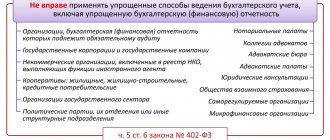

What is the tax regime

Businesses pay taxes according to certain rules and formulas. Simply put, the tax regime (or taxation system) is the set of formulas by which taxes will have to be calculated and transferred to the budget. There are several such systems in Russia, they differ in the number of taxes and their size, and in the number of reports that will have to be submitted. Each system has its own tolerances and criteria: if a business fits these tolerances, it has the right to use the system; if it “doesn’t fit in,” then it doesn’t.

- OSNO - general taxation system - the basic system on which all new companies and individual entrepreneurs find themselves “by default”, unless they choose a different regime and write a notification about it to the tax office. Therefore, OSNO is called the main system, or “classic”, and the remaining tax regimes are called special, or special regimes.

- The simplified tax system is a simplified taxation system, simplified.

- PSN - patent taxation system, patent.

- Unified agricultural tax - unified agricultural tax - for farmers and peasant farms.

- NPI - professional income tax - for the self-employed.

Great, where is the “but”?

You are right, there were some “buts”. Despite many positive changes, there are those that small businesses are not happy with:

- New details for paying taxes and contributions - see letter of the Federal Tax Service of Russia dated 10/08/2020 No. KCh-4-8/ [email protected] ;

- You will have to report on some types of goods that are included in the list of traceable goods (see Federal Law No. 371-FZ dated November 09, 2020). The path of goods will be tracked from the moment they are imported into the country until they are sold to the consumer. Invoices issued for the sale of such goods can only be issued in electronic form;

By the way, new details for traceable goods have appeared in the invoice form - quantity, units of measurement, batch number;

- A progressive personal income tax scale has appeared. For income over 5 million rubles, you will have to pay tax at an increased rate - 15%, this also applies to individual entrepreneurs on the general taxation system;

- From July 1, 2021, entrepreneurs who previously received a deferment for using an online cash register must start using it. It takes time to select, purchase, register and connect an online cash register, so we recommend that you start dealing with this issue not in the last days of June;

- For those who already work with cash registers, let us remind you that from July 1 it is necessary to write the name on the check, if previously you had the right not to do this;

- If an employee comes to you next year to get a job, for whom this is the first place of work, he needs to immediately start keeping an electronic work record book;

- From January 1, 2021, a number of goods (some types of outerwear and knitwear, bed linen, etc.) are subject to mandatory labeling. Without it, it is impossible not only to sell such goods, but even to store or transport them.

What influences the choice of tax regime

What parameters show whether you can apply a particular tax system or not? We list it.

- Annual revenue volume. Let's say, for the simplified tax system it is 200,000 million rubles, for PSN - 60 million rubles, for NPD - 2.4 million rubles, and for OSNO there are no restrictions.

- Number of employees. On a simplified basis you can work with a staff of up to 130 people, on a patent - up to 15 people, on NPD you cannot hire staff at all, and on OSNO there are again no restrictions.

- Organizational and legal form - individual entrepreneur, LLC, etc. For example, individual entrepreneurs can work on PSN and NPD, but LLC cannot.

- Activities. You can work with OSNO for any type of activity, but each special mode has a list of types for which it can be used. This is spelled out in the Tax Code and regional laws; we will talk about this in more detail when we talk about each special regime.

There are other tolerances for special regimes: the cost of fixed assets, the presence of branches, etc. We will also talk about this later.

What is a small enterprise: criteria for 2021

Both organizations in the form of a legal entity and individual entrepreneurs can be recognized as a small and medium-sized business, subject to compliance with:

- income limit;

- restrictions on the number of employees (full-time and hired);

- the limit of the permissible share of other organizations in the authorized capital of the company.

The requirements for classifying a business entity as a small enterprise are established by current legislative acts. In 2021, legislators established the following criteria for small businesses:

| No. | Criteria for a small business | Description |

| 1 | Income level | The amount of income received by the organization at the end of the reporting year should not exceed 800,000,000 rubles. This amount is calculated based on the chosen taxation system and is confirmed by the indicators reflected in the tax return |

| 2 | Number of employees | The average number of employees of the organization, calculated based on the results of the reporting year, should not be more than 100 people |

| 3 | Share of other organizations in the authorized capital of the enterprise | The limitation on the share of participation of other organizations in the authorized capital of the company is set in the following amount:

The share of participation of organizations that are themselves small businesses is not limited by a limit. |

Also, current legislative acts establish requirements for classifying organizations and individual entrepreneurs as micro- and medium-sized enterprises:

| No. | Type of business entity | Criteria |

| 1 | Medium enterprise | The annual income level is up to 2 billion rubles, the average number of employees is from 101 to 250 people. |

| 2 | Microenterprise | The annual income level is up to 120 million rubles, the average number of employees is up to 15 people. |

How to choose a tax regime

Step 1. “Filter” all possible regimes by organizational and legal form. For example, you have an LLC: OSNO and USN are suitable. If you have an individual entrepreneur, any of the modes will do.

Step 2. We look at annual revenue. If according to the business plan you have to earn 45 million rubles, then the NPD will no longer be suitable, but the patent, simplified version and OSNO will do.

Step 3. We count the employees on staff. For example, you have 60 employees: the patent and NPD are no longer required, what remains is simplification and OSNO.

Step 4. We cut off tax regimes by type of activity: check the tolerances for your type. Let's say that insurers do not work on the simplified tax system.

Step 5. We check the remaining criteria: for example, a company with branches or participation of another company in the authorized capital of more than 25% cannot apply the simplified tax system.

Step 6. If you still have a choice before this step, calculate your tax burden. To do this, look at what taxes are paid in each applicable tax regime and calculate the amounts based on your planned or current income. Then compare them and choose the most favorable tax regime.

The choice of taxation system can be made automatically - using a free calculator from Kontur.Accounting. The calculator will help you cut out unsuitable regimes, tell you how to fill out the fields for calculation, and show the tax burden for each system. All you have to do is choose the profitable mode.

Legal optimization of the fiscal burden

A modern entrepreneur can significantly reduce taxes, simplify accounting, and also take advantage of benefits for small businesses. The key condition is the correct choice of mode or proper combination of mechanisms.

Recommendations for simplified taxation system payers

The safest option is a simplified system with a rate of 6%. This solution is suitable for beginning entrepreneurs who have no idea about primary reporting and do not want to take risks. The object of taxation is especially relevant when providing services via the Internet. The system is recommended for self-employed citizens - freelancers.

