entrusted to this person.

Can individual entrepreneurs fill out a work report for themselves?

Although the law establishes the obligation of an individual entrepreneur to maintain the work records of his employees, the entrepreneur himself should not make an entry in his work record that he is working in his enterprise.

The employment relationship between the employee and the employer begins after the conclusion of the employment contract, but in this case, both parties to the contract would be one person, which cannot be. An entry into the employment record must be confirmed by an employment contract and a corresponding order, and since no contract has been concluded, an entry cannot be made.

An individual entrepreneur is registered to conduct business, and not for the purpose of carrying out labor activities, therefore the owner of the individual entrepreneur does not have to keep a work book. At the same time, the entrepreneur’s work experience will not be taken into account, but it is important for assigning a pension. But there is no need to be upset about this, since the law regulates this issue.

If a person works for himself, then when calculating his pension, not his work experience, but his entrepreneurial experience will be taken into account. Entrepreneurial activity is confirmed by documents confirming the registration of an individual entrepreneur with the tax authority.

True, the old-age labor pension is assigned only to insured persons working for themselves. So, after registering an individual entrepreneur, you need to report this to the Pension Fund and subsequently pay insurance premiums.

Entrepreneur reporting on employee

With hired employees, the entrepreneur has an increased number of reports that must be submitted to different authorities. Accordingly, it is important for the employer to know where, within what time frame and what reports must be submitted.

Employee reports are submitted to three authorities:

- Tax authority;

- Pension Fund;

- Social Insurance Fund.

The following reports must be submitted to the tax office:

Information on the average number of employees - data is submitted once a year. They must be provided by January 20 of the following year. For example, a report for 2021 must be submitted by January 20, 2021. The information is needed so that the tax office controls the number of employees when calculating taxes and imposing special tax regimes.

Certificate 2-NDFL - the report is provided once a year until April 1 for each employee. The certificate displays information about the employee’s income, required deductions and withheld income tax for the past year. If an individual entrepreneur has more than 25 people on staff, the report is submitted electronically.

Certificate 6-NDFL - submitted quarterly until the 1st day of the next quarter. The certificate must be provided on time. For delay, in addition to a fine, the tax office has the right to block the current account.

Calculation of insurance premiums - due quarterly until the 30th of the next quarter.

Two reports must be submitted to the Pension Fund:

Information on insurance experience - submitted once a year at the end of the year. The report must be submitted by March 1 of the following year. SZV-M - the report must be submitted monthly by the 15th of the next month. The document contains information about the employer and employees. The following information must be available for employees: full name, SNILS and Taxpayer Identification Number.

Social Insurance Fund:

4 FSS - a report is provided once a quarter by the employer who pays contributions for accidents. The report is needed so that the employer can return part of the funds paid. Information must be provided by the 25th of the next quarter.

How to record information?

In order to fill out a work book, an individual entrepreneur must have:

- Waterproof handle. The ink color should be blue, black or dark purple.

- The seal of the organization is not mandatory for an individual entrepreneur, but if it is available, it must be affixed to the work book.

- The order of acceptance to work . It is necessary for an individual entrepreneur to unify his documents, and orders must have a number.

- Employment contract with the employee.

If you have the things listed above, then you can start filling out the work book.

For employees who did not have a work book, the first employer, in our case an individual entrepreneur, fills out a new document. The work book form itself must be purchased at a licensed store; the form must contain marks indicating that the book complies with GOST. Both the employee and the employer can purchase the document form. But this function is not officially assigned to individual entrepreneurs.

For those entering work for the first time, an individual entrepreneur must issue a work book within seven days. When filling out the title page, indicate:

- Full name and date of birth of the owner;

- Education (general, secondary or higher);

- Speciality;

- Date of filling out the work book;

- Employee signature;

- Seal (if any) and signature of the entrepreneur.

Let's look at how to record the hiring and dismissal of an employee.

Documentation

To fill out a work book you need:

- employee's passport (or other identification document);

- diploma of education;

- work record book;

- certificate of individual entrepreneur or Charter of the organization;

- official seal.

For details on how to fill out the title page of the work book, watch the video.

The work book is divided into three parts:

- A title page containing information about the owner of the document.

- Information about the work, including the name of the enterprises where the work was carried out and the duration of such work.

- Awards section.

Please note that the rules for filling out work books oblige you to make adjustments in case of possible changes:

- company name (including legal form);

- type of printing (using different ones in one book is unacceptable!).

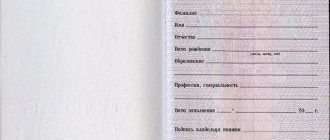

Title page

On the first page of the work book you need to indicate all the information about the employee, based on the documents provided by him. It should contain:

- Full name of the owner;

- date of birth (in numerical terms);

- level of education (secondary, specialized secondary, higher);

- name of the profession indicated in the diploma;

- date of opening of the work book;

- employee signature;

- signature of the person filling out the document;

- official seal of the organization.

Title page of the work book, sample filling 2021:

Job details

Each page of the middle and most extensive section consists of four columns containing:

- The serial number of the entry (from No. 1 onwards).

- Hiring date and other events.

