The simplified tax system is becoming increasingly popular among owners of enterprises whose average number of employees does not reach 100 people. Large enterprises are not allowed to use the simplified tax system by law. Entrepreneurs prefer the simplified tax system for its simplicity and reliability. The attractiveness of the system lies in the convenience of quickly calculating economic indicators in tax and accounting. The simplified tax system allows you to flexibly respond to market changes, changing the object of taxation depending on the situation in the business world and within the business itself, thereby regulating the tax burden. Not all organizations have the right to apply the simplified tax system. The law establishes restrictions, for example, for non-state pension funds. Pawnshops, budget organizations, banks, insurance companies and other categories of enterprises will not be able to apply the simplified tax system. In addition to the profile, affiliation with government bodies and the number of staff of the enterprise, restrictions on the use of the simplified tax system will be the participation share of more than 25% in the authorized capital of the enterprise of other legal entities, as well as the amount of the residual value of fixed assets of more than 150 million rubles. If all these conditions are not applicable to the enterprise, it can work according to the simplified tax system by notifying in advance the tax office with which the organization is registered. An already operating enterprise can also switch to the simplified tax system; this requires that the enterprise’s income not exceed 112.5 million rubles for the period from January to September. If the enterprise’s income has not reached the specified figure, the company has the right to submit a notification to the tax office about the transition to the simplified tax system. This should be done no later than December 30, so that from January 1 of next year you can work on a simplified basis. Notifying the tax office is a mandatory condition, failure to comply with which deprives the organization of the right to work under the simplified tax system.

What is subject to taxation under the simplified tax system

The simplified taxation system has one original feature: the taxpayer himself can choose which object he will tax. There are only two options:

A business entity has a certain freedom in choosing to pay taxes: the application of the simplified tax system, as well as the determination of the object of taxation, is carried out at the request of the taxpayer. The choice is a declarative procedure; permission from regulatory authorities is not required. However, to be able to use the simplified tax system, certain conditions must be met:

Types of taxation under the simplified tax system

When switching to the simplified tax system, an enterprise chooses one of two types of taxation:

- simplified tax system income;

- USN income minus expenses.

The options differ in the tax base, tax calculation procedure and tax rate. A significant difference is the object of taxation.

Option one. Object – income. In the first case, the income of the enterprise is allocated as an object. By choosing this option, the owner of the enterprise sums up the income received during the allocated period and multiplies the result by the tax rate, expressed as a percentage. The standard rate is six percent, but in some regions a reduced tax rate applies. The tax rate is regulated by authorized state regional bodies. The rate is determined by several factors and is applicable by the enterprise exclusively in the region. A controversial issue remains the tax on the sale of property owned by the owner of an enterprise under the simplified tax system “Income”: does an entrepreneur have the right to declare the sale of property owned by him as an individual? Indeed, in this case, the owner will avoid paying tax or significantly reduce it. Tax authorities carefully monitor such moments, because the property could be used by the entrepreneur to make a profit. That is, if an entrepreneur used a vehicle to deliver goods or rent out real estate owned by him, then the sale of such property can be counted as business income. Tax authorities consider such income to be income received as a result of business activities. When selling property that was used to conduct business using the simplified tax system “Income,” the entrepreneur is required to pay 6 percent to the budget in the form of tax. How to prove that the property being sold did not participate in the business activity of the simplified tax system (object of taxation - income)? Since 2021, there have been no innovations in the law related to this issue. An entrepreneur must present, for example, proof of the sale of real estate or land only once, that is, the sales were not multiple, and the funds did not go to the company’s current account. By proving the absence of a system, the entrepreneur will prove that he has the right to a property deduction as an individual.

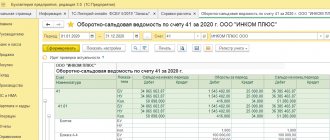

Option two. Object – income minus expenses. In the second case, the object allocates income reduced by expenses, that is, the difference between the income and expenses of the enterprise. This delta is multiplied by 15 percent. In this case, too, the state grants regions the right to lower the tax rate depending on the category of enterprise operating under the simplified tax system. It is worth noting that most of the costs associated with running a business can be taken into account: the purchase of goods and materials, payment of wages and the necessary taxes and contributions from them, rent, etc. An important difference between the simplified tax system “income minus expenses” and the simplified tax system “income” is the obligation to confirm expenses incurred with primary documents.

Which option should I choose for use in an enterprise? In order to determine which object is most preferable for an enterprise, let’s look at the formula as an example. This formula allows you to calculate which expenses “equate” the tax amounts of each option.

