Home / Articles / How to withdraw authorized capital upon liquidation of an LLC

Published: 01/12/2018

When creating a commercial enterprise, the founders are required to contribute funds in a total amount of 10,000 rubles. At the same time, the owners have the right to pay for their shares with money or other things and rights. During the course of the company’s activities, these funds cannot disappear anywhere, they cannot be withdrawn or spent as other property. However, if the owners decide to leave the business, then the LLC is subject to closure, and all its obligations are immediately fulfilled.

Authorized capital: postings

The content of the article

Authorized capital is part of the organization’s own capital, representing the amount of funds invested by the owners to ensure authorized activities recorded in its constituent documents. This value determines the minimum size of property that guarantees the interests of creditors. Depending on the organizational and legal form, the authorized capital of an organization may be called authorized capital, mutual fund, or share capital. We will talk about synthetic and analytical accounting of authorized capital in our consultation.

The credit balance of account 80 must correspond to the amount of the authorized capital recorded in the constituent documents of the organization. This means that accounting entries for account 80 are made only after appropriate changes have been made to the constituent documents.

Accounting for authorized capital and settlements with founders (account 80 and 75)

Why do you need authorized capital? It forms start-up capital, which is used in the commercial activities of the enterprise, that is, it is the basis for further activities. In addition, the founders are liable for the debts of the enterprise within the framework of their shares in the authorized capital. That is, for creditors this is the minimum amount of property that they can return, a kind of guarantee of return of funds.

But that is not all. The formation of authorized capital is a business transaction, and for each operation we must carry out accounting entries using the double entry principle. Details on how to make postings are written here. In short, from the Chart of Accounts you need to select two accounts involved in the business transaction associated with the formation of the authorized capital, and make a simultaneous entry for the debit of one and the credit of the other.

Stage 6. Settlements with participants

The property and funds remaining after settlements with creditors must be distributed among the participants in proportion to their shares in the authorized capital.

If the participants were unable to agree on joint ownership, for example, of real estate, they will have to sell it and distribute the proceeds from the sale between them (clause 8 of Article 63 of the Civil Code). Or they couldn’t decide who would take the table, who the nightstand, and who the water cooler.

As everyone has already guessed, the accountant will make payments to the participants.

Postings 75 of the account for contributions to the authorized capital: to the current account, in the form of fixed assets and intangible assets

The fundamental procedure for creating any organization is the formation of its authorized capital. Founders and shareholders can use both cash and fixed assets (real estate, cars, equipment, etc.) as a contribution. The authorized capital is accounted for in accounting account 75. From this article you will learn how to reflect the founder’s contribution to the authorized capital in the transactions, depending on its type.

In order for an organization to be registered, it is necessary to contribute at least 50% of the authorized capital. But it should be noted that the legislation provides an exception for such an organizational and legal form as a joint-stock company. A joint stock company can obtain state registration without contributing authorized capital. But at the same time, half or more of the amount of the authorized capital must be paid for a period of no more than 3 months after state registration, the rest - no later than a year.

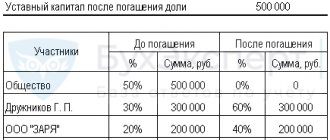

Return of part of the authorized capital to the founder-individual

In the event that the value of the corresponding part of the share is returned to the company's participants, or in the event that the authorized capital is reduced in accordance with the requirements of the legislation of the Russian Federation, the amount of such reduction in the authorized capital will not be included in the tax base when calculating income tax.

As already stated above, in accordance with Art. 66 of the Civil Code of the Russian Federation, property created through the contributions of founders (participants), as well as produced and acquired by a business partnership or company in the course of its activities, belongs to it (that is, the company) by right of ownership.

Capital contribution

When an enterprise is formed, as well as a change in the size of the authorized capital (registered in accordance with the law), the founders can transfer fixed assets, including motor vehicles, to the enterprise as a contribution . In accordance with clause 3.3 of PBU No. 6/01, the initial cost of fixed assets contributed to the contribution to the authorized (share capital) of the organization is recognized as their monetary value, agreed upon by the founders of the organization. In this case, the contribution can express the value of the car at the residual price, higher or lower than the original cost according to the documents of the transferring party.

