If an individual entrepreneur has paid an amount to the budget that exceeds the tax due to him, the difference between these amounts does not go away, it is formed as an overpayment. Most often, this situation arises when an entrepreneur independently calculates the tax in the declaration, uses the wrong rates, or makes mistakes in the payment order. But it also happens that the tax authority itself makes a decision to collect an additional amount, which is subsequently declared invalid by the court. Both overpaid and collected taxes can be returned; a businessman has every right to do so.

Application form KND 1150058 - what is it

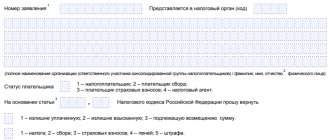

KND 1150058 hides an application form for the return of the amount of overpaid (collected, subject to reimbursement) tax (fee, insurance premiums, penalties, fines).

| Application form KND 1150058 |

| An example of filling out an application form for legal entities |

| An example of filling out an application form for individuals |

Refusal to refund the tax paid in a larger amount

The tax office may refuse to refund overpaid taxes. On what grounds can a tax refusal be issued? For example, if the taxpayer applied for a tax refund after 3 years, since the refund is made for a maximum of 3 years.

Sometimes, the tax office may refuse if some information is not specified in the refund application. At the same time, there is judicial practice when such a refusal was appealed and the court sided with the taxpayer.

Taking into account the above, the tax office may refuse to return the tax paid both on legal grounds and on not entirely legal grounds. If the refusal is not based on the law, then the tax decision should be appealed.

Current form for KND 1150058 in 2021

The form valid in 2021 was approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected]

The latest changes to the form were made by order of the Federal Tax Service of Russia dated November 30, 2018 No. ММВ-7-8/ [email protected] , which was published on December 29, 2021 on the official legal information portal https://www.pravo.gov.ru.

According to the Decree of the President of the Russian Federation of May 23, 1996 No. 763, the order of the Federal Tax Service No. MMV-7-8 / [email protected] acquired legal force after 10 days from the date of publication on the portal.

This means that the new version of the application for KND 1150058 is valid from January 9, 2021.

You may also be wondering how to calculate insurance premiums for Q2 2021

For what period can contributions be recalculated?

Only contributions that have passed no more than three years from the date of payment can be returned or credited (Clause 7, Article 78 of the Tax Code). So, for example, in January 2021 you can return the money that you transferred from January 1, 2021. If you paid your contributions on time, these are the amounts for 2017–2019.

The tax office has not yet calculated contributions for 2021, most tax contributions for 2021 have already been calculated according to the new rules, but no one has automatically recalculated contributions for previous years: (Therefore, in order to return them, you will need to recalculate the contributions yourself and write a tax letter. But let's go in order.

Differences between the new form for KND 1150058 2021 and the previous form

Officials made quite a few changes to the form. Look them up in the table.

| Field name | Old form | New form 2021 |

| Barcode of the form | 1660 1017 | 1660 2014 |

| Payer status | Absent | A new field has been introduced where you need to specify a number by selecting the corresponding status: 1 - taxpayer; 2 - payer of the fee; 3 - payer of insurance premiums; 4 - tax agent |

| The specified amount must be transferred to a bank account. | Present on the title page | Absent |

| Lower left part of the title page “I confirm the accuracy and completeness of the information specified in this application:” | One of three numbers is substituted: 1 - head of the organization; 2 - representative of the taxpayer; 3 - individual | One of two numbers is substituted: 1 - payer; 2 - payer representative |

| Name of the bank | Name of the bank (credit organization) | Name of the bank |

| Account type | The name of the field is “Account name”, where the text should have included “current, current, etc.” | The field name is “Account type (code)”, where one of the following values is substituted: 01 - current account; 02 - current account; 07 — account for deposits; 08 — personal account; 09 — correspondent account; 13 — correspondent subaccount |

| Correspondent account | Present | Absent |

| Recipient | The field is immediately filled in with text, namely the full name of the organization (responsible participant in the consolidated group of taxpayers) / last name, first name, patronymic of the individual | First, enter the digital designation of the recipient based on their proposed options: 1 - organization (responsible participant in the consolidated group of taxpayers); 2 - individual; 3 - the body responsible for opening and maintaining personal accounts. Next, the field is filled in with text, namely the full name of the organization (responsible participant in the consolidated group of taxpayers) / last name, first name, patronymic of the individual / full name of the payee body that opens and maintains personal accounts |

| Information about the identity document on the second page of the form | Present | Absent |

| Recipient's budget classification code | Absent | New field, filled in when returning to accounts with the authority that opens and maintains personal accounts |

| Recipient's personal account number | Absent | New field, filled in when returning to accounts with the authority that opens and maintains personal accounts |

| Field “Address of residence (place of stay) in the Russian Federation” of the last page of the form “Information about an individual who is not an individual entrepreneur” | Present | Absent |

