In this section you can fill out the 3-NDFL tax return for free when purchasing an apartment/house. All sample forms are available for download in .pdf format. To open them you need Acrobat Reader, Foxit Reader or any other program for opening PDF files.

You can download the 3-NDFL declaration form, samples of filling out an application for a tax refund and other documents in the section Forms and forms of documents for property deduction:

- 3-NDFL declaration forms;

- sample application for tax refund for property deduction;

New form: approved or not

The form of a certificate of income for an individual 2-NDFL and the procedure for filling it out were approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485. At the same time, a new form of 2-NDFL certificate for reporting for 2016 was not developed or approved. The new form simply does not exist. In 2021, you need to fill out the form that was used before when reporting for 2015 was submitted. See “Certificate 2-NDFL in 2021: current form.”

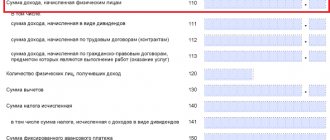

The composition of the current form of certificate 2-NDFL is as follows:

| Help 2-NDFL in 2021: composition | |

| Section 1 | Tax agent information. |

| Section 2 | Data about an individual |

| Section 3 | Income taxed at the rate (the rate must be specified). |

| Section 4 | Standard, social, investment and property deductions. |

| Section 5 | Total income and tax amounts (total information). |

You can download the current 2-NDFL certificate form using this link.

Filling out the certificate: useful samples

Next, we will explain the procedure and features of filling out 2-NDFL certificates for 2016 using specific examples. We will also provide a final sample of the filling, which can be downloaded as a visual example.

Formatting the title

In the title of the certificate for 2021, in the “attribute” field, mark 1 if the certificate is provided as an annual report on income and withheld amounts of income tax (clause 2 of Article 230 of the Tax Code of the Russian Federation). If you are simply informing the Federal Tax Service that it was impossible to withhold tax in 2021, then indicate the number “2” (clause 5 of Article 226 of the Tax Code of the Russian Federation).

In the “Adjustment number” field, show one of the following codes:

- 00 – when preparing the initial certificate;

- 01, 02, 03, etc. – if you fill out a corrective certificate (that is, if in 2021 you “correct” previously submitted information”);

- 99 – when filling out a cancellation certificate (when you need to completely “cancel” the information already submitted before).

In the “In the Federal Tax Service (code)” field, mark the tax office code, indicate the year “2016” in the title, and also assign a serial number and date of generation to the certificate. As a result, the title of the 2-NDFL certificate for 2021 may take the following form:

Section 1: enter information about the tax agent

In section 1 of the form, provide basic information about the organization: name, tax identification number, checkpoint, contact telephone number. However, keep in mind that individual entrepreneurs indicate only the TIN, and they put a dash in the checkpoint field.

If the income of an individual was paid by the head office of the company in 2021, then in the 2-NDFL certificate you need to show the TIN, KPP and OKTMO at the location of the head office. If the income was received from a separate division, then mark the checkpoint and OKTMO at the location of the “separate division”.

In the “OKTMO Code” field, indicate the code of the territory in which the tax agent is registered. You can recognize this code by the Classifier approved by order of Rosstandart dated June 14, 2013 No. 159-st. However, if the 2-NDFL certificate is generated on behalf of an individual entrepreneur, then the approach when filling out should be as follows:

- indicate OKTMO at the place of residence of the entrepreneur according to the passport (except for individual entrepreneurs on UTII and on the patent taxation system);

- if the individual entrepreneur is on “imputed” or “patent”, then reflect OKTMO at the place of business in the appropriate tax regime.

Section 2: fill in information about the recipient

In section 2, enter the details of the individual to whom the income was paid. So, in particular, indicate your full name and tax identification number, date of birth. We will explain in more detail how to fill out section 2 of the 2-NDFL certificate for 2021 in the table:

| Filling out the fields in section 2 of the 2-NDFL certificate | |

| Field | What to indicate |

| "TIN in the Russian Federation" | Identifier specified in the TIN certificate of an individual. |

| "TIN in the country of residence" | TIN or its equivalent in the country of citizenship of the foreign employee. |

| "Taxpayer status" | One of the following codes: • 1 – for tax residents; • 2 – for non-residents (including for citizens of the EAEU: the Republic of Belarus, Kazakhstan, Armenia and Kyrgyzstan); • 3 – for non-residents – highly qualified specialists; • 4 – for employees who are participants in the state program for the voluntary resettlement of compatriots living abroad; • 5 – for foreign employees who have refugee status or have received temporary asylum in the Russian Federation; • 6 – for foreign employees working on the basis of a patent. |

| "Citizenship (country code)" | Code of the country of permanent residence of the person. The code, for example, of Russia is 643 (according to the Classifier, approved by Resolution of the State Standard of Russia dated December 14, 2001 No. 529-st). |

| “Identity document code” | Code from the reference book “Document Codes” (Appendix 1 to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485). |

| “Residence address in the Russian Federation” | Address of permanent residence of an individual according to a passport or other document confirming such address. |

| Subject code | Directory code “Codes of subjects of the Russian Federation and other territories (Appendix 2 to the order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/485). |

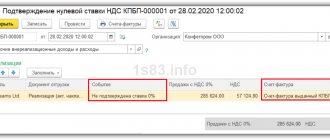

Section 3: grouping income

In the table of section 3 of the 2-NDFL certificate for 2021, show the amount of income received for 2021, the codes of income and deductions and the tax rate. Please fill out this table monthly. At the beginning of the table, show the tax rate at which the income reflected in this section is taxed. If in 2021 an individual was paid income taxed with personal income tax at different rates, then fill out section 3 several times - at each rate.