In accordance with clause 2.13 of Instruction No. 37, property merged by enterprises for the purpose of joint activities is not subject to income tax. The property of legal entities united by the parties to the agreement for joint activities is accounted for on the joint balance sheet of the participant who, in accordance with the agreement, is entrusted with managing the common affairs of the parties to the agreement. This participant acts on the basis of a power of attorney signed by the other parties to the agreement.

3.3 Interim liquidation balance sheet

7 PBU 9/99 “Income of the organization” {amp}lt;4{amp}gt;) accordingly - even if the assets themselves, on which deferred tax arose, are shown in the liquidation balance sheet as property subject to distribution between the founders ( participants).———————————{amp}lt;3{amp}gt; Approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33н.{amp}lt;4{amp}gt; Approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n.

The procedure for writing off SHE and IT

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

The amount of IT is written off to the profit and loss account (clause 15 of PBU 10/99) as a conditional income tax expense, since in connection with the liquidation of the organization it is obvious that it is impossible to obtain economic benefits in the future in the form of a reduction in income tax calculations by the amount recorded on account 09 “Deferred tax assets” (p.

19 PBU 10/99). An entry is made: Debit 99 Credit 09. Basis - accounting statement and order (instruction) of the head of the organization. The amount IT is also written off to the profit and loss account, but as conditional income for income tax, since this obligation will no longer be able to affect the future for income tax calculations.

In essence, IT in the amount of the balance in account 77 “Deferred tax liabilities” has actually already brought economic benefit to the organization - at the time the temporary difference arose, which caused the formation of deferred tax. In other words, there is the formation of income and the need for its recognition in accounting (clause 16 of PBU 9/99). An entry is made for the write-off of IT: Debit 77 Credit 99. Basis - accounting certificate and order (instruction) of the head of the organization.

According to the author, when drawing up a liquidation balance sheet, an organization must write off the balances of ONA and ONO, listed on accounts 09 and 77, to the financial result, since these values will no longer be able to affect the state of the organization’s income tax calculations in the future due to its closure. The corresponding account in this case is account 99 “Profits and losses”. The basis for write-off is an accounting certificate and an order from the manager.

The authorized capital of an LLC (Limited Liability Company) is the amount of money or other funds that was invested in the project at the time of creation of the structure.

Accounting accounts 80 and 75

First of all, with its help, start-up capital is formed for the subsequent commercial activities of the enterprise. It consists of contributions from the founders, which can be either in the form of tangible property or in cash. Each founder has his own certain share in the capital, depending on its size, he will subsequently receive the corresponding profit from the commercial activities of the enterprise (dividends). The company is responsible for its obligations within the framework of this capital, so for creditors this is a kind of guarantee of satisfaction of their interests.

Authorized capital is the initial amount of funds (start-up capital) that the founders are willing to invest to ensure the activities of the enterprise. When registering an organization with the relevant authorities, constituent documents are drawn up, which include the cost of the authorized capital.

Main concepts

Availability of authorized capital is a mandatory condition when opening a legal entity. Without it, it is simply impossible to start any entrepreneurial activity within the organization. The amount depends on the legal structure of the legal entity.

Capital replenishment is provided through financial or property investments of the founders. The legislation determines that it is permissible to deposit funds both in rubles and in foreign currency (in this case, the amount of the authorized capital is reflected in the balance sheet in rubles at the MICEX exchange rate).

Provided that capital is formed from material assets (equipment, machinery, etc.) or intellectual assets (computer programs, unique developments, etc.), then when deposited they should be assessed and displayed in monetary terms.

If capital is formed through cash investments, then until all documents necessary for registration of a legal entity are submitted, it should be placed in a special bank account. This process looks like this:

- The founders decide on a bank that suits them as a servicer.

- The size of the authorized capital is calculated. It should be taken into account that it is not the same for different categories of legal entities (for example, for Open Joint Stock Companies its size must be at least 100 thousand rubles).

- The issue of the number of declared participants whose contributions form the capital is being resolved.

- An account is opened at the bank into which all funds are deposited.

