The processes of creating entries in the purchase ledger can be defined as:

- generated by register entries from document postings;

- generated by document 1C 8.3 “Creating purchase ledger entries”.

This step-by-step instructions are similar for the purchase book in 1C 8.2.

1) In the purchase book, in accordance with clause 2 of Appendix 4 of Rules No. 1137, entries are recorded based on the results of documents, for example, such as:

- invoices (including adjustment ones) received;

- adjustment invoices compiled and issued by the seller when the value of the goods decreases;

- invoices registered by sellers upon receipt of advance payment;

- invoices registered when the terms of the contract are changed or terminated.

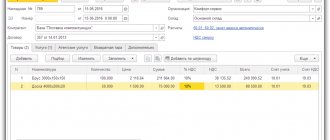

To get an idea of the process of creating entries in the purchase ledger, consider an example:

The organization purchased goods worth RUB 344,399.52, including VAT 18% RUB 52,535.52. Costs for delivery of goods - 5,000 rubles, including VAT 18% - rubles.

Transport costs are included in selling costs.

Procedure for completing documents:

- receipt (act, invoice)

- invoice received

Import of goods

Situation: how to fill out a purchase book when importing goods?

When importing goods, you need to fill out the purchase book in a special way. This is due to the fact that the foreign supplier does not issue an invoice, and the importer pays the tax at customs (tax office). Therefore, in the purchase book, instead of an invoice, the importer registers the details of a customs declaration or application for the import of goods and payment of indirect taxes (paragraphs 2–3, subitem “e”, paragraph 6 of section II of Appendix 4 to the Procedure approved by the Decree of the Government of the Russian Federation of December 26 2011 No. 1137). In this case, how to fill out each column of the purchase book, see the table below.

| Purchase ledger column | How to fill out | |

| Box 1 | Operation sequence number | |

| Column 2 | Transaction type code 19 (import from the countries of the Customs Union) or 20 (import from other states) (attachment to the letter of the Federal Tax Service of Russia dated January 22, 2015 No. GD-4-3/794) | |

| Column 3 | In the column indicate: – number and date of the application for the import of goods and payment of indirect taxes - when importing goods from the countries of the Customs Union (letter of the Federal Tax Service of Russia dated March 21, 2021 No. ED-4-15/4611); – number and date of the customs declaration – when importing goods from other countries | |

| Columns 4–6 | Not filled in | |

| Column 7 | Details of the payment order confirming payment of VAT at customs (at the tax office - if goods are imported from a country participating in the Customs Union) | |

| Column 8 | Date of receipt of goods | |

| Column 9 | Seller's name. There are no exceptions for filling out the purchase book when importing subparagraph “m” of paragraph 6 of Section II of Appendix 4 to the Procedure approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Therefore, in column 9 you need to indicate the name of the foreign supplier | |

| Box 10 | Not filled in | |

| Columns 11 and 12 | Not filled in | |

| Box 13 | Not filled in | |

| Box 14 | You don't have to fill it out. Information from the purchase book is needed to be reflected in section 8 of the VAT return. At the same time, in the exchange file, the element “Currency Code” from the purchase book is optional (Appendix 4 to the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558). The absence of optional elements does not affect the declaration's passage of format and logical control. Therefore, if the “Currency Code” is not indicated in the purchase book when registering a customs declaration, then this is not an error. According to some representatives of the tax service, the currency code must be indicated when registering customs declarations. Such clarifications are based on the literal interpretation of Section II of Appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 (letter of the Federal Tax Service of Russia for Moscow dated November 13, 2015 No. 24-15/121141). If the importer shares this item, column 14 can be completed. Since the amount of VAT at customs is determined in rubles, enter code 643 | |

| Box 15 | The specific procedure for filling out column 15 when importing goods is not specified in Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Typically, this column duplicates the cost of goods indicated in column 9 in the “Total payable” line of the invoice (subparagraph “t”, paragraph 6 of Section II of Appendix 4 to the Procedure approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137 ). But when importing goods, the foreign supplier does not issue an invoice. Instead of an invoice - a customs declaration (statement on the import of goods and payment of indirect taxes). To generate the indicator in column 15, you need to take the customs value of the goods and add to it the amount of customs duties, excise taxes (on excisable goods) and VAT. Define this indicator as follows: | |

| The cost of goods indicated in column 42 “Price of goods” of the declaration approved by decision of the Customs Union Commission dated May 20, 2010 No. 257 | + | Customs duties, excise taxes (when importing excisable goods), VAT paid at customs |

