If you discovered an error in OKTMO yourself

If you find an error in your payment slip in OKTMO, submit an application to the Federal Tax Service to clarify the payment as soon as possible (Article 45 of the Tax Code of the Russian Federation). You can make an application in free form, since there are no special forms for it. In the application, please indicate:

- date of payment, amount indicated in the payment order, as well as purpose of payment;

- incorrectly specified details;

- correct value of the attribute;

- list of documents attached to the application.

Please attach to your application a copy of the payment order in which the error was made, as well as a bank statement confirming the transfer of the payment.

Based on your application, the inspectorate can initiate a reconciliation of taxes paid or immediately make a decision to clarify the payment on the day the tax is actually paid. Penalties accrued on the personal account will be recalculated.

OKTMO in a payment order in 2021

The corresponding field 105 in the payment order is filled in only when paying taxes or insurance premiums. In other cases, for example, when making payments to suppliers, this column remains empty. The OKTMO classification was developed by Rosstandart in order No. 159-st dated June 14, 2013. The current digital codes of municipalities (municipalities) serve to territorially designate the taxpayer’s activities and are used in 2021 instead of the previously relevant OKATO.

The size of the code varies and can be either 8-digit for inter-populated areas and municipalities, or 11-digit for populated areas. For example, OKTMO of the Rostov region is 60701000, and OKTMO of the village of Kushchevskaya, Krasnodar Territory is 03628416101. 8-digit codes are mainly used to designate MO. If it is necessary to identify a specific locality - village, village, etc., then an additional 3-digit encoding is added. How to correctly fill out field 105 in a payment order?

If an error in OKTMO was discovered by the tax authorities

If the tax office discovers an error in OKTMO in the payment slip, you will first receive a demand for payment of the resulting arrears with accrued penalties and fines. The arrears will need to be paid within eight working days from the date of receipt of the request. Unless, of course, it specifies a longer period of time to pay the tax.

If the debt is not repaid within the established period, the Federal Tax Service will begin the procedure for collecting the arrears. This means that the tax authorities will write off the required amount from your account. And the same amount will be blocked to ensure payment of the arrears.

If the demand was not made, the tax authorities do not have the right to write off taxes for collection.

How long your account will be blocked is stated in paragraph 7 of Article 76 of the Tax Code.

The suspension of transactions of a taxpayer-organization on his bank accounts and transfers of his electronic funds is valid from the moment the bank receives a decision of the tax authority to suspend such operations, such transfers and until the bank receives a decision of the tax authority to cancel the suspension of transactions on the accounts of the taxpayer-organization with the bank, decision of the tax authority to lift the suspension of transfers of its electronic funds

.

For several days you will not be able to manage your money until the payment is “attached” to your OKTMO again. During this time, you will actually pay the tax twice, as well as penalties and fines, and you will have an overpayment.

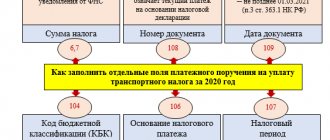

Accounting Encyclopedia. Situation 6: “How to fill out a payment form for taxes and contributions”

Instructions on how not to make mistakes when filling out the fields of a payment order for taxes and contributions, where errors are most often made.

Since 02/04/2014, filling in the “budget” fields of a payment order is regulated by Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation.”

This is what the payment looks like now.

Field 101. Payer status

The Payer Status field is intended primarily for financial statistics purposes.

This field is very important from a technical point of view: it is this field that determines whether the payment order is budgetary.

If a value is specified in the “Payer Status” field, then banks are required to check that fields 102–109 are filled in (therefore, unused fields must be filled in with the number “0”). There is no zero in field 110, it remains empty

