Gifts in 6-NDFL: how to correctly indicate tax amounts

Section 1 of Calculation 6-NDFL reflects the cumulative totals for the year, and Section 2 provides data on the amounts of income and tax for the last quarter.

If the gift is presented in kind, then the date of actual receipt of income when filling out page 100 of Section 2 will be the day the gift was given. For a gift in cash, this date is considered the day of payment (transfer) to the employee (clause 1 of Article 223 of the Tax Code of the Russian Federation).

There is no need to reduce the value of the gift at the expense of tax: when receiving natural income, personal income tax is withheld from other immediate cash payments, for example, salaries or bonuses. Such a tax can be withheld in an amount of no more than 50% of the amount of cash income received (clause 4 of Article 226 of the Tax Code of the Russian Federation). Personal income tax must be transferred no later than the day following the tax withholding.

Let's remember when personal income tax arises and the deadlines for paying taxes

Article 223 of the Tax Code of the Russian Federation determines the dates of occurrence of various types of income, and Art. 226 and 226.1 of the Tax Code of the Russian Federation indicates the timing of tax transfer to the budget. We present them in the table:

| Main types of income | Income date | Deadline for transferring personal income tax |

| Salary (advance) | The last day of the month for which the salary was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated 08/09/2016 No. GD-4-11/14507, dated 08/01/2016 No. BS-4-11/ [ email protected] ) | No later than the day following the day of salary payment for final payment |

| Vacation pay, sick pay | Payment day (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated 01/25/2017 N BS-4-11/ [email protected] , dated 08/01/2016 No BS-4-11/ [email protected] ). | No later than the last day of the month in which vacation pay or temporary disability benefits were paid |

| Payments upon dismissal (salary, compensation for unused vacation) | Last day of work (clause 1, clause 1, clause 2, article 223 of the Tax Code of the Russian Federation, article 140 of the Labor Code of the Russian Federation) | No later than the day following the day of payment |

| Help | Payment day (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated May 16, 2016 No. BS-4-11/ [email protected] , dated August 9, 2016 No. GD-4-11/14507) | |

| Dividends | No later than the day following the day of payment (if the payment is made by LLC). No later than one month from the earliest of the following dates: the end of the relevant tax period, the date of payment of funds, the date of expiration of the agreement (if it is a JSC) | |

| Gifts in kind | Day of payment (transfer) of the gift (clauses 1, 2, clause 1 of Article 223 of the Tax Code of the Russian Federation, Letters of the Federal Tax Service dated November 16, 2016 No. BS-4-11/ [email protected] , dated March 28, 2016 No. BS-4-11/ [email protected] ) | No later than the day following the day the gift was issued |

“TAX CODE of the Russian Federation (part two)” dated 08/05/2000 No. 117-FZ (as amended on 12/28/2016)

The edition begins on January 1, 2017

6-NDFL: gifts up to 4000

In section 1, the value of the gift is reflected on line 020, but if during the year the employee received gifts with a total value of no more than 4,000 rubles. – such gifts may not be reflected at all in the 6-NDFL declaration. This is stated in the Letter of the Federal Tax Service dated July 21, 2017 No. BS-4-11/ [email protected]

If the cost of gifts given to an employee during the year exceeds 4,000 rubles, then the amount of gifts and the deduction must be shown in the corresponding lines of form 6-NDFL (lines 020 and 030).

Example

For the 1st quarter, Location LLC accrued income to its employees in the amount of 210,000 rubles. (70,000 rubles per month). The amount of standard deductions for the quarter was 4,200 rubles. (1400 rubles per month). The salary payment date is the 7th.

Personal income tax in each month of the quarter was: (70,000 -1,400) x 13% = 8,918 rubles.

The amount of calculated personal income tax for 3 months is equal to: (210,000 – 4,200) x 13% = 26,754 rubles.

The withholding tax (p. 070) does not include the amount for March, because March's salary was paid in April.

In addition, in February, an employee was given a gift worth 3,500 rubles, and by March 8, an employee was given 4,000 rubles. Since these amounts did not exceed the established limit, the gifts were not reflected in 6-NDFL. Sections 1 and 2 were completed as follows:

An example of filling out 6-NDFL with a gift over 4,000 rubles.

Let's consider line-by-line filling out the 6-NDFL calculation for income in the form of gifts more than 4,000 rubles.

Example

Salaries accrued to 10 company employees:

- for December 2021 (paid in January) - 405,000 rubles;

- for January 2021 (paid in February) - 350,000 rubles,

- for February 2021 (paid in March) - 420,000 rubles,

- for March 2021 (payment in April) - 410,000 rubles.

