Registering a vehicle

We will reflect the purchase of a vehicle. For fixed assets that do not require installation, you can use the “Receipt of fixed assets” document, which serves to simultaneously reflect the receipt and acceptance of fixed assets (Fixed Assets) for accounting. The document is located in the section “Fixed assets and intangible assets” - group of documents “Receipt of fixed assets”, hyperlink “Receipt of fixed assets”.

Fig. 1 1C program window: Accounting 8.3 – section OS and intangible assets

Let's look at an example. Elita LLC purchased a Volkswagen Polo passenger car worth RUB 829,900. from the supplier "Klyuchavto". We will reflect the arrival of the car in the program. Let’s create the document “Receipt of fixed assets” (the “Create” button in the document journal).

Fig.2 Creation of the document “Receipt of fixed assets”

Next, fill out the form with the necessary data, indicating the counterparty, the contract, and the financially responsible person. Pay attention to the “Method of reflecting costs” field. In our case, we will indicate account 26 “General business expenses”, because The car is intended for administrative needs. In the case when the vehicle is associated with production, auxiliary production or trading activities, then other cost accounts are indicated (for example, account 25 “Overall production expenses”, 23 “Auxiliary production”, 44 “Distribution costs”). Be sure to indicate the OS accounting group – “Vehicles”.

Fig. 3 Document form “Receipt of fixed assets”

The name of the vehicle is indicated in the tabular part, for which we will enter it in the directory.

Fig.4 OS directory - creating an OS object

Fig.5 OS card

Please note that in order to generate an inventory card and further calculate depreciation, you must fill in all the fields of the OS card below - manufacturer, serial number, registration number and also the OKOF classifier that determines the depreciation group.

Fig.6 OS card - filling out information for the inventory card, accounting and classifiers

Fig.7 Code selection by OKOF

When posting the document, postings were generated and our car was put on the balance sheet.

Fig. 8 Document journal “Receipt of fixed assets” – toolbar, button “Show transactions and other document movements”

Fig. 9 Receipt flow report

Registration of vehicles in 1C 8.3

The registration of the vehicle with the State Traffic Safety Inspectorate is reflected in the information register Registration of vehicles in the Main section - Settings - Taxes and reports - Transport tax tab.

Fill in the basic data from the Vehicle Registration Certificate or Vehicle Passport (PTS):

- The main means is TS;

- Date - date of registration or change of data in the traffic police;

- The tax rate will be determined automatically.

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Car registration

- State duty in BU and NU: Legislation

- Accounting for the fee for state registration of a car: Step-by-step instructions

- If the PTS has 2 powers

- How to correctly calculate the increasing coefficient for “expensive” cars?

Let's look at calculating transport tax step by step

The first step in setting up is to register our tool. To do this, go to “Directories”, item “Taxes”.

Fig.10 “Taxes” menu

The corresponding section contains items - “Vehicle registration”, “Payment procedure”, “Rates”, “Methods of recording expenses”.

Fig.11 Menu items

In essence, registration is the entry into a form of all the car data, which indicates the make, number, engine size, and environmental class.

You can determine whether you belong to the environmental class by looking at the car’s PTS; there should be a mark indicating the standard.

Based on this data, the tax rate for your region is determined.

Fig.12 Registration card

Fig. 13 Tax rates at the place of registration of the vehicle

Fig. 14 Vehicle registration log

To reflect tax expenses in the “Methods of Reflection” journal, in the window that opens, click the “Create” button to set the necessary parameters. In this case, you can set one setting for all vehicles or reflect an individual expense item for each, which is important when an organization maintains records for different departments.

Fig.15 Settings window

If you plan to make advance tax payments, then fill out the “Payment Procedure”.

Fig. 16 Payment procedure

After these simple settings, both the tax return and the postings will be generated automatically by the system at the end of the month once a year, in December.

Entering benefit information

The laws of the constituent entities of the Russian Federation may provide benefits for vehicles. Information about them is indicated in the “Tax benefit” form, which opens by clicking on the input field of the same name in the “Vehicle registration” form. The benefit is set using a switch, which is set to one of the following positions:

- “Not applicable” – if the benefit is established in the form of tax exemption;

- “Exemption from taxation, benefit code” - when selecting this mode, the button for selecting the type of tax exemption code becomes active, which can be selected from the proposed codes by clicking on three dots and entering the basis for applying the benefit becomes active (article of the regulatory legal act of the representative body of the municipality, in according to which the benefit is provided);

- “Reduced tax rate to” – if the benefit is established in the form of a reduction in the tax rate (the reduced tax rate is indicated in the input field);

- “Reduction in the amount of tax by” - if the benefit is established in the form of a reduction in the calculated amount of tax as a percentage (the input field indicates what percentage of the tax is not payable).