Overpayment of “simplified” taxes

The payer of the simplified tax system may overpay tax in the following cases:

- when filling out the payment order, the accountant made a mistake, and therefore an amount exceeding the tax calculated and reflected in the declaration was paid to the budget;

- when calculating the tax “simplified”, the amount of insurance contributions, which reduces the amount of tax liabilities, is not taken into account;

- the payer incorrectly calculated the tax base, which led to an overstatement of the tax amount;

- The Federal Tax Service has withheld tax in excess, for which there is a corresponding decision (written notification from the fiscal service);

- the overpayment is confirmed by a court decision, the overpayment is returned on the basis of a writ of execution.

In addition to the above cases, overpayment of tax may occur in other cases when the accountant made an error in calculating tax, which led to an overstatement of tax liabilities.

According to the Tax Code of the Russian Federation, a “simplified” person has the right to offset the amount of overpayment against payment for future periods, or to return the amount of overpayment by submitting a corresponding application to the Federal Tax Service.

Where to download the application form according to KND 1150058

It is best to contact official sources to download approved forms.

So, on the tax portal you can download the form for KND 1150058 to fill out in PDF format using the link.

In addition, current application forms are always available in popular legal databases, provided they are updated regularly.

The Simplified magazine team also monitors updates to the legislative framework and regularly updates the information available on the website. Therefore, feel free to download the form located in the next section of this publication.

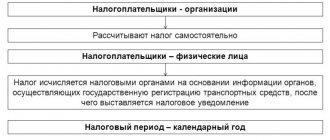

The procedure for paying tax on the simplified tax system

According to Art. 26.2 of the Tax Code of the Russian Federation, legal entities and entrepreneurs using the simplified tax system are payers of a single tax, the amount of which is determined depending on the chosen taxation scheme:

- when using the “STS 6%” scheme, a business entity using the simplified tax system pays a tax in the amount of 6% of total income, excluding expenses;

- “simplified people” who apply the “STS 15%” scheme calculate the taxable base as the difference between income received and expenses incurred, and the tax amount as the product of the taxable base and the tax rate of 15%.

Based on Art. 346.21 “simplified” pays tax in the form of quarterly advance payments until the 25th day of the month following the reporting quarter. At the end of the year, the payer makes the final tax payment (the annual tax amount minus advance payments).

How to fill out KND form 1150058 for refund of overpayment

The main nuances of filling out the form are indicated directly on the application form itself at the bottom of the last page.

Please note that for each KBC and OKTMO you fill out a separate application. Just like the tax itself (fee, contribution) or penalties or fines for it fall into their form according to KND 1150058.

In general, look at the main recommendations in the table below.

| Field name | Recommendations for filling |

| checkpoint | Remember that if you submit an application, for example, for a refund of land tax, the location of which is different from the place of your registration, the checkpoint is indicated specifically for the tax authority where the land plot is registered |

| Application number | The serial number of the application for the current year is controlled by the taxpayer himself |

| Payer status | Set the number that corresponds to the situation (For example, when returning income tax, you will put 1, and when returning personal income tax, you will put 4) |

| Based on the article | 78 of the Tax Code of the Russian Federation - refund of overpayment of taxes, fees, contributions, penalties 79 of the Tax Code of the Russian Federation - return of excessively collected amounts of taxes, fees, contributions, etc. 176 of the Tax Code of the Russian Federation - VAT refund 203 Tax Code of the Russian Federation - refund of excise tax 333.40 Tax Code of the Russian Federation - refund of state duty |

| At the rate of | Indicate the amount according to the reconciliation of mutual settlements with the tax office |

| Tax (settlement) period (code) | This is the period in which the overpayment occurred. Sometimes the overpayment accumulated over several periods - indicate the first one. This field can be filled in either by a specific date (in case of an overpayment in connection with a specific payment) or by a reporting (tax) period. To indicate the period, use the following alphanumeric notations:

MS - month; KV - quarter; PL - half a year; GD - year (for cases of paying taxes (penalties, fines) or submitting a declaration (calculation) once a year);

01 - 12 - if “MS” is selected; 01 - 04 - if “HF” is selected; 01 - 02 - if “PL” is selected; 00 — if “GD” is selected; the last four signs are the year. |

| KBK | Take the indicator from the certificate of mutual settlements |

| OKTMO | Take the indicator from the certificate of mutual settlements |

| Account details | Enter your account details |

| Account type | In most cases, you should indicate 01 - calculated. |

| Recipient's BCC | To be completed only by state employees |

| Recipient's personal account number | To be completed only by state employees |

| Information about an individual who is not an individual entrepreneur | Filled out by individuals in case of absence (or incompleteness of the field for other reasons) TIN |

Deadlines for refunding overpaid taxes

As a general rule, the tax office must make a decision on a tax refund or refusal to refund within 10 days from the date of receipt of the application or from the day the joint reconciliation act is signed.