This procedure is confirmed by the letter of the Ministry of Finance of Russia dated February 8, 2016 No. 03-07-08/6235.

In this case, the cost of goods indicated in column 42 must be recalculated at the exchange rate on the date of registration of the customs declaration. This course can be taken in column 23 of the declaration, approved by decision of the Customs Union Commission dated May 20, 2010 No. 257.

If the accounting program does not allow you to form this indicator based on the customs value, you can take the contract value of the goods and add to it the VAT paid at customs. In private explanations, representatives of regulatory agencies allow this option.

If an organization imports goods from the countries of the Customs Union, take the indicator for filling out column 15 from the Application for the import of goods and payment of indirect taxes

Column 16 Amount of VAT paid when importing goodsAn example of filling out a purchase book when importing goods. Registration of customs declaration

The Alpha organization imported a batch of full-fat cocoa paste from Germany in April.

The cost of the goods is 7000 euros.

Full-fat cocoa paste is included in the Unified Customs Tariff of the Customs Union with the HS code 1803 10 000 0. The import customs duty rate is 3% of the customs value of the goods.

The date of registration of the customs declaration is April 17, 2015. The euro exchange rate on the date of import of goods is 52.9087 rubles. per euro.

The customs value of goods on the date of import was 370,360.90 rubles. (7000 euros × 52.9087 rubles).

The customs duty amounted to 11,110.83 rubles. (RUB 370,360.90 × 3%).

The tax base for calculating VAT was RUB 381,471.73. (RUB 370,360.90 + RUB 11,110.83).

The amount of VAT payable at customs was RUB 68,664.91. (RUB 381,471.73 × 18%).

VAT was paid on April 17 (payment order No. 1501 dated April 17, 2015).

The goods were received on April 21.

The accountant recorded data on imported goods in the purchase ledger.

An example of filling out a purchase book when importing goods. Registration of an application for the import of goods and payment of indirect taxes

The Alpha organization imported a consignment of goods from the Republic of Belarus in April. Supplier – Hermes LLC. The cost of the goods is 7000 euros. The VAT rate on imported goods is 18 percent.

The date of acceptance of goods for accounting is April 17. The euro exchange rate on this date is 52.9087 rubles. per euro. The cost of goods on the date of their acceptance for accounting (tax base for calculating VAT) amounted to 370,360.90 rubles. (7000 euros × 52.9087 rubles).

The amount of VAT payable is RUB 66,664.96. (RUB 370,360.90 × 18%). VAT was paid on April 17 (payment order dated April 17, 2021 No. 1501).

The accountant registered an application for the import of goods and payment of indirect taxes dated April 17, 2021 No. 548 in the purchase book.

Making changes to the purchase book

If you need to make changes to the purchase book, proceed in the following order.

If you need to adjust data for the current period (before the end of the quarter), make correction entries directly in the purchase ledger. To do this, indicate the cost and tax amount of the canceled invoice with a minus sign, and enter the indicators of the new (corrected) invoice with positive values.

If the seller (executor) corrects invoices for past tax periods, then draw up an additional sheet to the purchase book for the period in which the original invoice was registered. The form of the additional sheet is given in Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. In this additional sheet, the original invoice must be canceled (register its indicators with a minus sign). Register the corrected invoice in the purchase book (with a positive value) in the period when the organization has the right to a tax deduction.