For all benefits, the benefit code 20200 is automatically entered (in accordance with Appendix No. 7 to the Procedure for filling out the electronic form of the tax return for transport tax, approved by Order of the Federal Tax Service of the Russian Federation dated December 5, 2016 No. ММВ-7-21-/ [email protected] ).

If the law of a constituent entity of the Russian Federation changes the tax rate, amount and procedure for providing tax benefits, it will be necessary to re-enter the registration record of the vehicle in the register of information “Registration of Vehicles”, indicating in the “Date of Registration” detail the date from which the changes come into force.

The list of organizations that are provided with benefits for paying transport tax in the Rostov region is specified in Article 7 of the Regional Law of April 19, 2012 “On regional taxes and some tax issues in the Rostov region.”

Vehicles and land plots: nuances of “declaration-free” tax payment for 2021

In a letter dated 02/05/2021 No. BS-4-21/ [email protected] the Federal Tax Service of Russia explained how messages from organizations about the availability of vehicles and land plots that are subject to taxes are processed.

The need for clarification is due to the launch of a new mechanism for interaction between the Federal Tax Service and taxpayers - legal entities, which provides for the abolition of declarations for these taxes.

From the history of the “declaration-free” tax payment procedure

Let us recall that changes to the Tax Code of the Russian Federation were made in 2021 with the adoption of two federal laws - dated 04/15/2019 No. 63-FZ and dated 09/29/2019 No. 325-FZ.

Reporting on transport and land taxes was considered unnecessary. And in order to reduce the administrative burden on participants in tax relations, the legislator abolished the obligation to submit tax returns for transport (clause 17, article 1 of law No. 63-FZ) and land (clause 26, article 1 of law No. 63-FZ) taxes.

The “non-declaration” procedure began to operate with reporting for the tax period 2021 and will be applied in subsequent tax periods

(Part 9, Article 3 of Law No. 63-FZ). In connection with adjustments to the Tax Code of the Russian Federation, from January 1, 2021, the orders of the Federal Tax Service of Russia dated December 5, 2016 No. ММВ-7-21/ [email protected] and dated May 10, 2017 No. ММВ-7-21/ [email protected] , which Forms and formats for submitting tax returns for transport and land taxes, respectively, were approved, as well as procedures for filling them out (Order of the Federal Tax Service of Russia dated September 4, 2019 No. ММВ-7-21/ [email protected] ).

Payers of transport and land taxes may need to submit declarations (updated declarations) for tax periods preceding 2021 (for 2021 and earlier). What to do in such situations? There's no need to worry. Tax authorities are required to accept such declarations in the forms that were in force during the relevant tax periods (letter of the Federal Tax Service of Russia dated September 12, 2019 No. BS-4-21/ [email protected] ).

Example

The organization purchased a forklift in November 2021 for use in production activities (in warehouses and on company premises). The forklift was put into operation in December 2021. At the same time, during trial operation, malfunctions of the forklift were identified. The organization filed a claim with the supplier, but was denied warranty repairs. The refusal was justified by the fact that the organization accepted the forklift according to the acceptance certificate, which did not reflect the presence of any malfunctions. In connection with these circumstances, the organization registered the forklift with Gostekhnadzor in January 2021 in violation of the established rules (more than ten days after purchase). The registration procedure in force at that time was approved by Decree of the Government of the Russian Federation dated August 12, 1994 No. 938. The document became invalid as of January 1, 2021 due to the adoption of Decree of the Government of the Russian Federation dated September 21, 2020 No. 1507 (the validity period of the newly approved rules is limited to January 1, 2027) .

When filing the 2021 return, the forklift was not taken into account when calculating the 2021 vehicle tax. The error was discovered only in January 2021. In order to avoid a dispute with the Federal Tax Service, it was decided to make corrections to the accounting, issue an updated declaration for 2021 (including a forklift) and submit an “adjustment” to the Federal Tax Service. Before submitting this declaration, the organization paid the arrears of transport tax and penalties for days of late payment. In such a situation, the Federal Tax Service will have to accept an updated declaration for the tax period preceding 2021.