If the company's costs are significant, it makes sense to pay attention to the 15% rate. The key to success will be documenting expenses. Checking counterparties for integrity will be of great importance. To avoid challenging costs by regulatory authorities, preference should be given to non-cash payments.

The simplified regime is relevant for developing businesses. A high annual turnover threshold allows companies to actively expand and enter new markets. Unlike PSN and UTII, there are no territorial boundaries for conducting commercial activities. You can work in any region of the country without additional registration.

Tax optimizer advice! If a company on the simplified tax system begins to regularly sell products, the sales area can be allocated to UTII. The scheme will be legal if there is a clear delineation of cash flows and documentation of the movement of material assets.

Recommendations for UTII payers

Since this tax system for small businesses is not related to real income and costs, emphasis should be placed on physical indicators. So, you can reduce the fiscal burden by remodeling the premises. Installation of partitions separating the sales area from warehouse and technical areas will legally reduce payments to the budget. It is better for UTII payers to rent fixed assets. In the event of a sharp decline in income or downtime, the agreement can be terminated. The absence of a physical indicator will exclude the calculation of tax. It will be much more difficult for owners of commercial assets to prove the “freezing” of their business.

Tax optimizer advice! Some types of activities subject to UTII duplicate positions in the PSN and STS lists. If the actual revenue in a direction is lower than the imputed income, it is wiser to change the system.

Optimization when applying the PSN regime consists of competently calculating the period of activity. The legislator allowed the acquisition of a patent with minimal terms. This option is optimal for seasonal businesses.

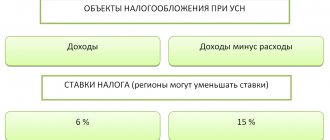

USN: taxes and reports, for whom it suits

Simplified is one of the most understandable and profitable special regimes for small businesses; the rules for working and switching to the simplified tax system are in Chapter. 26.2 Tax Code of the Russian Federation. Under the simplified system, they pay one tax (however, if a company has transport and land, then transport and land taxes are paid separately). Every quarter, so-called “tax advances” are transferred, and at the end of the year, the remaining tax is calculated and paid. But there is only one tax return - it is submitted once a year: organizations until March 31, individual entrepreneurs - until April 30.

Another advantage of the system is that the authorities of your region can reduce the tax rate under the simplified tax system for some types of business, then the savings will be even more noticeable.

There is no need to work with VAT on the simplified tax system. Therefore, it is not profitable for other companies that pay VAT to buy goods and services from companies or individual entrepreneurs using the simplified tax system. So the “Osnoshniks” try not to work with the “Simplers”.

Tolerances and restrictions when working on the simplified tax system:

- annual income - no more than 200 million rubles;

- number of employees - no more than 130;

- cost of fixed assets - no more than 150 million rubles;

- the authorized capital of the company should contain no more than 25% of the contribution of another organization;

- the company should not have branches;

- Manufacturers of excisable goods cannot work on a simplified basis, extract minerals, work with securities, or give loans: in Art. 346.12 of the Tax Code of the Russian Federation lists everyone who is not allowed to work for the simplified tax system.

The rules for calculating simplified taxes depend on the object of taxation. This is the amount on which tax is paid. There are two options on the simplified tax system:

- income;

- income minus expenses.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Moscow State University of Printing Arts

6.

Tax accounting and reporting for small businesses

6.1.

Types of taxation for small businesses

For small businesses, tax accounting and reporting are the most important elements of accounting policy. The main purpose of tax accounting and reporting in a small enterprise is to summarize the information necessary for the correct calculation of the tax base by type of tax payments.

The existing taxation system in the Russian Federation includes general and special taxation regimes, which allows all small businesses to be divided into three main groups.

The first group includes small enterprises that have chosen the general taxation regime along with large and medium-sized enterprises.

The second group includes small enterprises that apply this type of special taxation regime, such as a simplified taxation system, the application of which is regulated by Chapter 26.2 “Simplified taxation system” of the Tax Code of the Russian Federation.

The third group consists of small enterprises that apply another type of special taxation regime in the form of payment of a single tax on imputed income, the application of which is regulated by Chapter 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities” of the Tax Code of the Russian Federation.

Thus, any small enterprise can choose either general or one of the special types of taxation regime.

A small enterprise that uses the generally accepted taxation system must pay a fairly large number of taxes (we list the main ones), including:

Federal significance:

Organizational profit tax at rates 0, 6,; 10, 15, 20, 24% (Article 284 of the Tax Code of the Russian Federation). The basis for levying this tax is Chapter 25 “Organizational Income Tax” of the Tax Code of the Russian Federation. The object for taxation is income received, reduced by the amount of expenses incurred (Article 247 of the Tax Code of the Russian Federation). The tax reporting period for this tax is the calendar year (Article 285 of the Tax Code of the Russian Federation). Tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated December 7, 2001 No. BG-3-02/542 (as amended on July 12, 2002);

Value added tax (VAT) at the rate: 0%, 10%; 18% . The basis for collection is Chapter 21 “Value Added Tax” of the Tax Code of the Russian Federation. The object of taxation is regulated by Art. 146 “Object of taxation”, the tax reporting period is a calendar month.

It should be especially noted here that for small businesses the reporting period is extended to a quarter, provided that the monthly revenues from the sale of goods (works, services) during the quarter do not reach a million rubles excluding tax (Article 163 of the Tax Code of the Russian Federation).

Tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated July 3, 2002 No. BG-3-03/338;

Excise taxes, the payment of which is regulated by Chapter 22 “Excise Taxes” of the Tax Code of the Russian Federation. The object of taxation is the sale of produced excisable goods at rates established in rubles and kopecks per unit of measurement of excisable goods, depending on their type (Article 193 of the Tax Code of the Russian Federation). The tax period is a calendar month (Article 192 of the Tax Code of the Russian Federation) and tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated December 17, 2002 N BG-3-03/716;

Tax on personal income, the basis for collection of which is Chapter 23 “Tax on personal income” of the Tax Code of the Russian Federation. The object of taxation is income paid by a small enterprise to employees (individuals) in the form of remuneration for work performed, services rendered, etc. (Article 208 of the Tax Code of the Russian Federation), at established rates of 6, 13, 30, 35% (Article 224 Tax Code of the Russian Federation). The tax period is established by the calendar year (Article 216 of the Tax Code of the Russian Federation) and tax reporting is a certificate of income of an individual for the year in Form No. 2-NDFL, approved by Order of the Ministry of Taxes of the Russian Federation dated December 2, 2002 No. BG-3-04/686;