This procedure follows from the provisions of paragraphs 4 and 9 of Section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

If changes made to the purchase book reduce the amount of the previously declared VAT deduction, an updated tax return for the corresponding period must be submitted to the inspectorate (Federal Tax Service of Russia dated November 5, 2014 No. ГД-4-3/22685).

If, as a result of the adjustment, the amount of the previously declared VAT deduction increases, then the organization has a choice:

- submit an updated declaration for the relevant period (a right, not an obligation). In this case, it will be necessary to prepare an additional sheet to the purchase book for the period in which the original invoice was recorded;

- claim a deduction in the current period (within three years). In this case, make entries only in the purchase book for the reporting period;

- do nothing (for example, if the deduction amount is insignificant).

This follows from the provisions of paragraph 3 of paragraph 1 of Article 54, paragraph 2 of paragraph 1 of Article 81, paragraph 1.1 of Article 172 of the Tax Code of the Russian Federation.

The procedure for drawing up an additional sheet

When compiling an additional sheet of the purchase book, use the following algorithm.

1. In the tabular part of the additional sheet, in the “Total” line, transfer the data in column 16 from the purchase book for the quarter in which the invoice (adjustment invoice) was registered before corrections were made to it.

2. On the lines following the “Total” line, reflect the data of invoices that are canceled (i.e., data on the invoice (adjustment invoice) before changes are made to it). Indicate indicators in columns 15–16 with a minus sign.

3. In the “Total” line, summarize the total in column 16. To do this, from the indicators in column 16 in the “Total” line, you must subtract the indicators in column 16 in the line of invoices (adjustment invoices) to be cancelled.

If several corrections are made relating to one quarter, then reflect the data in columns 2–16 on the “Total” line of the previous additional sheet on the “Total” line of the subsequent sheet.

Use the “Total” line data to make corrections to the declaration.

This follows from Section IV of Appendix 4 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Example of designing an additional sheet for a purchase book

In August, the accountant of Alpha LLC discovered that errors were made in the purchase book for the second quarter:

1. Incorrectly registered invoice dated June 30, 2021 No. 1200 from Master LLC in the amount of RUB 236,000. (including VAT – 36,000 rubles).

2. Invoice dated June 15, 2021 No. 560 from Hermes LLC in the amount of RUB 118,000 was not registered. (including VAT – 18,000 rubles).

On August 10, the accountant issued an additional sheet to the purchase book, in which he canceled the invoice dated June 30, 2021 No. 1200 in the amount of RUB 236,000. and registered an invoice dated June 15, 2021 No. 560 in the amount of RUB 118,000.

Invoice issued (for sale)

Example: On August 30, 2012, the Vishera organization shipped goods to the buyer Top-Invest LLC in the amount of 146,000 rubles.

(including VAT 18%). An invoice has been issued to the buyer. It is necessary to enter the implementation document into the program and carry it out. In this case, a posting for VAT calculation will be generated: Dt 68.02 Kt 90.03. Then, based on the implementation document, you need to enter “Invoice issued” (you can enter the invoice using the link from the implementation document). In the created document “Invoice issued”, by default the invoice type is indicated: “For sales”, transaction type code: “01 – Sold goods, works, services”. In order for an invoice to be included in the journal of received and issued s/f, you must indicate the date when it was issued. Then post the document. The document is saved in the journal of issued invoices (menu: “Sales – Maintaining a sales ledger”).

Making a purchase book

Lace up the shopping book, number its pages and seal them. If the book is maintained manually, then this must be done at the initial moment of making entries in the purchase book. It is possible to maintain a purchase ledger in electronic form. However, for each quarter the book must be printed, numbered, laced and sealed. This must be done no later than the 20th day of the month following the expired quarter.

Additional sheets for the purchase book can also be maintained electronically. In this case, print out the completed sheets and staple them with the purchase book for the quarter in which the invoice was registered before the corrections were made. Moreover, the numbering of the purchase book for this quarter must be continued, taking into account additional sheets. After the purchase book, taking into account additional sheets, is stitched and numbered, seal it with the organization’s seal.