If you do not pay to the budget, then the “Payer status” field is not filled in

| Code | Meaning |

| 01 | taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - a legal entity; |

| 02 | tax agent; |

| 03 | the federal postal service organization that has drawn up an order for the transfer of funds for each payment by an individual, with the exception of payment of customs duties; |

| 04 | tax authority; |

| 05 | Federal Bailiff Service and its territorial bodies; |

| 06 | participant in foreign economic activity - a legal entity, with the exception of the recipient of international mail; |

| 07 | customs Department; |

| 08 | payer - a legal entity, an individual entrepreneur, a notary engaged in private practice, a lawyer who has established a law office, the head of a peasant (farm) enterprise, transferring funds to pay payments to the budget system of the Russian Federation (with the exception of taxes, fees, insurance premiums and other payments administered by tax authorities); |

| 09 | taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - individual entrepreneur; |

| 10 | taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - a notary engaged in private practice; |

| 11 | taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - a lawyer who has established a law office; |

| 12 | taxpayer (payer of fees, insurance premiums and other payments administered by tax authorities) - head of a peasant (farm) enterprise; |

| 13 | taxpayer (payer of fees for the performance by tax authorities of legally significant actions, insurance premiums and other payments administered by tax authorities) - an individual; |

| 15 | a credit organization (a branch of a credit organization), a payment agent, a federal postal service organization that has drawn up a payment order for the total amount with a register for the transfer of funds accepted from payers - individuals; |

| 16 | participant in foreign economic activity - an individual, |

| 17 | participant in foreign economic activity - individual entrepreneur; |

| 18 | a payer of customs duties who is not a declarant, who is obligated by the legislation of the Russian Federation to pay customs duties; |

| 19 | organizations and their branches (hereinafter referred to as organizations) that have drawn up an order for the transfer of funds withheld from the wages (income) of a debtor - an individual to repay arrears of payments to the budget system of the Russian Federation on the basis of an executive document sent to the organization in the prescribed manner ; |

| 20 | a credit organization (branch of a credit organization), a payment agent, who drew up an order for the transfer of funds for each payment by an individual; |

| 21 | responsible participant in a consolidated group of taxpayers; |

| 22 | member of a consolidated group of taxpayers; |

| 23 | Social Insurance Fund of the Russian Federation; |

| 24 | payer - an individual who transfers funds to pay fees, insurance premiums administered by the Social Insurance Fund of the Russian Federation, and other payments to the budget system of the Russian Federation (except for fees for the performance of legally significant actions by tax authorities and other payments administered by tax and customs authorities); |

| 25 | guarantor banks that have drawn up an order for the transfer of funds to the budget system of the Russian Federation upon the return of value added tax excessively received by the taxpayer (credited to him) in a declarative manner, as well as upon payment of excise taxes calculated on transactions of sale of excisable goods outside the territory of the Russian Federation , and excise taxes on alcohol and (or) excisable alcohol-containing products; |

| 26 | founders (participants) of the debtor, owners of the property of the debtor - a unitary enterprise or third parties who have drawn up an order for the transfer of funds to pay off claims against the debtor for the payment of mandatory payments included in the register of creditors' claims during the procedures applied in a bankruptcy case |

| 27 | credit organizations (branches of credit organizations) that have drawn up an order for the transfer of funds transferred from the budget system of the Russian Federation, not credited to the recipient and subject to return to the budget system of the Russian Federation; |

| 28 | participant in foreign economic activity - recipient of international mail. |

Field 104. Budget classification code (BCC)

The “Budget classification code” field is the main one for determining the purpose of the payment to the budget. The code consists of 20 digits. Lists of BCCs for each year can be found on our website in the Tools section.

The BCC values are the same for the entire country; if your company has divisions in different regions, then for the same taxes you will indicate the same BCC.

Field 105. Code OK (previously the OKATO code was indicated in this field) contains the code assigned to the territory in which funds from taxes, fees and other payments are mobilized. If the payment is made on the basis of a declaration, then the OKTMO code in the declaration must match the code in the order. OKTMO codes are established not only for the municipalities themselves, they correspond to:

- municipalities;

- inter-settlement territories (i.e. territories that are not part of urban and rural settlements)

- individual settlements included in the settlement.