The Unified Social Tax (UNS), the payment of which is regulated by Chapter 24 “Unified Social Tax” of the Tax Code of the Russian Federation. The object of taxation is payments and other remuneration in favor of individuals under labor and civil law contracts that are concluded for the performance of work, provision of services, as well as for work performed under copyright agreements (Article 236 of the Tax Code of the Russian Federation). The rates are set as a percentage and depend on the amount of income paid (Article 241 of the Tax Code of the Russian Federation). The tax period is set to a calendar year (Article 240 of the Tax Code of the Russian Federation), and tax reporting is a Tax Declaration in the form approved by Order of the Ministry of Taxes of the Russian Federation dated October 9, 2002 No. BG-3-05/550, as well as calculation of advance payments approved By order of the Ministry of Taxes and Taxes of the Russian Federation dated 01.02.2002 No. BG-3-05/49.

Regional level:

Organizational property tax, the payment of which is regulated by Ch. 30 “Property tax of organizations” of the Tax Code of the Russian Federation (introduced by Federal Law No. 139-FZ of November 11, 2003), the rate of which is established by the laws of the constituent entities of the Russian Federation and cannot exceed 2.2% (Article 380 of the Tax Code of the Russian Federation). The object of taxation is the average annual value of property as of the reporting date (Articles 375, 377 of the Tax Code of the Russian Federation). The tax period is established by the calendar year (Article 379 of the Tax Code of the Russian Federation). Tax reporting is tax calculations for advance payments submitted within the deadlines established for quarterly and annual financial statements (Article 386 of the Tax Code of the Russian Federation). Calculation of the property tax of enterprises is carried out according to the form approved by the instruction of the State Tax Service of the Russian Federation dated 06/08/1995 No. 33 (as amended by Order of the Ministry of Taxes of the Russian Federation dated 01/18/2002 N BG-3-21/22);

Transport tax (the rate is set in rubles, depending on the type of vehicle (Article 361 of the Tax Code of the Russian Federation). The basis for collection is Chapter 28 “Transport Tax" of the Tax Code of the Russian Federation. The tax reporting period is set to a calendar year (Article 360 of the Tax Code of the Russian Federation), The tax return form is established by the laws of the constituent entities of the Russian Federation.

Local taxes:

Land tax, the rate of which is set by the constituent entities of the Russian Federation. The basis for collecting land tax is the Law of the Russian Federation of October 11, 1991 No. 1738-1 “On Payment for Land” (as amended by the Federal Law of December 24, 2002 No. 176-FZ. The tax period is set to a calendar year (Article 3 Law of the Russian Federation No. 1738-1), tax reporting is carried out according to the Tax Declaration for Land Tax in the form approved by Order of the Ministry of Taxes of the Russian Federation dated April 12, 2002 No. BG-3-21/197;

Advertising tax, the basis for collection of which is the Law of the Russian Federation of December 27, 1991 No. 2118-1 “On the fundamentals of the tax system in the Russian Federation” (as amended by the Federal Law of November 11, 2003). The tax rate is set by local governments, but should not exceed 5% (Article 21p.4 of RF Law No. 2118-1). The object for taxation is the cost of advertising services without value added tax. Local government bodies establish the tax period (for the city of Moscow - quarter) and the reporting form for advertising tax.

Even just the list of main taxes and fees indicates that for small businesses the general taxation regime is a heavy burden. Therefore, a number of small enterprises are switching to a special taxation regime, which includes a simplified taxation system, which is applied along with the general taxation system.

6.2.

Simplified taxation system

The use of a simplified taxation system provides for the replacement of payment of: 1) corporate income tax; 2) tax on property of organizations; 3) the unified social tax and 4) the value added tax (with the exception of the value added tax payable when importing goods into the customs territory of the Russian Federation) by paying a single tax, which is calculated based on the results of the organization’s economic activities for the tax period (Article 346.11 p. .2 Tax Code of the Russian Federation).

All other taxes are paid by small businesses that have switched to a simplified system in accordance with the general taxation regime.

The transition of a small enterprise to a simplified taxation system has a certain procedure, which is established by Chapter 26.2 (Article 346.12 “Taxpayers”).

- • A small enterprise has the right to switch to a simplified taxation system if, based on the results of nine months of the year in which the organization submits an application to switch to a simplified taxation system, sales income (revenue from the sale of goods (work, services, property rights) as its own production , and previously acquired) did not exceed 11 million rubles. (Article 346.12, paragraph 2);

• Does not have the right to apply the simplified taxation system:

• organizations whose average number of employees for the tax (reporting period) exceeds 100 people;

• organizations whose residual value of fixed assets and intangible assets, determined in accordance with the legislation of the Russian Federation on accounting, exceeds 100 million rubles;

• organizations that have branches and (or) representative offices;

• Organizations that cannot apply the simplified taxation system include: banks, insurers, non-state pension funds, investment funds, professional participants in the securities market, pawnshops;

• Organizations and individual entrepreneurs engaged in the following types of activities cannot switch to a simplified taxation system:

• production of excisable goods;

• extraction and sale of minerals, with the exception of common minerals;

• gambling business;

• notaries engaged in private practice.

• Organizations and individual entrepreneurs cannot be such if they:

• are parties to production sharing agreements;

• transferred to a taxation system for agricultural producers (single agricultural tax);

• are organizations in which the share of direct participation of other organizations is more than 25 percent (in this case, this restriction does not apply to organizations whose authorized capital consists entirely of contributions from public organizations of disabled people, if the average number of disabled people among their employees is at least 50 percent, and their share in the wage fund is at least 25 percent) (Article 346.12, clause 3).

• A separate paragraph 4 of Article 346.12 (introduced by Federal Law No. 117-FZ of July 7, 2003) established a procedure for organizations and individual entrepreneurs transferred to the payment of a single tax on imputed income for certain types of activities for one or more types, which they are now entitled to apply a simplified taxation system in relation to other types of business activities carried out by them. But at the same time, for these organizations and individual entrepreneurs, restrictions on the amount of income from sales, the number of employees and the value of fixed assets and intangible assets established by Article 346.12 are determined based on all types of activities they carry out.

