Every year, tax agents submit information about the profits received by individuals and the amounts of income tax (NDFL) calculated and withheld from it for the past period. So for 2015, data must be provided before April 1, 2021 for those employees on whose income tax can be withheld and before March 1 for those individuals for whom tax cannot be withheld. We also draw your attention to the fact that from 2016 it is necessary to apply the new 2-NDFL certificate, which was approved by Order of the Federal Tax Service of the Russian Federation N ММВ-7-11 / [email protected] dated October 30, 2015.

For whom you need to submit certificates in form 2-NDFL

Certificate 2-NDFL with sign 1 is submitted for each individual to whom the organization paid income, except for those to whom you paid only income (clause 1, clause 1, article 227, clause 2, clause 1, article 228, clause 2, art. 230 Tax Code of the Russian Federation, Letters of the Ministry of Finance dated 03/07/2014 No. 03-04-06/10185, Federal Tax Service dated 02/02/2015 No. BS-4-11/ [email protected] ):

- under purchase and sale agreements;

- under agreements concluded with them as entrepreneurs;

- in the form of dividends (if the organization is a joint-stock company).

A 2-NDFL certificate with attribute 2 must be submitted for those individuals from whose income the organization was unable to fully withhold the calculated personal income tax (clause 5 of Article 226 of the Tax Code of the Russian Federation, Section II of the Procedure for filling out the certificate).

This situation is possible, for example, when an individual who is not an employee of the organization is given a non-monetary gift worth more than 4,000 rubles.

For the same people, you must also submit a 2-NDFL certificate with attribute 1 (Letter of the Federal Tax Service dated March 30, 2016 No. BS-4-11/5443).

Personal income tax reporting for 2021

Since 2021, personal income tax reporting consists of: certificate 2-NDFL and form 6-NDFL.

Form 6-NDFL - submitted by all employers, not for each employee, but for all employees as a whole 04/07/2016

Form 6-NDFL reflects the dates and amounts of income actually received and personal income tax withheld. But in form 2-NDFL they enter only the amount of income by month, but do not indicate the dates

From this article you will learn:

- How to correctly fill out personal income tax reporting

- When do you need to submit personal income tax reports in 2021?

- What is the penalty for failure to submit personal income tax reports in 2021?

How the 2-NDFL certificate has changed in 2021

Certificate 2-NDFL was approved by order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11/ [email protected] The changes that were made to it are minor.

So, a field was added to the 2-NDFL certificate where the details of the notification for social deduction are indicated (Article 219 of the Tax Code of the Russian Federation).

In Form 2-NDFL you now need to record the details of the notification of offset of advances paid by foreign workers. At the request of foreign employees, employers receive such notification from the Federal Tax Service.

The “Adjustment number” field appeared in the certificate. If you are submitting certificates for 2015 for the first time, enter 00. If there were errors in the certificate and you are submitting an updated one, indicate the correction number - 01, 02, etc.

In the 2-NDFL certificate, personal income tax reporting in 2021 indicates the codes of the employee’s income and deductions. These codes were approved by order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. And changes were made to them. True, the new codes are no different from the previous ones. For example, the code “2000” remained for salary income, and “2010” for vacation pay. However, those that were not valid were removed from the list of deduction codes.

If you make a mistake in choosing a code and enter the wrong one, then no sanctions will follow. But this error may later affect the tax payment procedure.

The most frequently entered code for the type of income in the 2-NDFL certificate is 2000 . It is noted when the employee is paid remuneration for work. Moreover, if an employee received a bonus for labor achievements, then this income is also designated by the code 2000. But if the bonus was given to the employee for a holiday or anniversary, then this income belongs to a different category of codes and the value 4800 must be entered.

In general, personal income tax code 4800 is used for any other income that does not have a code designation. That is, if you do not know what income an employee’s income relates to, feel free to write code 4800.

For example, this code must be used when paying

- compensation for unused vacation upon dismissal of an employee;

- daily allowances received in excess of the standard established by the local regulatory act of the organization;

- compensation accrued to an employee for the use of his personal property for the purposes of the organization, etc.

Code 2760 is indicated when paying financial assistance to employees, including those who retired due to age or disability.