Field 106. Payment basis indicator

This field, along with several other fields, is intended to identify the purpose of the payment. The field is encoded with two characters:

| Code | Meaning |

| TP | current year payments; |

| ZD | voluntary repayment of debts for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority to pay taxes (fees, insurance contributions); |

| BF | current payment of an individual - a bank client (account holder), paid from his bank account; |

| TR | repayment of debt at the request of the tax authority to pay taxes (fees, insurance contributions); |

| RS | repayment of overdue debt; |

| FROM | repayment of deferred debt; |

| RT | repayment of restructured debt; |

| PB | repayment by the debtor of debt during the procedures applied in a bankruptcy case; |

| ETC | repayment of debt suspended for collection; |

| AP | repayment of debt according to the inspection report; |

| AR | repayment of debt under a writ of execution; |

| IN | repayment of investment tax credit; |

| TL | repayment by the founder (participant) of the debtor, the owner of the property of the debtor - a unitary enterprise, or a third party of debt in the course of procedures applied in a bankruptcy case; |

| ST | repayment of current debt during the procedures applied in a bankruptcy case. |

If the value zero (“0”) is indicated in detail “106” of the order for the transfer of funds, tax authorities, if it is impossible to clearly identify the payment, independently attribute the received funds to one of the above payment grounds, guided by the legislation on taxes and fees

Field 107. Tax period indicator

The “Tax period indicator” field consists of 10 characters (including separator dots). The value of the field depends on the contents of field 106 “Basis of payment”:

| Field 106 | Meaning | Field digits | ||||

| 1−2 | 3 | 4−5 | 6 | 7−10 | ||

| TP or ZD or BF | monthly payments | MS | . | month number (01−12) | . | year |

| quarterly payments | K.B. | . | quarter number (01−04) | . | year | |

| semi-annual payments | PL | . | semester number (01−02) | . | year | |

| annual payments | GD | . | 00 | . | year | |

| tax paid in annual installments over several deadlines established by law | payment term ( HH.MM.YYYY ) | |||||

| TR | payment deadline established in the tax authority’s request for payment of taxes (fees) | term ( HH.MM.YYYY ) | ||||

| PC | date of payment of part of the installment tax amount in accordance with the established installment schedule | date ( HH.MM.YYYY ) | ||||

| FROM | deferment end date | date ( HH.MM.YYYY ) | ||||

| RT | date of payment of part of the restructured debt in accordance with the restructuring schedule | date ( HH.MM.YYYY ) | ||||

| PB | date of completion of the bankruptcy procedure | date ( HH.MM.YYYY ) | ||||

| ETC | date of completion of the suspension of collection | date ( HH.MM.YYYY ) | ||||

| IN | date of payment of part of the investment tax credit. | date ( HH.MM.YYYY ) | ||||

| TL | date of payment | date ( HH.MM.YYYY ) | ||||

| ST | date of payment | date ( HH.MM.YYYY ) | ||||

| AP | — | 0 | ||||

| AR | — | 0 | ||||

In case of early payment of a tax payment, the tax period indicator shall indicate the first upcoming tax period for which the tax (fee) is paid.

Field 108. Document number indicator

The “Document number indicator” field contains the document number (without the number sign!), the type of which depends on field 106 “Basis of payment”:

| Field 106 | Purpose of field 108 |

| TP | 0 |

| ZD | 0 |

| TR | number of the tax authority's request for payment of taxes (fees) |

| RS | installment plan number |

| FROM | deferment decision number |

| RT | restructuring decision number |

| PB | number of the case or material considered by the arbitration court |

| ETC | number of the decision to suspend collection |

| AP | inspection report number |

| AR | number of the enforcement document and the enforcement proceedings initiated on the basis of it |

| IN | number of the decision on granting an investment tax credit; |

| TL | number of the arbitration court ruling on the satisfaction of the statement of intention to pay off the claims against the debtor. |

| ST | 0 |

When drawing up an order to transfer funds to pay tax payments of a payer - an individual - a bank client (account holder) based on a tax return (calculation), zero (“0”) is indicated in the field.

The “No” sign is not written in the field. The field may also contain the value “0” if the corresponding indicator is not applicable to the payment of this type.

Field 109. Document date indicator

The “Document date indicator” field contains the document date (in the format “ HH.MM.YYYY

"), specified in field 108 "Document number indicator":

| Field 106 | Purpose of field 109 |

| TP | date of signing of the declaration by the taxpayer |

| ZD | 0 |

| TR | date of the tax authority's request for payment of taxes (fees) |

| RS | date of decision on installment plan |

| FROM | date of decision to postpone |

| RT | date of decision on restructuring |

| PB | date of the arbitration court's decision to initiate bankruptcy proceedings |

| ETC | date of decision to suspend collection |

| AP | date of inspection report |

| AR | date of issuance of the writ of execution and the date of enforcement proceedings initiated on its basis. |

| IN | date of decision to grant investment tax credit |

| TL | date of the arbitration court ruling on the satisfaction of the statement of intention to repay the claims against the debtor |

| ST | 0 |

When a taxpayer - an individual - a bank client (account holder) fills out a settlement document for payment of tax payments on the basis of a tax return, field 109 indicates the date of submission of this declaration to the tax authority, or when sending a tax return by mail, the date of sending the postal item.