One more nuance. As a general rule, when reorganizing in 2021, the organization had to submit declarations on transport and land taxes.

According to the Tax Code of the Russian Federation (clause 3 of Article 55), when an organization is terminated through liquidation or reorganization, the last tax period for it is the period from January 1 of the calendar year in which the organization was terminated until the day of state registration of the fact of liquidation or reorganization. Taking this into account, in the period from 01/01/2020 to 12/31/2020, tax returns for the 2021 tax period could be submitted by liquidated or reorganized companies.

After submitting the initial declaration for transport and (or) land taxes, it may be necessary to submit updated declarations to the Federal Tax Service after January 1, 2021 (for example, if errors are discovered during the audit of the annual reporting). Tax authorities will also accept such declarations (letter of the Federal Tax Service of Russia dated October 31, 2019 No. BS-4-21/ [email protected] ). Filling out a tax return is implemented in the “Legal Taxpayer” software package, located on the website of the Federal Tax Service of Russia.

Tax payment mechanism for 2021

So, for 2021, organizations (except liquidated and reorganized ones) do not need to submit transport and land tax returns.

The tax period has ended, advance payments (in those regions where they are provided for by regional legislation) were made during 2020. Now you need to calculate and pay taxes at the end of the year. For the payment of transport (paragraph 2, paragraph 1, Article 363 of the Tax Code of the Russian Federation) and land (paragraph 2, paragraph 1, Article 397 of the Tax Code of the Russian Federation) taxes, a single deadline is established - no later than March 1 of the year following the expired tax period.

– transfer of information by registration authorities

From January 1, 2021 (including for the tax period 2021), transport and land taxes for legal entities are calculated by the Federal Tax Service. To calculate taxes, they will use information received from registration authorities, in particular information:

- from the Unified State Register of Taxpayers (USRN);

- from the bodies carrying out state registration of vehicles (State Traffic Safety Inspectorate, Gostekhnadzor, GIMS centers of the Ministry of Emergency Situations of Russia, Rosmorrechflot, Rosaviatsia, etc.) and rights to real estate (territorial divisions of Rosreestr).

From January 1, 2021, state registration of motor vehicles in the registration divisions of the State Traffic Safety Inspectorate of the Ministry of Internal Affairs of Russia is carried out according to the rules and in the manner approved by Decree of the Government of the Russian Federation dated December 21, 2019 No. 1764.

Clause 4 of Article 85 of the Tax Code of the Russian Federation obliges the tax authorities to provide information about real estate located on the territory subordinate to the registration authorities (including land plots), about registered vehicles (rights and transactions registered with these authorities) and about their owners.

Information must be submitted to the Federal Tax Service at the location of the registration authorities:

- within 10 days from the date of corresponding registration, and

- annually until February 15 (as of January 1 of the current year and (or) for other periods determined by interacting bodies (organizations, officials)).

The form by which registration authorities transmit information about motor vehicles and their owners to tax authorities (KND 1114609, Appendix 1 to the order of the Federal Tax Service of Russia dated November 25, 2015 No. ММВ-7-11 / [email protected] ) contains almost all the information necessary for calculation of transport tax (recording characteristics of vehicles, including state registration plate, make and model of the vehicle, type codes of the motor vehicle, engine size), as well as the start and end dates of the search (return) of the stolen car, information about the organization, to which the motor vehicle is registered, and other information.

– sending messages by tax inspectorates

To confirm the correctness of payments for the calculated amounts of transport and land taxes, the Federal Tax Service will inform taxpayer organizations by sending them messages (clauses 4, 5 of Article 363 and clause 5 of Article 397 of the Tax Code of the Russian Federation).

Order of the Federal Tax Service of Russia dated July 5, 2019 No. ММВ-7-21/ [email protected] approved forms for reporting the amount calculated by the Federal Tax Service:

- transport tax (KND 1152006) (Appendix 1 to the order);

- land tax (KND 1153007) (Appendix 2 to the order).