- Once the company completes the registration process as a legal entity, the money must be transferred to the bank account of the newly created organization.

If the capital consists of material assets, then the participants must sign an act of acceptance and transfer of property. Officially, the contribution is fixed only after the created structure acquires the status of a legal entity.

To start operations, an organization will need an authorized capital

Thus, we can say that the authorized capital of the organization performs the following functions:

- Allows you to open and register a company as a legal entity.

- Helps to establish the size of the share of profit due to each founder, depending on the size of the contribution to the management company.

- Guarantees creditors that in the event of force majeure they will be able to return all their investments.

Chapter 2

Thus, it is up to the court to determine whether a company’s violation of its registration procedure is gross or irreparable. Therefore, the requirements of Article 20 of Law No. 14-FZ themselves cannot serve as an automatic basis for the liquidation of the company. Whether the company is liquidated or not will be decided by the court, taking into account the nature of the violations committed by the company and the consequences caused by them.

There are also intangible assets for which it is impossible to determine their useful life. Then this period is taken equal to 20 years (but, of course, not more than the life of the company itself). Let us immediately draw the attention of readers to the fact that for tax accounting purposes for the same intangible assets, the useful life is set within 10 years (and also no more than the period of activity of the taxpayer himself). This is stated in paragraph 2 of Article 258 of the Tax Code of the Russian Federation.

Are refund amounts subject to personal income tax?

According to Article 210 of the Tax Code of the Russian Federation, all income received by taxpayers forms the base for personal income tax. It does not matter the property or monetary form of income.

Despite the fact that the capital of an LLC is created through contributions from participants, it is the property of the company.

When receiving their shares, the founders also receive income from the company's own funds. Based on the above, refund amounts should be subject to personal income tax at a rate of 30 percent.

But in arbitration practice there is a different opinion. Participants receiving their shares do not directly benefit from this operation, since their previously invested funds are returned to them. Therefore, the amount returned should not be subject to income tax. However, such a position sometimes needs to be defended in court.

Formation of authorized capital: accounting entries

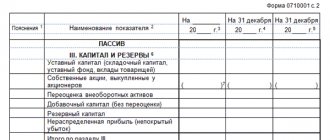

The authorized capital is the amount that the founders contribute after registering the company. It is displayed in the liability side of the balance sheet, since it is the source of the formation of assets. The founders can make contributions in the form of cash, non-cash funds, materials, fixed assets. The activities of the enterprise are financed from the funds of the management company.

How is the formation of authorized capital reflected in accounting? Postings depend on the sources of funds. To account for the authorized capital, accounts 80 and 75 are used. Receipts of funds are reflected in credit 75, and write-offs are shown in debit 75. The entry drawn up when forming the authorized capital in joint-stock companies looks like this: DT75 KT80 - the debt of the founders is reflected in the Criminal Code. Each owner must contribute to the capital in accordance with his share. Profits will then be distributed in the same ratio.

Accounting entries

The composition of accounting entries depends on the method of liquidation of the company.

- If an enterprise is liquidated by a voluntary decision of the owners, the management company is reflected in the liability.

Accounting entry Dt according to account 80.

Accounts 84 “Undistributed loss” or 99 “Profit and loss” become corresponding credit accounts.

When returning funds to the founders, the accounting entry will be as follows: Dt account 80 Kt account 75.

Sometimes the authorized capital is expressed in property value. In such situations, postings to account 80 correspond according to Kt with accounts 01, 41, 51.

From the moment these transactions are completed, the company can close bank accounts.

- If the LLC is reorganized by the owners, it is not necessary for the founders to reflect the transfer of the capital. But to streamline accounting, 00 accounts are used.

Authorized capital: postings

- Cash:

- cash;

- non-cash;

- Inventory assets:

- equipment (Deb. 01);

- vehicles (Deb. 01);

- goods (Deb. 10);

- materials (Deb. 10);

- Intangible assets:

- patents (Deb. 08.5);

- know-how (Deb. 08.5);

- licenses (Deb. 08.5);

- franchises (Deb. 08.5);

- agreement on assignment of rights (Deb. 08.5);

- shares, bonds of third legal entities. (Deb. 58);

Account No. 80 is inactive, but passive. Account 80 is necessary to summarize information about the movement and general condition of the organization's management company. Account balance 80 should be equal to the capital specified in the organization’s charter. Any movements in the MC account occur when a MC is created or changed (increased or decreased).