The field may also contain the value “0” if the corresponding indicator is not applicable to the payment of this type.

Field 22. Code (UIN)

Unique accrual identifier. Consists of 20 or 25 characters. If there is no UIN, 0 is entered.

Field "Purpose of payment"

The “Purpose of payment” details of the order for the transfer of funds indicate additional information necessary to identify the purpose of the payment. In some cases, this information is strictly regulated, for example, when paying taxes for another person.

Customs payments

I would also like to draw the attention of organizations and individual entrepreneurs working with foreign counterparties to the changes affecting customs duties. In this case we are talking about payments administered by customs authorities.

For payments established by the Customs Union, new payment basis codes have appeared, indicated in field “106” of the payment order:

- “DK” – declaration for goods (field “108” – the last 7 digits from the customs declaration number (serial number), field “109” – date from the number of the declaration for goods);

- “PC” – customs receipt order (field “108” – number of the customs receipt order, field “109” – date of the customs receipt order);

- “КК” – adjustment of the goods declaration (field “108” – the last 7 digits from the customs declaration number (serial number), field “109” – date from the goods declaration number);

- “TC” – requirement for payment of customs duties (field “108” – number of the requirement for payment of customs duties, field “109” – date of the requirement for payment of customs duties).

If you are an individual, then if you indicate in field “101” of the payment document one of the payer statuses “03”, “16”, “19”, “20” and at the same time there is no UIN in field “22”, put in field “108” "The value "0" is only possible when filling out the "TIN" column.

In connection with these changes in payment orders to the budget system of the Russian Federation, all fields that are provided for the transfer of tax payments must be filled in. Without these fields, the bank will not process the payment.

Which fields should we fill out in a new way?

On March 28, 2021, the changes approved by Order of the Ministry of Finance of the Russian Federation dated September 23, 2015 No. 158n and Directive of the Central Bank of the Russian Federation dated November 6, 2015 No. 3844-U came into force regarding the completion of payment orders when transferring funds to the budget system of the Russian Federation. The changes affected the completion of the following fields of the payment order: code 60 (TIN), code 22 (UIN), code 102 (KPP), code 104 (KBK), code 105 (OKTMO), code 110 (payment type) (Fig. 1).

Regarding the TIN, KPP, OKTMO and KBK, the Ministry of Finance clarified the number of characters that these fields should consist of:

- The checkpoint (field 102, 103) must consist of 9 digits, and the first two digits must not be zeros. This is explained by the fact that the first two digits of the checkpoint are the subject code. Also, the checkpoint should not consist only of zeros. In the event that there is no checkpoint (for example, for an individual entrepreneur), 0 is simply entered in field 102.

- KBK (field 104) must consist of 20 digits. Moreover, all numbers in the KBK cannot be zeros at the same time.

- OKTMO (field 105) must consist of 8 or 11 digits and cannot consist only of zeros.

- The TIN (field 60.61) for legal entities must consist of 10 digits, for individual entrepreneurs - 12. The first and second characters of the TIN cannot begin with “00”. According to the new requirements, individuals may not indicate the TIN in the payment order if SNILS (field 108) or UIN (field 22) is indicated. If these fields are not filled in, the TIN must be indicated.

UIN (field 22) is now mandatory to fill out if tax is paid upon request. The UIN consists of 20 or 25 digits and is taken from the request for which payment is made. When paying current taxes, you must enter 0 in field 22. This rule was adopted to make it easier for the tax inspectorate to identify the payer in order to prevent “losses” of tax payments when they are determined as “unclarified” due to the indication of incorrect details.

Another important change affected field 110 “Payment Type”. From March 28, the field value must be empty. To ensure that setting this value does not cause difficulties, you need to promptly update the database of your 1C accounting program.