The Federal Tax Service must send messages within the following time frames (clauses 4–7 of Article 363 and clause 5 of Article 397 of the Tax Code of the Russian Federation):

- within ten days after preparation, but no later than six months from the date of expiration of the established deadline for payment of tax for the specified tax period;

- no later than two months from the date of receipt by the Federal Tax Service of documents and (or) other information entailing the calculation (recalculation) of the amount of tax payable by the relevant taxpayer-organization for previous tax periods;

- no later than one month from the date the Federal Tax Service Inspectorate receives the information contained in the Unified State Register that the relevant organization is in the process of liquidation.

– actions of the taxpayer in case of failure to receive a message from the Federal Tax Service

In connection with the introduction of a “non-declaration” procedure for paying transport and land taxes, the legislator imposed an additional obligation on taxpayer organizations. It is established by paragraph 2.2 of Article 23 of the Tax Code of the Russian Federation. According to this norm, taxpayers-organizations are required to send to the Federal Tax Service, at their choice, a message about the availability of vehicles and (or) land plots recognized as objects of taxation for the relevant taxes. The form and format for submitting such a tax document in electronic form, as well as the procedure for filling out the form and the procedure for sending it via TKS, are approved by order of the Federal Tax Service of Russia dated February 25, 2020 No. ED-7-21 / [email protected] This document should be sent if the organization will not receive a message about the amount of transport and (or) land taxes calculated by the Federal Tax Service in relation to the specified objects of taxation for the period of their ownership. You need to inform the Federal Tax Service once before December 31 of the year following the expired tax period. A similar procedure is provided for taxpayers - individuals. And now organizations should get along with this way of communicating with the Federal Tax Service.

If the Federal Tax Service has sent a message about the calculated amount of tax, then the organization must check this amount with the one it calculated independently. If it turns out that the amount of tax calculated by the organization is less than that reported by the Federal Tax Service, the tax will need to be paid additionally. If you do not agree with the tax authorities, it may be better to make an additional payment and then find out why the discrepancies arose. If deadlines are tight, tax arrears may arise with all the ensuing consequences.

If the tax amount in the IFTS message turns out to be less than the calculated amount, you should check how the tax authorities formed the tax base and whether they took into account all the objects. If some object was not indicated in the message of the Federal Tax Service Inspectorate, then it is necessary to inform the Federal Tax Service Inspectorate in the manner established by the Tax Code of the Russian Federation (clause 2.2 of Article 23).

What to do if the tax payment deadline (March 1) arrives, and the organization does not receive a message from the Federal Tax Service about the calculated tax amount? Is it stupid to sit and wait for the natural ending?

The Federal Tax Service of Russia recommends the following.

Firstly, you need to take into account the deadlines for sending a message by the Federal Tax Service Inspectorate provided for by the Tax Code of the Russian Federation (subparagraphs 1–3, paragraph 4 of Article 363). As stated earlier, tax authorities must meet the deadline of six months from the date of expiration of the established deadline for paying tax for the specified tax period. If we are talking about paying tax for 2021, then the Federal Tax Service must report the calculated amounts of transport and (or) land tax by 09/01/2021.

Until this date, taxpayer organizations should not worry and submit their reports.

If after 09/01/2021 the taxpayer does not receive information from the Federal Tax Service, he will be required to send his message by 12/31/2021. It is not the responsibility of the tax authorities to inform the taxpayer about the results of consideration of such a message.

If an organization does not send a message to the Federal Tax Service about the availability of taxable objects (cars or land), it faces a fine of 20% of the tax that the organization did not pay before March 1

for such objects (clause 3 of article 129.1 of the Tax Code of the Russian Federation). Such liability was introduced for legal entities by Federal Law No. 325-FZ dated September 29, 2019.

Tax calculation

In 1C the calculation is carried out:

- quarterly—advance payments are set in the settings;

- at the end of the year - the settings do not set the payment of advances.

Tax calculation, including advance payments, is carried out through the Month Closing procedure - operation Calculation of transport tax.

During the reporting period

At the end of the year

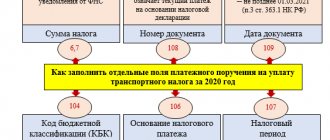

Transport tax declaration

Fill out the declaration in the section Reports - 1C-Reporting - Regulated reports.

When filling out the declaration, select the tax authority with which the vehicle is registered.

Section 1 reflects the amounts of calculated advances and how much tax remains to be paid.

In Section 2, a separate sheet with tax calculation is filled out for each vehicle.