The procedure for transition to a simplified taxation system is determined by Art. 346.13 of the Tax Code of the Russian Federation, which establishes that:

Organizations that have voluntarily expressed a desire to switch to a simplified taxation system submit an application to the tax authority at the location of the organization (or place of residence) in the period from October 1 to November 30 of the year preceding the year from which taxpayers switch to a simplified taxation system (Article .346.13 p.1);

Newly created organizations have the right to submit an application for the transition to a simplified taxation system simultaneously with the submission of an application for tax registration, which gives them the opportunity to apply the simplified taxation system in the current calendar year from the moment of establishment of the organization (Article 346.13, paragraph 2);

Taxpayers using the simplified taxation system do not have the right to switch to the general taxation regime before the end of the tax period (Article 346.13, paragraph 3).

The procedure for calculating the single tax

The objects of taxation for calculating the single tax are:

- • income;

• income reduced by the amount of expenses (Article 346.14 clause 1).

Thus, with a simplified taxation system, a small enterprise independently chooses the tax base, taking into account the specific type of its activity, the composition of expenses or income, etc.

When making a choice in favor of income or income reduced by the amount of expenses, it is necessary to follow the procedure for determining the income of a small enterprise (Article 346.15), as well as expenses (Article 346.16).

According to Article 249 of the Tax Code of the Russian Federation, income is recognized as income from sales in the form of proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and proceeds from the sale of property rights.

If a taxpayer recognizes as an object of taxation income reduced by the amount of expenses, then in this case he must reduce the income received by the amount of expenses incurred.

Expenses are recognized as justified (economically justified) and documented (supported by documents and executed in accordance with the legislation of the Russian Federation) expenses, provided that they are incurred to carry out activities aimed at generating income (Article 252 of the Tax Code of the Russian Federation). Expenses not taken into account for tax purposes are determined by Art. 270 Tax Code of the Russian Federation.

To expenses according to the criteria of Art. 252 of the Tax Code of the Russian Federation can include primarily those defined by Article 346.16 (clause 1 subclause 1-4):

- • expenses for the acquisition of fixed assets, including expenses for repairs of fixed assets, including leased ones;

• expenses for the acquisition of intangible assets;

• rental payments (including leasing) for rented (including leased) property.

Particular attention should be paid to the costs of acquiring fixed assets, which are accepted in the manner determined by Art. 346.16 clause 3 of the Tax Code of the Russian Federation.

You should also keep in mind the procedure for recognizing income and expenses.

Article 346.17 determines that: 1) the date of receipt of income is the day the funds are received in accounts (in banks and (or) at the cash desk); 2) expenses are recognized as expenses after their actual payment (expenses for the acquisition of fixed assets are reflected on the last day of the reporting (tax) period).

When determining the tax base of the single tax, income and expenses are determined on an accrual basis from the beginning of the tax period (Article 346.18, paragraph 5).

The tax rate of the single tax is established depending on the selected object of taxation:

6 percent if the object of taxation is in the form of income;

15 percent when the object of taxation is in the form of income reduced by the amount of expenses (Article 346.20 of the Tax Code of the Russian Federation).

The types of payments for the single tax are:

Quarterly advance payments, which are counted towards the payment of the single tax at the end of the tax period. In this case, the amount of tax at the end of the tax period is determined by the taxpayer independently (Article 346.21, paragraph 2).

Example of calculating a single tax [6]:

In an organization using a simplified taxation system, at the end of 2003, the income amounted to 362,500 rubles, including:

- — for the first quarter — 125,000 rubles;

— for half a year — 225,000 rubles;

— for 9 months — 235,000 rub.

Let us assume that the organization has chosen as the object of taxation income reduced by the amount of expenses. At the same time, the total amount of expenses amounted to 302,500 rubles, including:

- — for the first quarter — 100,000 rubles;

— for half a year — 180,000 rubles;

— for 9 months — 250,000 rub.

Calculation of the amount of advance payments, as well as the amount of tax for the reporting year.

- I quarter 2003:

tax base for the single tax for the first quarter:

125,000 rub. — 100,000 rub. = 25,000 rub.;

advance payment amount based on the results of the first quarter:

25,000 rub. x 15% / 100% = 3750 rub.

Half year 2003:

tax base for the single tax for the half-year: 225,000 rubles. -180,000 rub. = 45,000 rub.

amount of advance payment at the end of the half year:

total: 45,000 rub. x 15% / 100% = 6750 rub.

paid at the end of the half year: 6,750 rubles. — 3750 rub. = 3000 rub.

9 months 2003:

tax base for the single tax for 9 months of 2003:

235,000 rub. — 250,000 rub. = - 15,000 rub.

If the tax base is negative, the advance payment of the single tax for 9 months of 2003 is not calculated and paid.

- 2003

tax base for the single tax for the tax period:

RUB 362,500 — 302,500 rub. = 60,000 rub.

tax amount at the end of the tax period:

60,000 rub. x 15% / 100% = 9000 rub.

subtract advance payments: 9,000 rubles. — 3750 rub. — 3000 rub. = 2250 rub. Consequently, this amount will be paid as a single tax for 2003.

Example 2. At the end of 2003, the organization’s income amounted to 362,000 rubles. The organization chose income as the object of taxation. At the same time, the total amount of contributions for compulsory pension insurance in the current year was 15,000 rubles, the amount of payments of temporary disability benefits was 2,000 rubles.

Let's calculate the amount of single tax for 2003:

- the amount of single tax calculated based on the results of 2003:

RUB 362,500 x 6% /100% = 21,750 rub.

Now you should calculate the amount by which the amount of tax can be reduced due to contributions to compulsory pension insurance, since the amount of contributions paid to compulsory pension insurance (15,000 rubles) is more than 50% (Article 346.21, paragraph 3):

RUB 21,750 x 50% / 100% = 10,875 rub. Consequently, only by this amount can the amount of the single tax reduced by “pension” contributions be reduced.