The purchase book and additional sheets to it, compiled in electronic form, should be signed with an electronic signature when transferring them to the tax office in cases provided for by tax legislation.

This procedure is established by paragraph 24 of Section II and paragraph 5 of Section IV of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Sales book

If you are unable to create a sales book or it is being generated incorrectly, then you need to use the “VAT Accounting Assistant”.

To correctly form a book, you must follow the sequence when posting documents and set up the “Accounting Policy of the Organization.” Setting up an organization's accounting policy

To set up accounting policies, you need to go to the “Main” menu in the “Organizations” section. The program will open a window with a list of organizations from which you need to select one or create a new one.

In the document window, you need to follow the “Accounting Policy” link and create a new “Accounting Policy” and immediately go to the “VAT” tab.

Here all settings can be left as default, except in cases where an organization needs to be exempt from VAT or separate VAT accounting. You can finish setting up VAT accounting and registering invoices. Click "Save and Close".

Finished works on a similar topic

- Coursework Formation of a purchase book and a sales book in 1C 420 rub.

- Abstract Formation of a purchase book and a sales book in 1C 260 rub.

- Test work Formation of a purchase book and a sales book in 1C 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Register an outgoing invoice

First, fill out the document “Sales of goods and services”, which is located in the “Sales” menu, in the hyperlink “Sales (acts, invoices)”. When you click on the hyperlink, a list of implementation documents will open.

Click the “Implementation” button and select the type of document in the drop-down list. The program will open a document form that needs to be filled out. When filling out, you need to pay attention to the link with information about VAT. If “Document without VAT” is indicated, then the invoice cannot be issued. In all other cases, after filling out the document, the “Write an invoice” button will appear at the bottom of the screen, which you need to click, and the program will generate an outgoing invoice.

Formation of a sales book

Before creating a sales book, go to the “VAT Accounting Assistant” processing and make sure that documents for the current date are posted and the sequence is restored. If something is wrong, the assistant will show you that some documents need to be redone. Follow the link, click on the “Fill” button and submit the document. After re-posting the documents, the program will immediately create an entry in the sales book.

Are you an expert in this subject area? We invite you to become the author of the Directory Working Conditions

Registration for separate VAT accounting

For some transactions for which invoices (other documents) are issued, the law provides for a special procedure for their registration in the purchase book.

If an organization maintains separate VAT accounting, then register invoices in the purchase ledger only for the amount of VAT that is subject to deduction. That is, in column 15 of the purchase book, indicate the full cost of goods (work, services), which is reflected in column 9 of the presented invoice. And in column 16, indicate only the amount of VAT to which the organization has the right to deduct in the current quarter. This procedure is provided for by subparagraphs “t” and “y” of paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. Similar explanations are contained in the letter of the Ministry of Finance of Russia dated March 2, 2015 No. 03-07-09/ 10695.

An organization can transfer an advance (partial payment) towards future deliveries of goods (work, services, property rights), which will be used in both taxable and non-VAT-taxable transactions. In this case, the invoice received from the supplier (contractor) for advance payment (partial payment) must be registered in the purchase book for the entire amount (paragraph 5, subparagraph “y”, paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

If a product is purchased that the organization will use in tax-exempt transactions, there is no need to register such an invoice in the purchase ledger. After all, the buyer will not have the right to deduct on such an invoice. This follows from the provisions of subparagraph 1 of paragraph 3 of Article 169 and paragraph 2 of Article 171 of the Tax Code of the Russian Federation.

An example of filling out a purchase book. The organization carries out taxable and VAT-exempt transactions

The organization carries out taxable and tax-exempt transactions. The organization calculates the proportion for the distribution of input VAT on goods (works, services) for general economic purposes for the current quarter.