These employees have a total of 12 children, for whom deductions are provided monthly: 12 * 1,400 = 16,800.

For an anniversary, one of the employees was presented with a gift worth 10,000 rubles, and personal income tax was calculated: (10,000 - 4,000) * 13% = 780 rubles. The gift was presented on February 25, and personal income tax was withheld on March 5 - when paying salaries for February. The tax was transferred to the budget the next day after the withholding, March 6.

Let’s fill out the 6-personal income tax calculation for the 1st quarter of 2021 using these data.

The personal income tax withheld from income in the form of salary for each month was:

- in January0) * 13% = 50,466 rubles.

- in February: (350,000 - 16,800) * 13% = 43,316 rubles.

- in March0) * 13% = 52,416 rubles.

- in April0) * 13% = 51,116 rubles.

Line 020 will include all income accrued for the period from January to March 2021, including the amount of the gift: 350,000 + 420,000 + 10,000 + 410,000 = 1,190,000 rubles. However, the salary for December is not included here, since it was accrued in 2021.

In line 030, reflect deductions - for children and from gifts: (16,800 * 3) + 4,000 = 54,400 rubles.

In line 040, show the total amount of calculated personal income tax: (1,190,000 - 54,400) * 13% = 147,628 rubles.

Indicate the tax withheld in the 1st quarter, including from a gift, in line 070: this will also include personal income tax for December 2021, withheld in January 2021. But the tax for March was withheld in April, so it is calculated for the 1st quarter no need to include: 50,466 + 43,316 + 780 + 52,416 = 146,978 rub.

Lines 040 and 070 may not be equal to each other. They will be the same only if personal income tax was accrued and withheld in the same reporting period.

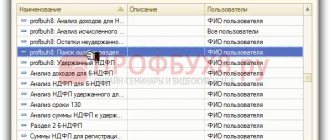

Section 1 of form 6-NDFL is as follows:

ndfl_1.png

If during this year the same employees receive more gifts from the company, then in the quarter when this happens, it will be necessary to reflect the total value of all gifts and show a deduction of 8000 (4000 x 2 employees) on line 030.

Let's continue our example:

Let’s assume that in the second quarter the monthly salary of employees remained the same as in the 1st quarter – 70,000 rubles. Also on April 15, employees received another gift in connection with the company’s anniversary - 5,000 rubles. every. The total cost of gifts for the six months was 17,500 rubles. (4000 + 3500 + 5000 + 5000). Then the following should be indicated in the Half-Year Calculation:

According to page 020, the amount of income is 437,500 rubles. (210,000 for 1 quarter + 210,000 for 2 quarters + 17500).

On page 030, taking into account the deduction for gifts, the amount will be 16,400 rubles. (1400 x 6 months + 4000 + 4000).

The total calculated amount of personal income tax (line 040) is 54,743 rubles. ((437500 – 16400) x 13%).

At the same time, personal income tax should be withheld from the above-limit value of gifts - 1235 rubles. ((17500 – 8000) x13%).

In the 1st quarter in 6-personal income tax, gifts up to 4000 were not shown. Tax on gifts received in April was withheld when paying salaries for April and reflected in the semi-annual Calculation.

Filling out form 6-NDFL for the six months:

Definition and legal regulation

Form 6-NDFL is a relatively new type of mandatory reporting, which is used to provide information on personal income tax by all tax agents. The basic requirements for the calculation and execution of documents until 2021 were determined by Order No. ММВ-7-11 / [email protected] , signed by the head of the Federal Tax Service of the Russian Federation on October 14, 2015. Somewhat later, by departmental Order No. ММВ-7-11/ [email protected] , adopted on January 17, 2021, changes were made to the established procedure.

Starting in 2021, another Order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] , dated October 15, 2021. He approved the new report form and made some changes to the procedure for filling it out.

6-NDFL is issued in two forms - paper or electronic. Currently, only those individual entrepreneurs and organizations with fewer than 25 employees have the right to apply the first option. If the specified quantity is exceeded, the report may be submitted exclusively in electronic format.

IMPORTANT. Starting in 2021, further changes will be made to the rules. The ability to submit a paper report will remain only for enterprises and individual entrepreneurs with up to 10 employees. All other business entities will be required to submit the document electronically.

A characteristic feature of 6-NDFL is the fact that its introduction did not lead to the abolition of the need to draw up and submit the “older” version of the income tax report - 2-NDFL. Currently, the documents complement each other, and their main difference lies in two significant points:

- 6-NDFL is issued quarterly with an increasing total over the year, and 2-NDFL - only once a year;

- 6-NDFL includes data on accrued tax as a whole for an individual entrepreneur or company, and 2-NDFL includes information for each individual.