Table 45. Tax reporting of a small enterprise under the simplified taxation system

| No. | Tax name | Basis for charge | Tax rate (fee, contribution) | Tax reporting | Tax (reporting) period |

| 1 | 2 | 3 | 4 | 5 | 6 |

| 1 | Single tax (federal) | Chapter 26.2. “Simplified taxation system” of the Tax Code of the Russian Federation | 6% (income) 15% (income minus expenses) | Tax return in form (Order of the Ministry of Taxes of the Russian Federation dated November 12, 2002) | calendar year (Article 346.19 of the Tax Code of the Russian Federation) |

| 2 | VAT regarding payment when importing goods to customs. territory. Russian Federation (federal) | Chapter 21. “Value added tax” Tax Code of the Russian Federation | 10% 18% | Not generated and not submitted to the tax authorities | absent |

| 3 | Excise taxes (federal) | Chapter 22. “Excise taxes” of the Tax Code of the Russian Federation | Rates depending on the type of goods (Article 193 of the Tax Code of the Russian Federation) | Tax return in form (Order of the Ministry of Taxes and Taxes of the Russian Federation dated December 17, 2002) | calendar month |

| 4 | Personal income tax (federal) | Chapter 23. “Tax on personal income” Tax Code of the Russian Federation | 6% 13% 30% 35% | Certificate of income of individuals (Order of the Ministry of Taxes of the Russian Federation dated December 2, 2002 | calendar year (Article 216 of the Tax Code of the Russian Federation) |

| 5 | Transport tax (regional) | Chapter 28. “Transport tax” Tax Code of the Russian Federation | Rates depending on the type of vehicle (Article 361 of the Tax Code of the Russian Federation) | Tax return (laws of the constituent entities of the Russian Federation) | calendar year (Article 360 of the Tax Code of the Russian Federation) |

| 6 | Land tax (local) | Law of the Russian Federation of October 11, 1991 “On payment for land” No. 1738-1 | Rates are set by the laws of the constituent entities of the Russian Federation | Tax return in form (Order of the Ministry of Taxes of the Russian Federation 12.04.200) | calendar year (Article 3 of the Law of the Russian Federation “On Payment for Land”) |

| 7 | Advertising tax (local) | Law of the Russian Federation “On the Fundamentals of Tax. systems in the Russian Federation" dated December 27, 1991 No. 2118-1 | Not higher than 5% (Article 21, paragraph 4 of the Law of the Russian Federation of December 27, 1991 No. 2118-1) | The form is established locally (Article 21, paragraph of Law No. 21118-1) | installed locally (Article 21, Clause 4, Law of the Russian Federation No. 2118-1) |

| 8 | Fear. contributions to liabilities pension insurance | Federal Law of December 15, 2001 “On Obligations.” penny. insurance" | Rate based on age and gender (Article 22, 23 Federal Law) | Insurance tax return. contributions | calendar year (Article 23 clause 1 of the Federal Law) |

| 9 | Starkh. contributions to liabilities social fear. from accident sl. in production and prof. zab. | Federal Law of July 24, 1998 "125-FZ "On Obligations. social fear. from accident sl. on etc. zab | Prof. class rate risk (Article 21,22 Federal Law No. 125-FZ) | Sec. II Calc. led on Wednesday FSS of the Russian Federation according to the Post form. FSS dated October 29, 2002 No. 13 | quarter, half year, 9 months, year |

| 10 | Voluntary fear. vzn. on the next vr. not difficult. | Federal Law dated December 31, 2002 No. 190-FZ | 3% | Fear reporting. from 04/25/2003 | quarter, half year, 9 months, year |

Finally, let’s reduce the amount of the single tax by the amount of temporary disability benefits paid to employees:

RUB 10,875 — 2000 rub. = 8875 rub.

It is this amount that must be paid by the organization in the form of a single tax to the budget based on the results of 2000.

As a result, we will compile a table of tax reporting for small businesses using a simplified taxation system (Table 45).

Thus, we can conclude that the use of a simplified taxation system, which small enterprises can use under certain conditions in accordance with Russian legislation, to a certain extent relieves tax tension and promotes the development of entrepreneurial activity.

6.3.

Taxation in the form of a single tax on imputed income for certain types of activities

A special type of special taxation regime is a single tax on imputed income for certain types of activities. The fundamental difference between this tax and the single tax under the simplified taxation system is that it is levied not on actual, but on imputed income.

Currently (since January 1, 2003), the procedure for establishing and enforcing a single tax on imputed income is regulated by Chapter. 26.3 of the Tax Code of the Russian Federation “Taxation system in the form of a single tax on imputed income for certain types of activities.”

The following taxes are not collected from single tax payers on imputed income (Article 346.26, clause 4):

- • corporate income tax;

• personal income tax;

• value added tax (except for the part on payment of tax when importing goods through the customs territory of the Russian Federation);

• property tax for enterprises and individuals;

• unified social tax.

The object of taxation when applying a single tax is imputed income.

In Art. 346.27 provides the concepts of imputed income, basic profitability, basic profitability coefficients:

- — imputed income is the potential income of a single tax payer, calculated taking into account a set of factors that directly influence the receipt of said income, and used to calculate the amount of a single tax at the established rate;

— basic profitability is a conditional monthly profitability in value terms for one or another unit of a physical indicator characterizing a certain type of business activity in various comparable conditions, which is used to calculate the amount of imputed income;

— adjusting coefficients of basic profitability are coefficients showing the degree of influence of a particular factor on the result of entrepreneurial activity carried out on the basis of a certificate of payment of a single tax.

The tax base is calculated as the product of the basic profitability for a certain type of activity and the value of the physical indicator characterizing this type of activity.

The basic yield is adjusted (multiplied) by coefficients K1 (adjustment coefficient), K2 (adjustment coefficient), K3 (deflator coefficient).

Coefficient K1 is determined depending on the cadastral value of land (based on data from the State Land Cadastre) at the place of business activity by the taxpayer and is calculated using the following formula:

K1 = (1000+Kof) / (1000+Kom),

where Kof is the cadastral value of land (based on data from the State Land Cadastre) at the place of business activity by the taxpayer; Com - the maximum cadastral value of land (based on data from the State Land Cadastre) for this type of business activity; 1000 - cost estimate of other factors influencing the amount of basic profitability, reduced to a unit of area.

In 2003, K1 was not used.

The values of the adjustment coefficient K2 are determined for all categories of taxpayers by the constituent entities of the Russian Federation for the calendar year and can be set in the range from 0.01 to 1 inclusive (Article 346.29, clause 7).

K3 depends on the index of changes in consumer prices for goods (works, services) in the Russian Federation (K3 in 2003 was equal to 1).

Using coefficients K1, K2 and K3, the basic profitability is adjusted.

It is very important to emphasize that a small enterprise under Art. 26.3 of the Tax Code of the Russian Federation cannot switch on a voluntary basis to paying a single tax on imputed income; moreover, this transition can even be carried out on a “forced” basis (by decision of a constituent entity of the Russian Federation).