- The record itself, which represents information about the organization (its full and abbreviated name), job title (indicating qualifications) and department. In addition to the fact of hiring, cases of transfer to another position and dismissal are also recorded here. Information about this must be entered in the column within 7 days from the date the order is issued, with the exception of the record of dismissal, which is drawn up directly on the day of its commission.

- Documentary evidence of the entry - the name of the order, the date of its issue and number (in that order).

For details on how to make notes about work in the work book, watch the video

additional information

The section containing information about the work may include additional information:

- At the request of the employee, information about part-time work is entered into it. The entry is made on the basis of documents provided by another enterprise where the employee is employed in a combined position. In this case, the same principles for filling out the column are used as when entering information about the main work. The work book must be kept by the employee of the personnel department at the place of main work, who is the only one who has the right to enter any information into it.

- Acquisition of a second profession, obtaining a rank, and advanced training are also reflected in this section.

- If the enterprise is renamed, a corresponding entry is made indicating the document that served as the basis for this. This information will be able to explain the discrepancy in the seals given during the employment and dismissal of the employee. The same steps are performed when renaming a position.

- In case of reorganization of the enterprise, the section notes the dismissal of the employee with his subsequent employment in the new company.

Sample of filling out a work book during the liquidation of an LLC:

Examples

A. S. Kopacheva joined the position of legal adviser at Avelan OJSC on February 27, 2021. On August 12, 2021, she was transferred to the position of senior legal adviser. This fact was reflected in the “Work Information” section.

| Entry no. | Date: Date Month Year | Information about hiring... | Name, date and number of the document on the basis of which the entry was made |

| 1 | 2 | 3 | 4 |

| Open Joint Stock Company "Avelan" | |||

| 4 | 27 02 2016 | Hired as a legal consultant | Order No. 7/K dated February 27, 2016 |

| 12 08 2016 | Transferred to the position of Senior Legal Adviser | Order No. 16/K dated August 12, 2016 |

When dismissing an employee, in column No. 3 you must indicate the regulatory act of the Labor Code, according to which this measure was applied. The entry must be confirmed by the seal of the company or human resources department and the signature of the person who filled out the work book. The employee must also sign in this column, thereby confirming his agreement with the entries made during his work.

A. M. Sholokhov served as a salesman at CJSC Continent. On March 6, 2021, he was fired for unexcused absence from work. The dismissal order was signed on the same day.

| Entry no. | Date: Date Month Year | Information about hiring... | Name, date and number of the document on the basis of which the entry was made |

| 1 | 2 | 3 | 4 |

| 4 | 06 03 2017 | Dismissed due to absenteeism (subparagraph “a” of paragraph 6 of Article 81 of the Labor Code of the Russian Federation) Head of the HR Department of JSC Continent: Marifov (Marifov) Introduced by: Sholokhov (Sholokhov) | Order No. 32 of 03/06/2017 |

Awards

This section contains information about the titles assigned to the employee, diplomas, certificates and other awards provided for by the company’s internal regulations and legislation. These do not include verbal gratitude from management, as well as regularly paid cash bonuses included in the payroll system. Which explains the complete lack of information in this section, which is found in the work books of most workers. Moreover, various certificates and diplomas issued to an employee without issuing a corresponding order are also only a nominal expression of gratitude, not reflected either in the work book or in the personal file.

Filling out the work book 2021, sample:

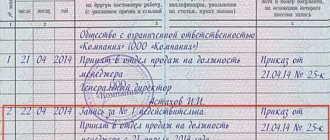

Reception of an employee

The main pages of the work book are each divided into 4 fields:

- Record number;

- Date of entry;

- The name of the individual entrepreneur, the position for which recruitment is being made / from which dismissal is taking place, indicating the reasons and legal grounds;

- The number of the document on the basis of which the entry is made.

When hiring, the date of employment is entered in the second field. And in the next one is the name of the organization, the entry “accepted for the position,” the basis for admission. If the entry does not fit, then you can write in the following lines below. In the next field, you must note the number of the order that is the basis for the entry, with the signature and transcript of the person filling out the document.

Accounting, registration, maintenance and preservation of official documents

The maintenance and further storage of documents recording labor activity depends on the employer. This is regulated by official Russian law. There are two main documents that control this process:

- Logbook. It is maintained by official employees of the company in the personnel department, where dates of employment, work, official personal data, all important order numbers, positions held, details, etc. are recorded.

- Book of receipts and expenses. It is carried out in the accounting department, where all monetary transactions are recorded, both in terms of income and expenses, the issuance of a work book, with the obligatory entry of details of the transactions carried out.

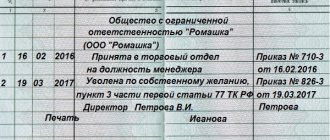

We fire an employee

Upon dismissal, the employment document is filled out in the same way:

- The entry number and date of completion are also indicated.

- Next, in the third field, information is filled in that the employee is fired, with reference to the article and the reason for dismissal.

- And column 4 still contains the number of the order to dismiss the employee, the full name and position of the person filling out the document, his signature and the seal of the individual entrepreneur. Then the employee’s signature is placed indicating familiarization with the document.