Personal income tax code 2300 is noted in the 2-NDFL certificates of personal income tax reporting for 2021 when paying benefits for temporary disability. After all, such benefits are subject to income tax (Clause 1, Article 217 of the Tax Code of the Russian Federation). This means that they must be reflected in the 2-NDFL certificate.

If you rent a car from an employee and pay him rent for the use of this property, then you can enter code 2400 . Also in this case, you can use code 4800 (“Other income”).

The region code in the 2-NDFL certificate must be entered according to the list of these codes. It is given in the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected]

Since 2021, new codes have appeared in this list; they were assigned to Crimea and the city of Sevastopol. The code of Crimea is “91”, Sevastopol is “92”.

the document code line of the 2-NDFL certificate according to the directory of these codes. They are indicated in the order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. ММВ-7-11/ [email protected] There are 14 such codes in total. Usually they enter code 21, which indicates a Russian passport.

From 2021, more companies can submit 2-personal income tax on paper. Thus, organizations that submit information for 24 people or less can report on paper for 2015 using Form 2-NDFL. The rest are required to transmit information on employee income via the Internet. Let us recall that until 2021, a company could submit 2-NDFL certificates on paper only if it employed 10 people (clause 2 of Article 230 of the Tax Code of the Russian Federation).

In the certificate, as before, you must indicate the sign “1” or “2”. Sign “1” means that the certificate includes income from which personal income tax was withheld. Sign “2” shows: the employer failed to withhold tax. Information with attribute “1” must be sent to the tax office no later than April 1. Certificates 2-NDFL with sign “2”—until March 1 inclusive.

If, when drawing up a 2-NDFL certificate in the employee’s TIN, you make a mistake (indicate someone else’s TIN), the inspectorate will fine you under Art. 126.1 of the Tax Code of the Russian Federation (letter of the Federal Tax Service of the Russian Federation dated February 11, 2016 No. BS-4-11/2224).

Let us remind you that the fine under this article is 500 rubles for each document containing false data.

If you discover any inaccuracies in the information provided, immediately submit clarifications. You will have time to submit them before the inspection finds the errors, and there will be no fine (Clause 2 of Article 126.1 of the Tax Code of the Russian Federation).

How to draw up form 6-NDFL in 2021

From 2021, everyone who makes payments to individuals is required to report quarterly to the Federal Tax Service. To do this, you need to submit form 6-NDFL personal income tax reporting for 2021. This is new reporting. It was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/ [email protected]

It reflects information on all citizens as a whole. That is, the report in Form 6-NDFL is not personalized.

Fill out Form 6-NDFL based on accounting data for income accrued and paid to individuals, tax deductions provided to individuals, calculated and withheld personal income tax. Make the calculation on an accrual basis for the first quarter, half a year, nine months and a year

When to submit 6-NDFL?

For the first time in 2021, you will need to submit Form 6-NDFL in the first quarter. The deadline is May 4, 2021, since April 30 falls on a Saturday, and from May 1 to May 3 are weekends (letter of the Federal Tax Service of Russia dated December 21, 2015 No. BS-4-11 / [email protected] ). However, there is no need to submit a report for 2015.

For the six-month period, Form 6-NDFL must be submitted no later than July 31, but since this is a day off, the deadline is postponed to August 1.

For 9 months - no later than October 31, and for a year - no later than April 1 of the next year, but since this is a day off, the deadline is postponed to April 3, 2021 (Clause 2 of Article 230 of the Tax Code of the Russian Federation)

Submit calculations in form 6-NDFL to the Federal Tax Service in electronic form. You can report on paper only if during the period you paid income to no more than 24 employees (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

And if 25 or more people received payments from you for the first quarter, then via the Internet

What are the penalties for failure to submit information on Form 6-NDFL?

If you do not submit Form 6-NDFL to the tax office at your place of registration within the prescribed period, for example, instead of May 4, 2021, submit it on May 10, 2021, then you will be fined 1,000 rubles. for each full or partial month from the day established for reporting (clause 1.2 of article 126 of the Tax Code of the Russian Federation).

Tax authorities also have the right to suspend transactions on your bank accounts if Form 6-NDFL is not submitted within 10 days after the deadline.

If there is false information in form 6-NDFL, the company faces a fine of 500 rubles. for each document containing false information (Article 126.1 of the Tax Code of the Russian Federation). Moreover, if you yourself find an error in the 6-NDFL form, correct it and submit the updated 6-NDFL form, then there will be no fine.

