| A busy schedule prevents you from attending professional development events? We found a way out! |

In January 2015, the selling organization issued an invoice with a technical error in the VAT amount. The total cost including VAT in the invoice has not changed. The declaration for the first quarter of 2015 has been submitted. The error led to an understatement of the tax base.

Consultation provided on June 11, 2015.

What to do in this situation? Do I need to issue a correction invoice? How to fill out an updated declaration?

Having considered the issue, we came to the following conclusion:

In this situation, the organization must issue the buyer not an adjustment invoice, but a corrected one. Corrections to the invoice are made by drawing up a new copy of the invoice.

In the additional sheet to the sales book for the first quarter of 2015, the organization should cancel the erroneously issued invoice and register a corrected invoice. We believe that this procedure does not conflict with paragraph three of clause 11 of the Rules for maintaining a sales book used in VAT calculations.

It is also necessary to recalculate the tax base and the amount of VAT for the first quarter of 2015 and submit to the tax authority an updated tax return for the specified tax period.

Is clarification needed?

If inaccurate information and errors are found in the tax return submitted to the Federal Tax Service, which did not lead to an understatement of the amount of tax payable, the taxpayer has the right, but is not obliged, to make the necessary changes to the tax return and submit an updated tax return (clause 1 of Article 81 of the Tax Code RF).

This means that in the general case, recalculation of the tax base in the period when an error was identified, which led to an excessive payment of tax, can be done in the current period, that is, the period when the error was identified (clause 1 of Article 54 of the Tax Code of the Russian Federation).

But this general procedure does not apply to errors in the VAT return made in the past period. They are corrected only during the period of commission (clause 3, 11 of the Rules for maintaining the sales ledger). After all, when correcting errors of past periods, it is impossible to correctly fill out the declaration for the current period, in particular, the data on issued invoices in section 9 of the VAT declaration.

This means that when canceling an erroneously issued invoice for the previous quarter, you must:

- make corrections to the sales book by drawing up an additional sheet with negative numerical data for the extra invoice;

- submit an updated VAT return for the quarter for which an additional sheet was left with the cancellation of the extra invoice.

Rationale for the conclusion:

Invoice

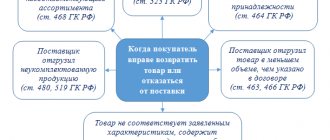

In accordance with paragraph three of clause 3 of Art. 168 of the Tax Code of the Russian Federation, an adjustment invoice is issued by the seller to the buyer when the cost of shipped goods changes, including in the event of a change in price (tariff) and (or) clarification of the quantity (volume) of shipped goods. The seller issues this invoice no later than five calendar days, counting from the date of drawing up the documents specified in clause 10 of Art. 172 of the Tax Code of the Russian Federation.

Based on the provisions of paragraph 10 of Art. 172 of the Tax Code of the Russian Federation, such documents are: contract, agreement, other primary document confirming the buyer’s consent (fact of notification) to a change in the cost of shipped goods, including due to a change in price (tariff) and (or) change in the quantity (volume) of shipped goods (for additional information, see letters from the Ministry of Finance of Russia dated October 7, 2013 N 03-07-09/41454, dated December 29, 2012 N 03-07-09/168).

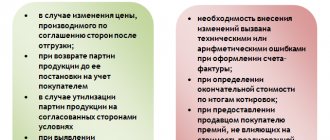

Please note that an adjustment invoice is drawn up in cases where the cost or quantity of previously shipped goods changes and the invoice issued for the shipment of this product was drawn up correctly by the seller.

In a letter from the Federal Tax Service of Russia dated 02/01/2013 N ED-4-3/ [email protected] , tax department specialists indicated that if a change in the cost of goods (work, services) occurred as a result of correcting a technical error that arose as a result of incorrect entry of price data and (or) the quantity of goods shipped (work performed, services provided) into the information systems used for accounting and tax accounting, then the seller does not issue an adjustment invoice.