In October, the organization was provided with waste removal services in the amount of 59,000 rubles, including VAT - 9,000 rubles. On October 29, the contractor (Proizvodstvennaya JSC) issued invoice No. 2569 to the organization for the entire amount of services provided.

These services are of a general business nature. It is impossible to determine what specific type of activity they relate to. Therefore, part of the input VAT amount is deducted, the remaining tax amount is included in the cost of services.

To distribute input VAT, the organization's accountant determined the share of tax-exempt transactions for the fourth quarter.

The volume of sales of goods during this period amounted to 1,000,000 rubles. excluding VAT, including:

- 800,000 rub. – from the sale of goods subject to VAT;

- 200,000 rub. – from the sale of goods exempt from taxation.

The share of transactions exempt from taxation was 0.2 (200,000 rubles: 1,000,000 rubles). Accordingly, the amount of tax included in the cost of garbage removal services is equal to: 9000 × 0.2 = 1800 rubles.

VAT is accepted for deduction in the amount of: 9,000 rubles. – 1800 rub. = 7200 rub.

The Master's invoice for this amount was recorded in the purchase book.

Situation: is it possible to register an invoice for the entire amount of VAT in the purchase book if an organization purchased materials intended for use in taxable and non-VAT transactions? The supplier has issued one invoice.

No you can not.

This is due to the fact that VAT is deductible only on those goods (works, services) that are used in activities subject to VAT (clause 4 of Article 170 of the Tax Code of the Russian Federation). The amount of VAT that can be deducted is determined based on the separate accounting of input VAT. In the purchase book, register an invoice for exactly this amount. The Russian Ministry of Finance made a similar conclusion in letter dated September 11, 2007 No. 03-07-11/394.

Situation: how to keep a purchase book if an organization conducts taxable and non-VAT activities? The tax amounts subject to deduction are determined at the end of the quarter as a percentage based on the cost of goods (work, services) shipped.

Register invoices issued by suppliers (performers) when shipping goods (performing work, providing services, transferring property rights) at the time of determining the amount of VAT to be deducted. That is, on the last day of the quarter. In this case, in column 16 of the purchase book, indicate the amount of tax that can be deducted in accordance with the calculation. Column 15 - the total cost of goods accepted for registration (including VAT).

This procedure follows from subparagraph “y” of paragraph 6 of section II of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Situation: how to register an invoice in foreign currency in the purchase book?

If the obligation under the terms of the transaction is expressed and paid in foreign currency, the supplier organization has the right to issue an invoice in foreign currency (clause 7 of Article 169 of the Tax Code of the Russian Federation). In the purchase ledger, such an invoice must be registered in the invoice currency. In this case, in column 14 you should indicate the name and code of the currency according to the All-Russian Classifier of Currencies, and in column 15 - the total cost of purchases (including VAT) in the invoice currency. Column 16 indicates the amount of VAT in rubles and kopecks. To do this, recalculate the amounts indicated in the invoice into rubles at the official rate in effect at the time of registration of goods (work, services) and property rights. This procedure follows from the provisions of paragraph 4 of paragraph 1 of Article 172, paragraph 5 of Article 45 of the Tax Code of the Russian Federation.

Main VAT regulatory documents

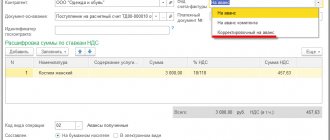

In previous versions of the program, it was necessary to enter regulatory documents “Creating purchase book entries” and “Creating sales book entries” (if the organization maintained “regular”, not simplified VAT accounting).

Now VAT accounting has become easier. The document “ Creating purchase ledger entries ” is now required to reflect VAT deductions on receipts only if the “Reflect VAT deductions” flag was not set in the received invoice (or in the receipt document). If the flag was set, all necessary register movements and postings were made by the invoice (or receipt document), and the invoice will go to the purchase ledger. “Creating purchase ledger entries” also serves to reflect VAT deductions from advances received, by tax agent, to reduce the cost of sales.