This is due to the fact that, according to existing legislation, only organizations engaged in certain types of business activities can apply a single tax on imputed income, which (according to Article 346.26, paragraph 2 of the Tax Code of the Russian Federation) includes 6 types of activities:

- — provision of household services;

— provision of veterinary services;

— provision of repair, maintenance and washing services for vehicles;

- retail trade carried out through shops and pavilions with a sales floor area for each trade facility of no more than 150 square meters, tents, trays and other trade facilities, including those without a stationary retail space;

— provision of catering services carried out using a hall with an area of no more than 150 square meters;

— provision of motor transport services for the transportation of passengers and goods carried out by organizations and individual entrepreneurs operating no more than 20 vehicles.

At the same time, in Art. 346.27 introduces the following explanations, among which we note the most important: a) retail trade is the trade in goods and the provision of services to customers in cash, as well as using payment cards; b) a stationary retail chain is a retail chain located in specially equipped buildings intended for trading (shops, pavilions, kiosks); c) a non-stationary trading network is a trading network operating on the principles of distribution and distribution trade; d) trading place is a place used for making purchase and sale transactions; e) household services - paid services provided to individuals (with the exception of pawnshop services), which are classified in accordance with the All-Russian Classifier of Services to the Population: OKUN - OK 002-93, approved by Resolution of the State Standard of Russia dated June 28, 1993 No. 163 (ed. 07/01/2003) according to gr. 01 “Household services” (except for repair, maintenance and washing services of vehicles); f) number of employees - the average number of employees for the tax period, taking into account all employees, including part-time workers.

To calculate the amount of a single tax on imputed income depending on the type of business activity, a small enterprise uses physical indicators and indicators of basic profitability per month, which are presented in table. 46 (Article 346.29, paragraph 3).

Table 46. Tax base for calculating the single tax on imputed income

| Types of business activities | Physical indicators | Basic income per month (rubles) |

| Provision of household services | Number of employees, including individual entrepreneurs | 5000 |

| Provision of veterinary services | Number of employees, including individual entrepreneurs | 5000 |

| Providing repair, maintenance and washing services for vehicles | Number of employees, including individual entrepreneurs | 8000 |

| Retail trade carried out through stationary retail chain facilities with trading floors | Sales area (in square meters) | 1200 |

| Retail trade carried out through objects of a stationary trading network that does not have trading floors, and retail trade carried out through objects of a non-stationary trading network | Trading place | 6000 |

| Catering | Area of the visitor service hall (in square meters) | 700 |

| Provision of transport services | Number of vehicles used to transport passengers and cargo | 4000 |

| Retail trade carried out by individual entrepreneurs (with the exception of trade in excisable goods, medicines, products made of precious stones, weapons and ammunition, fur and technically complex household goods) | Number of employees, including individual entrepreneurs | 3000 |

So, the amount of imputed income (tax base) for calculating the amount of a single tax is calculated as the product of the values of the basic profitability per month for a certain type of business activity, calculated for the tax period, and the value of the physical indicator characterizing this type of activity, as well as the values of the adjustment coefficients of the basic profitability K1, K2 and K3.

The tax period for a single tax is a quarter (Article 346.30).

“Methodological recommendations for the use of Ch. 26.3 “Taxation system in the form of a single tax on imputed income for certain types of activities of the Tax Code of the Russian Federation”, approved by Order of the Ministry of Taxes of the Russian Federation dated December 10, 2002 No. BG-3-22/707 (as amended on April 3, 2003, dated October 28, 2003), it was proposed to use the following calculation formula when calculating the tax base:

VD = (BD x (N1+N2+N3) x K1 x K2 x K3,

where VD is the amount of imputed income; BD - the value of the basic profitability per month for a certain type of business activity; N1, N2, N3 - physical indicators characterizing this type of activity in each month of the tax period; K1, K2, K3 - adjustment coefficients of basic income.

If the value of a physical indicator changes during the tax period, the taxpayer, when calculating the tax base, takes into account such change from the beginning of the month in which this change takes place.

Example 1. A small enterprise that provides household services to the population from January 1, 2003 was transferred to paying a single tax on imputed income.

The basic profitability was 5,000 rubles. per month.

In January 2003, the average number of employees was 5 people, in February - 6 people, in March - 8 people.

The value of the basic profitability adjustment factors:

- K1 - 1

K2 - 0.5

K3 - 1

The tax base at the end of the tax period was

VD = 5000 x (5 + 6 + x 1 x 0.5 x 1 = 47,500 rub.

x 1 x 0.5 x 1 = 47,500 rub.

The single tax on imputed income is calculated by the taxpayer based on the results of each tax period (quarter) at a rate of 15% of imputed income (Article 346.31 of the Tax Code of the Russian Federation) according to the formula

EH = VD x 15/100, where EH is a single tax; VD - imputed income; 15/100 is the tax rate.

The amount of single tax calculated for the tax period is reduced by the amount:

- · insurance contributions for compulsory pension insurance paid during this period of time to employees employed in those areas of activity for which a single tax is paid;

· Paid benefits for temporary disability.

In this case, the amount of the single tax cannot be reduced by more than 50% on insurance contributions for compulsory pension insurance.

Example 2. A taxpayer, an individual entrepreneur operating in the retail trade sector, calculated a single tax on imputed income in the amount of 6,000 rubles at the end of the tax period, and also paid insurance premiums for compulsory pension insurance for employees engaged in this activity in the amount of 3,800 rubles. and insurance premiums in the form of a fixed payment in the amount of 450 rubles.

In addition, the taxpayer paid temporary disability benefits in the amount of 1,500 rubles during the tax period.

In this case, the taxpayer reduces the amount of the calculated single tax by only 3,000 rubles. insurance contributions paid by him for compulsory pension insurance:

(6000 x 50/100) < 4250, and

for the entire amount of temporary disability benefits paid.

The total amount of payments for the tax period will be 5,750 rubles, including:

- • single tax on imputed income - 1,500 rubles. (6000 -3000 - 1500);

• amount of paid contributions for compulsory pension insurance - 4250 rubles.

Example 3. Based on the results of the tax period, the taxpayer calculated a single tax on imputed income in the amount of 4,100 rubles.

Paid insurance premiums for compulsory pension insurance in the amount of 1,500 rubles. and insurance premiums in the form of a fixed payment in the amount of 450 rubles.

During the tax period, benefits for temporary disability in the amount of 1,100 rubles were also paid.

In this case, the taxpayer has the right to reduce the amount of the single tax calculated by him on imputed income by the entire amount of paid insurance contributions for compulsory pension insurance:

(4100 x 50/100) > 1950 rubles, as well as the entire amount of temporary disability benefits paid.