Reasons for liquidation

Considering that a company can be liquidated on a voluntary basis and forcibly, the reasons for these two types differ. If an organization ceases its activities based on an internal decision of the constituent meeting, then the reasons for this may be the following:

- The enterprise becomes unprofitable or its profit is very small.

- Contradictions arise between participants that cannot be resolved in any other way.

- Upon the departure of all founders, if they no longer want to engage in the type of commercial activity that the liquidated structure is oriented towards.

- The purpose for which the organization was created has been fully achieved.

- The time frame for which the opening of a legal entity was aimed has ended (for example, the license has expired).

The liquidation process can be initiated either by the owner himself or by the state. authority when detecting violations

Provided that liquidation occurs as a result of a court decision or order of authorized government bodies, the reasons for this may be the following:

- The company was initially opened in violation of the law.

- A legal entity carries out illegal activities or activities that are not stated in the organization’s Charter.

- The work of the enterprise is not supported by the availability of the necessary permits (certificates, licenses, etc.).

- Bankruptcy.

- Tax evasion.

There are a number of other reasons that are difficult to classify:

- Force majeure circumstances. This could be a natural disaster or an act of terrorism, i.e. something that could lead to damage to property, but does not depend on the will of the participants in the enterprise.

- An organization can be closed simply because its founders lose interest in its further activities.

Basic entries used for authorized capital

The authorized capital is created through founders' contributions, expressed in the form of cash or any property assets. There are often cases when founders invest not just money, but fixed assets or tangible assets that can be used in the production and economic process. In this regard, contributions to the authorized capital must be correctly allocated to accounting accounts.

When funds or property are transferred by participants for the purpose of contributing to the authorized capital, this action must necessarily be reflected in the accounting accounts. In other words, after the shares themselves have been reflected as a credit of 80 and a debit of 75, we show the components of the shares. Examples of correspondence regarding cash and material property include the following postings:

During liquidation there is no money to return the authorized capital

Authorized capital upon liquidation

When the tax authority decides to suspend transactions on the accounts of a liquidated company, the rights of participants to register ownership of the received property are limited. In this case, they have the opportunity to go to court (Resolution of the Federal Antimonopoly Service of the Moscow Region dated April 28, 2011 No. KG-A40/3403-11, Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 23, 2009 No. A69-4315/08-F02-1027/09). If the founders, in violation of the procedure established by law, take away the property before full settlement with creditors, then such property can be demanded from them.

If it is impossible to return the property in kind, its value is claimed.

- All property is subject to distribution if the legal entity has no obligations to creditors. In this case, compliance with two basic conditions is mandatory. Firstly, the period for receiving claims from creditors is two months. The period must be counted from the date of publication of the liquidation record in the Bulletin. Secondly, the compiled interim liquidation balance sheet must reflect all settlements with creditors.

- Only the part of the property remaining after full settlement of debts will be distributed. The remaining funds must be entered into the liquidation balance sheet.

- The property is not distributed or transferred to the company's participants, since it is not available after settlements with creditors. Such information is also entered into the balance sheet.

After its creation, the liquidation commission develops and approves a plan for the liquidation of the enterprise, which begins with a complete inventory. In accordance with subparagraph 27 of the Order, an inventory is required of a legal entity at the beginning of the liquidation procedure. All positions of assets and liabilities are subject to inventory. If discrepancies are identified between accounting data and the actual availability of property, they must be reflected in the accounting accounts. 100% of the authorized capital of a Russian LLC that is in the process of liquidation belongs to another Russian organization. In 2011, the LLC acquired a stake in the authorized capital of an organization that is a resident of the Republic of Belarus; the cost of the contribution to the authorized capital was determined in US dollars; as payment for the share in the authorized capital, the company transferred an object of fixed assets.