Let us remind novice accountants that each type of income and each type of tax deductions are assigned individual codes, for example:

- for income in the form of wages - code 2000;

- when paying remuneration under other civil contracts (except copyright) – code 2010;

- when paying benefits for temporary disability - code 2300;

- if there is no separate code for income - code 4800. That is, for example, under code 4800 you can show above-limit daily allowances, compensation for unused vacation, severance pay in excess of three times the average earnings, etc. (letter of the Federal Tax Service of Russia dated September 19, 2021 No. BS- 4-11/17537).

If we talk about the most common case, then if an employee in the period from January to December 2021 received only wages under an employment contract, then section 3 of the 2-NDFL certificate for 2021 with sign “1” may look like this:

Also, in section 3 of the 2-NDFL certificate for 2021, you need to reflect the codes of deductions provided to individuals and the amount of such deductions. However, do not get confused: in section 3, reflect only professional tax deductions (Article 221 of the Tax Code of the Russian Federation), deductions in the amounts provided for in Article 217 of the Tax Code of the Russian Federation and amounts that reduce the tax base on the basis of Articles 214.1, 214.3, 214.4 of the Tax Code of the Russian Federation. The corresponding deduction code must be indicated opposite the income for which this deduction is applied.

New income codes from 2021

In 2-NDFL certificates, separately show the bonuses that employees received in 2016 for production results as part of their remuneration. For such bonuses, code 2002 has been in effect since 2021. If bonuses were issued at the expense of net profit, then show them with code 2003. Note that until 2021, bonuses were not allocated with a separate code: for bonuses for labor, the same code was indicated as for salary in cash – 2000.

Standard, social, investment and property tax deductions should not be reflected in section 3 of 2-NDFL certificates. The following section of the 2-NDFL certificate is provided for them.

Section 4: highlighting deductions

In section 4 of the 2-NDFL certificate, show the standard tax deductions provided in 2021 (Article 218 of the Tax Code of the Russian Federation), social (Article 219 of the Tax Code of the Russian Federation), investment, as well as property deductions for the purchase (construction) of housing (subclause 2 p. 1 Article 220 of the Tax Code of the Russian Federation). The code that must be entered in the “Deduction Code” column can be determined from Appendix 2 to the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. In the “Deduction Amount” column, enter the deduction amount corresponding to the specified code.

Some social and property deductions are provided by employers to their employees. In this regard, in the lines “Notification confirming the right to a social tax deduction” and “Notification confirming the right to a property tax deduction,” the accountant needs to note the number and date of the corresponding notification and the code of the Federal Tax Service that issued the notification.

Changes to deduction codes from 2021

From January 1, 2021, the Federal Tax Service has updated the codes for standard tax deductions. Of the codes that were in force in 2021, only two remained the same: 104 and 105. In addition, the previously valid deduction codes for children 114–125 do not apply from January 1, 2021. They were excluded from the directory. Instead, use the new “children’s” codes from 126 to 149. For more information, see “New income and deduction codes for 2-NDFL certificates from December 26, 2021.”

You can also find a complete list of income and deduction codes that may be required to generate a 2-NDFL certificate for 2021 in the material: “Personal income tax codes and amounts of deductions in 2021: table with explanation.”

Let's assume that the employee was provided with the standard tax deduction for the first child in 2021. This deduction in 2017 corresponds to deduction code 126. The deduction amount was 16,800 rubles. In this case, an example of filling out section 4 of the 2-NDFL certificate for 2021 will look like this:

Show all indicators in the certificate for 2021 (except for the personal income tax amount) in rubles and kopecks. However, reflect the amount of tax (personal income tax) in full rubles (do not take into account amounts up to 50 kopecks, amounts of 50 kopecks or more - round up to the nearest whole ruble). For example, if the tax is 15.78 rubles, then show 16 whole rubles on the certificate.

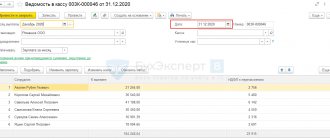

Section 5: summing up

In section 5 of the certificate, summarize the total amount of income of an individual and personal income tax at the end of 2021 for each tax rate. If, during the tax period, the tax agent paid an individual income taxed at different rates (for example, 9%, 13%, 15%, 30%, 35%), then for each of them it is necessary to create sections 3 - 5 of certificate 2 -NDFL. Below in the table we will explain the general procedure for filling out the 2-NDFL certificate for 2021.