The total amount of payments for the tax period will be 3,000 rubles, including:

- • single tax on imputed income - 1,500 rubles. (4100 - 1950 - 1100)

• the amount of insurance contributions paid for compulsory pension insurance - 1950 rubles.

Based on the results of the tax period, a tax return for the single tax on imputed income is filled out in the form approved by order of the Ministry of Taxes of the Russian Federation dated November 12, 2002 No. BG-3-22/648, which is submitted no later than the 20th day of the first month of the next tax period.

Payment of the single tax is made by the taxpayer based on the results of the tax period no later than the 25th day of the first month of the next tax period.

6.4.

Questions for self-control

1. What types of taxes are not calculated under the simplified taxation system?

2. What types of taxation object does it have under the simplified system?

3. What are the tax rates under the simplified taxation system?

4. List the types of business activities to which the taxation system is applied in the form of a single tax on imputed income.

5. Give the concept of basic profitability.

6. What is imputed income? What is the formula for calculating it?

7. Describe the adjustment factors of basic profitability.

8. What formula is used to calculate single income?

USN “Income”

The tax rate is from 1 to 6% depending on the region and type of activity. This option is usually beneficial if your expenses are difficult to verify or your expenses are less than 60% of your income. If the company's annual income is from 150 to 200 million rubles or the number of employees is from 100 to 130 people, the rate rises to 8%.

Insurance premiums paid can be deducted from the tax amount: these are individual entrepreneurs’ contributions “for themselves” and contributions for employees. Here we talk in more detail about reducing the tax on the amount of contributions.

You can keep records and submit reports to the simplified tax system “Income” yourself to save on an accountant. It is better to do this not in Excel tables, but in a special program or service. For example, the Kontur.Accounting service will calculate taxes, fill out a book of income and expenses and a tax return, and warn about the timing of payments and reporting. For employees - calculates and prepares salaries, contributions, personal income tax, reports.

Features of the simplified mode

Taxation of small businesses under a simplified system is carried out on two objects.

The first is the total income of the enterprise. The tax payment in this case is 6% of the income.

The second is the difference between income and expenses. In this case, the tax burden will be 15% of the difference received.

Entrepreneurs have the right to choose any of these objects for taxation, but first it is necessary to calculate the costs of the enterprise. To find out which object is more profitable for the organization.

Replacing basic taxes with a single one does not relieve small business representatives from other responsibilities to the state, such as:

- regular provision of tax and statistical reporting;

- payment of other taxes depending on the conduct of business: for the use of water resources, for the extraction of minerals, etc.;

- payment of excise taxes if the entrepreneur sells excisable goods;

- payment of other fees, such as deductions and contributions to extra-budgetary funds - Pension Fund, Social Insurance Fund. So, if a private entrepreneur pays a fixed amount for himself to the pension fund once a year, then he must make contributions monthly for his employees.

USN “Income minus expenses”

The tax rate is from 5 to 15% depending on the region and type of activity. It will be beneficial if your expenses are easily supported by documents and they account for more than 60% of your income. If the company's annual income is from 150 to 200 million rubles or the number of employees is from 100 to 130 people, the rate rises to 20%.

Paid insurance premiums for individual entrepreneurs and employees can be included in expenses. But not all expenses reduce the tax base on which taxes are paid. To recognize an expense there are requirements:

- the expense is justified and made for the purpose of generating income;

- consumption is mentioned in the list from Art. 346.16 Tax Code of the Russian Federation;

- you received from the supplier what you paid for and paid in full;

- there are documents that confirm the expense;

- if expenses are related to goods for resale, then they can be written off only after the sale of these goods.

In order not to get confused when taking into account the costs of the simplified tax system, it is better to keep records in a special service or involve an accountant. Let's say, the web service Kontur.Accounting takes into account expenses according to all the rules, calculates payments, fills out KUDiR and declaration, generates payments, reminds about the dates of payments and reports. The service has a salary block for working with employees. And with the help of management reports, the manager will be able to control finances.

Where to display all the information

For some small enterprises, it will be enough to keep only a book of records of economic activity facts - this is the simplest option, suitable in cases where the company has very few operations. If there are many transactions or if the company’s activities involve significant costs of material resources, then the Book should additionally provide special accounting registers for each group of property. When conducting accounting, SMP representatives should always remember two points:

- Accounting must be carried out to the extent that will allow for the display of account balances and the preparation of financial statements, plus provide management with the necessary amount of information.

- Any SMP facility can grow into a larger organization - life does not stand still, and the goal of any business is to expand its activities and increase profits. To avoid difficulties in the future with the preparation of real financial statements and ensuring the comparability of current indicators with the figures of previous periods, you cannot start accounting - it should be carried out efficiently.

For SMEs, there is another important point in the possibility of conducting simplified accounting: such legal entities can use the cash method, that is, recognize income / expenses upon payment. What's the advantage here? This is very convenient for those who use simplified. In this case, SMP will use the same method for both accounting and calculating the amount of tax.

SMPs can generate reporting accounting forms both according to standard rules (balance sheet + all appendices + explanations to it), and according to “simplified” ones - provide only two forms - balance sheet and financial performance statement. When choosing the last of the two options, the values of indicators in the tables of reporting forms are allowed to be shown enlarged, and applications can be filled out only when, in your opinion, they are very significant. Explanations are not required - they are also required only in exceptional cases when you have something to explain.

There are special simplified reporting forms for SMEs: special forms are provided for the balance sheet and profit and loss account. Their difference from standard forms is expressed in the fact that the indicators in them are enlarged even more. For example, the balance sheet consists of two short sections: the asset has 5 indicators, and the liability - 6. The forms are unified, they can be seen among the appendices to the Order of the Ministry of Finance No. 66n dated 07/02/2010.

There is a special concession for micro-enterprises : such companies can keep records in registers without using the standard double entry for accounting. But there are a couple of important limitations here. First, double entry is inextricably linked with the cash method of accounting. That is, if you choose the cash method, then in any case you keep double-entry accounting - there can be no other option. If you want to avoid double entry, you will have to use the accrual method of accounting. Secondly, the benefit of not using double entry should be used with great caution: the enterprise may grow, but restoring accounting for previous years will be very difficult both in terms of financial costs and in terms of labor resources.

BASIC: accounting, reporting, complexity

Small businesses rarely choose OSNO: only if they see benefits in working with VAT payers - many suppliers and buyers are more willing to cooperate with those who also pay value added tax. This tax is paid on OSNO, as well as income tax and corporate property tax if the property owns real estate. If there is transport and land, taxes on them are paid separately. Reporting for each tax is submitted quarterly.