This financial investment has not been revalued by the organization. The LLC applies a general taxation system. What is the procedure for accounting and tax accounting (profit tax) for a liquidated organization of the transaction of transferring to the sole participant a contribution to the authorized capital of a Belarusian organization? Let us recall that in accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, information on the availability and movement of financial investments is reflected in account 58 “Financial investments”, and all settlements with LLC participants are reflected in account 75 “Settlements with founders (see also the letter of the Ministry of Finance of Russia dated 03.07. 2007 N 07-05-12/06). In accordance with Part 3 of Art. 62 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), after approval of the decision to liquidate a legal entity, a liquidation commission is to be formed, whose task is to conduct the liquidation procedure and determine its terms.

The commission will carry out its activities at all stages of liquidation of a legal entity, including taking part in the distribution of property between the founders. If a company has been active and functioning at all stages of its existence, it is possible that it may accumulate debts. Debt settlement is an integral part of the liquidation procedure and the further distribution of property between the company's participants.

Stage one. Start of the procedure

Probably, many will now think that at the very beginning of the procedure the accountant definitely has nothing to do. The decision to begin liquidation and appoint a liquidator is made by the participants; the liquidator (who is often appointed as a director) becomes the manager; again, the liquidator must notify the tax authorities. What's an accountant to do?

No one can cancel the current activities of an accountant - submitting reports to the tax office and funds, calculating and paying wages.

Salaries need to be mentioned separately. According to clause 1, part 1, art. 81 of the Labor Code of the Russian Federation, employees dismissed due to the liquidation of the company must be notified two months before dismissal. Since it is illogical to notify them before the decision to liquidate is made, this should be done immediately after it is made.

The algorithm turns out like this:

- The participants decide on liquidation and the appointment of a liquidator.

- The liquidator notifies employees of the upcoming liquidation and their dismissal in connection with this.

- After two months, the liquidator terminates the employment contracts with the employees.

- During these two months, employees must be accrued and paid wages.

Further, if the company has money to pay employees, they are paid all the payments due upon dismissal.

If there is no money, the employees become creditors of the liquidated company. Perhaps the debt owed to them will be compensated after the sale of the property. If there is not enough money in this case, the company is obliged to go to the simplified bankruptcy procedure.

By the way, if the accountant is also a personnel officer, then the notice to employees will most likely be assigned to him. Although the liquidator must do this.

Find out the cost of accounting and personnel records!

What to do with the authorized capital upon liquidation of an LLC

All savings that remain after settlements with creditors are divided between the founders in the shares that were contributed when drawing up the authorized capital. The accountant's task is to determine the market value of the property and the actually paid shares. If the price of the former is higher than the initial contribution of the founder, then the difference is written off as assets received free of charge.

If the amounts are equal, then the amount written off is not taxable. If losses occur, the value of the contribution made to the management company is also not subject to taxation.

- organize a general meeting of founders;

- approve the decision to liquidate the LLC and form a liquidation commission;

- notify the tax office of the upcoming liquidation;

- submit an announcement to the media (specialized magazine “Bulletin of State Registration”) about the closure of the enterprise and the acceptance of claims from creditors;

- determine the amount of accounts payable by forming an interim liquidation balance sheet;

- make settlements with creditors, employees and other authorities;

- pay profit to the founder;

- approve the liquidation balance sheet (final);

- Submit an application for registration of liquidation, a liquidation balance sheet, and a receipt for payment of the state duty to the registering authority.

5. Appeal the actions or inaction of the Company to the Federal Service for Supervision in the Sphere of Communications, Information Technology and Mass Communications or in court if a citizen believes that LLC Legal Company “Start” is processing his personal data in violation of the requirements of Federal Law No. 152 -FZ “On personal data or otherwise violates his rights and freedoms. Processing of personal data is any action (operation) or set of actions (operations) performed using automation tools or without the use of such means with personal data, including collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution, provision, access), depersonalization, blocking, deletion, destruction of personal data;7) Personal data is stored in a form that allows you to identify the subject of personal data no longer than required by the purposes of processing personal data, unless the period for storing personal data is established by federal law, an agreement to which the subject of personal data is a party, beneficiary or guarantor. The processed personal data is subject to destruction or depersonalization upon achievement of the processing goals or in the event of loss of the need to achieve these goals, unless otherwise provided by federal law.