In this case, appropriate corrections must be made to the invoice issued upon shipment. These corrections are made by the seller in the manner established by clause 7 of the Rules for filling out an invoice used in VAT calculations (hereinafter referred to as the Rules) to the Decree of the Government of the Russian Federation of December 26, 2011 N 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax" (hereinafter referred to as Resolution N 1137) by drawing up a new copy of the invoice (see also letters of the Federal Tax Service of Russia dated 08/23/2012 N AS-4-3/ [email protected] , Ministry of Finance of Russia dated 08/23/2012 N 03-07-09/125, dated 08/15/2012 N 03-07-09/119, dated 08/08/2012 N 03-07-15/102, dated 04/13/2012 N 03-07-09/34, dated 03/23. 2012 N 03-07-09/25, dated 12/05/2011 N 03-07-09/46, dated 11/30/2011 N 03-07-09/44).

In the situation under consideration, a technical error was made in the issued invoice that was not related to the cost and quantity of goods.

Therefore, in this case, the organization must issue the buyer not an adjustment invoice, but a corrected one.

Please note that new copies of invoices are not drawn up if the errors do not prevent the tax authorities from identifying the seller, the buyer, the name of the goods, their value, as well as the tax rate and the amount of tax charged to the buyer (second paragraph of clause 2 of Article 169 of the Tax Code of the Russian Federation, paragraph four of clause 7 of the Rules).

In the analyzed situation, an error was made in the tax amount. Accordingly, it is necessary to make corrections to a previously issued invoice (by drawing up a new copy) (for additional information, see letter of the Ministry of Finance of Russia dated May 30, 2013 N 03-07-09/19826).

Sales book

The seller must cancel the original (erroneous) invoice and accept a new (corrected) one instead. All these changes are recorded by him in the sales book.

Clause 2 of the Rules for maintaining the sales book, used in VAT calculations, approved by Resolution N 1137 (hereinafter referred to as the Rules for maintaining the sales book), determines that the registration of invoices in the sales book is carried out in chronological order in the tax period in which the tax liability arises .

At the same time, in paragraph three of clause 3 of the Rules for maintaining the sales book it is stated that if it is necessary to make changes to the sales book (after the end of the current tax period), the registration of the corrected invoice is made in an additional sheet of the sales book for the tax period in which the invoice was registered. invoice before corrections are made.

In accordance with clause 11 of the Rules for maintaining the sales book, when registering invoices and adjustment invoices in the sales book, the indicators in columns 13a-19 of the sales book are indicated with a positive value, except in cases of cancellation of an entry in the sales book. If these entries are canceled (before the end of the current tax period) in the sales book, the indicators in these columns are indicated with a negative value.

When an entry in the sales book is canceled (after the end of the current tax period) for an invoice (including an adjustment one) due to corrections being made to it, additional sheets of the sales book are used for the tax period in which the invoice was registered (including including adjustment) until corrections are made to it.

Corrected invoices (corrected adjustment invoices) in the specified cases are registered in the sales book or an additional sheet of the sales book as the obligation to pay tax arises, indicating positive values in the corresponding columns of the sales book, additional sheet of the sales book.

Let us note that since the last paragraph of clause 11 of the Rules for maintaining a sales book applies both to cases of cancellation of entries before the end of the current tax period, and to cases of cancellation of entries after the end of the tax period, then, in our opinion, under the phrase “as the obligation to payment of tax" should be understood as including the occurrence of the obligation to pay tax in the previous tax period.

For example, in a situation where an invoice is corrected before the end of the tax period, the erroneously issued invoice is recorded in the sales book again. At the same time, its indicators are entered in columns 13a-19 with the sign “-“. And the corrected invoice is registered in the sales book in the prescribed manner with positive values.