At OSNO you will have to maintain full-fledged accounting and tax accounting - quite complex and painstaking. This is hardly possible without special accounting knowledge, even if you work in a specialized service. So on OSNO, companies and individual entrepreneurs most often work with an accountant.

But still, accounting services simplify your work and eliminate mistakes. For example, in Kontur.Accounting there is a special tool “VAT Calculation”, which helps reduce the tax payable, tells you what documents are missing in the system and what errors were made in accounting.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

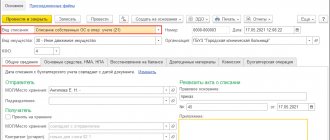

Setting up accounting registers

Let's consider the formation of an accounting register using the example of an account balance sheet in the section: “Reports”

–

"Account balance sheet"

.

In the "Period"

indicate the time interval for which you would like to view data in the

“Account”

- the required accounting account.

However, if you look carefully, you can determine that the generated data is not enough to indicate all the mandatory details specified in Part 4 of Art. 10 of Law No. 402-FZ, which means this report cannot be considered an accounting register. To create an accounting register, you need to perform a number of additional steps using the “Show settings”

above the tabular part of the report.

On the “Grouping and Selection”

You can set grouping by analytical objects, set detailing by subaccounts, select a breakdown by time periods, and set selection.

On the “Design”

check the

“Heading”

,

“Unit of Measurement”

and

“Captions”

at the bottom of the tab (Fig. 4).

Now the report has additional details: unit of measurement and signatures of responsible persons.

“Help-calculation” reports

, which are formed according to routine operations of closing the month and which are located in the section:

“Operations”

-

“Calculation certificates”

are also used as accounting registers. The necessary details are configured in the same way.

Patent: criteria, combination

The patent is similar to the UTII regime, which has been canceled since 2021. Here the amount of tax depends not on actual income, but on potential income. This income is set by regional authorities; the cost of a patent can be calculated on the official website of the tax office.

Working for PSN is easy: you need to make payments for the patent on time and keep a book of income. If you have transport and land, pay taxes on them, and if you have employees, pay personal income tax, contributions and submit personnel reports. From 2021, it has become possible to reduce the amount of the patent for insurance premiums for yourself and employees, similar to the canceled UTII.

Here are the permissions to work on a patent:

- Only individual entrepreneurs can work on PSN;

- your type of activity must fit under the PSN, each region has its own list (for example, catering, children's development centers, photographic services), check this information with your tax office;

- the entrepreneur has no more than 15 employees;

- annual income - no more than 60 million rubles;

- Individual entrepreneur does not work with excisable goods and goods subject to mandatory labeling.

There is no need to submit patent reports, except for employee reports. Therefore, you can cope with accounting and reporting on PSN yourself. In Kontur.Accounting there is an opportunity to work on a patent.

Reporting for employees

If there is at least one employee (general director) on staff, then it is necessary to submit a package of reports on paid insurance premiums and income taxes.

| Document's name | Summary of the document | Who is renting? | Where to submit? | How often should I take it? | Samples and forms |

| SZV-M - information about earnings (remuneration), submitted monthly | A list of all employees: working, fired, newly hired, on sick leave, on maternity leave. Based on these data, the pension is indexed | All employers with at least one salaried employee (CEO) | To the Pension Fund of Russia (PFR) | Monthly | Available offline |

| Unified calculation of insurance premiums | Information about all insurance premiums paid by the employer for employees, with the exception of contributions for injuries | All employers who employ employees under an employment contract or contract on a salary subject to insurance contributions | To the Federal Tax Service (FTS) | Quarterly | filling samples, instructions |

| 4-FSS | Information on paid insurance premiums for employees whose work is associated with injuries and occupational diseases | All employers who have employees who receive a salary (if the activity is not related to injuries and occupational diseases, you still need to submit a report - zero) | To the Social Insurance Fund (SIF) | Quarterly | form and sample |

| Average number of employees (SChR or SSCh - both abbreviations are in use) | Information about employees registered with the company during the calendar year | All employers who have (or had) employees. If there is only a general director, we also rent. | To the Federal Tax Service | Once a year For new companies - 2 times a year: after registering an LLC and at the end of the year. Then - once a year. | form and sample |

| 2-NDFL | Income information - for each employee | Employers whose employees receive taxable salaries | To the Federal Tax Service | 1 time per year | Offline |

| 6-NDFL | General information about employee income - not for each individual employee, but for the company as a whole | Employers whose employees receive taxable salaries | To the Inspectorate of the Federal Tax Service (IFTS) | 1 time per quarter | Offline |

| Certificate of confirmation of the main type of activity (application and report) | Information about business activity codes according to OKVED, on the basis of which the Social Fund. Insurance calculates the amount of insurance premiums for employees | Employers with employees for whom insurance premiums are paid. New organizations do not need to submit a certificate! | To the Social Insurance Fund | 1 time per year | samples, application for change |

If the company employs more than 25 people, then reporting must be submitted only electronically . If it is less, you can submit it both on paper and electronically.

The dates until which tax reporting, accounting and reporting for employees are accepted are determined by the tax calendar, which changes every year. For delays or failure to submit reports, fines will be imposed, including blocking the company's current account.

Now let's talk about how to make your life easier and submit your reports on time.

Combination of tax regimes

Sometimes in business it is beneficial to distinguish two areas and apply a different tax regime for each of them. From 2021, only entrepreneurs can combine different modes. There are two options:

- simplified tax system + patent;

- BASIC + patent.

OSNO and simplified modes cannot be combined; both of these modes are basic and apply to all activities. And NPD cannot be combined with anything.

To summarize: carefully study whether each tax regime is suitable for you in terms of tolerances and criteria, compare the tax burden using our free calculator and work in the most profitable regime for your business. And the web service Kontur.Accounting will help you keep records, calculate salaries and report on any taxation system or when combining them. For the first two weeks, all newcomers work for free.

Results

To summarize, we note once again that the reporting of SMEs in each specific case depends on the type of activity, the taxation system that the organization or entrepreneur applies, the presence or absence of employees, as well as the fact whether the benefits provided by the legislator to representatives of small and medium-sized businesses are used. medium entrepreneurship.

So that you can more accurately navigate the reporting dates, we recommend that you read the material “Annual Declaration: What taxes should you submit reports for?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.