Another fine awaits you if you submit a paper version to the tax office instead of the electronic form 6-NDFL. In this case, the fine will be 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). Until January 1, 2016, liability under Article 119.1 of the Tax Code of the Russian Federation did not apply to tax agents for personal income tax. The fact is that previously Chapter 23 of the Tax Code of the Russian Federation did not contain such a requirement - how to submit a calculation of personal income tax amounts calculated and withheld by tax agents.

Magazine Salary

Post:

Comments

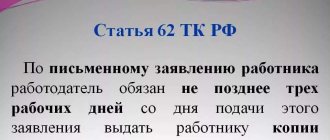

Deadline for submitting certificates in form 2-NDFL

The deadline for submitting 2-NDFL certificates depends on the number entered in the “Sign” field.

Certificate 2-NDFL with feature 2 must be submitted no later than March 1 of the year following the year of payment of income, and a certificate with feature 1 must be submitted no later than April 1 (clause 5 of Article 226, clause 2 of Article 230 of the Tax Code of the Russian Federation).

Thus, for 2021 you must submit 2-NDFL certificates (clause 7, article 6.1 of the Tax Code of the Russian Federation):

- with sign 2 - no later than 03/01/2017;

- with sign 1 - no later than 04/03/2017 (since April 1, 2017 is a day off).

How to fill out section 2 of the 2-NDFL certificate

In Sect.

2 certificates indicate information about the individual for whom the certificate was drawn up. In the “Citizenship (country code)” field, you must indicate the code of the country of which the individual is a citizen. This code is taken from the All-Russian Classifier of Countries of the World (OKSM). For example, for an employee who is a citizen of the Russian Federation, you need to enter code 643.

In the “Identity document code” field, indicate the code of this document in accordance with the Directory. For example, a passport of a citizen of the Russian Federation corresponds to code 21.

What income and deduction codes must be indicated in the 2-NDFL certificate

Income and deductions are reflected in the certificate according to the codes approved by the Order of the Federal Tax Service dated September 10, 2015 No. ММВ-7-11 / [email protected]

The most common income codes:

- 1010 — dividends;

- 2000 - wages;

- 2010 - remuneration under a civil contract for the performance of work (provision of services);

- 2012 - vacation pay;

- 2300 - temporary disability benefit;

- 2610 - material benefit from savings on interest for the use of borrowed funds;

- 2760 - financial assistance to employees (except for financial assistance issued in connection with the death of a family member, the birth of a child, a natural disaster or other emergency circumstances);

- 4800 - income for which there are no codes. For example, excess daily allowance, compensation for unused vacation upon dismissal (Letters of the Federal Tax Service dated September 19, 2016 No. BS-4-11/17537, dated July 6, 2016 No. BS-4-11/12127).

A list of deduction codes with a description is provided in accordance with Appendix No. 2 to the order dated September 10, 2015 No. ММВ-7-11/ [email protected] as amended by the Order of the Federal Tax Service of Russia dated November 22, 2016 No. ММВ-7-11/ [email protected]

The most common codes deductions:

- 126 - standard deduction for the first child to the parent (in a single amount);

- 127 - standard deduction for the second child to the parent (in a single amount);

- 128 - standard deduction for the third and next child to the parent (in a single amount).

- 311 - property deduction in the amount spent on the purchase (construction) of housing;

- 327 - social deduction for employee expenses on non-state pension provision, voluntary pension insurance, voluntary life insurance;

- 403 - professional deduction under the GPA for the performance of work (rendering services);

- 501 - deduction from the cost of gifts (up to 4,000 rubles per year);

- 503 - deduction from the amount of financial assistance (up to 4,000 rubles per year).

Reflection of income

The tax form indicates income paid to an employee under a civil law or employment contract, in accordance with paragraph 3 of Article 226 of the Tax Code. In this case, a special list of “Income Codes” is used. It contains new values that need to be taken into account when compiling the reference form for 2021. The amounts of bonuses paid for production results and other similar indicators provided for by the norms of Russian legislation, labor contracts or collective agreements are reflected with code 2002. If the amounts of remunerations transferred from the organization’s net profit, special-purpose funds or targeted revenues are indicated, then in the form indicate code 2003.

Sometimes the income received by an employee can be reduced by the amount of tax deductions. They are also indicated when reflected from the report. Section 4 of the form is intended for this.