- if one of the LLC participants has not been paid his part of the profit, division of the authorized capital (hereinafter referred to as the authorized capital) may only be possible after all payments have been made;

- in the event that the liquidation balance indicator is negative, then first it is repaid at the expense of the authorized capital, and then the property is divided between the participants of the LLC;

- If a company declares itself bankrupt, debts are covered from the authorized capital, and then the remaining amount is divided among the participants.

What documents are needed?

The liquidation process is accompanied at all stages by the need to draw up all kinds of documents. It looks like this:

- Minutes that record the decision on liquidation adopted at the general meeting.

- Notice of impending liquidation to the Tax Office (must be sent within 3 working days after the meeting).

- Information letter on the formation of the liquidation commission.

- An interim liquidation balance sheet, in which all debts should be displayed, as well as a list of all tangible property of the company and the amount of monetary assets. This document is drawn up no earlier than 2 months after the publication of information about the beginning of liquidation, so that all creditors have time to present their claims. After completing work on the document, it must be certified by a notary and sent to the Tax Service.

- An act on the distribution of remaining funds, which must be signed by all founders and members of the liquidation commission.

- The final liquidation balance sheet is drawn up only after all debts to creditors, government agencies and employees of the enterprise have been repaid.

- A receipt confirming the fact of payment of the state duty.

In addition, all primary documentation, accounting reports for the entire life of the enterprise, correspondence with funds and government agencies must be submitted to the archive.

The liquidation process must be accompanied by a variety of documentation

Systematization of accounting

The main goal of any business enterprise is to earn a profit in the amount necessary to ensure normal functioning, including investing in assets and using the profits for consumption. At the same time...Lyudmila Dmitrievna is simply burning! Of course they are... is. yes, after all, he may not take part in management, and be the founder of 5 companies at once - at the same time, for him, everything brings profit and is an object of investment. Securities can be divided into debt and equity. Debt securities are all types of securities that give their owner the right to return

by a certain date the amount lent to them and a fixed income. Debt securities...If there are securities, there is a market, there are no securities and there is no market.

That's the whole secret. Well, I don't think it's a difficult question. Go to the websites of investment companies, or just search on the Internet. Shares, bonds, derivatives market and how you can use it... when closing an LLC after repaying all debts, the authorized capital

and the remaining property is divided between the founders according to the Charter (becomes property). After this, you can safely register an individual entrepreneur.

Individual entrepreneur has authorized capital

no, so nothing...maybe just issue an invoice for all the goods for 1p... Sell in installments, and after

liquidation

pay off the debt. Listen to STELLA until she says “But this option is possible... Because if you show the implementation (within OSNO), you will have to pay VAT...ed. Federal Law of December 28, 2002 N 185-FZ) A share is an issue-grade security that secures the rights of its owner (shareholder) to receive part of the profit of a joint-stock company in the form of dividends, to participate in the management of a joint-stock company... you need an economic dictionary Zhanna... here is a link to the library everything is there. SHARES (from the Dutch actie, German aktie) securities issued by joint-stock companies, companies, commercial banks, without... In contrast to compulsory motor liability insurance (damage insurance), under CASCO (that is, under a voluntary insurance agreement) there may be certain problems.

However, with the revocation of the license, the insurer’s responsibilities do not cease. He is obliged to settle everything within six months... Compensation payments are provided only by the law on compulsory motor liability insurance; as for CASCO, there is no one to present losses to. I’ve already had a lawsuit with this company, if you’re interested, write to the soap also via Casco. No way. To the court and to the RSA. To receive...The joint stock company issues exclusively issue-grade securities, which by their definition cannot but be registered, so Yuri’s answer is incorrect.

A joint stock company has the right to issue shares and bonds. Since the bonds... are registered, the owner of which must be registered in the appropriate register. When reselling registered shares, the coordinates of the new owners must be entered. Most often, these shares are used to analyze the shareholder structure, with the aim of... During liquidation, there is no money to return the authorized capital