If the application is sent electronically, the tax must be returned within a month.

If the tax office conducts a desk audit, then the above period begins to be calculated after 10 days have expired from the day the desk audit is completed, which can be carried out within 3 months.

Thus, in total, taking into account the time for a desk audit, the return period is about 4 months, if all documents are completed correctly and the tax office has no questions.

Attention: watch a video on the topic of tax audits and disputes with tax authorities, ask your question in the comments to the video and get free legal advice on the YouTube channel, just don’t forget to subscribe:

An example of filling out the form according to KND 1150058

Look at the form for KND 1150058 for a sample filling based on the following data:

The organization is a single tax payer under the simplified tax system with the object “Income minus expenses”. During 2021, advance payments were made based on the corresponding tax base. But by filing a declaration, the company exercised the right to reduce the tax base by the loss of previous years. In this regard, according to the declaration, a legal entity accrues only the minimum tax for the year. The overpayment amount is refundable. The organization is preparing an application to the tax office in the amount of 75,000 rubles.

See what the sample form for legal entities looks like for KND 1150058.

| KND 1150058 sample filling for legal entities |

Examples:

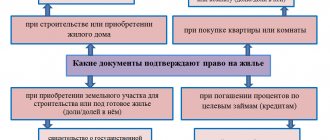

Calculation of tax refund for individual entrepreneurs using the simplified tax system when purchasing a home

Individual entrepreneur Sidorova M. bought an apartment for 2.5 million rubles. in 2021. Is she entitled to a refund from the 2017 budget if she used the simplified tax system?

Art. 219 of the Tax Code indicates that a tax deduction is made on income taxed at a rate of 13% (personal income tax). The simplified tax system for individual entrepreneurs does not require the payment of this tax, so Sidorova M. will not be able to return the tax from the budget for this year. If a citizen were on the general taxation system, she would have the right to count on a refund. For further examples, we will keep in mind that the citizen is a personal income tax payer.

Obtaining a tax deduction for treatment

Citizen Kuznetsov A. had surgery in 2021 at a cost of 40 thousand rubles. His total income for this year was 280 thousand rubles. He will calculate the amount of refund that Kuznetsov A. has the right to receive in 2021 after presenting all the necessary documents (3-NDFL declaration, 2-NDFL certificate, certificate of payment for medical services, agreement with a medical institution, copy of the license, checks).

280000*0.13=36400 rub. – the tax transferred by the employer for Kuznetsov A.;

280000-40000=240000 rub. – tax base minus the amount of the transaction (funds spent on the operation are not subject to personal income tax);

240000*0.13=31200 rub. – personal income tax amount for 2021;

36400-31200=5200 rub. – the difference between the accrued and paid personal income tax amount, which can be returned from the budget.

Social tax deduction for training

Citizen Makarova S. is studying at a university on a correspondence course and works officially in the organization. For 2021, her earnings amounted to 310 thousand rubles; for the year of study she paid 130 thousand rubles. Let's calculate its return:

310000*0.13=40300 rub. – paid personal income tax;

310000-120000=190000 rub. – tax base (Makarova paid 130,000 rubles, but there is a restriction under clause 2 of Article 219 of the Tax Code: the deduction cannot exceed 120,000 per year);

190000*0.13=24700 rub. – calculated tax;

40300-24700=15600 rub. - return.

Property deduction for the purchase of an apartment

Individual entrepreneur Semenov P., located at OSNO, bought an apartment in 2021 for 2.2 million rubles. His income according to the 3-NDFL declaration amounted to 350 thousand rubles. Let's calculate how much money he can return from the budget for this year.

350000*0.13=45500 rub. – paid tax;

the maximum deduction amount is 2 million rubles (although the cost of housing is 2.2 million rubles), so you can only return 13% of this amount (260 thousand rubles). For the year, individual entrepreneur P. Semenov paid 45,500 rubles, this is the refund amount. The rest (260,000-45,500 = 214,500 rubles) can be returned in subsequent years, subject to payment of personal income tax.