Why do you need a 2-NDFL certificate?

The certificate may be needed by tax agents, individuals, individual entrepreneurs, as well as pensioners.

A tax agent is an entity that pays citizens a certain amount with taxation. Agents are required to submit information about paid taxes to the tax service using Form 2-NDFL.

REFERENCE!

Tax agents are all employers operating in the country. Their responsibilities include calculating, withholding and paying taxes to all employees with reporting.

For individuals, the paper is a reflection of income; accordingly, it is needed in all cases when it needs to be confirmed. These include applying for a loan, paying for vacations, sick leave, days off, calculating pension accruals and processing various benefits.

In the same cases, individual entrepreneurs need a certificate. If the individual entrepreneur is also employed, a certificate can be requested from the employer.

Pensioners require 2-NDFL to apply for a loan or various subsidies. Only those persons who receive payments from the NPF can request a certificate.

Basically, a 2-NDFL certificate is needed in the following cases:

- Registration of loans and mortgages. Most often, banks require proof of income.

- Dismissal. When applying for a new job, the employer may require a declaration from the previous one.

- For deduction. It may be necessary to provide a certificate to the tax office in order to confirm the correctness of the accruals and obtain specific deductions.

- Apparatus employed. 2-NDFL is required by the accounting department so that it can see what deductions the employee had in his previous place. This will affect future deductions from income.

- To social protection. The document is needed to receive various benefits.

- To kindergarten and school. In this case, a certificate is needed so that, with a low income, the child is provided with some benefits, for example, free food.

- To obtain citizenship and visa. The certificate confirms that the applicant will be able to provide for himself and his family members.

- To court. Required for proceedings regarding labor disputes.

- Decree. Before going on maternity leave, a woman is required to provide a certificate for the last two years in order to process and pay benefits.

Help 2 Personal income tax for social protection: features of registration and submission to the government agency

Every person has encountered a situation in life where they need to prove their income. For these purposes, a personal income tax certificate 2 is provided. The certificate contains information about remunerations received by the employee and taxes paid to the budget for the employee. The certificate is issued by the employer. The employee requests it to be submitted to an institution - the tax office and credit institutions. A certificate is also required when applying to social security.

However, different government agencies have requirements for the date of issue. For example, if a person wants to return a property deduction, the tax office will accept certificate 2 of personal income tax, regardless of what period of time has passed since the date of issue. But social security will only accept the paper within a month after registration.

What kind of certificate is this anyway?

The 2-NDFL certificate form is approved at the legislative level. This document contains all the necessary information regarding the taxpayer and tax agent, the amount of income and the tax withheld. It includes the following sections:

- information about the tax agent;

- information about the individual who receives the income;

- income that is subject to taxation at the tax rate;

- data on standard, social, property tax deductions;

- total profit and tax.

The certificate may be required both for personal purposes and as a form of reporting to tax authorities.

Where can I order and get a 2-NDFL certificate for a working person?

Article 62 of the Labor Code of the Russian Federation states that the employer is obliged to issue information about the income of employees, in particular, 2-NDFL certificates. The obligation to issue certificates rests with the employer, since in accordance with Art. 116 of the Tax Code of the Russian Federation, he is a tax agent.

In view of this, obtaining a certificate for an employed person is very simple. All you have to do is contact your employer. He is obliged to issue a certificate within three days, without specifying why the employee needs it.

IMPORTANT!

If the employer fails to fulfill its obligations regarding the certificate, sanctions may be imposed upon the employee upon complaint. For officials, the fine is up to 5 thousand rubles, for an enterprise – up to 50 thousand. It is even possible to suspend the organization's work.

If there are errors in the document, you need to quickly correct them. Changes must be made both to the certificate of the employee who issued it at his request, and to the certificate that is sent to the tax authority. If a tax error is discovered before correction, the employer may be fined.

How long is certificate 2 personal income tax valid for social security?

Mortgage lending refers to a long-term loan that requires large investments on the part of the banking institution. That is why personal income tax certificate 2 must contain information about income for several years. Although for some organizations several months are enough. A mortgage certificate is valid for a minimum of 10 days and a maximum of 30 days.

Every person has encountered a situation in life where they need to prove their income. For these purposes, a personal income tax certificate 2 is provided. The certificate contains information about remunerations received by the employee and taxes paid to the budget for the employee. The certificate is issued by the employer. The employee requests it to be submitted to an institution - the tax office and credit institutions. A certificate is also required when applying to social security.

How to obtain a 2-NDFL certificate from an employer?

To obtain a certificate of employment, you need to visit the organization’s accounting department and write a free-form application addressed to the director. By law, the employer is required to issue a certificate within three days. If this does not happen, the person has the right to file a complaint with the labor inspectorate, and if this does not help, then with the prosecutor’s office.

IMPORTANT!

Tax documentation must be kept by the company for four years. At the end of this period, the employer may refuse to issue a certificate.

When is it possible to receive 2-NDFL from the tax office?

Providing 2-NDFL certificates to individuals is not the responsibility of tax employees, as stated in Art. 32 of the Tax Code of the Russian Federation. However, if you need a certificate of income that you received at your previous job in a company that no longer exists, then only tax officials can provide this data.

To do this, an individual must submit a written request to the tax authority in accordance with the place of registration of the former employer. Tax officials must provide information about income based on information that was previously received from the former employer, because he is obliged to annually provide 2-NFDL certificates for each employee no later than April 1 of the year following the current one (clause 2 of Article 230 of the Tax Code of the Russian Federation) . For situations where a company is liquidated, in particular during transformation, the timing may differ, but liquidated organizations are required to submit 2-NDFL before complete closure.