The formula looks like:

SD*6%=(SD-SR)*15%,

where: SD – the amount of income of the enterprise; SR – the amount of expenses of the enterprise. According to this formula, the amount of taxes payable for different objects of taxation will be equal for expenses within 60% of the amount of income. After this mark, as expenses increase, the tax will decrease according to the second option. Thus, with equal amounts of income, option 2 “Income minus expenses” seems more profitable. However, adjustments to this statement can be made by a limited list of categories of expenses recognized for deduction, as well as the procedure for selling purchased goods. The fact is that the cost of products purchased for resale can be deducted only if the enterprise has documentation confirming the sale of these products from the warehouse. That is, while the purchased products are in the enterprise’s warehouse, the entrepreneur does not have the right to deduct their cost as an expense. The document flow when registering expenses accepted for accounting must be impeccably executed. An error, an incorrectly completed form, a typo, a technical error, the absence of a seal or the required signature - all this will cause the inspector to refuse to recognize the expense for deduction, and the formula will lose its relevance. An additional way to reduce the tax base is to take into account losses from previous years using the simplified tax system “income minus expenses.” If an entrepreneur is confident in the ability to provide the inspector with documentation completed in accordance with all the rules confirming the legality of expenses, and these expenses amount to 60 percent or more of the enterprise’s income, it is beneficial to use the option with the simplified tax system “Income minus expenses.” Otherwise, you should leave your choice on the first option. Before choosing which option is more economically feasible, you should take the following step: calculate the amount of tax payable when an entrepreneur changes the object of taxation.

When to submit a notice to avoid fines and additional charges

In general, you can switch to a simplified tax system from another tax system only from the beginning of the next tax period, that is, from the new year.

As already mentioned, the simplified tax system can be applied from the moment of registration of a business entity.

How does the taxable object change under the simplified tax system?

An annual change of the object of taxation is the right of any taxpayer (clause 2 of Article 346.14 of the Tax Code of the Russian Federation). This opportunity does not depend on the statute of limitations for working on the simplified tax system.

To learn about which object under the simplified tax system a taxpayer should choose with the greatest benefit, read the material “Which object under the simplified tax system is more profitable - “income” or “income minus expenses”?” .

The Tax Code of the Russian Federation establishes that changing the object of taxation under the simplified tax system is possible no earlier than the beginning of the next calendar year (tax period). Art. 364.14 of the Tax Code of the Russian Federation prohibits the transition to a new object of taxation during the year.

Example

Individual entrepreneur Glebov I.K. has been applying the simplified tax system since January 2021. The object of taxation is “income”. In June, he decided to change the object of taxation (clause 2 of Article 346.14 of the Tax Code of the Russian Federation). In accordance with the legislation, individual entrepreneur I.K. Glebov can switch to the object of taxation “income minus expenses” no earlier than 01/01/2018.

About what changes have occurred in the income limits that are significant for the simplified tax system since 2021, read the article “Since 2017, simplified taxation system limits have been increased .

How to change the object of taxation of the simplified tax system

What to do if the idea arises of changing the object of taxation? Depending on the reasons for such a change, the order of transition from one object to another also depends.

Already existing business entity

If a change in the object of taxation is dictated by the economic reasons of an existing business entity, then the following nuances must be kept in mind:

Newly created organization or individual entrepreneur

Let's assume a different situation. A new business entity has just registered and submitted a notice of transition to the simplified tax system from the moment of registration. As we have already written, this can be done within 30 days from the date of registration.

The question arises, if the taxable object is incorrectly indicated in the submitted notification (a technical error was made or the taxpayer immediately realized that he had made the wrong choice), when can it be changed? Only from the next calendar year?

In 2021, Letter No. SD-4-3/14754 of the Federal Tax Service of Russia dated September 11, 2020 was issued, explaining this point.

If a notification with an incorrect object of taxation is submitted before the expiration of 30 days from the date of registration of the business entity, then it is permissible to submit another notification about the transition to the simplified tax system with an already correct object of taxation.

We pay attention to the following nuances:

Changing the object of taxation when applying the simplified tax system

During the first year of work on the simplified tax system, you cannot change the selected taxable object.

This right appears only from the beginning of a new tax period.

A change in the object of taxation is also carried out by notifying the tax authorities, which must be sent before December 31 of the current year.