In a situation where an invoice is corrected after the end of the tax period, an additional sheet of the sales ledger is issued for the quarter in which the erroneous invoice was registered. The additional sheet reflects (clause 3 of the Rules for filling out an additional sheet of the sales book used in VAT calculations approved by Resolution N 1137 (hereinafter referred to as the Rules for filling out an additional sheet of the sales book)):

1) an erroneously completed invoice. Its indicators are entered in columns 13a-19 with the sign “-“;

2) corrected invoice in accordance with the established procedure with positive values.

Thus, we believe that in the situation under consideration, the corrected invoice should be registered in an additional sheet of the sales book for the past tax period in which the invoice with erroneous data was registered.

This position is also confirmed by the fact that, on the basis of clause 5 of the Rules for filling out an additional sheet of the sales book, an updated VAT tax return in this case should be formed taking into account the data in the “Total” line of the additional sheet of the sales book for the past quarter.

Tax return

Based on paragraph 1 of Art. 81 of the Tax Code of the Russian Federation, if a taxpayer discovers in the tax return submitted by him to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of tax payable, the taxpayer is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority .

In the situation under consideration, an error made when drawing up an invoice led to incomplete payment of VAT to the budget for the previous tax period. Consequently, the organization is obliged to submit an updated declaration for the first quarter of 2015 to the tax authority.

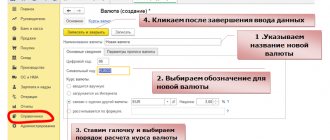

The updated tax return is submitted to the tax authority in the form that was in force in the tax period for which the corresponding changes are made (clause 5 of Article 81 of the Tax Code of the Russian Federation).

The procedure for correcting information in sections 8, 9 and 10 of the VAT declaration

You can correct errors in the sales book and purchase book by drawing up additional sheets and clarifying Appendix 1 to sections 8 or 9. In the updated declaration, indicate correct data only on those lines that were filled out incorrectly in the original declaration.

To correct errors in the invoice journal, you need to update all the data in the revised declaration, not just the erroneous information. If an error was made in part 1 of the journal (in the list of issued invoices), then in the updated declaration, provide the entire section 10 with the correct data. And if the error was in part 2 of the journal (in the list of invoices received), include the entire section 11 with the correct data in the updated declaration. In line 001 enter the value 0.

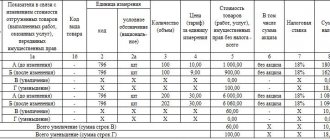

| Situation | How to correct an accounting error | How to make a clarification |

| Corrections in the sales book | ||

| Forgot to register an invoice for shipment or prepayment | Record the forgotten invoice on an additional sheet of the sales ledger for the quarter in which the error was made. | For the correct amount, create Appendix 1 to Section 9. In line 001, enter the value 0. In Sections 8 and 9, in line 001, enter 1. If due to an error, the tax in the primary declaration is underestimated, pay it with penalties before submitting the adjustment (clause 4 Article 81 of the Tax Code of the Russian Federation) |

| There was an extra invoice in the book. For example, you registered the same thing twice | Cancel the entry for this invoice in the additional sheet of the sales ledger for the quarter in which the error was made. Indicate cost indicators with a minus sign | For the correct amount, form Appendix 1 to section 9. In line 001, enter 0. In sections 8 and 9, in line 001, enter 1 |

| We found an error in the invoice for advance payment or shipment. A revised invoice was issued in the next quarter. | Prepare an additional sheet for the sales book for the quarter in which the error was made. First, record the original invoice with the cost data with a minus sign. Then - a record of the corrected invoice | For the correct amount, create Appendix 1 to Section 9. In line 001, enter 0. In Sections 8 and 9, in line 001, enter 1. If, due to an error, the tax in the primary declaration is underestimated, pay it with penalties before submitting the adjustment (clause 4 of Art. 81 Tax Code of the Russian Federation) |