In addition, the deduction codes have also changed - they have been updated and supplemented. Now, eight new codes have been added to standard deductions, which must be taken into account starting January 1, 2021.

The standard deduction for a second child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 to the parent, spouse of the parent, adoptive parent who is supporting the child, reflected by code 127. If we are talking about a deduction for the third and subsequent children, then it is necessary to indicate code 128. Deduction for a disabled child under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24, being a disabled person of group I or II, is indicated by code 129.

note

The dates of actual receipt of income, the procedure for calculating and transferring personal income tax affect the filling out of the tax accounting register, based on the data of which the calculation in form 6-NDFL and certificate 2-NDFL are generated.

If deductions are provided to a guardian, trustee, adoptive parent, or spouse of an adoptive parent who is providing for the child, code 130 is indicated for the first child, 131 for the second, and 132 for the third and subsequent children.

Deductions for disabled children under the age of 18 or a full-time student, graduate student, resident, intern, student under the age of 24 who are a disabled person of group I or II are reflected by code 133.

Social tax deductions have been supplemented with a new code that allows you to take into account the amount of costs for an independent assessment of qualifications - code 329. It must be applied from January 1, 2021.

How to fill out section 3 of the 2-NDFL certificate

In Sect. 3 certificates provide information:

- about income received by an individual, taxed at a specific tax rate (13, 15, 30 or 35%);

- about tax deductions that apply to specific types of income. These include, in particular, professional deductions and amounts not subject to personal income tax under Art. 217 of the Tax Code of the Russian Federation (Section V of the Procedure for filling out a certificate). Standard, property and social deductions in section. 3 are not shown.

The amounts of income are reflected in section. 3 certificates in chronological order, broken down by month and income code. In this case, the amounts of income are shown in the month in which the corresponding income is considered actually received (Section V of the Procedure for filling out the certificate). For example, if an employee received a salary for December 2021 in January 2021, then its amount must be reflected in the certificate for 2016 as part of income for December (Letter of the Federal Tax Service dated 02/03/2012 No. ED-4-3 / [email protected ] ).

After all, income in the form of wages is considered to be actually received on the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Opposite the income amounts for which deductions have been applied, the deduction code and its amount are indicated.

How to correctly fill out information about income for employees?

Form 2-NDFL is presented in several parts:

- the title part to reflect the details of the certificate and information about the tax agent;

- section 1 to reflect information about the employee;

- section 2 for income and income tax;

- section 3 for deductions;

- information about the person confirming the accuracy of the completed data.

At the top of the form there should be the TIN and KPP of the tax agent organization (if it is an individual entrepreneur, then without KPP).

The following is filled in sequentially:

- serial reference number;

- year for which submitted (2019);

- sign - 1 or 3 for reorganized companies;

- adjustment number - zero if 2-NDFL is submitted for the first time;

- tax number;

- name of the organization or individual entrepreneur acting as a tax agent;

- OKTMO;

- telephone;

- reorganized companies also indicate the form of reorganization and the TIN and KPP of the former organization.

In the section about the employee, fill in information about him:

- FULL NAME;

- status (for citizens of the Russian Federation this is 1);

- birth information;

- citizenship (643 for the Russian Federation);

- details of a passport or other identification document.

In the section on income and tax, you need to reflect data for the entire year in a generalized form for a specific employee:

- annual income accrued in favor of the employee;

- the basis for calculating the tax is the difference between income and the total amount of deductions provided;

- tax calculated from the base (13% * size of the tax base);

- tax deducted from an employee's salary;

- tax transferred to the budget;

- overpayment of personal income tax, if any;

- tax not withheld for various reasons.

The amount of deductions for calculating the tax base is calculated in the next section, where you need to show the deduction code and the corresponding amount for the year. For example, for standard benefits for children, code 126 is provided.

If in 2021 an employee applied to the Federal Tax Service to receive a tax notice to receive a property or social deduction through an employer, then you must indicate the details of the notice and the amount of the deduction provided for it.

The certificate must be signed and dated. If the transfer of 2-NDFL is carried out through a representative, then you must additionally indicate his full name and details of the power of attorney.

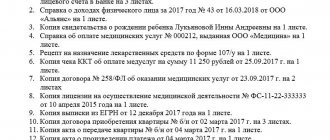

Filling example: