Form P14001 is no longer relevant!

On November 25, 2020, new rules for making changes to information about LLCs came into force.

This article describes the legacy rules. We have prepared a new article with up-to-date information. Go to new article Prepare documents according to the new rules

If you decide to change the types of activities, you need to register new OKVED codes with the tax office. To do this, you need to fill out sheet H of application P14001. To add new codes, fill out sheet 1, and to delete existing ones, fill out sheet 2. If you find an error in already registered codes, a free form application will suffice.

What sheets to fill out to change OKVED

Form P14001 includes 51 pages. There is no need to fill them all out. Use only those that relate to changes in OKVED codes. Blank pages do not need to be returned.

Page 001

The cover page of the application must always be completed.

Application on form P14001 - Create an application

- Generate an application automatically You can quickly and free of charge create an application using form No. P14001. You don’t have to figure out what and how to fill out. Simply select the required activities from the list. Our service will automatically insert OKVED codes into the application. You will then be able to print the completed application. Create an application

- PDF, 31 MB

- XLS, 1.5 MB KB

The first page is filled out in strict accordance with the data of the Unified State Register of Legal Entities. To do this, you can download a free electronic statement, which contains all the necessary information. In Section 2, you must indicate the reason for submitting the application: This may be a “1” if a change is being made, or a “2” if an error needs to be corrected.

Sheet N

To change codes, fill out the pages of sheet N. Their number can be any.

Sample of filling out pages of 1 sheet N

Sample of filling out pages 2 sheets N

If you want to add new codes, fill out sheet N, page 1. To exclude old codes, fill out sheet H, page 2.

In order to change the main type of activity, the new OKVED code must be indicated on sheet N page 1, and the old one on sheet N page 2. If the main code does not change, but only additional ones change, fill out page 1 of sheet N. If to exclude previous codes without changing the main one, fill out page 2 sheet N.

If you want to add or exclude many activity codes and one sheet H is missing, fill out and attach several sheets.

You can find out the necessary OKVED codes in the directory. When specifying codes, the following rule is used: they must be at least four characters, they must be written not in a column, but in a row - from left to right.

Sheet P

Sheet P is intended to indicate information about the applicant.

Sheet R page 1

Sheet R page 2

Sheet R page 3

Sheet R page 4

If you change OKVED codes, the applicant will be the head of the LLC. You must put the code “01” in the first section. Enter your manager's details and contact details. Sign section 5 in the presence of a notary, and section 6 will be completed by the notary himself.

Instructions for filling out form 14001 new

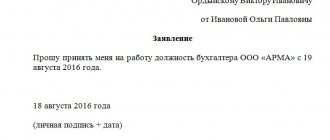

Section 4 reflects information about the applicant: full name, tax identification number, date and place of birth, identification document details, address of location in the Russian Federation and contact information. The telephone number must be indicated, and if the application is submitted to the inspectorate electronically, then an email address must also be indicated.

Attention!

There can only be one main activity code. The codes are filled in line by line from left to right. At least 4 digital characters of the type of activity must be indicated. If necessary, fill out several sheets N of the application. Blank application sheets do not need to be numbered and printed, i.e. If you are only adding types of activities, then you do not need to print out the blank “Sheet H page 2” of the application.

How to correct an error in OKVED

If you find an error in OKVED codes, first figure out who made it. To do this, you can look at a copy of the previous application and check the codes indicated there. If you don’t have it left, act on the assumption that the mistake was made by a tax officer. To correct it, make a statement in free form. In this case, P14001 does not need to be filled out.

If the codes were entered in accordance with your application, you will receive a refusal from the Federal Tax Service. After this, you can send form P14001 to the inspection by filling out the necessary sheets. In this case, on page 001 in section 2 you must indicate code 2, which means that the application was submitted in connection with the correction of errors made in a previously submitted application.

Requirements for filling out form P14001 in 2021

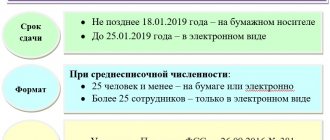

You can fill out form P14001 in two ways: manually or on a computer. Completed pages must be numbered at the top, starting with “001.”

When filling out the form on a computer, you must use capital letters, height 18, and Courier New font. Double-sided printing of the application is prohibited.

If you want to fill out Form P14001 by hand, you will need a blank form. All information must be written in capital letters. A black pen is used for filling. There should only be one character per cell, be it a letter, number or punctuation mark. An empty cell is used for spaces.

If you fill out the form with errors, the Federal Tax Service will refuse to register your changes.

Fill out application P14001 about changing OKVED codes automatically

You will be required to provide your details in the form fields. After this, our automated service will prepare an application that meets the requirements of the Federal Tax Service. We will do it quickly and free of charge.

Prepare an application

Prepare an application

Form 14001 – what is it?

So, what is form P14001?

First, it should be noted that it was approved relatively recently, namely on January 25, 2012 by the Federal Tax Service of the Russian Federation, and is also relevant today - this is the kind of document that is used to draw up an application notifying about changes being made to the Unified State Register of Legal Entities. The form is submitted as a 51-page application form. However, you need to take into account the fact that recording is carried out only for those that relate to adjustments in the Unified State Register of Legal Entities. As we have stated before, P14001 is issued only in cases where the statutory documents are affected.

After drawing up the form, it is submitted to the tax service, where it is reviewed within five working days, after which government officials issue a receipt confirming the changes made to the Unified State Register of Legal Entities.

( Video : “Filling out P14001 when changing the director of an LLC”)

What changes are made according to application P14001

In fact, enterprises and organizations quite often use this form, since only with its help is it possible to register any changes in the Unified State Register of Legal Entities. persons Major such changes may include the following information:

- when it comes to changing the share in an institution, that is, sale, inheritance, and so on;

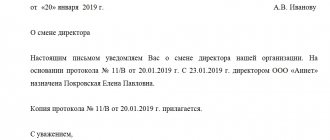

- change of the head of the company;

- when the address of the institution changes. However, here it is necessary to take into account the nuance associated with the fact that the data is entered into the P14001 form only if they do not affect the charter;

- editing OKVED codes when they correspond to information about employment information included in the charter of the enterprise.

In addition to the above adjustments, changes are also made to the current form that are associated with errors in the documents of the unified register, that is, the Unified State Register of Legal Entities.

It should also be noted that one copy of the application may contain several adjustments, for example, replacing the boss and editing OKVED. However, there is an exception that presupposes the inadmissibility of editing registration information and edits in a single registry in one form.

Notarization form P14001

The law requires that the applicant's signature on Form P14001 be certified by a notary before submitting it to the tax office. Moreover, this does not depend on whether the applicant submits the form in person or not.

There is an exception to this rule: if you submit form P14001 through the Federal Tax Service website using an electronic digital signature, you will not have to certify it.

Before going to the notary's office, make sure that the form is filled out correctly, without corrections or erasures. The notary places his certificate on sheet R. The applicant must appear before the notary in person and sign in his presence.

In order to certify form P14001, you will need the following documents:

- Completed and unstitched form P14001,

- The original charter of the LLC,

- Applicant's passport

- Original certificates or sheets of registration OGRN, INN,

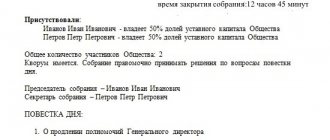

- Protocol or order on the appointment of a manager,

- Minutes of the general meeting of participants or the decision of the sole founder to change OKVED codes.

The notary may request additional documents. Check this information in advance.

To certify the signature on form p14001 you will have to pay about 1,000 - 2,000 rubles. The exact cost can also be found at a notary office.

Sample of filling out form 14001 when changing the position of a manager

The application form can be filled out using software that provides a two-dimensional barcode on the application pages when printed. Sheet E of the application “Information about the participant - an individual” is filled out taking into account the provisions of subparagraph 5. If the value is 1, the corresponding sections - 2 - 9 are filled out. Section 6 “Information about the person who certified the authenticity of the applicant’s signature in a notarial manner” is filled out taking into account the provisions paragraph 2. Section 7 “Contact telephone number” indicates the telephone number by which communication can be made with an individual who has the right to act on behalf of a legal entity without a power of attorney. Stanislav, Mr. Good afternoon. If you are not sure that one is enough, put it off until later.

My question to you is the following: is it necessary to fill out form p14001 when changing the passport details of the head of an enterprise, and is this appointment of a new director a basis for making changes to the charter? Section 7 “Information on trust management” is completed in the event that a participant of a legal entity transfers his share in the authorized share capital of the authorized share fund of the legal entity into trust management. Section 4 “A legal entity is reorganized in the form” is filled in during reorganization in the form of division or separation, carried out simultaneously with reorganization in the form of merger or accession if in section 3 on page 002 of the application the value 6, 7, 8 or 9 is entered by putting in a field consisting of one familiarity corresponding to a digital value. Section 4 “Position” indicates the position of a person who has the right to act on behalf of a legal entity without a power of attorney. Section 3 “Information about the participant entered into the Unified State Register of Legal Entities” is filled out taking into account the provisions of paragraph 2. In particular, if you change the head, you will have to submit a message to the tax authority in form p14001. In this case, section 1 is filled out only on the first page AND of the application. The identification document submitted by the applicant is filled out by the official of the registration authority who accepted the application. Section 1 “OGRN” indicates the main state registration number of the legal entity. Section 4 “Share in the authorized capital of the share capital, authorized capital, mutual fund” indicates information about the founder’s share in the authorized share capital of the authorized share fund of the legal entity being created. Only p14001 is filled out when there is a change of general director, but this form is currently accepted in both the old and new formats, but there are some fundamental differences in how they are filled out.

We recommend reading: Benefits for a residence permit with a preferential socio-economic status

How to submit an application P14001 to the tax office

After you have certified form P14001, you can send it to the Federal Tax Service in the following ways:

- In person

to the tax office or through the MFC, as well as with the help of a representative, in this case you will need a notarized power of attorney; - By registered mail

, be sure to indicate the declared value and fill out an inventory of the attachment. In Moscow, you can also submit the form using courier services.

In addition, you can submit an application in form No. P14001 without certification by a notary and in electronic form using the tax office’s online service. In this case, an electronic signature is required to sign the application. You can obtain it from the regional Pension Fund, as well as other accredited organizations.

Please note that only the manager or his representative, acting under a notarized power of attorney, has the right to submit an application for registration to change OKVED codes.

An employee of the Federal Tax Service will require the following documents from you when submitting form P14001:

- Completed and notarized application P14001,

- Applicant's passport

- Minutes of the general meeting or the decision of the sole founder of the LLC to change OKVED codes.

Registration of a change in OKVED codes is free of charge; in this case, there is no need to pay a fee for making changes to the Unified State Register of Legal Entities. Activity codes will be registered within 5 working days.

Sample of filling out form 14001 when changing the position of a manager

According to the unequivocal position of the Federal Tax Service, the applicant when changing the director of an LLC is the new director. Therefore, the protocol (decision) must confirm the accomplished fact, i.e. change of director, not future intention. The notary is also required to personally appear only for the new director with a passport and constituent documents.

An LLC cannot operate without a sole executive body, that is, a general director, since, according to the LLC Law, it is this body that manages the current activities of the company. By virtue of this provision, there should be no time gap between the dismissal of an existing director and the assumption of office by a new one.