| Corrections in the purchase book | ||

| Forgot to register an invoice for goods, work or services in the purchase book | There are two options. 1. Make an additional sheet to the purchase book for the quarter in which the error was made. 2. Register the invoice in the purchase book in the current quarter (within three years from the date of registration of goods, works or services) | 1. For the correct amount, create Appendix 1 to section 8. In line 001, indicate the value 0. In sections 8 and 9, in line 001, indicate the value 1. 2. There is no need to make a clarification |

| Forgot to register an advance invoice in the purchase book | Record the advance invoice on an additional sheet of the purchase ledger for the quarter in which the error was made. | For the correct amount, form Appendix 1 to section 8. In line 001, indicate the value 0. In sections 8 and 9, in line 001, indicate the value 1 |

| We reflected the extra invoice in the purchase book. For example, registered the same invoice twice | In the additional sheet of the purchase ledger for the quarter in which the error was made, cancel the entry for this invoice. Indicate cost indicators with a minus sign | For the correct amount, create Appendix 1 to Section 8. In line 001 of the Appendix, indicate the value 0. In Sections 8 and 9, in Line 001, indicate 1. Before submitting the amendment, pay additional tax and penalties |

| An invoice from the supplier was registered in the purchase book. In the next quarter we received a corrected one | Void the original invoice entries on the supplemental purchase ledger sheet for the quarter in which the error occurred. Register the corrected invoice in the purchase ledger in the next quarter. | For the correct amount, create Appendix 1 to Section 8. In line 001, enter the value 0. In Sections 8 and 9, in this line, enter 1. Before submitting the amendment, pay additional tax and penalties |

| The cost data from the supplier's invoice was entered into the accounting program with an error and the deduction was overstated | There are no clear rules. You can proceed as usual. Cancel the original entry in the additional sheet of the purchase ledger, indicating the cost data with a minus sign. In the next line of the additional sheet, enter the correct data | For the correct amount, create Appendix 1 to Section 8. In line 001, enter the value 0. In Sections 8 and 9, in this line, enter 1. Before submitting the amendment, pay additional tax and penalties |

| Data not related to cost indicators was entered into the accounting program from the supplier's invoice with an error. | There are two options. 1. You can proceed as usual. Cancel the original entry in the additional sheet of the purchase ledger, indicating the cost data with a minus sign. In the next line of the additional sheet, enter the correct data. 2. Do not correct anything, because the error does not affect the amount of VAT | 1. For the correct amount, create Appendix 1 to section 8. In line 001, enter the value 0. In sections 8 and 9, enter 1 in this line. 2. There is no need to submit a clarification. If inspectors identify an error and request clarification, the correct indicators can be sent in the form of a table |

| Corrections in the invoice journal | ||

| The intermediary identified an error in part 1 of the accounting journal, where issued invoices are recorded | Cancel the incorrect entry. To do this, fill out a new line in the accounting journal for the quarter in which the error was made. Indicate the cost indicators with a minus sign. Please provide the correct information on the next line. | For the correct amounts, create section 10. On line 001, enter the value 0. In other sections, enter the value 1 |

| The intermediary identified an error in part 2 of the log book where invoices received were recorded | To void an incorrect entry, complete a new journal line. Cost indicators must be indicated with a minus sign. Please provide the correct information on the next line. | For the correct amounts, create section 11. On line 001, enter the value 0. In other sections, enter the value 1 |

| The commission agent who sells the goods issued an invoice to the buyer and registered it in the invoice register. And I received the consignor’s invoice in the next quarter | Reflect the invoice of the principal in part 2 of the accounting journal for the quarter in which the invoice was received from the principal. Add the details of this invoice to column 12 of part 1 of the accounting journal for the quarter in which the invoice for the sale of goods of the principal is registered (letter of the Ministry of Finance of Russia dated April 27, 2015 No. 03-07-11/24223). To do this, in a new line, first cancel the original entry on the invoice, reflecting its indicators with a minus sign. In the next line, make the same entry again, but with column 12 filled in | For the correct amounts, create section 10. In line 001 of this section you need to indicate the value 0. In other sections - value 1 |