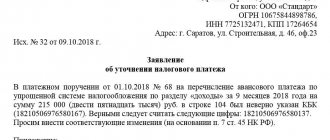

For this purpose, form No. 26.2-6 “Notification of a change in the object of taxation” is used in accordance with Appendix No. 6 to the order of the Federal Tax Service of Russia dated November 2, 2012 No. MMV-7-3 / [email protected]

The form for changing the taxable object according to the simplified tax system also provides for indicating the corresponding code opposite the selected object: “1” or “2”.

To reflect information about the amount of income received through the simplified tax system, form No. 26.2-6 does not establish any lines or columns.

Therefore, when changing the object of taxation, they do not need to be indicated.

However, the right to apply the simplified tax system presupposes compliance with the income limit of 150 million rubles established by paragraph 1 of paragraph 4 of Article 346.13 of the Tax Code.

If they are exceeded, the organization loses the right to apply the simplified tax system, including changing the object of taxation.

Let's pay attention!

From January 1, 2021, a transition period will be established for small and medium-sized businesses that have exceeded the restrictions allowing the use of the simplified tax system.

If the income of the simplified tax system payer exceeds 150 million rubles, but not more than 50 million rubles, and the average number of employees does not exceed 130 people, then he will be able to continue to apply this tax regime.

However, due to an increase in income or number of employees, there will be a need to pay a “simplified” tax at increased rates:

- 8% for those applying the object of taxation in the form of income;

- 20% for those who have chosen the object of taxation in the form of income reduced by the amount of expenses.

It will be possible to take advantage of the transition period starting from the quarter when the limits established for the simplified tax system on the amount of income and the number of employees were exceeded.

If they are exceeded, the organization loses the right to apply the simplified tax system, including changing the object of taxation.

More on the topic:

How to take into account expenses when changing a simplified tax system object

When changing the object of taxation in the simplified tax system, expenses cannot be taken into account

The “profitable” simplification has changed the tax object. What about the costs?

Let's sum it up

You can change the object of taxation under the simplified tax system only from the beginning of the next calendar year, that is, no more than once a year. If a newly created organization or individual entrepreneur submitted a notification about the transition to the simplified tax system and made a mistake with the object of taxation, then they have the right to submit a similar notification again, with the correct object of taxation, attaching to it a letter asking to cancel the first notification. This is only possible if the second notification is submitted within 30 days from the date of registration of the business entity.

Procedure for filling out form 26.2-6

according to the KND form 1150016 in PDF format, please follow the link

It is important to pay attention to filling out the fields:

- When filling out the form, legal entities must indicate the TIN and KPP and the name of the organization. Individual entrepreneurs indicate their full last name, first name and patronymic;

- tax office code;

- the year from which the taxpayer makes a change to the object of taxation of the simplified tax system;

- code number - indicates the desired version of the object of taxation of the simplified tax system;

- At the bottom of the form, you must indicate “1” if the notification is submitted personally by the manager or entrepreneur, and “2” is indicated if the notification is submitted by a representative on the basis of a power of attorney issued by the manager or individual entrepreneur personally.

How to send a notification to the Federal Tax Service

The notification nature is a distinctive feature of the transition to the simplified tax system. But this does not mean that you should receive a notification from the tax service. Quite the opposite: it is provided for filling out a notice of transition to the simplified tax system (form 26.2-1) for an LLC or individual entrepreneur and sending it to the Federal Tax Service at the place of registration. Previously, there was a separate form of notification about the possibility of applying a simplified taxation system from tax authorities; this form served as a response to the taxpayer’s application. But it lost force back in 2002 by order of the Federal Tax Service of Russia No. ММВ-7-3/ [email protected] Now there is no need to wait for permission from the tax authorities to use the simplified form. After sending the notification, it is allowed to apply the simplification from the date specified in the application.

There is also no need to confirm the right to use this regime. If you do not meet the conditions, this will become clear after the first report, and only then will you have to be financially responsible for the deception. The tax service has no reason to prohibit or allow the transition to a simplified system; its use is the taxpayer’s decision. In addition, the notification about the transition to the simplified tax system of form 26.2-1 has the nature of a recommendation. It is allowed to notify the Federal Tax Service of your intention to use the special regime in any form, but it is more convenient to use a ready-made one.

Results

Existing taxpayers can change the applicable object of taxation from January 1 of the following year by submitting a corresponding notification to the tax office before December 31 of the current year.

Newly created taxpayers (both individual entrepreneurs and organizations) who wish to apply the simplified tax system from the beginning of their activities must submit a corresponding application to the INFS, which indicates the selected object of taxation.

The main thing is not to miss the 30-day deadline for filing it. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.