But in 2021, both reports are combined into one. 2-NDFL, which received the official name “Certificates of income and tax amounts of an individual,” becomes Appendix No. 1 to 6-NDFL. Moreover, the application must be completed at the same frequency – at the end of the year.

Other changes introduced by Order No. ED-7-11/ [email protected] are as follows:

- absence of dates of actual tax withholding and receipt of income;

- introduction of new lines for personal income tax, which is returned to individuals;

- introduction of new lines indicating data on excess tax withholding;

- introduction of new lines intended to indicate data on past reporting periods;

- changing the names of sections (for example, the first section is called “Data on the obligations of the tax agent” instead of “Generalized indicators”).

IMPORTANT. The need for timely execution and submission of 6-NDFL calculations to the Federal Tax Service is beyond doubt. Any violations of the rules for drawing up or submitting a report, regulated at the legislative level, result not only in serious penalties, but also in close attention from the fiscal authorities, which is difficult to classify as a positive factor for business.

Gifts in 6-NDFL over 4,000 rubles.

So, if the gift exceeds 4,000 rubles, then personal income tax must be calculated from the excess amount and the entire cost of the gift must be included in page 020 of Section 1. On page 030, you need to indicate a deduction of 4,000 rubles. The amount of tax withheld on page 070 is indicated if tax was withheld from the amount of the next cash payment. If the employee no longer has cash income from which tax can be withheld on the value of a gift given in kind (for example, he quit), then the amount of unwithheld tax is shown on line 080.

Example

An employee was given an expensive gift for his wedding day with a total value of 42,000 rubles. At the same time, personal income tax was calculated taking into account the deduction:

(42,000 – 4000) x 13% = 4940 rub.

The gift was ceremonially presented to the employee on March 25, 2021, and personal income tax was withheld only when his salary was paid for March - April 10, 2021. In the declaration 6-NDFL for the half-year, the following lines will be filled in regarding the gift:

Gift from a legal entity to an individual

As you know, domestic legislation allows donations on behalf of organizations in favor of ordinary citizens.

This legal relationship is regulated by the general rules of Chapter 32 of the Civil Code, but at the same time it has a number of features in the registration and gratuitous transfer of certain types of gifts, as well as additional restrictions and grounds for canceling the transaction.

In addition, the specifics of taxation require special consideration—the donor also becomes obligated to pay taxes.

Registration of donation between a legal entity and an individual

A gift between an organization and an individual, as a general rule, is formalized by a gift agreement (Article 572 of the Civil Code).

According to it, the organization transfers free of charge or undertakes to transfer any thing, property right or release the donee from property obligations.

Please note that such an agreement cannot contain any property obligation or counter-representation of the donee, otherwise it will be void.

Important

If the value of the gift transferred to the legal entity. person exceeds 3 thousand rubles, the agreement must be drawn up in writing . Violation of this rule entails the nullity of the concluded transaction (clause 2 of Article 574 of the Civil Code).

Note that the requirement for any agreement concluded by a legal entity to be in writing. person, contained in paragraph 1 of Art. 161 Civil Code.

In addition to the form, the contract must meet the requirements and. So, according to Art. 432 of the Civil Code, the contract must contain a condition on the subject . According to paragraph 2 of Art. 572 of the Civil Code, a gift agreement that does not indicate a specific gift is void. Thus, the deed of gift describes in detail all the significant characteristics of the gift, distinguishing it from among similar items.

In addition to the subject matter, the procedure for its transfer to the recipient citizen must be specified in the contract. In particular, the conditions of transfer, the method and timing of delivery, additional documents to be drawn up, procedures to be carried out, third parties involved, etc. must be determined.

If the gift being transferred has shortcomings that may cause any harm to the recipient, then a representative of the donor’s organization is obliged to inform him about them (Article 580 of the Civil Code). In addition, it is advisable to also reflect these shortcomings in the contract.

Since making a donation is not only a transaction, but also a financial transaction that requires accounting, then in addition to the gift agreement, the legal entity needs to prepare other documents. In particular, the donation is also formalized by an order from the head of the organization and a statement of issuance of the gift, which serves as a deed of transfer.

Please note that on behalf of the organization, a gift transaction is always concluded by its authorized representative, who acts under a power of attorney issued by the head of the organization. According to paragraph 5 of Art. 576 of the Civil Code, such a power of attorney must necessarily contain an indication of the donee and the subject of the donation .