| General procedure for filling out the 2-NDFL certificate for 2016 | ||

| Help field | Filling | |

| 2-NDFL with sign 1 | 2-NDFL with sign 2 | |

| "Total Income" | Total income at the end of 2021 (excluding deductions). | The total amount of income in 2021 from which personal income tax was not withheld. |

| "The tax base" | The tax base from which personal income tax is calculated in 2021. | Tax base for calculating personal income tax |

| "Tax amount calculated" | The amount of calculated personal income tax (the tax base is multiplied by the tax rate). | The amount of personal income tax that has been calculated but not withheld. |

| “Amount of fixed advance payments” | The amount of fixed advance payments by which the personal income tax should be reduced (data taken from the notification of the Federal Tax Service). | 0 |

| "Tax amount withheld" | The amount of personal income tax withheld from the income of an individual. | 0 |

| “Tax amount transferred” | The amount of personal income tax transferred for 2021. | 0 |

| “Amount of tax over-withheld by the tax agent” | The excess amount of personal income tax not returned by the tax agent, as well as the amount of overpayment of personal income tax due to a change in tax status. | 0 |

| “The amount of tax not withheld by the tax agent” | The calculated amount of personal income tax not withheld in 2016. | |

Here is an example of filling out section 5 of the 2-NDFL certificate for 2021. Let's assume that the income of an individual for 2021 was 549,200 rubles. After applying tax deductions, the tax base amounted to 457,500 rubles. The tax rate is 13 percent. This means the personal income tax amount is 59,475 rubles (457,500 x 13%). This amount was calculated and withheld by the employer at the end of 2021. And I filled out section 5 of the help like this:

As a result, after filling out all the above sections, a sample 2-NDFL certificate for 2021 with sign “1” may look like this:

Deadline

Organizations and individual entrepreneurs are required to submit 2-NDFL certificates about income and withheld personal income tax to the Federal Tax Service no later than April 1 of the year following the reporting year (clause 2 of Article 230 of the Tax Code of the Russian Federation). However, April 1, 2021 is a Saturday. In this regard, the deadline for submission is moved to the next working day. Accordingly, most tax agents need to submit 2-NDFL certificates for 2016 with “sign 1” no later than April 3, 2021 (inclusive).

Also, information must be submitted to the Federal Tax Service on Form 2-NDFL in relation to individuals to whom the tax agent paid income in 2021, but personal income tax was not withheld from this income. For example, if in 2016 an organization gave a gift worth more than 4,000 rubles to a citizen who is not its employee. The deadline for submitting such certificates is no later than March 1 of the year following the reporting year (clause 5 of Article 226 of the Tax Code of the Russian Federation). Accordingly, if you paid income to individuals in 2021 from which personal income tax was not withheld, then no later than March 1, 2021 (this is Monday) you need to submit 2-NDFL certificates to the Federal Tax Service Inspectorate for these individuals with the “2” order. Moreover, within the same period, the “physicist” himself must be notified about the unwithheld tax. See “2-NDFL due date: important dates.”

Presentation method

It is possible to submit 2-NDFL certificates “on paper” only if in 2016 the number of individuals who received income from a tax agent is less than 25 people (Clause 2 of Article 230 of the Tax Code of the Russian Federation). If 25 or more people received income, then they must report electronically via telecommunications channels through an electronic document management operator.

How to fill out the section of the declaration “Deductions for children”?

Filling out 3-NDFL deductions for children is also not difficult:

- Go to the "Deductions" tab. On the contrary, the line “Provide standard deductions” must be checked;

- Based on Article 118 of the Tax Code of the Russian Federation, code 104 or code 105. If neither one nor the other code is relevant to you, select the appropriate column;

- After this, you need to select “Deduction for children (child)”. There is a special column for single parents. This item can also be selected by persons when the second parent has written a waiver of the tax deduction;

- You can also choose standard or double return;

- In the next paragraph, enter the details of all children.

Responsibility of tax agents

If you do not submit a certificate in form 2-NDFL for 2021 to the Federal Tax Service on time, the tax authorities will have the right to impose a fine on the organization or individual entrepreneur under Article 126 of the Tax Code of the Russian Federation: 200 rubles.

Also, for failure to submit or for late submission of the annual 2-NDFL certificate, at the request of the Federal Tax Service, the court may impose administrative liability in the form of a fine in the amount against the manager or chief accountant: from 300 to 500 rubles. (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

In addition, if inspectors from the Federal Tax Service identify errors in 2-NDFL, they may regard them as “unreliable information.” And then the tax agent can be additionally fined 500 rubles for each “unreliable” document. If there are a lot of erroneous certificates, then the fine may increase.

Sample of filling out the 3-NDFL declaration for 2013 for property deduction (with mortgage)

Description of the example: In 2013, Ivanov I.I. bought an apartment for 3,000,000 rubles, of which 1 million rubles. he took out a mortgage loan. In 2013, he paid interest on a loan in the amount of 100 thousand rubles. In the same year, Ivanov I.I. worked at Avanta LLC and received an income of 3 million rubles. (390 thousand rubles in tax were paid). Based on the results of the declaration to Ivanov I.I. 273 thousand rubles must be returned from the budget. (260 thousand rubles of the main deduction and 13 thousand rubles of interest deduction). In subsequent years, he will be able to continue to receive a credit interest deduction.