Let’s create a document (menu: “Operations – VAT Regulatory Documents” or “Purchases – Maintaining a Purchase Ledger”) and fill it out using the “Fill – Fill out document” button. In our case, only the tabular part “Deduction of VAT from advances received” has been completed. When posted, the document generates a posting for deducting VAT from the advance payment: Dt 68.02 Kt 76.AB.

The document “ Creating sales book entries ” in the new VAT accounting system serves only to reflect the recovery of VAT on advances issued. All other register movements and postings are generated when posting invoices issued, which automatically enter the sales ledger.

Let’s create a document (menu: “Operations – VAT Regulatory Documents” or “Sales – Maintaining a Sales Book”) and fill it out using the “Fill – Fill out document” button. In our case, the tabular section “Recovery for Advances” is filled out. When posted, the document generates a VAT recovery entry: Dt76.VAKt68.02.

Documents are saved in the journal:

menu: “Operations – VAT regulatory documents”

Also, VAT regulatory documents can be created through the “VAT Accounting Assistant” (the “Purchase” and “Sale” tabs)

Registering an invoice for an advance payment

If an organization has received an advance (partial payment) from the buyer for upcoming deliveries (including in non-monetary form), it must register an invoice for the advance (partial payment) issued to the buyer in the sales book (clause 17 of Section II Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137).

At the time of shipment of goods (performance of work, provision of services, transfer of property rights), for which an advance payment (partial payment) was received, register previously issued invoices in the purchase book (clause 22 of section II of Appendix 4 to the Decree of the Government of the Russian Federation dated 26 December 2011 No. 1137).

The same rules apply if the buyer refuses delivery before shipment and the seller returns the previously received advance payment (partial payment). In this case, previously issued invoices for advance payments (partial payment) are recorded in the purchase book after all adjustments related to the return are reflected in the accounting records. In this case, in column 7 of the purchase book, you must indicate the details of the document confirming the return of the advance payment to the buyer (letter of the Ministry of Finance of Russia dated March 24, 2015 No. 03-07-11/16044). An invoice can be registered in the purchase ledger no later than one year after the buyer’s refusal to deliver. This is stated in paragraph 2 of paragraph 22 of Appendix 4 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Continued >>

Invoice received (for receipt)

Example: On August 30, 2012, the Vishera organization received goods from the supplier Borovik LLC in the amount of 83,600 rubles.

(including VAT 18%), invoice No. 67 was presented. On the same day, materials in the amount of 30,480 rubles were received from the same supplier. (including VAT 18%), invoice No. 31 was presented. The invoice received can be reflected in the program in two ways.

1) With the first method, you need to enter a receipt document (“Receipt of goods, etc.) and post it. The document will generate a VAT accounting entry: Dt 19 Kt 60. Then, based on the posted receipt document, you need to enter “Invoice received”; you can enter it from the receipt document using the “Enter invoice” link.

In the created document “Invoice received,” the following details must be filled in: invoice type (default: “For receipt”), transaction type code (default: “01 – Goods, works, services received”). In addition, there is a flag “Reflect VAT deduction”. If you set it, then the VAT deduction will be immediately reflected in the purchase book, without additional registration with a regulatory document, and the posting for the VAT deduction will be generated when posting an invoice.

When conducting “Invoice received”, it generates a posting for VAT deduction: Dt 68.02 Kt 19 (with the “Reflect VAT deduction” flag set). The document is saved in the journal of invoices received (menu: “Purchase – Maintaining a purchase ledger”).

2) Another option for reflecting the received invoice is registration in the receipt document itself. On the “Invoice” tab, you need to check the “Invoice presented” flag and indicate its details, including the transaction type code, as well as, if necessary, for automatic reflection in the purchase book. When posted, the receipt document will generate entries for VAT accounting: Dt 19 Kt 60, and for VAT deduction: Dt 68.02 Kt 19 (if the “Reflect VAT deduction” flag is selected). The invoice is not saved as a separate document.