How long is the 2-NDFL certificate valid?

EXAMPLE In 2021, Katyshev applied to the tax authority with an application for a property deduction and asks to issue it for 2012. However, according to paragraph 7 of Article 78 of the Tax Code, this will no longer be possible, since the three-year period has expired. In this case, the citizen will be denied the deduction.

We recommend reading: List of documents for obtaining permission to build a private house

Articles 218 – 220 of the Tax Code of the Russian Federation regulate the receipt of social, property and standard deductions when submitting a completed form 3-NDFL to the Federal Tax Service. And in this case, the validity period of 2-NDFL will be quite long and will be three years. Again, let's look at what has been said with an example.

Where can I get a 2-NDFL certificate for an unemployed person?

If an individual is unemployed, you can obtain a certificate in the following ways:

- Go to the dean's office of your university if you are a student.

- Visit the employment center if you do not work, but are registered with the employment service.

In each case, you must write an application in the form recommended by the authority issuing the certificate. In other cases, due to the absence of a tax agent at the place of request, documents are presented that confirm the impossibility of providing a certificate. Thus, those who do not work, before going somewhere for help, need to understand the sources of their income and whether they are individual entrepreneurs.

Purpose and procedure for issuing a certificate of income for 3 months

Often such a certificate is issued on the company’s letterhead (all details are already entered into it), but this is not necessary. The text of the certificate itself may look something like this: “Issued to Sergei Viktorovich Ivanov that he actually works at Teremok LLC in the position of “security guard” from July 15, 2021 to the present, and his salary for the period from June 2021 to August 2021 amounted to 30,600 rubles, including for June 10,000 rubles, for July 10,400 rubles, for August 10,200 rubles. The certificate was issued on the basis of a personal account for presentation at the place of request.”

We recommend reading: Buy an Apartment Using Maternal Capital for Up to 3 Years Without a Mortgage

A family is considered low-income if its average total income for the three months preceding the application for social security, divided by the number of family members, is below the subsistence level. When making your own calculations to determine whether you are included in this category of citizens, keep in mind the following: what is taken into account is not the amount that each working family member actually received in person, but the amount of wages before taxes and fees are deducted.

Features of filling out the 2-NDFL certificate

Depending on where the certificate will be provided, it can be filled out in various ways. Most often it is prepared by accountants who are either employed in a company that is a tax agent or work with individual entrepreneurs under a contract. In some cases, the certificate can be filled out by the entrepreneur himself or the head of a small organization. There are programs and online resources for this that allow you to save as much time as possible.

Also, 2-NDFL can be filled out independently. This can cause a number of difficulties for a person unfamiliar with all the intricacies, but in fact everything is simple. The declaration form can be downloaded from the official tax website. Let's look at some features of filling out the document.

- You need to start filling out declarations by entering the date. The header also indicates the Federal Tax Service code.

- The first section indicates the name of the legal entity. Enter contact phone number, INN, OKTMO code. There is also a field about the reorganization or liquidation of the company. It is filled out by successor enterprises that prepare reports for tax authorities instead of the liquidated company.

- The second section must contain information about the individual whose income and taxes are reflected in the certificate: full name, citizenship, date of birth, taxpayer code.

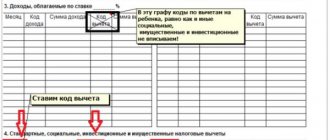

- Sections 3 and 4 indicate all sources of income subject to taxation. Here you can also see fields for deductions. Deductions are accompanied by documents certifying their legality.

- Section 5 – final. It contains the calculation of withheld and transferred tax taking into account the total amount of income with deductions.

- The last block must contain information about the person filling out the declaration. If it is the tax agent himself, a one is given, if the representative is a two. You must indicate the full name of the person who prepared the document and its details, and sign it. After this, you can submit the certificate wherever needed.

Possible difficulties

To avoid possible problems when receiving a certificate, be sure to check the following lines:

- Sign. This is a required field that allows you to determine the type of certificate. The number 1 must be included if the certificate displays information about income and the tax levied on it. The number 2 is set if income was received, but the income was not withheld. If the certificate is issued for an employee who received a salary with tax deduction, then, regardless of the purpose of receipt, the number 1 is entered.

- Code of the country. Mandatory column indicating citizenship. The taxation procedure for residents and non-residents of the Russian Federation is different. For Russians, the code in the column is indicated “643”.

- Region code. This indicates the region to whose budget the tax is paid. It corresponds to the registration of an individual. The region code can be found by the first two digits of the TIN.

- Tax deduction code. It may differ, for example, if a person has minor children.

- Section 5. It displays the income and its amount received by an individual during the reporting period. The tax base is indicated as the difference between profit and deductions.

If an error was made in the certificate, for example, a tax return was provided, a 2-NDFL adjustment must be submitted to the tax office. Its form is similar to the standard declaration, only the “adjustment number” field is different. When submitting a certificate for the first time, the number “00” is entered, if an adjustment is submitted for the first time, “01” and so on.

IMPORTANT!

It is better to notice the presence of unreliable information before the tax authorities do it. In this case, you can avoid a fine.

Certificate 2-NDFL is an important document that is required in all cases when confirmation of a citizen’s income is required. In its absence, many services may be unavailable. Obtaining this document is quite simple. This can be done through the employer or the Federal Tax Service website online.